Volopay vs Brex vs Ramp vs Stripe: Best corporate credit cards for small business

The emergence of corporate cards as the chosen method of business payments is increasingly being accepted across the globe as the way forward in the future of business. As a direct consequence of this increase in demand for corporate cards, there has also been a growth in the number of competing corporate card providers.

To get the best out of these cards for your startup it’s obvious that you must thoroughly inspect all the options out there and pick out the one that is best suited to your business needs. What you need is a corporate card comparison that helps navigate your choice.

Best features of corporate credit cards for startups

Spending limit

Each of these card providers allow quite a generous spending limit on the corporate cards they issue, especially in comparison with older, traditional corporate cards.

Your credit history is also not required by any of these providers when determining the spending limit.

Integration

Software integration solves the problem of data transfer and management you would otherwise have to face when onboarding a new expense management system.

Business credit cards for startups must be API- enabled (Application Programming Interface) for them to be truly effective. The higher the number of software your card management platform can sync with, the easier it will be for you to manage operations.

Budgeting and forecasting

An important reason behind expense management is to help your finance team budget better and forecast future performance accurately.

Your budgeting and forecasting efforts will be heavily dependent on past performance, cashflows, revenue channels, expense reports, etc. Therefore, you must also compare business credit cards with regard to whose budgeting and forecasting features suit you the best.

Expense reporting

Corporate cards by themselves are already powerful tools to manage expenses.

However, only when card usage is combined with expense reporting and management features do you get the best out of corporate cards. Each of the providers we are comparing has its own unique set of expense reporting features.

Analytics and insights

Data alone can only do so much. For data to be effective you need to be able to draw insights from it.

Moreover, these insights need to be actionable, i.e. the data needs to provide information that you can use to improve operations. In this context, analytics and insights are features that are extremely useful when it comes to corporate card management.

Looking for the corporate cards to manage your business expenses?

Why should you consider corporate card for your startup?

Corporate cards are being adopted by more and more companies simply because they are far easier to use, offer much more control to admins, and are extremely safe. Traditionally, employees would have to follow long and tedious processes before they could get reimbursed for a business expense they incur.

While the nuances of traditional expense management differ from company to company, the general steps are still universal. Employees would have to fill out expense details on lengthy forms, store and provide physical receipts and then wait for the end of the month to come around before having these expenses reimbursed.

For the company as well this would mean a long process of manually verifying expenses, reconciling them, following up on discrepancies, and, finally, reimbursing the amount.

In comparison, business corporate cards are much more efficient. You can issue individual cards to each employee that needs to make an expense. These cards can be issued in physical as well as virtual forms, both of which can be easily controlled from your card provider’s mobile or web application. Your employees can then proceed to use these cards for any and every expense they incur while on the job.

The best part about using these cards is that you can store only the amount of money you need to spend. This means the chance of overspending or unauthorized expenditure is drastically reduced. Moreover, each expense your employees make with these cards is immediately recorded and compiled in real-time.

These cards also come equipped with custom payment approval parameters that you can set up to automate payments and approvals.

Top corporate credit cards for startups

When you compare corporate credit cards the biggest names that stand out include Brex, Ramp, Stripe, and Volopay. While each of these is, in its own way, the ideal business credit card for startup business they do still differ in terms of the extent and scope of services they provide. Therefore, when you compare business credit cards each of these platforms provides, it makes sense to dive deep into the services they provide.

Spending limit

- Brex: Bank balance based, higher bank balance equals higher spending limit.

- Ramp: Bank balance based, higher bank balance equals higher spending limit.

- Stripe: Bank balance based, higher bank balance equals higher spending limit. Also takes into consideration payment processing history, particularly if you’ve used the platform previously.

- Volopay: Card spending limit can be set by the user. Specific budgets can be allocated to each card issued depending on the purpose it is to be used for.

Integration

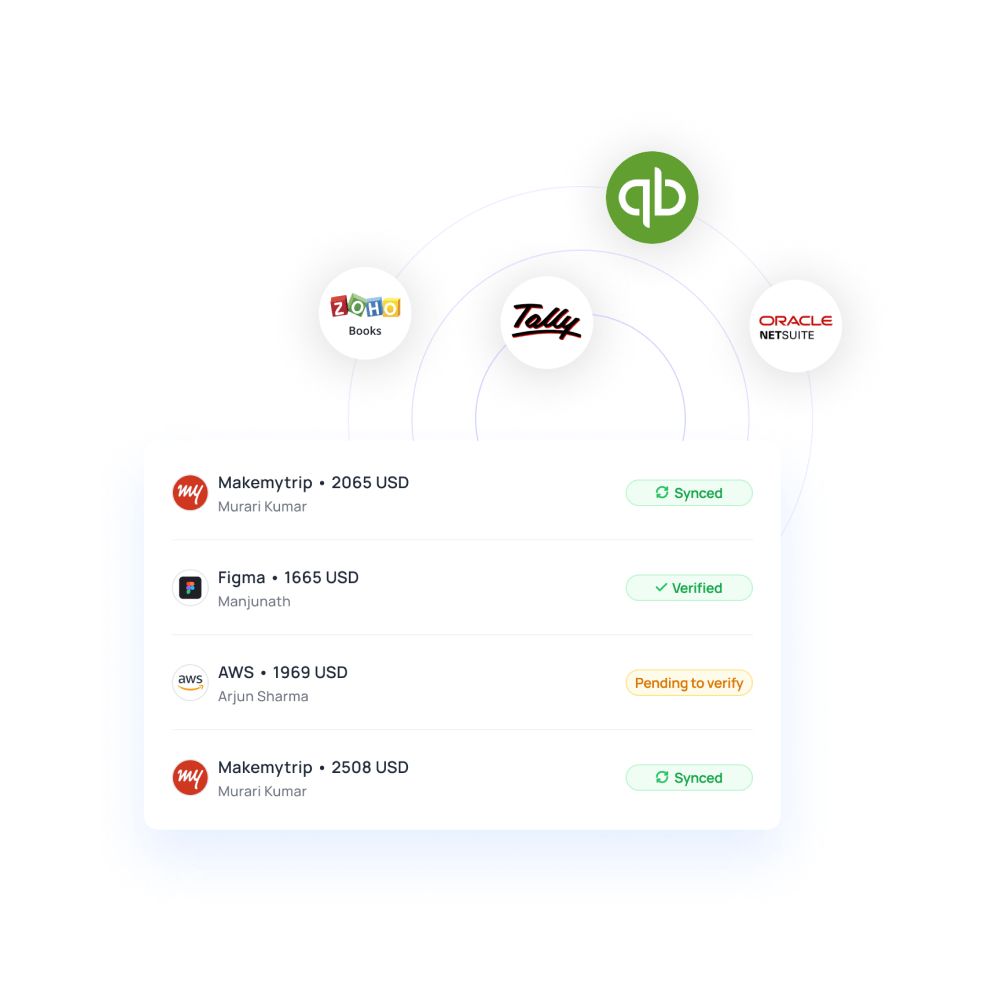

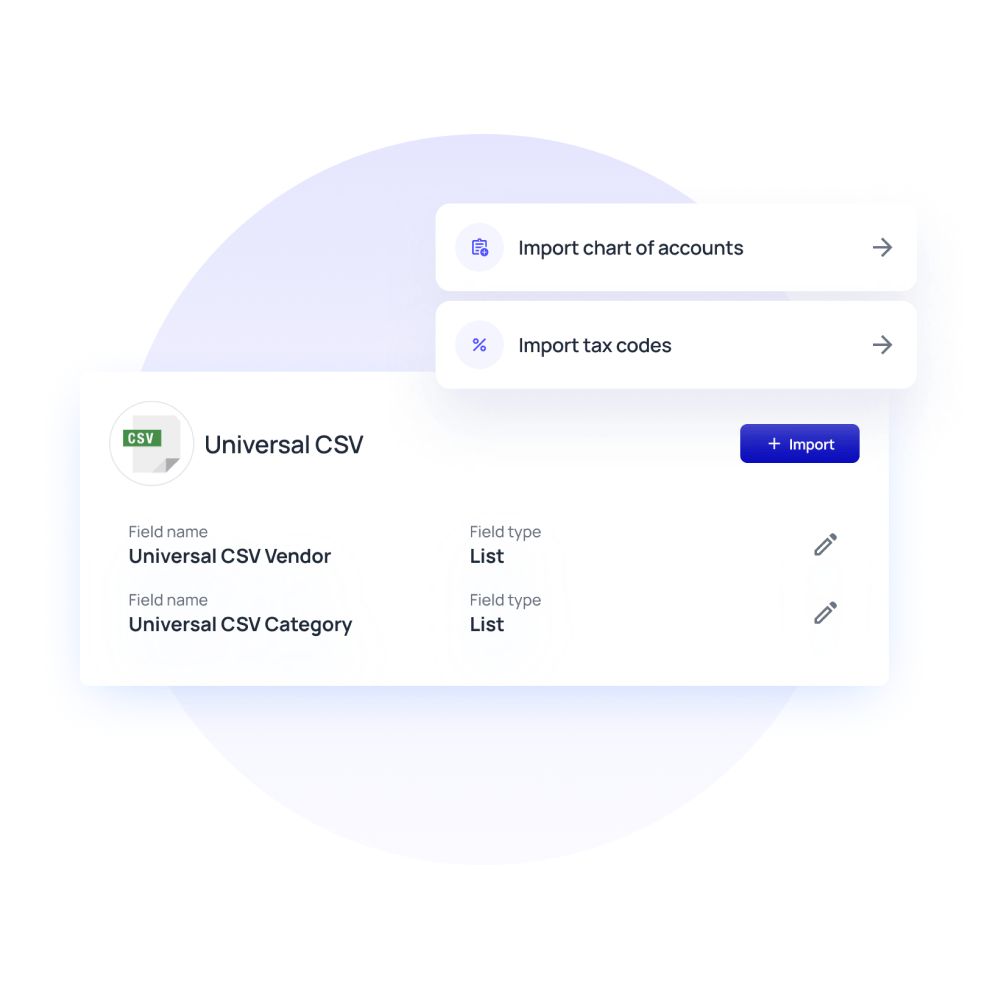

Software integration solves the problem of data transfer and management you would otherwise have to face when onboarding a new expense management system. Business credit cards for startups must be API- enabled (Application Programming Interface) for them to be truly effective. The higher the number of software your card management platform can sync with, the easier it will be for you to manage operations. Let’s see which of these providers are compatible with which software:

- Brex: Compatible with Quickbooks, Oracle NetSuite, Xero, Amazon, PayPal, Gusto, Stripe, Shopify, Expensify, SAP Concur, Rippling, Pilot, VS1 Cloud, Firstbase, Neo.tax, Alloy, Photon Commerce, ShipMonk.

- Ramp: Compatible with Quickbooks, Sage Intacct, NetSuite, Xero, Burnt Finance, Alloy.

- Stripe: Compatible with Quickbooks, Oracle, Xero, Bold BI, Booqable, Bright Funds, DG1, ElectroNeek, Enrolmy, FareHarbor, FormAssembly, GorillaDesk, and 1395 other platforms.

- Volopay: Compatible with Xero, Quickbooks, NetSuite, Deskera.

Budgeting and forecasting

An important reason behind expense management is to help your finance team budget better and forecast future performance accurately. And, your budgeting and forecasting efforts will be heavily dependent on past performance, cashflows, revenue channels, expense reports, etc. Therefore, you must also compare business credit cards with regard to whose budgeting and forecasting features suit you the best.

- Brex: Does not come with budgeting or forecasting features.

- Ramp: Ramp corporate card is specialized to help you forecast savings and adjust budgets accordingly.

- Stripe: While the Stripe corporate credit card is primarily focused on payment processing its sub-product Sigma does help you create custom reports. You may use this to aid budgeting and forecasting but it doesn’t directly work to boost efforts.

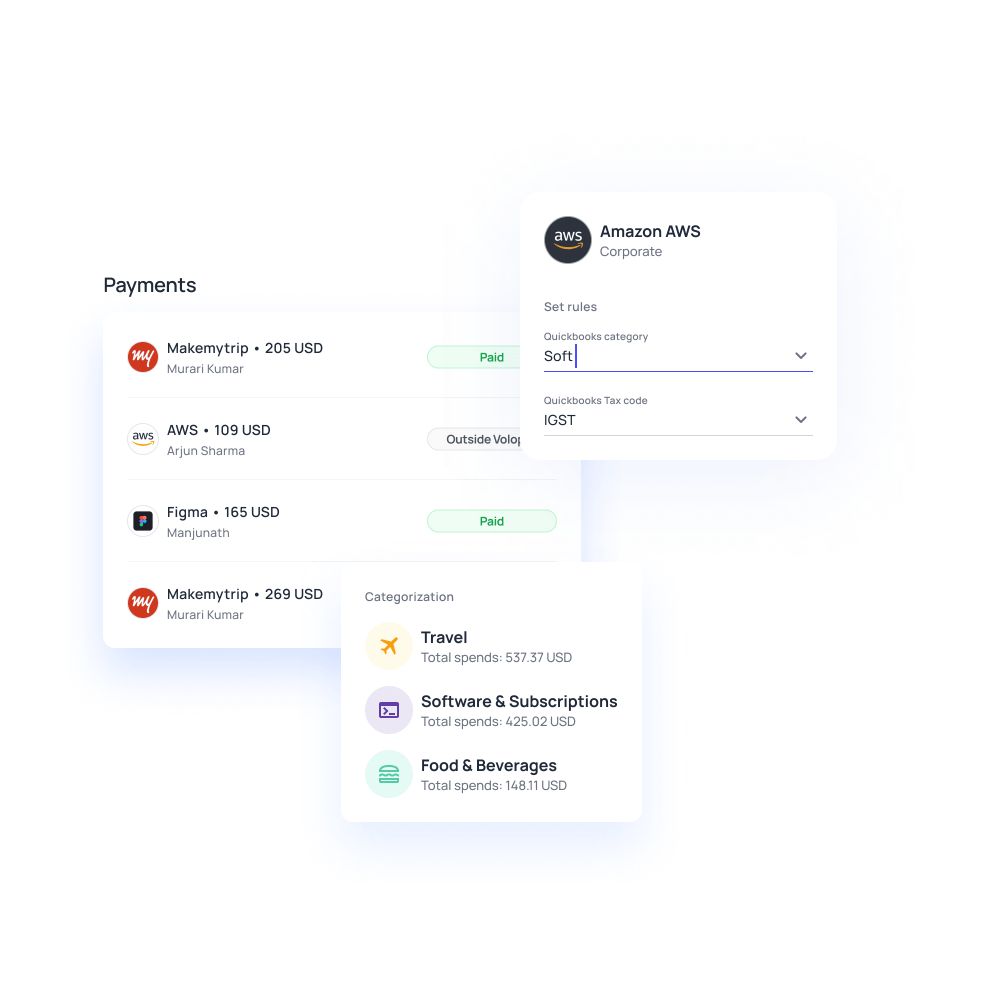

- Volopay: Comes with a comprehensive budgeting system that helps you allocate individual budgets to separate projects, track budget usage patterns and create reports on the same. In-depth analytic reports on spending behavior are also available to help you forecast future trends.

Expense reporting

Corporate cards by themselves are already powerful tools to manage expenses. However, only when card usage is combined with expense reporting and management features do you get the best out of corporate cards. Each of the providers we are comparing has its own unique set of expense reporting features, read on to know who offers what.

- Brex: Offers receipt management and spend control but apart from that neither physical nor brex virtual card offers a comprehensive expense reporting platform.

- Ramp: Offers approval process control, multi-currency payments, receipt management, spend control, and workflow management.

- Stripe: Sub-product Sigma offers some degree of custom reporting but otherwise Stripe does not offer expense reporting services.

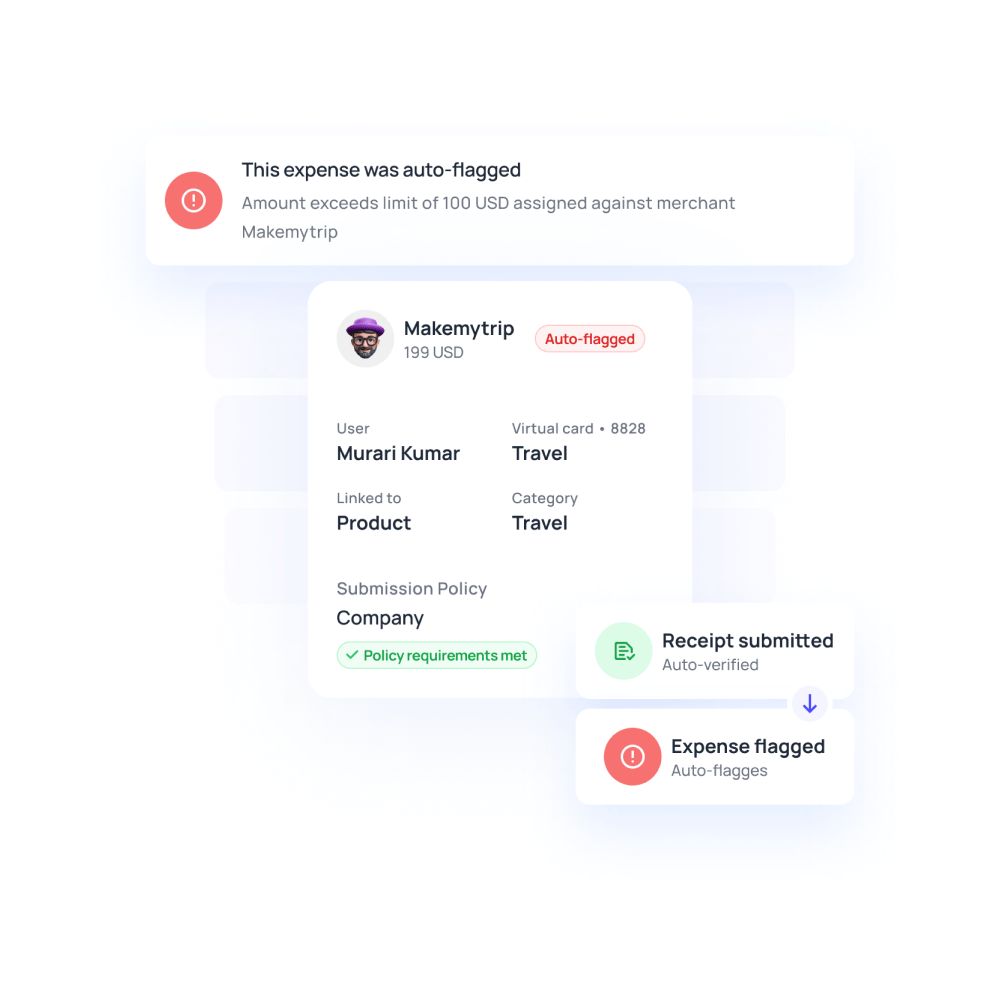

- Volopay: Offers invoice processing, receipt management, spend control, expense tracking, reimbursement, multi-currency transactions, approval process control, and accounts payable features.

Analytics and insights

Data alone can only do so much. For data to be effective you need to be able to draw insights from it. Moreover, these insights need to be actionable, i.e. the data needs to provide information that you can use to improve operations. In this context, analytics and insights are features that are extremely useful when it comes to corporate card management.

- Brex: Does not provide in-depth analytics or insights into spending.

- Ramp: Tracks and analyzes spending proactively. Provides reports and insights on spending behavior. Reports, however, are focused on increasing savings to help cut out wasteful spending.

- Stripe: Offers reporting, usage tracking, and analytics but only on payment gateway performance and subscription management.

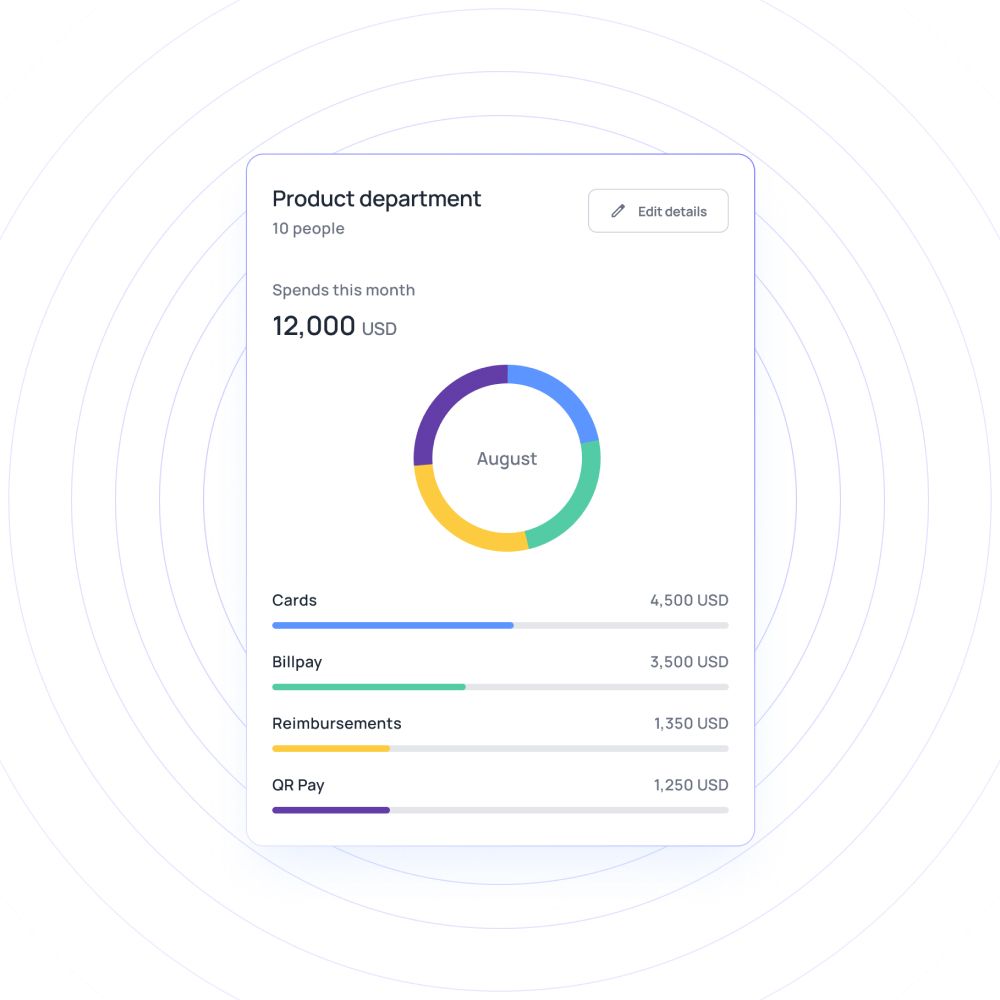

- Volopay: Provides in-depth analytic reports on all expenditures made via Volopay. The Volopay dashboard gives a comprehensive overview of all spend behavior and also comes with parameters that can be tweaked to give customized reports for specific time periods and spend types.

Volopay vs Brex vs Ramp vs Stripe: Business credit card comparison

- Virtual cards

- Physical cards

- End-to-end invoice processing

- Multi-level approvals & approval control

- Reimbursement management

- OCR scanning

- Accounting integration

- Subscription management

- Real-time reporting

- Multi-currency wallet

Get the best corporate card for your startup

Out of all the stages of growth that a business goes through, it’s at the startup stage that most of your decisions are going to have a strong, long-term impact on your overall development. Therefore, choosing the best business credit cards for startups is easier said than done. Moreover, while all four providers - Brex, Ramp, Stripe, and Volopay - are ideal choices in their own context, they’re not all suited for startups.

Volopay is a great option for startups also because its services are far more comprehensive, i.e. it covers more aspects of expense management than the other cards we’ve analyzed in our corporate card comparison.

Volopay corporate cards, especially, are easy to control, track and replace. These cards are also linked with a spend management system that records and reconciles transactions made in real-time.

The analytics and insights offered on these reports are also in-depth and customizable. This is particularly important for a startup because it helps you make the most out of the revenue you have at your disposal. So, Volopay offers a corporate card service that not only matches up to the best-in-class card providers but gives them a good run for their money.

FAQs

Yes, Volopay does provide international bill payments in different currencies. Currently, Volopay offers payments in USD, SGD, and AUD. You can also maintain different wallets for each currency you work with.

Trusted by finance teams at startups to enterprises.

Choose the best corporate cards for your business

Related pages to corporate credit cards

Explore top corporate credit cards in the US for 2025, their features, benefits, and tips for efficient management.

Understand what a corporate card is, how it works, its benefits, and why it’s essential for business expense management.

Discover the best prepaid business cards in the US for 2025. Compare types, benefits, limitations, and find the perfect fit.