Issue corporate credit cards for employees

Corporate credit cards have disrupted the conventional modes of sponsoring employee expenses. Companies now rely on corporate credit cards for employees for better expense identification and visibility. Employing corporate cards for business expenses allows the management to move away from the paper claims method and establish a solid base for expense reporting.

As for employees, they no longer need to finance business expenses through their personal funds. While on a business trip, they are not required to juggle between various modes of payment for online and in-store.

The employee spending cards offer dynamic functionalities that make them the first choice for businesses to manage employee expenses. Additionally, the benefits of virtual cards enhance security and control over spending, further improving the overall expense management process.

Checklist to issue corporate credit cards for employees

Company credit cards are not supposed to be issued to every employee in the organization. It creates an unnecessary blockage of money to print and administer corporate cards from the lowest management to the highest level in the company hierarchy. Effective corporate credit card management involves carefully analyzing who truly needs a card to ensure resources are allocated wisely.

Not to mention, these cards come with a certain degree of authority. If every employee in the company is given a card, the potential for fraud and personal gain increases. To mitigate this risk, exploring the best virtual credit card providers in the US can be a great option. These providers offer better controls and security features, reducing the chances of misuse and fraud.

Therefore, analyze your company situation and thoroughly consider if you need employee spending cards. Ensure to implement robust corporate card management best practices to prevent any kind of misuse, fraud and miscommunication within the organisation.

Before opting for a corporate card program, it's essential to understand that corporate credit cards are designed for larger organizations, providing enhanced controls and reporting features, while business credit cards are often used by small business owners and freelancers. For a detailed comparison, check out our blog on differences between business and corporate credit cards.

Employees traveling frequently

Employees who travel due to business reasons are constantly subjected to the heat of travel reports and expense claims. They are supposed to store proof of payments for every payment to submit later during the reimbursement procedure. The process becomes more cumbersome when the duration of the trip is long.

To prevent such a situation mentioned above, we advise issuing corporate credit cards for employees who travel a lot. Through the help of company credit cards, their business trips can become more generative, as they don't have to worry about invoice collection and expense reporting.

While physical cards are perfect for making in-person payments during travel, virtual cards are better suited for online transactions like booking flights or hotels. These key differences between corporate virtual cards and physical cards ensure businesses can manage both online and offline expenses effectively.

Marketing departments expenses

The marketing team handles a wide range of activities—from organizing events to running ad campaigns on platforms like Google Ads and Facebook. Given the frequent need for multiple payments and real-time tracking, having a flexible tool to manage these expenses is essential.

Corporate credit cards simplify cost tracking, and virtual debit cards and credit cards are especially useful for digital campaigns, allowing teams to manage recurring payments or ad spending without manually submitting reimbursements.

Employees directly dealing with vendors

Vendor management is often considered a back-office task. However, if not managed appropriately, it can lead to the rise of indirect costs of doing business and negatively impact the company's operational efficiency.

Corporate cards play an essential role in managing vendor payments and costs. You can track the supply of the goods and services, manage inventory costs, streamline the supply chain cycle, and ensure the vendor the paid in time. Having a well-defined corporate credit card policy further helps in regulating these transactions and ensuring accountability at every step.

Employees who are in charge of SaaS

SaaS tools have become an essential part of handling business functions. These online tools provide high-grade business solutions with seamless integrations and faster processing capacity. But SaaS payments are often jumbled up as companies have a hard time managing their SaaS subscriptions. Companies can create and manage past and upcoming SaaS payments with corporate virtual cards.

The subscription payments are logged in real-time, so you know which subscriptions are currently active and dormant. Additionally, while making payments, the in-built corporate credit card rules ensure that the person making payment and the card used to make payments are reflected to establish accountability.

Employees who look for reward programs

Incentivization does wonders on employee productivity. And if earning rewards is as simple as swiping a company credit card, employees would do it every time. However, it's not only the employee who benefits this way - it's the management too.

On the one hand, corporate credit cards for employees delight them with lucrative rewards and cashbacks that boost their motivation and stimulate making a majority of payments via their cards. In contrast, the management gains unambiguous visibility over expenses and the cost of operations.

Employees in human resource

Human resource is a collaborative work that requires extensive resource allocation in terms of funds. The manual system of recording expenses and payments often fails to keep pace with the cycle of events.

But with employee spending cards, you can handle HR activities like recruitment, selection, and training pretty well, alongside keeping an eye on office maintenance. With budgeting in corporate cards, you can specifically create budgets for each department, pooling in all the activities and ensuring the work is conducted with these means only.

When considering which employees should receive corporate credit cards, it's important to select the right options that align with your business needs. To learn more about the key factors to consider, check out our article on choosing the right corporate credit card for your business.

When should you decide to give corporate credit cards to employees?

Along with deciding which employees you should give a company credit card, it's also choosing when and where these cards can be used. Corporate credit card programs might not be reasonable for every business entity. Because the use of these cards is effortless, but the back-end processes need to be in place to ensure accountability and prevent employee misuse of corporate credit cards.

1. When your company is struggling to manage employee expenses through the manual method of accounting and reporting

2. Employees on business trips are required to use personal funds or out-of-pocket funds to finance meals and other expenses.

3. Your employees apply for reimbursements from the low to high-dollar value expenses.

4. Your manual reimbursements method is slow and sluggish to deliver.

5. Employees need to carry and maintain physical receipts and invoices for every payment.

6. Uneventful month-end expense reports need to be filed and submitted by the employees

7. Employees get no reward or incentives for making payments on behalf of the business.

8. You relatively have a large and scattered workforce.

9. The missing expense claims make it difficult for accounting reconciliation.

When issuing corporate credit cards for employees, it's essential to choose the best options available. Refer to our article on best company credit cards to ensure you're making the right choice for your business needs.

How to manage employee use of corporate credit cards?

Management's role does not conclude with providing employee spending cards. Monitoring their spending made via these cards is still a task for them. You don't need to oversee their activities in person or be physically present. A corporate credit card for expense management streamlines this process through automated tracking and reporting.

Issuing corporate cards

Just because you have enough corporate cards should not make you distribute them without prior consideration.

Issuing these corporate credit cards to unnecessary employees will increase your card spending expenses apart from making it difficult to track multiple cards.

Monitor expense reports

The corporate card software lets you effortlessly generate expense reports according to each department, card, and expense category.

Glancing through these reports can provide a transparent overview of the company's spending habits and other expenses.

Multi-level approval workflow

With a web of multi-level approval processes, employees' expenses get reviewed beforehand.

Approvers decide which transactions proceed and which do not. With the help of an approval matrix, any unidentified or unnecessary transaction does not get approved.

Corporate card policy

Everything at your company starts with a well-detailed yet straightforward corporate card policy.

Clearly defined corporate credit card rules help set the expectations from the employees and the management.

It acts as a guiding document, letting you know what is acceptable and not. It contains all the general rules and guidelines that will govern the spending policy related to corporate cards.

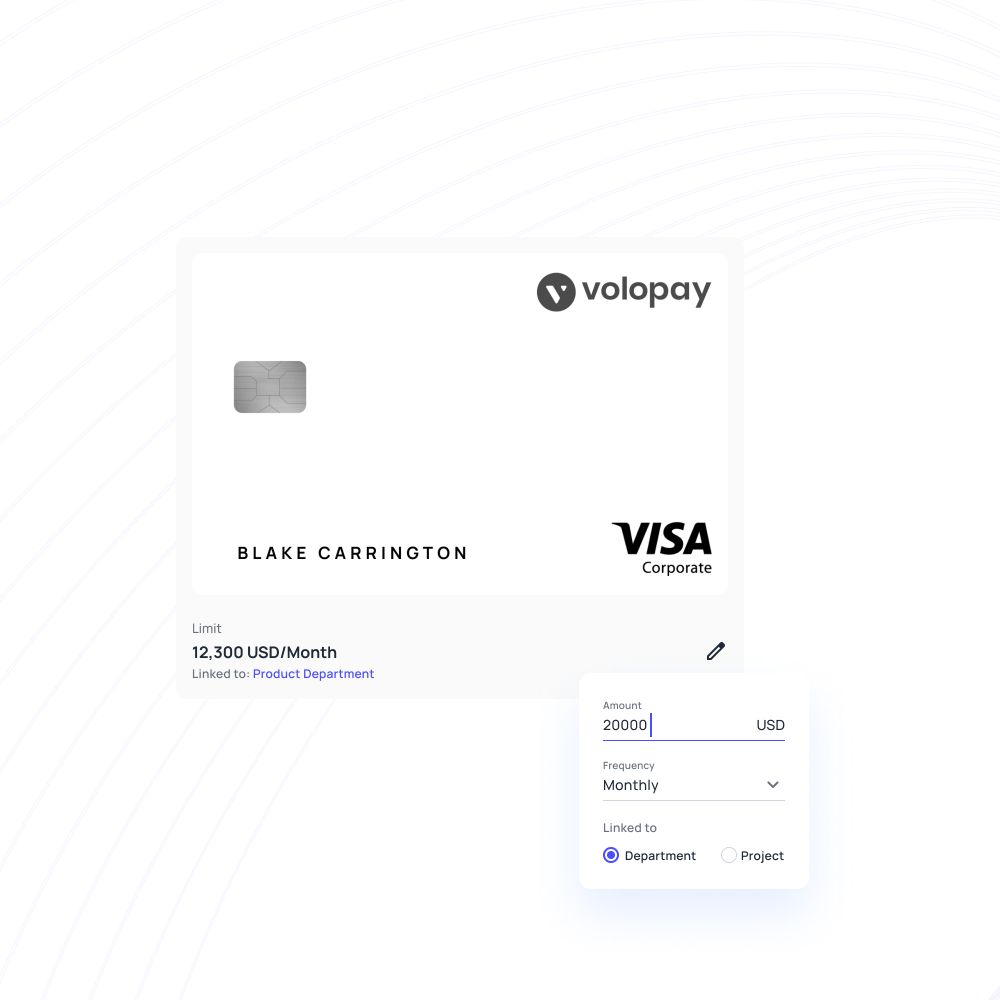

Create spending limits

To ensure your employees stay capped within a specific amount, you can set spending limits on their cards.

This will make them adjust their spending within the ceiling limit, and in case of a genuine requirement of funds, the additional amount can be loaded into their card.

Also, you can set individual spending limits to each so that every employee gets funds based on their needs.

Volopay corporate cards for your business

Volopay's corporate cards help simplify your business spending to the core. You can ditch the old methods to manage employee expenses through our cards.

With enhanced functionality like real-time reporting, compliance with expense policies, individual spending limits, customized approval workflows, automated expense reports, seamless integrations, and much more, Volopay remains the superior choice for businesses looking to revamp their accounting stack.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free

Related pages to corporate credit cards

Discover the best corporate credit cards in the US for 2025, their features, benefits, and tips for smart management.

Explore the key differences between virtual cards and company cards to determine the best payment solution for your business needs.

Explore how corporate credit cards benefit startups and small businesses, improve financial management, and support employees and finance teams.