How are virtual cards more secure than physical card?

Physical credit cards have become a part of our daily lives. We all know what it is, how it works, and what are the benefits we enjoy from it. With the evolving technology physical credit cards have also advanced to fulfill the ever-increasing needs of the modern world.

While physical cards provide convenience, entering their details on shopping websites and apps—often stored for ease—can increase vulnerability to fraud and security breaches.

Virtual cards address these concerns by generating unique, single-use numbers for transactions, offering a much more secure option. This difference is a significant part of the key differences between virtual cards and physical cards, making virtual cards a preferred choice for safer transactions.

Moreover, virtual credit cards benefit both individuals and businesses. Business owners can grant employees access to corporate expense accounts without issuing physical cards. This ensures greater control and transparency over all transactions. As a result, virtual cards have proven to be an ideal solution for reducing risks and managing expenses effectively.

Types of payment cards

Prepaid card

A virtual prepaid card is directly linked to the account of the institution issuing it, making it unnecessary for users to open a separate personal bank account to use it.

This type of card is typically given to third parties and is most commonly used as a gift or for promotional purposes.

It allows users to spend only the preloaded amount, which helps in ensuring controlled and limited usage of funds.

Credit card

A credit card is a payment tool where the amount spent is not deducted from the user’s bank account immediately.

Instead, the expense is charged to a credit limit approved by the bank or financial institution issuing the card.

Credit cards are essential for building a credit score and credit history, which can be beneficial when applying for loans or other financial services.

Debit card

A debit card is another widely used payment tool that allows for buying goods and services or receiving funds, such as salaries, directly into the cardholder’s account.

Unlike credit cards, where purchases are charged to a credit limit, debit cards deduct the amount directly from the holder’s bank account or linked prepaid account.

This makes them straightforward and practical for day-to-day transactions.

What are physical cards?

Physical cards are plastic cards issued to employees by a company for official business pending purposes. These cards have traditional card features like cardholder’s name, card number, magnetic strip, CVV, etc.

Also, these cards can be used for both online and offline purchases but you do not have complete control over these cards, you will always have to contact your bank for any information or concerns.

Make your business spending easier with virtual cards

What are virtual cards?

Virtual cards are similar to physical debit and credit cards in functioning but the major difference is that virtual cards exist only online. However, these cards also have 16 digit card numbers, card verification numbers, and expiration dates.

The major benefit virtual cards have is that you have full control over these cards, you don’t have to depend on your bank to take any action on the card.

How secure are virtual cards over physical ones?

Virtual cards are immensely secure in comparison to physical cards for the following reasons.

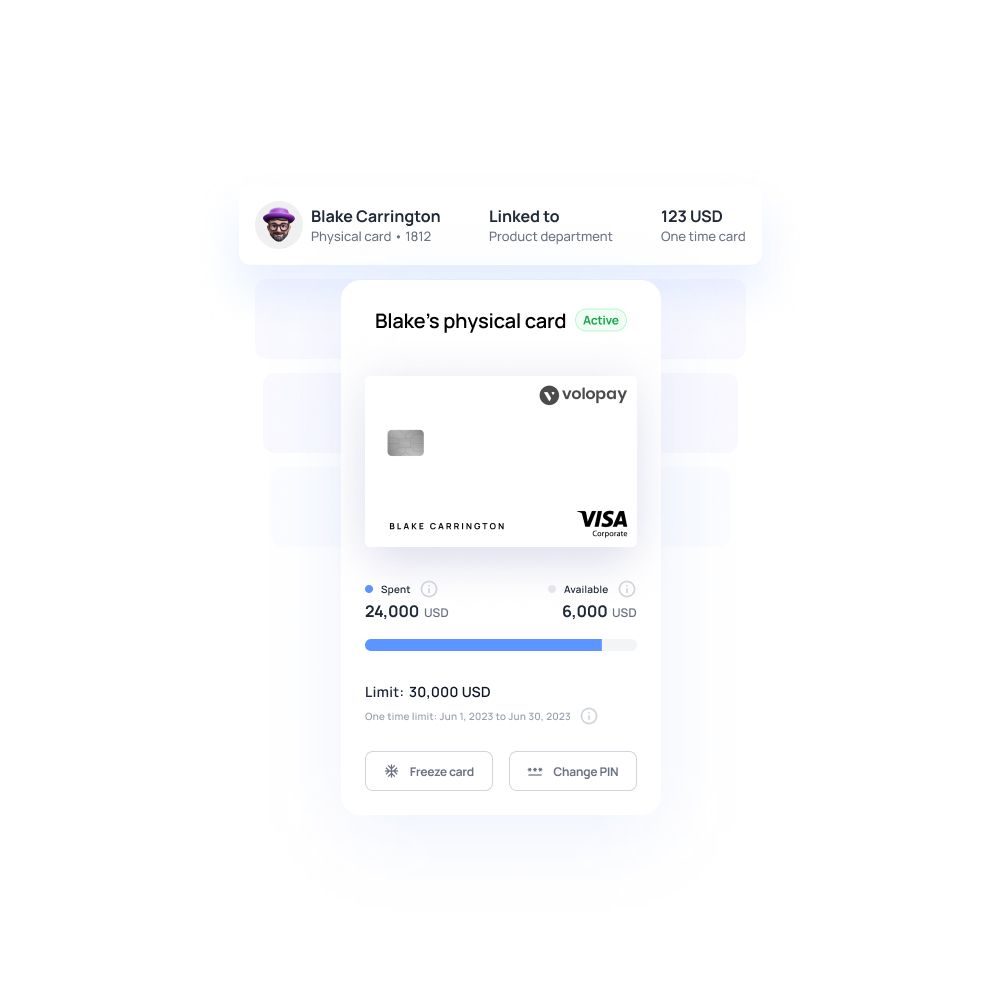

- With Virtual cards you get the feature to set spending limits. This means that every virtual card you use for your business can have a maximum spend limit and any transaction above that limit would simply be canceled. If the card is somehow in the wrong hands. Your money will still be safe.

- Unlike a physical card, virtual credit cards cannot be stolen or lost. This is because you carry a physical card everywhere with you and there are high chances that anyone can easily slide it out of your pocket or wallet. However, as virtual cards have no physical presence it is impossible to steal them.

- Online virtual cards are valid for a limited time period only. Every card is created online has limited validity depending on the card provider. However, the credit limit and validity time differ from bank to bank. However, this is not the case with physical cards, they do not have to spend a period.

- As you have complete control over virtual cards, you can block or freeze these cards instantly. Whereas if your physical corporate credit card is stolen or lost or in the wrong hands you will have to go through the long procedure of first contacting your bank and then waiting for them to process your request and then block or freeze your card.

- Virtual credit cards are subjected to Payment Card Industry Data Security Standard (PCI DSS). This means that these cards adhere to a set of policies and rules specially designed to protect credit or debit transactions to prevent the cardholder from the misuse of personal information.

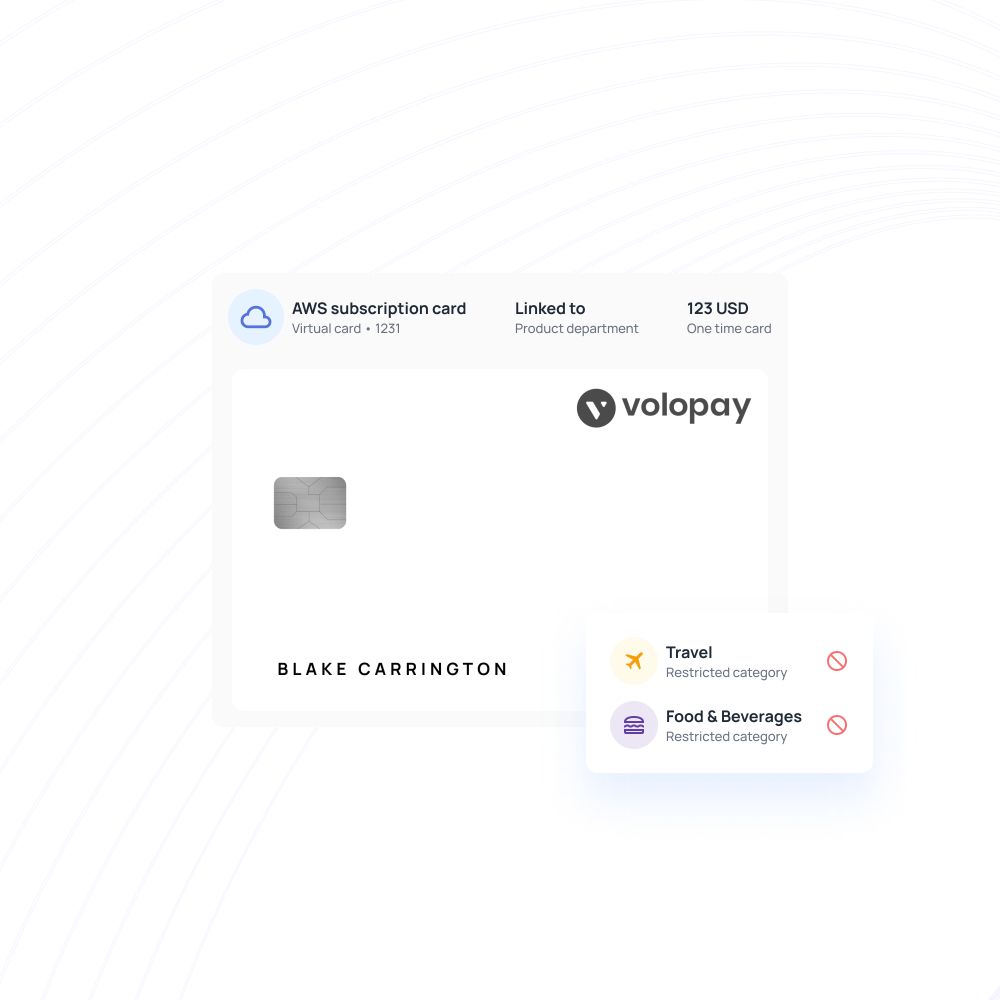

- With vendor-specific cards, you can assign each vendor a specific card. Since you don't have to use the same card for other vendor transactions, it will be much easier to track all the transactions. If different people are using the same card for payments, there are chances that some fraudulent transactions might happen through the card and it will be a tedious task for the accounting team to track all these transactions as well.

Few other significant benefits of virtual cards

Better accountability

One of the major benefits of corporate virtual credit and debit cards is that they provide better accountability over your business’s money. Since these cards can be issued to specific vendors or employees, you can always keep track of all transactions and see exactly where your money is going. Any purchase made with these cards is automatically recorded in your card management system.

This helps reduce a significant amount of time spent chasing and tracking expense receipts. Each payment is attributed to the exact team member who made the purchase, making it easy to monitor spending and reconcile transactions.

Easy to create and use

Virtual cards are extremely easy to create. Unlike physical cards, you don’t have to go to banks, get documents processed and then wait for the card to arrive. After choosing a virtual card provider for your company, just with a few clicks, you can create a virtual card.

Along with this, after creating the card you can instantly start using it. Allocate funds to the card, assign it to specific members or vendors, use it for subscription management if you want, and voila your virtual card is effectively making your life easier.

Easy reconciliation

Any purchase made with virtual cards is automatically recorded into the expense management system, eliminating the need for any paperwork. This lets you track, record, and reconcile every transaction which relieves your team members from the monotonous task and also reduces the need to write off unaccounted purchases. In turn, your Accounts Payable process is also automated and purchase orders, invoices, and financial transactions are automatically reconciled.

Better insight on business spending

As every transaction is automatically recorded and reconciled, there is no scope for human error in the process. This means that all the card data and information is accurate. You get better insights on your business money spending as every transaction is recorded under the name of the person who made it and for what purposes. With this, you can analyze all the expenses your company incurs and accordingly plan your finances.

Want to get virtual card for your business?

Volopay is your destination to get instant corporate virtual cards for your business. We give you the facility to issue virtual cards for each member of your team and also assign specific cards to each vendor of your business, along with the ability to control the spend limits of the virtual cards.

Virtual cards themselves are a secure way of money transaction but in Volopay you get advanced protection on your virtual cards with a two-level approval process, spend limit specifications, and time limit control.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free