Benefits of using virtual cards for eCommerce business

The eCommerce industry has been on the rise for a while and with the way things are moving, it doesn’t seem like there is going to be any decline in its growth. While the general conversations in the industry revolve around how to make payments easier and the entire experience more user-friendly for the end customer, very rarely is the convenience of running an eCommerce business spoken about.

A major shift that is taking place in the way eCommerce businesses carry out their operational payments is through the adoption of virtual payment cards.

Why eCommerce businesses should use virtual credit cards?

As an eCommerce business owner, you would know many of the backend tasks that need to run smoothly to keep your customers happy. A few of these tasks involve expenses and payments from your end. For these processes, corporate cards for eCommerce businesses become necessary to ensure that your eCommerce business doesn’t suffer.

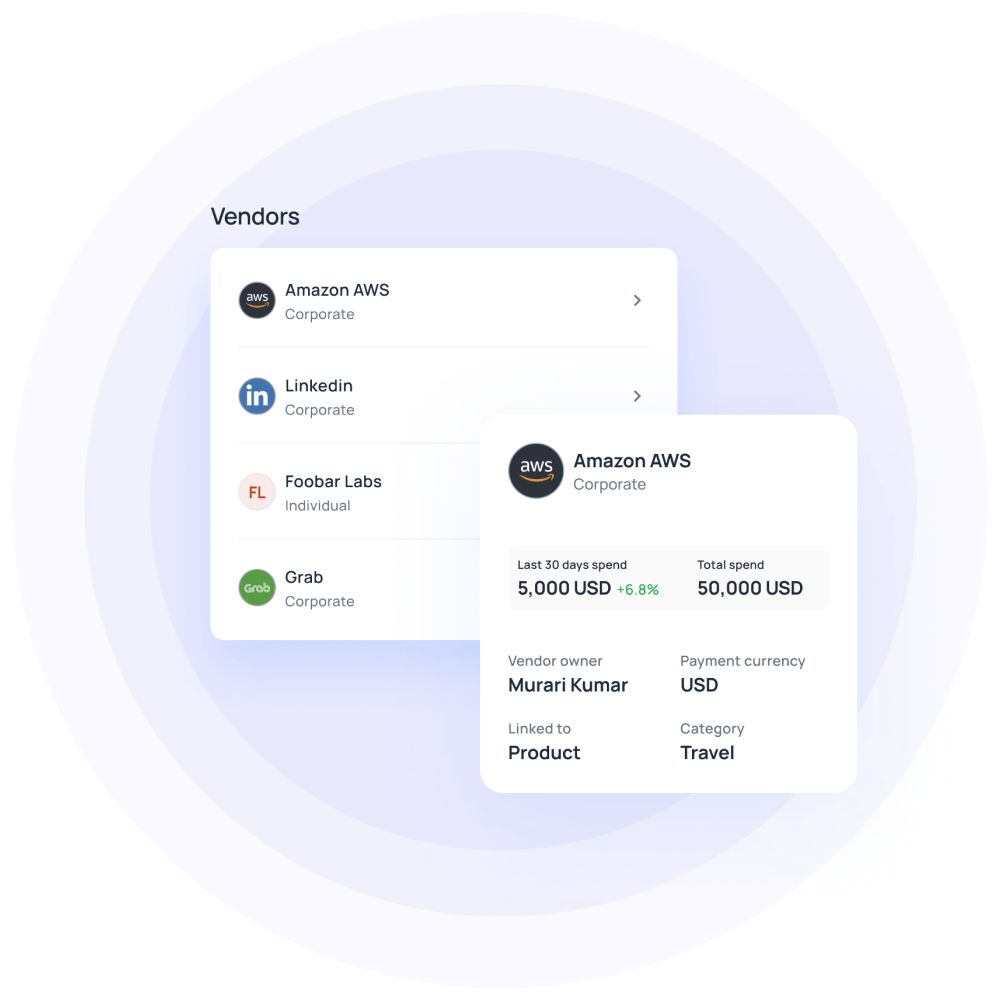

Payments to vendors or suppliers

In this case, you as the eCommerce business owner have to pay these vendors. To do this, wire transfers are an option but proper integration becomes tough when you have more than one vendor.

Checks are slow, and traditional corporate credit cards come with security risks and potential credit issues when used for multiple suppliers. An eCommerce credit card streamlines this process.

With Volopay you can create unlimited virtual cards, meaning you can create a payment card for each different supplier that you have.

Operational expenses

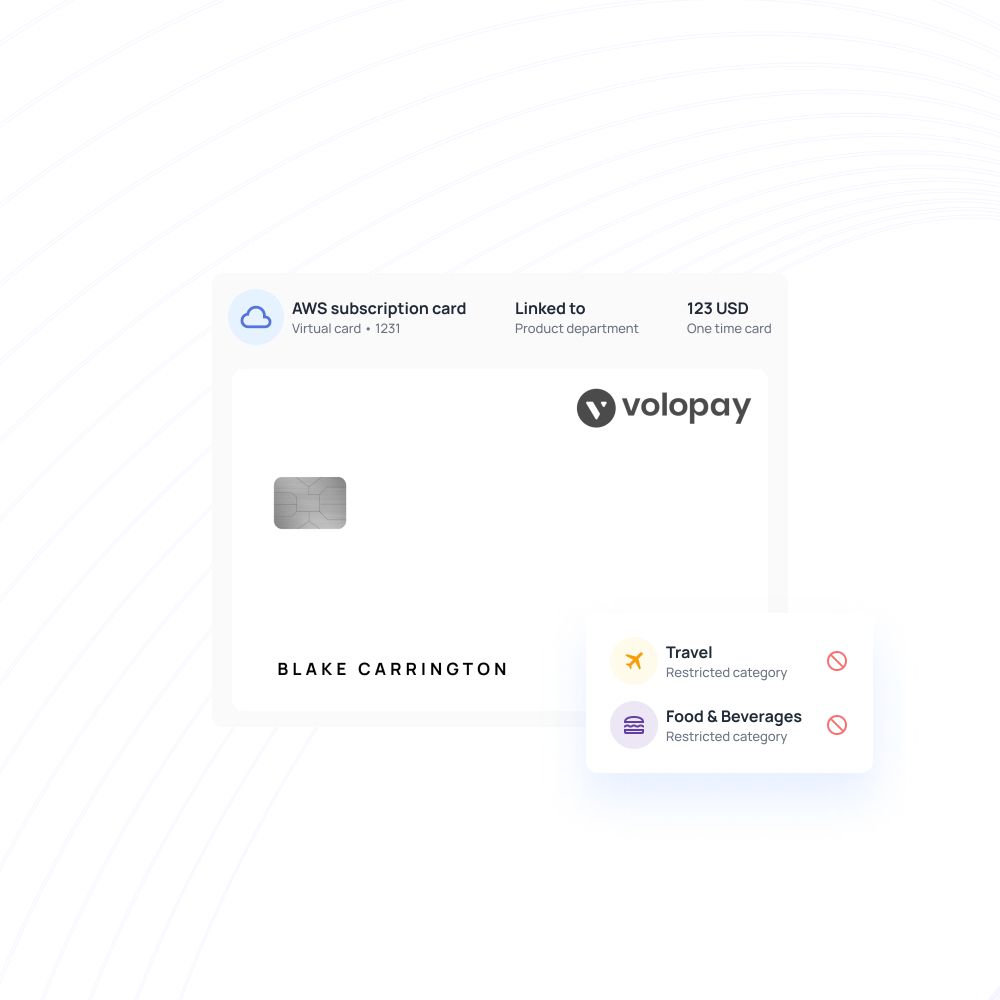

Running the eCommerce online store smoothly is not always dependent on internal team software. Many stores use third-party software products for specific features integrated with your store.

So a virtual card for an eCommerce startup like this becomes essential to carry out subscription payments to these software services that help run your online store without any hiccups.

Make vendor payments smooth and easy with Volopay

Why virtual cards for eCommerce transactions?

Protection from theft and fraud

To understand why virtual corporate cards are safer than traditional commerce spending cards, you’ll have to first understand how they are different from them.

A virtual card just like other cards has a 16 digit card number, an expiration date, and a CVV or security code. The two major differences are, first, it is linked to a credit or debit account but not directly to a bank account, and, it doesn’t have a lot of personal information other than your name attached to it.

So how does this help? Well since it is not directly linked to a bank account, it becomes tough for hackers to commit fraud even if they somehow access the card number; the name on the card is not associated with an individual’s personal account or company’s bank account and since the card acts as a virtual visa debit card, rather than a physical plastic card, you’re not at risk of losing it somewhere or it getting stolen.

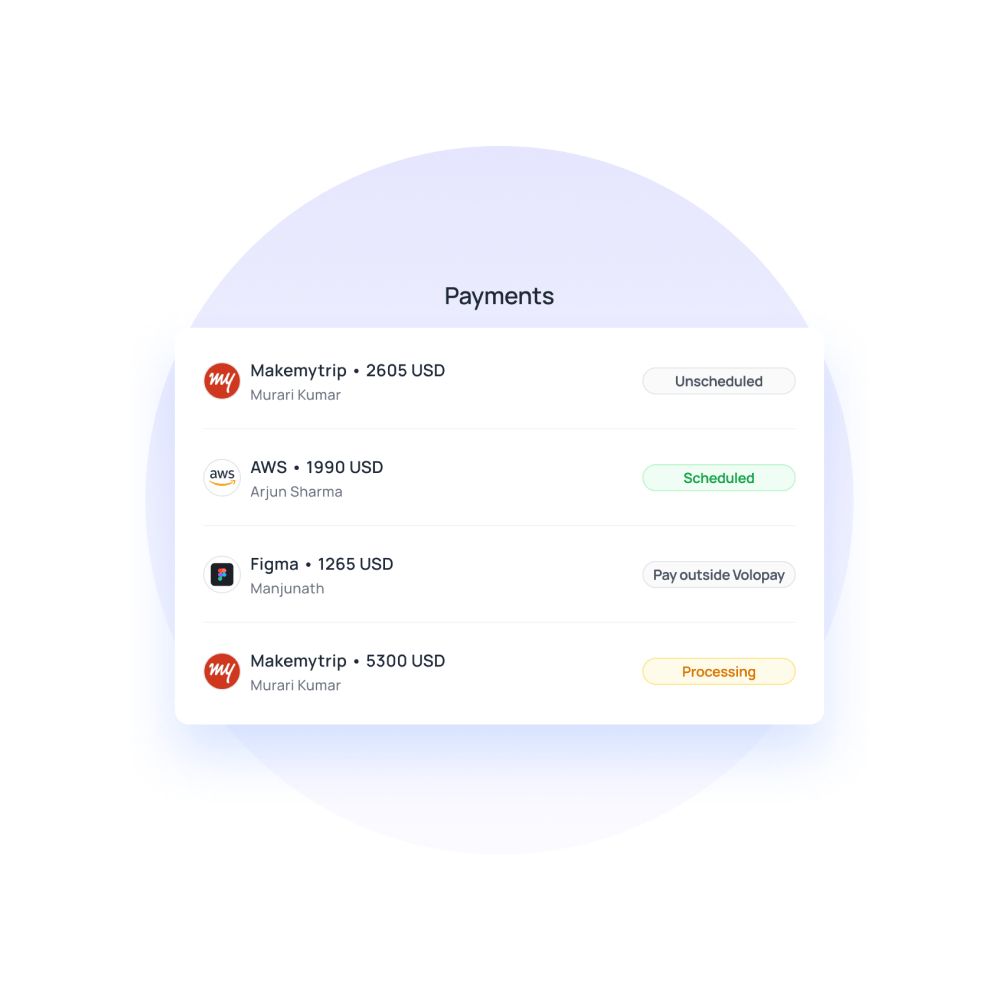

Financial control

For each virtual cards that you create, you can set a spending limit on it. This will help eliminate out-of-policy expenses by automatically declining any transactions over a certain limit.

You can even set up approval workflows for each card that you create. This is useful when you give the responsibility of conducting payments to an employee, but you still want real-time control over each spend.

So by setting yourself as an approver for a card transaction, every time your employee tries to execute an eCommerce card payment, a notification will be sent to you. This way, you don’t have to sit and do all the payments but are still in control of the money that is going out.

Easy vendor payment management

If your eCommerce store sources products from many vendors, chances are that it is tough to manage payments for each one of them as it is difficult to keep track of who has been paid how much. But since you can create unlimited virtual credit cards, you can make a card for every vendor that you have.

Issue refunds in minutes

Now that you have a virtual card for every vendor, keeping track of refunds also becomes simpler as your supplier refunds it back to the same virtual card that you used to pay them. This negates the confusion you would normally face when trying to track whether a refund has been processed by a particular supplier or not.

Volopay virtual cards for eCommerce spends

The benefits of using Volopay's virtual business cards for your eCommerce startup are very obvious from the points mentioned in the previous section. When you select Volopay as your virtual credit card provider, you get all the advantages of using it that you read in the article above and much more.

Get Volopay for your business

Get started free