Effortless virtual card payments for accounts payable team

The finance team has to go through many complicated payment processes. From vendor payments to employee payroll, all payments needed a new channel if you want to bring about efficiency and increased productivity in your company.

Thanks to technology we have a solution which is in the interest of all finance teams. Businesses no more use cheques or cash to make or receive payments. All things cliche and conventional have been eliminated with virtual cards.

The benefits of virtual cards are endless — from the HR team to accounts payable, sales, and the entire business — enabling teams to send money electronically, regardless of the company’s ERP or accounting system.. The overall B2B ePayments scenario has been made a lot easier with the use of virtual cards.

What are virtual card payments?

Virtual card payment is a digital transaction conducted between the AP departments. It is not a physical card instead it's a cardless way of making payments. Virtual card payments are of different kinds like single-use cards, third-party cards, etc. While making payments, you can pre-decide the amount.

One of the most common virtual payments is a single use card, where the possessor company of the card gets a uniques string of numbers that are connected to the company’s bank account and used for a one-time payment. Since the money transfer is being done virtually, this method is secure and protects against any fraud.

Why AP teams in the U.S. need virtual cards today

Virtual cards possess numerous special benefits which you do not get with any standard credit or debit card. This digitized spending solution empowers the user with control options over finances, company funds, and spending.

Your accounts payable department faces mounting pressure to streamline operations while maintaining tight financial controls. With vendor payments becoming increasingly complex and security threats on the rise, traditional payment methods are proving inadequate for modern business needs.

Reduced manual work and processing time

Virtual card payments can transform how your AP team handles vendor transactions by eliminating time-consuming manual processes. Instead of cutting physical checks or processing wire transfers, you can generate virtual cards instantly for each payment. This automation reduces the administrative burden on your team, allowing them to focus on strategic tasks rather than repetitive payment processing.

The benefits of virtual card payments extend to faster approval workflows, as you can set up automated routing based on predefined criteria. Your team will spend less time on data entry, check printing, and mailing, significantly reducing processing time from days to minutes.

Better control over vendor payments

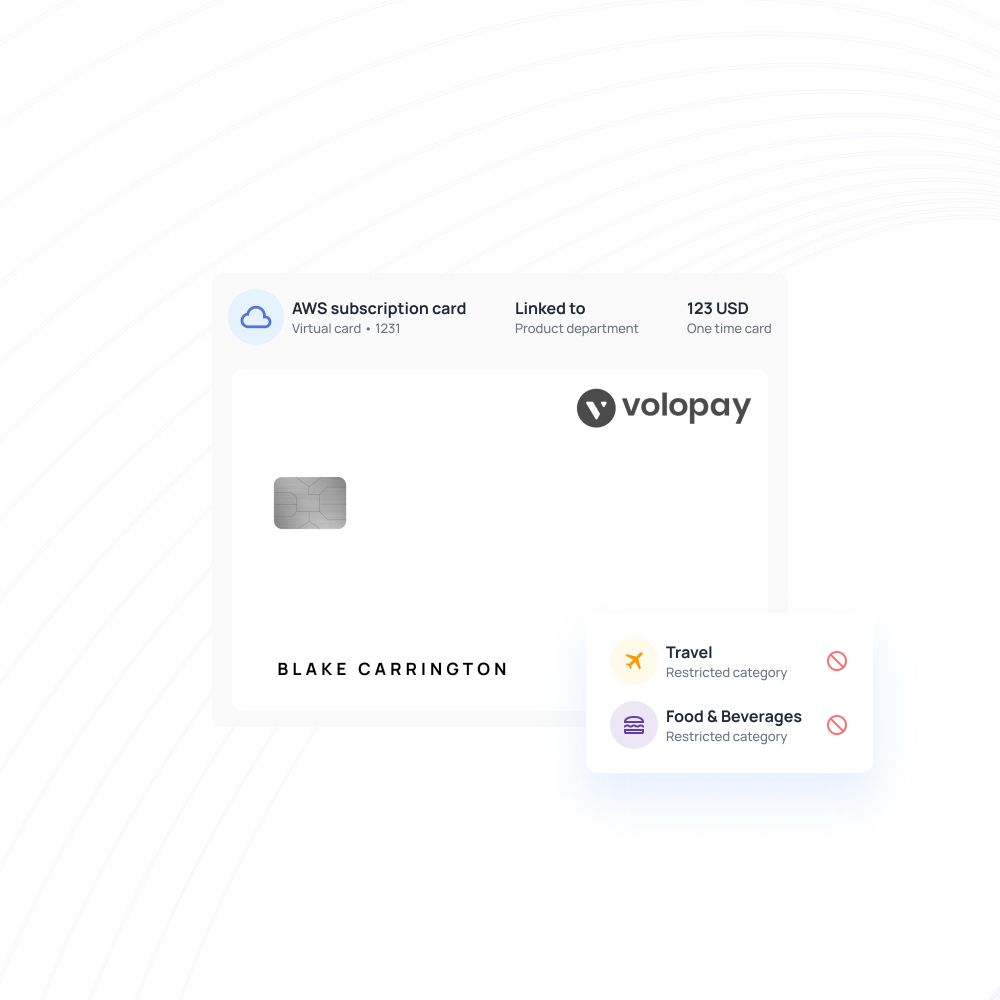

Virtual cards for accounts payable teams provide unprecedented control over spending. You can set specific spending limits, merchant restrictions, and expiration dates for each virtual card, ensuring payments align with approved purchase orders.

This granular control helps prevent unauthorized spending and gives your finance team real-time visibility into payment status. Virtual card payments for AP teams also enable you to track expenses more accurately, as each card can be tied to specific cost centers, projects, or departments.

Enhanced payment security and fraud prevention

Security remains a top priority for AP departments, and virtual card payments offer superior protection compared to traditional methods. Each virtual card generates unique payment credentials for every transaction, making it nearly impossible for fraudsters to reuse stolen information.

You can immediately deactivate compromised cards without affecting other payments, and the system provides detailed transaction logs for audit purposes. This enhanced security framework protects your organization from costly fraud while maintaining vendor relationships through reliable payment processing.

Why traditional accounts payable processes fall short

With paper checks, you have no way of knowing when vendors will cash them, making accurate cash flow forecasting nearly impossible.

Wire transfers provide limited tracking information, and credit card payments often lack the granular details needed for comprehensive financial reporting.

This lack of transparency forces your team to rely on manual follow-ups with banks and vendors, creating delays in financial reporting and budget planning.

Paper-based processes introduce human error at every step of the payment cycle.

Your AP team may accidentally process the same invoice twice, enter incorrect payment amounts, or send payments to the wrong vendors. These manual errors can be costly and damage vendor relationships.

Virtual card payments eliminate many of these risks by automating payment generation and validation processes, reducing the administrative burden on your staff.

Traditional payment methods make month-end reconciliation a nightmare for your accounting team.

Matching payments to invoices becomes time-consuming when dealing with multiple payment channels, each with different reporting formats and timing.

This inefficiency delays financial close processes and increases the likelihood of accounting errors that could impact your financial statements.

How virtual card payments transform accounts payable for businesses in the U.S.

Virtual card payments revolutionize your accounts payable operations by addressing every challenge that traditional systems create.

This modern payment solution transforms your AP workflow from a reactive, manual process into a proactive, automated system that drives business efficiency.

1. Automate vendor payments with control and transparency

Virtual cards for accounts payable teams provide complete payment automation while maintaining granular control over spending. You can set specific parameters for each payment, including merchant restrictions, spending limits, and expiration dates, ensuring every transaction aligns with your approval policies.

Real-time transaction data flows directly into your accounting systems, giving you instant visibility into payment status and eliminating the guesswork associated with traditional payment methods. This transparency enables accurate cash flow forecasting and immediate identification of any payment irregularities.

2. Improve AP efficiency without adding headcount

The benefits of virtual card payments include dramatic productivity improvements without expanding your team size. Your existing staff can process significantly more payments per day through automated workflows, reducing the time spent on manual tasks like check printing, envelope stuffing, and payment tracking.

Virtual card payments for AP teams eliminate the need for physical payment handling, allowing your team to focus on vendor relationship management and strategic financial analysis.

3. Cut processing costs and eliminate bottlenecks

Virtual card payments eliminate many cost centers associated with traditional payment methods, including check stock, postage, bank fees, and processing delays.

You'll reduce payment processing costs while accelerating payment cycles, improving vendor relationships through consistent, timely payments, and creating a more efficient accounts payable operation overall.

Why your business needs a secure, purpose-built virtual card solution

Not all virtual card solutions are created equal, and choosing the wrong platform can limit your accounts payable transformation. Your business requires a solution specifically designed for AP operations, not a generic payment tool that lacks essential functionality.

Generic virtual cards vs. purpose-built platforms

Generic virtual card offerings from traditional banks or payment processors typically provide limited spend controls, poor integration capabilities, and minimal reporting.

Purpose-built virtual card payments for AP teams offer advanced features like automated invoice matching, approval workflows, and comprehensive expense categorization.

You'll benefit from solutions designed specifically for accounts payable challenges, ensuring every feature supports your operational requirements.

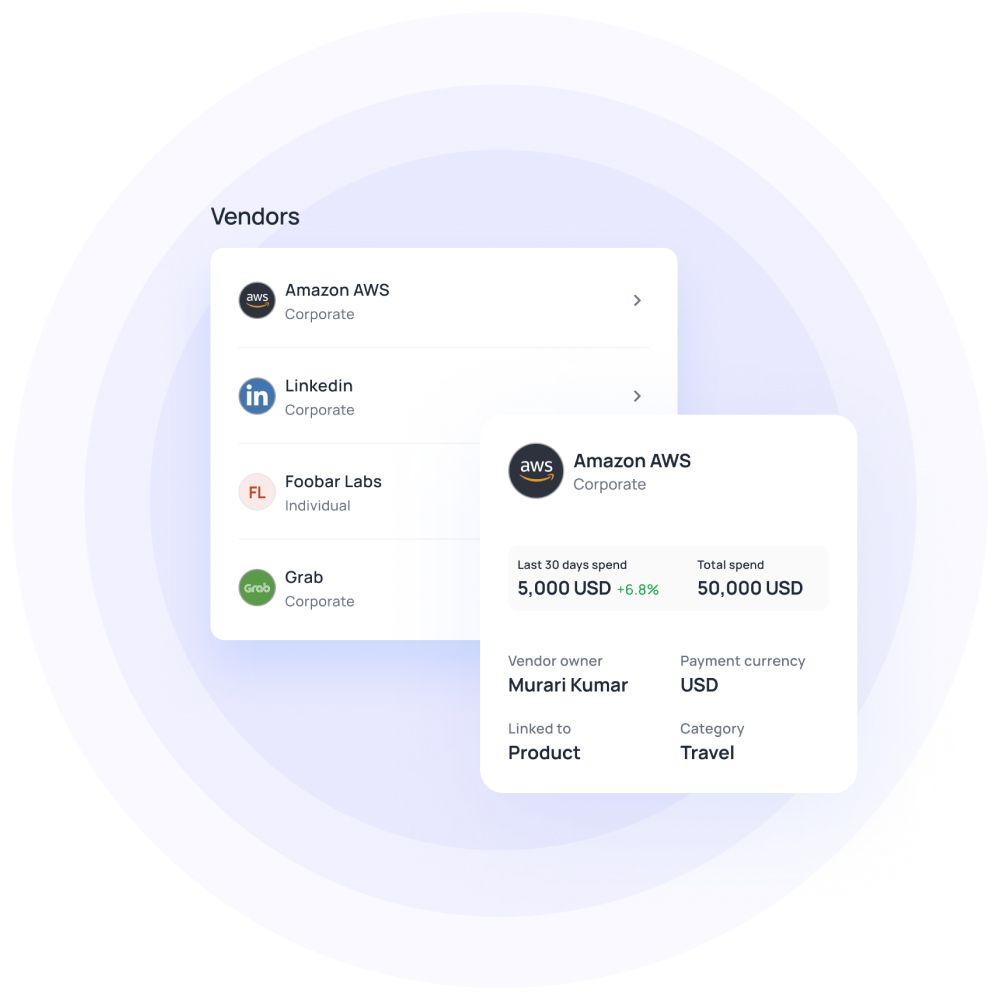

Centralizing spend and control with the right tool

The right virtual card platform centralizes all your vendor payments under a unified dashboard, giving you unprecedented visibility into organizational and departmental spending.

You can establish company-wide spending policies, monitor them in real-time, and generate detailed reports for stakeholders.

This centralization eliminates managing multiple payment methods and provides your finance team with the comprehensive oversight needed for effective cash management and control.

The case for an all-in-one payables card system

An integrated payables platform combines virtual cards for accounts payable teams with expense management, invoice processing, and financial reporting capabilities.

By centralizing these functions, AP teams gain real-time visibility and control over every business payment and expense.

This unified approach eliminates data silos, reduces software costs, and streamlines your entire procure-to-pay process under one comprehensive solution that scales with your business growth.

Volopay virtual cards: A smarter way to manage payables

Volopay delivers a purpose-built virtual card solution designed specifically for modern accounts payable teams.

Our comprehensive platform combines advanced payment technology with intelligent spend management features, enabling your organization to transform payables operations through a single, integrated system.

Instant and unlimited card issuance

Your AP team can generate virtual cards instantly for any vendor payment, eliminating delays associated with traditional payment methods. Volopay allows unlimited card creation, enabling you to issue unique virtual cards for each transaction or vendor relationship.

This flexibility ensures you always have the payment method you need when you need it, while maintaining complete control over spending parameters and usage restrictions for maximum security.

Built-in budgeting, approval flows, and policy enforcement

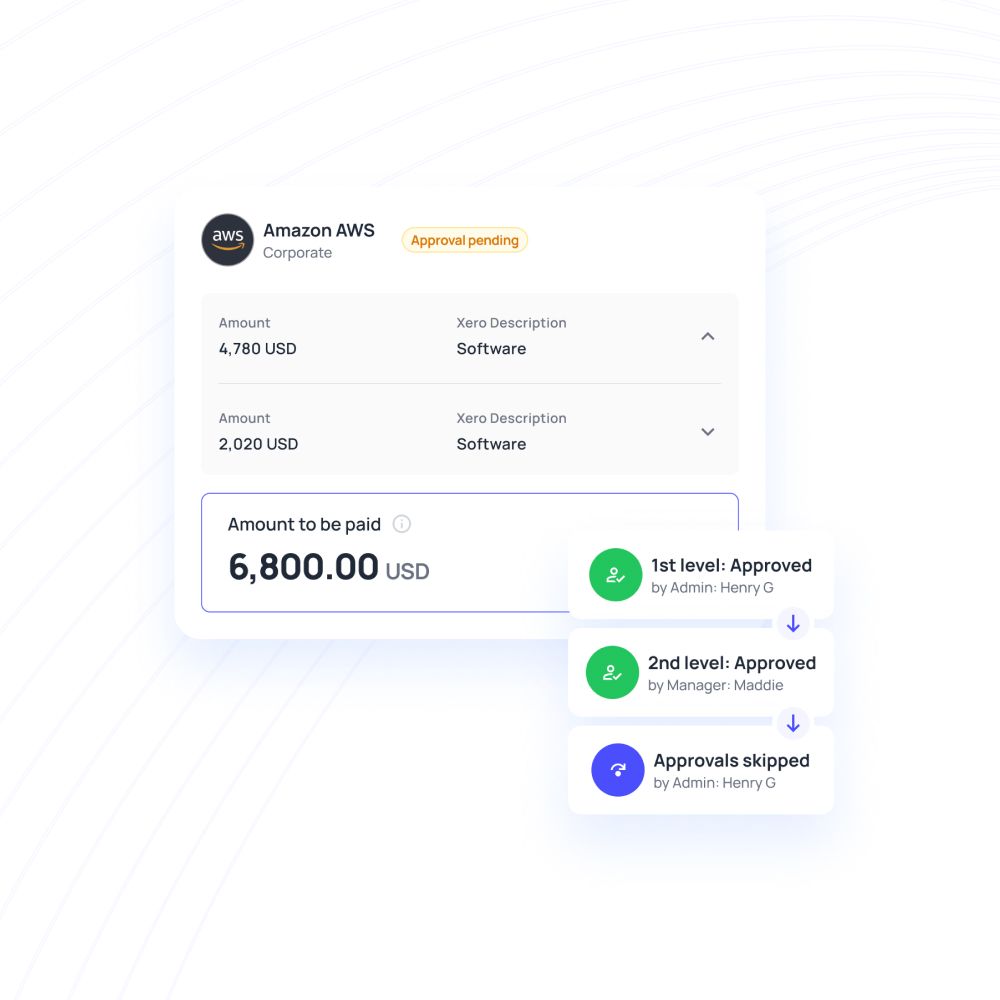

The benefits of virtual card payments through Volopay include automated policy enforcement that prevents unauthorized spending before it occurs. You can establish multi-level approval workflows that route payments based on amount, department, or vendor type.

Built-in budgeting tools help you allocate spending limits across teams and projects, while real-time policy enforcement ensures every transaction complies with your organizational guidelines without manual intervention.

Real-time spend tracking and oversight

Virtual card payments for AP teams provide immediate visibility into all spending activities through your Volopay dashboard. You can monitor transactions as they occur, track budget utilization in real-time, and identify spending patterns that inform future financial decisions. This transparency eliminates month-end surprises and enables proactive spend management across your organization.

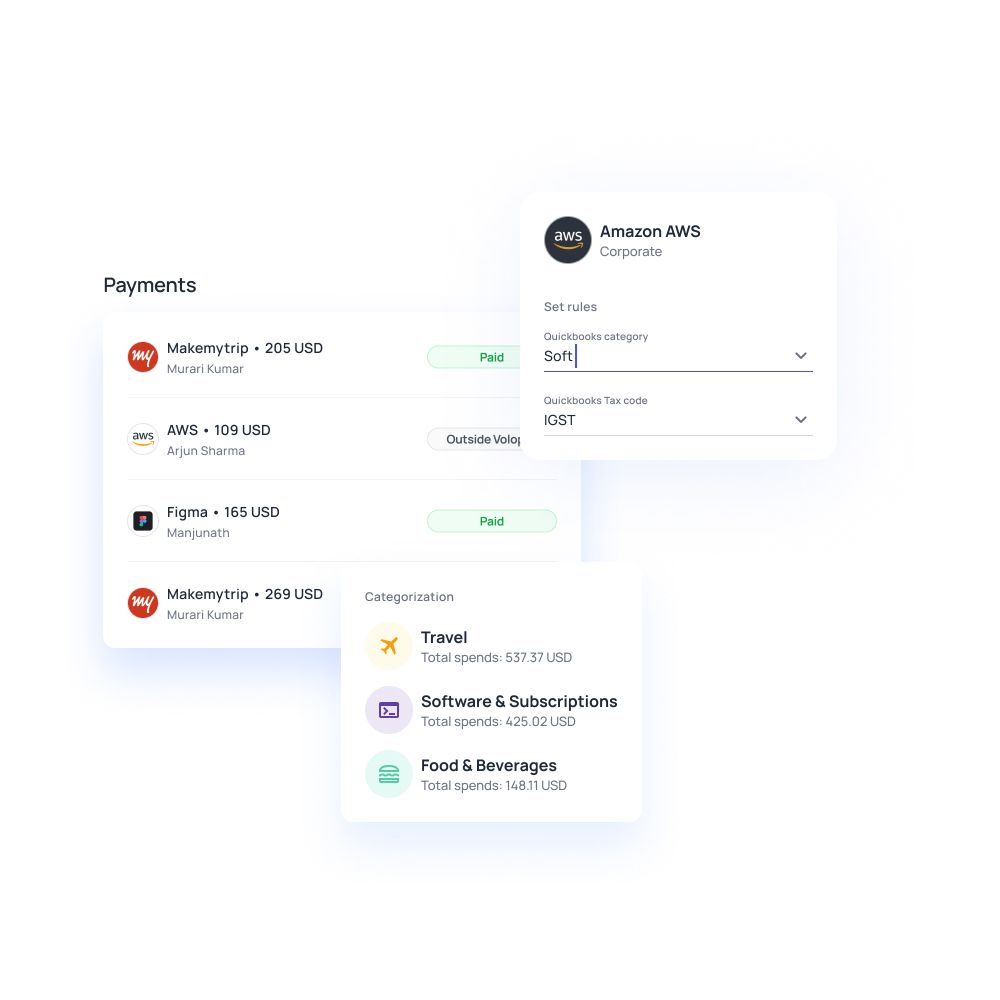

Seamless integration with accounting tools

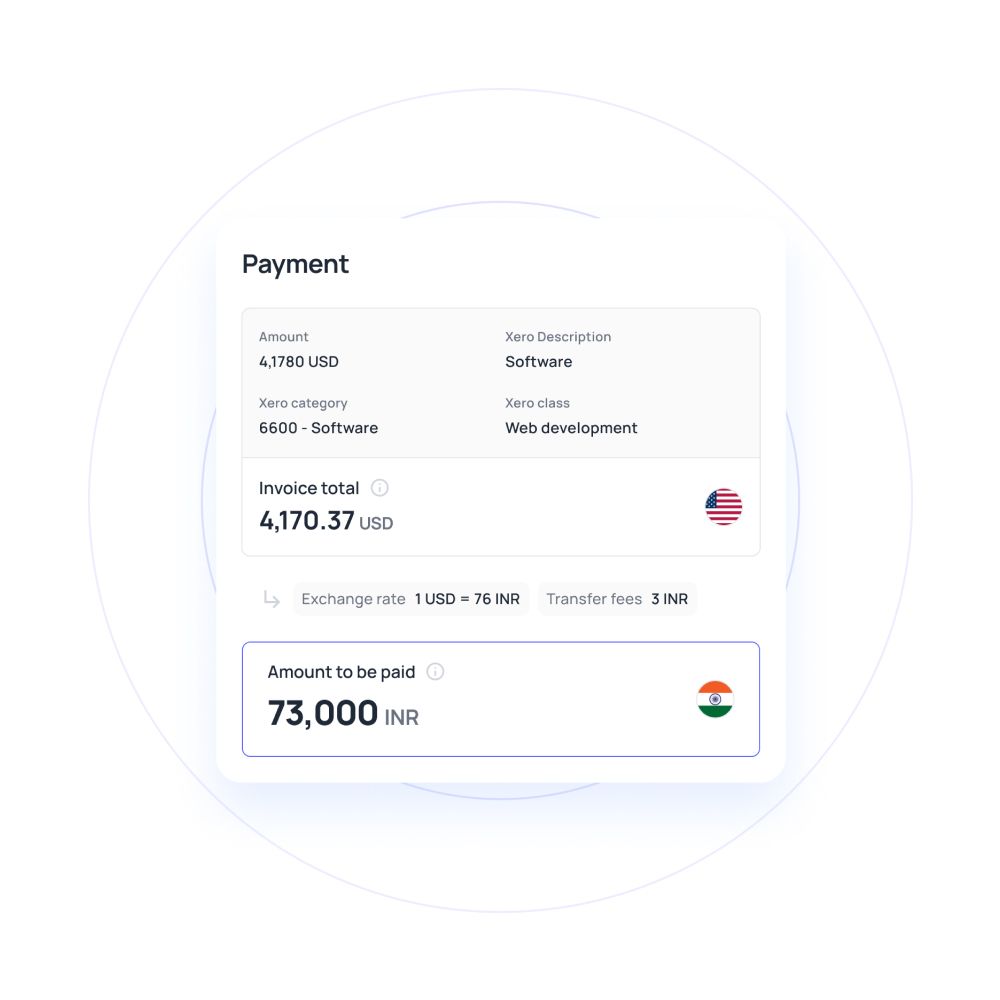

Volopay integrates directly with popular accounting platforms like QuickBooks, Xero, and NetSuite, ensuring transaction data flows automatically into your existing financial systems.

This integration eliminates manual data entry and reduces reconciliation time while maintaining accuracy in your financial records.

Issue multi-currency virtual cards to avoid FX fees

Volopay's multi-currency feature allows you to issue virtual cards for accounts payable teams in several different currencies, eliminating foreign exchange fees on international vendor payments.

This capability improves reconciliation accuracy by matching payment currencies to invoice currencies while increasing global vendor acceptance rates for seamless international business operations.

Why U.S. finance teams trust Volopay virtual cards for payables

Leading U.S. companies choose Volopay because we deliver measurable results that traditional payment methods simply cannot match.

Finance teams report significant improvements in operational efficiency, cost control, and financial visibility after implementing Volopay's virtual card solution.

1. Issue purpose-built cards for every vendor, project, or team

Volopay enables you to create customized virtual cards tailored to specific business needs, whether you're paying a single vendor, funding a project, or managing team expenses. Each card can be configured with unique parameters, merchant restrictions, and spending limits that align with your organizational structure.

This granular approach ensures virtual cards for accounts payable teams provide maximum flexibility while maintaining strict financial controls across all payment scenarios.

2. Automated controls, real-time limits, and custom approval flows

Our platform's intelligent automation prevents overspending and unauthorized transactions before they occur. You can establish dynamic spending limits that adjust based on budget availability, create custom approval workflows that route payments through appropriate stakeholders, and implement real-time controls that block non-compliant transactions. These automated safeguards reduce manual oversight requirements while ensuring every payment adheres to your company's policies.

3. Close books faster with cleaner, card-based reconciliation

Volopay’s virtual card payments generate detailed transaction data that integrates seamlessly with your accounting systems, dramatically reducing month-end reconciliation time.

The benefits of virtual card payments include automatic expense categorization, real-time transaction matching, and comprehensive audit trails that eliminate the guesswork associated with traditional payment reconciliation, enabling faster financial close processes.

Built for scale: Virtual cards that grow with your business

Volopay's virtual cards adapt to your organization's unique requirements, whether you're a growing startup or an established enterprise.

Our system scales seamlessly as your business expands, ensuring your accounts payable operations remain efficient regardless of transaction volume or complexity.

Customizable workflows for small and large AP teams

Your team can configure virtual card payments to match your current operational structure and easily modify workflows as your organization grows.

Small AP teams benefit from streamlined, automated processes that reduce manual workload, while larger departments can implement complex multi-tier approval structures with role-based access controls.

The platform accommodates both simple vendor payments and sophisticated enterprise-level procurement processes without requiring system changes.

Scale your payment volume without adding complexity

As your payment volume increases, Volopay's infrastructure handles the load without degrading performance or requiring additional setup.

You can process thousands of virtual card payments for AP teams while maintaining the same user experience and control levels.

Our automated features become more valuable as transaction volume grows, reducing per-payment processing time and administrative overhead.

Issue cards for specific teams, vendors, or currencies

Volopay virtual cards for accounts payable teams are flexible enough to be organized by department, project, vendor relationship, or currency requirement.

This flexibility enables precise budget allocation and spending tracking across your entire organization, ensuring financial visibility regardless of your company's structural complexity.

Eliminate cross-border payment friction with multi-currency support

Volopay's multi-currency virtual cards help significantly eliminate the complications of international vendor payments for your business.

You can issue cards in local currencies to avoid foreign exchange fees and simplify reconciliation processes, making global business operations as straightforward as domestic transactions while maintaining the same level of control and visibility.

Bring Volopay to your business

Get started now

FAQs

Yes, virtual card payments significantly reduce fraud risk through unique transaction credentials, instant card deactivation capabilities, and preset spending limits that prevent unauthorized usage and protect your organization's financial assets.

All industries benefit, but technology, healthcare, manufacturing, and professional services see exceptional results due to high vendor payment volumes, complex approval processes, and stringent compliance requirements that virtual cards address.

Absolutely. Small businesses gain automated payment processing, reduced manual work, better cash flow visibility, and enhanced security without requiring additional staff or complex infrastructure investments that traditional systems demand.

Volopay offers purpose-built AP features including unlimited card issuance, automated approval workflows, multi-currency support, seamless accounting integrations, and real-time spend tracking designed specifically for accounts payable operations.

Yes, virtual card payments provide superior international security through encrypted transactions, multi-currency support, real-time fraud monitoring, and instant card controls that protect against cross-border payment risks and unauthorized usage.

Trusted by finance teams at startups to enterprises.