What is a business credit score and how to increase your business credit score?

Go through our comprehensive guide on business credit scores and see how to increase your business credit score to stay ahead of the competition.

What is a business credit score?

A business starts with an idea, further fueled by funding. Whether you are a budding business owner or a well-established company, having a great business credit score can land you in the good books of top-tier lenders.

Just like an individual credit score is a reflection of how reliable your personal financial management is, a business credit score is an important insight into your company’s financial wellbeing. A company credit score allows lenders to assess your creditworthiness, i.e. how reliable you are in terms of starting a new credit line and how punctual you are in terms of repaying it back.

Why business credit score is important?

High credit score levels open doors to quicker credit approvals, competitive interest rates, and even access towards starting a bigger credit line.

Whereas, a lack of a good credit score can highlight the negative aspects of your company’s credibility instead, which could result in a domino effect of losing your reputation and any subsequent hopes of a new credit line.

From vendors to lenders to your business partners, anyone can do a quick business credit check to gauge the financial health of your company. Therefore, it is now more crucial than ever to maintain a healthy company credit score.

How is business credit score calculated?

Want to know how is business credit score calculated? Here’s a surprising fact about business credit score: There isn’t a ‘one-size-fits-all’ kind of scoring metric. In fact, there are multiple business credit monitoring systems which means your company has multiple business credit scores.

Credit score levels range from a scale of 1-5 to 1-1000, depending on which business credit monitoring system a particular lender is using. Therefore, if you want to stay on the safe side, it’s better to score as high as possible on these metric systems and not fall in the lowest quarter of any of them.

A business credit score is calculated on information received from three main areas:

Frequency of repayment

Most credit scoring platforms are tied up with various debt collection companies, so they are constantly aware of not just the amount of debt a company currently has, but also the frequency of on-time & delayed repayments made by the company to their vendors & lenders.

Public data available

All registered companies have data available publicly at government bodies and banking institutions which can be freely accessed by credit scoring companies when performing a business credit check.

Complaints and grievances

Another way credit scoring organizations assess your creditworthiness is by registering complaints from your vendors and suppliers who are dissatisfied with your speed of repayment or any other legitimate issues.

Avail flexible line of credit for your business

Benefits of a good business credit score

Any lending institution will look for two things: how reliable you are and how fast you repay. And a good credit score tells them everything they need to know! It is a sure-shot way of getting screened and approved faster than your competition, which means no waiting in line to get a new credit line.

No government would like to associate itself with any business entity that carries a lot of debt baggage. Having high credit score levels ensures a level of trustworthiness, good financial health, and credibility for your company, making you the obvious first choice for lucrative government contracts and grants.

The most important aspect of a supplier-buyer relationship is timely payments. A good credit score is indicative of punctual payments and appreciating credibility which can result in fruitful business between you and your vendor for a long time. In case of a default on payment, a vendor is more likely to show patience and understanding if you possess a higher credit rating.

Good credit scores are not just proof of your credibility but also your overall business acumen, making you a preferred choice for investors. This reassures your investors of your company’s future and that you can secure and manage debt to grow your business.

Most companies are unaware that their business credit scores significantly affect their business insurance rate. Insurance statistics show that companies that rank higher in their business credit checks file lesser claims and pay timely premiums. Therefore insurance companies are more likely to provide you with notably lower rates than those with a low credit score.

How can weak business credit score adversely affect my company?

A weak credit score might not seem like a big deal - at first glance. However, having low credit score levels can ensue a never-ending cascading effect causing you to lose your credibility and reputation.

Sky high-interest rates

The lower your credit score, the higher the interest rate is charged on your loan. Since your creditworthiness is taking a blow, you might have to resort to bad credit loans that charge more than 20-30%, thereby forcing you to push your product/service value extremely high and ultimately losing customers to your competition.

Choosing wrong vendors

Payment history reports are a crucial part of developing a good credit score. If you choose vendors who do not report your payment history to various credit scoring companies then you are not building a credit score, even though you think you are.

Focusing on one credit scoring systems

As we discussed earlier, there are multiple business credit monitoring bureaus. Since every potential lender has their preferred platform and they are not legally bound to tell you what scores they are assessing, focusing on one system alone can greatly damage your business credit score.

Lose out on partnerships and new accounts

A bad credit score reflects poorly on your company’s overall reputation and will cost you crucial partnerships and new accounts. Weak credit score levels encourage them to take their business to your competitors as you become branded a high-risk company.

Damage your personal credit and finances

Sometimes business owners tend to mix their business and personal lives. A weak score can wreck your personal credit score too especially if you provide a personal guarantee on loans or sign personally on business credit cards. Additionally, you also become liable for any business debts you have signed.

Get a business line of credit from Volopay

How to increase your business credit score?

Early and timely payments

It goes without saying that late and missed payments are one of the main contributing factors to plummeting credit score levels. So, always make credit repayments early or on time with an automated accounts payable system that keeps you up-to-date with all your due payments.

Corporate credit cards

Corporate credit cards can significantly help in growing your company’s credit scores. Use these corporate cards for travel and accommodation purposes, pay on time and reap great rewards such as healthy credit scores and exciting cashback offers!

Avoid legal problems

Being embroiled in a legal dispute will not be favorable for your business credit scores. All legal matter is recorded and reflected in your credit reports that can potentially malign your reputation. Therefore try to avoid any legal problems as much as possible.

Create your business bank account

Remember when we talked about the danger of mixing your personal finances with your business? Create your business’ independent identity with a separate business bank account. A business bank account will develop a favorable relationship with your bank when you apply for credit.

Maintain a low credit utilization ratio

A low credit utilization ratio is the difference between the amount of credit available to the business & the amount that has already been utilized. Try to maintain a healthy ratio and spend less than 15% of the available credit. If the current ratio is high, try to reduce spending on the credit line or increase the credit limit.

Oversee your business cash flow

Stay proactive when it comes to your business cash flow. There are times when your company might be short on cash. Instead of drowning yourself in debt, it might be better to come clean to your vendors and appeal for an extension. Once you explain what’s causing the low cash flow and when you’ll be able to pay the due, they are less likely to report to the credit scoring companies.

Avoid multiple credit and loan applications

Every business credit check performed by your lender is recorded into your credit report. This also keeps a track of all the previous credit line requests rejected in the past. It can reflect poorly on your business and impact your credit score as well. The best course of action is to do your research before applying for a loan, so as to ensure that you meet all the criteria and therefore have a good chance of getting approved.

Deal with high-risk businesses and late payers

In a B2B business, you might also come across high-risk businesses that score low on the credit scales. In that situation, instead of rejecting their businesses altogether, you can structure your agreements and put clauses regarding upfront deposit or late payment processing fees to safeguard your own business credit score. Additionally, try not to rely on these late payers and gradually remove them from your client base every cycle.

Constantly monitor your company credit score

Don’t assume, know! The worst thing you can do for your credit score levels is to not monitor them regularly and focus on just one credit scoring bureau. Instead, try to check in with all your credit scores at regular intervals and keep a lookout for any discrepancies. If you find your score falling significantly due to an error, invoice issue with the vendor, or signs of fraudulent activities (unauthorized business credit checks), report immediately to the respective bureau!

How can Volopay help provide flexible credit line and working capital for my business?

Now that you are armed with this newfound knowledge on how to increase your business credit score, it might be the right time for you to start a new credit line and breathe fresh life into your credit score levels with Volopay.

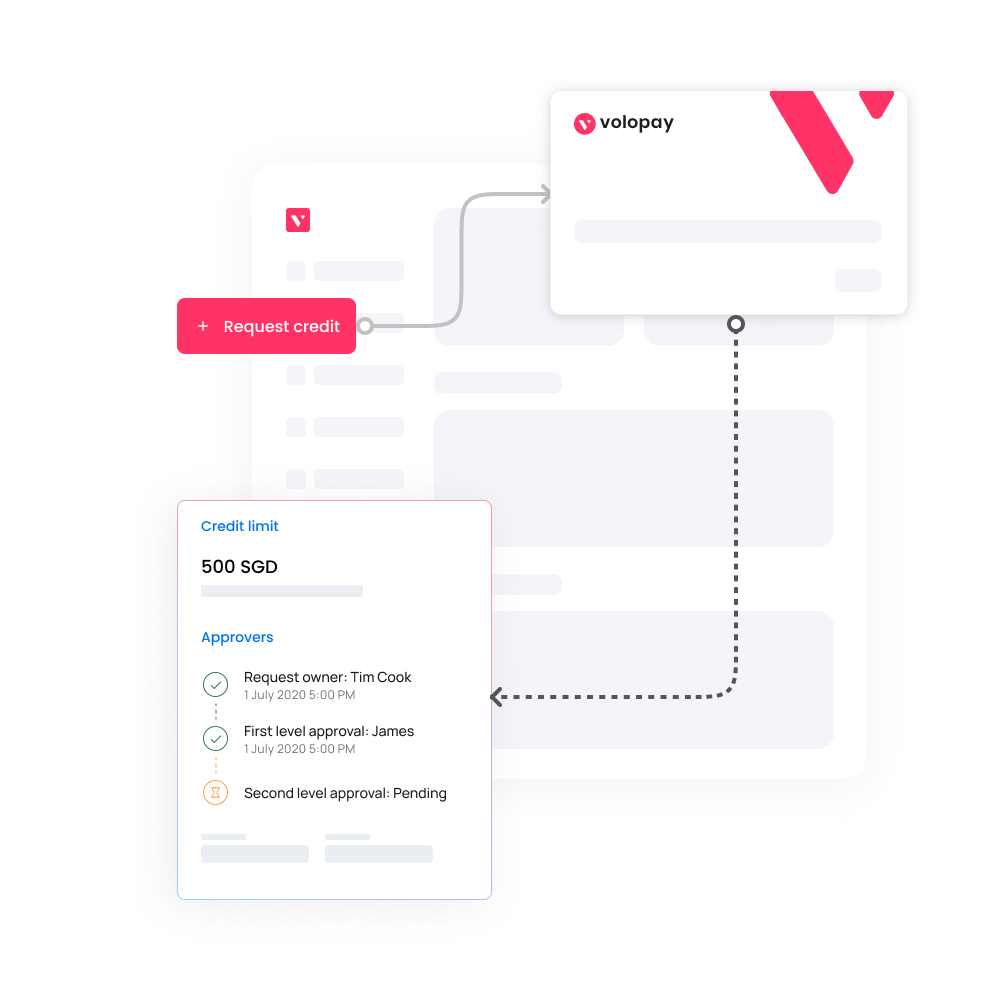

Volopay’s flexible credit line caters to a wide array of enterprises — from a budding startup to an established company, we help companies realize their true potential. Our approval process is fast and precise, with a scalable credit limit without any personal guarantees.

Stay up to date on all your credit spending by automated syncing with your choice of accounting software. We provide corporate credit cards with in-built credit for all your employees without you having to relinquish any control over its spending limits.

FAQs

To get your most recent business credit score, you can check business bureaus like Dun&Bradstreet, Experian, and Equifax. These agencies have monthly and annual paid plans to provide credit reports and other related services. Before you plan to build your business credit score, check your current score with them.

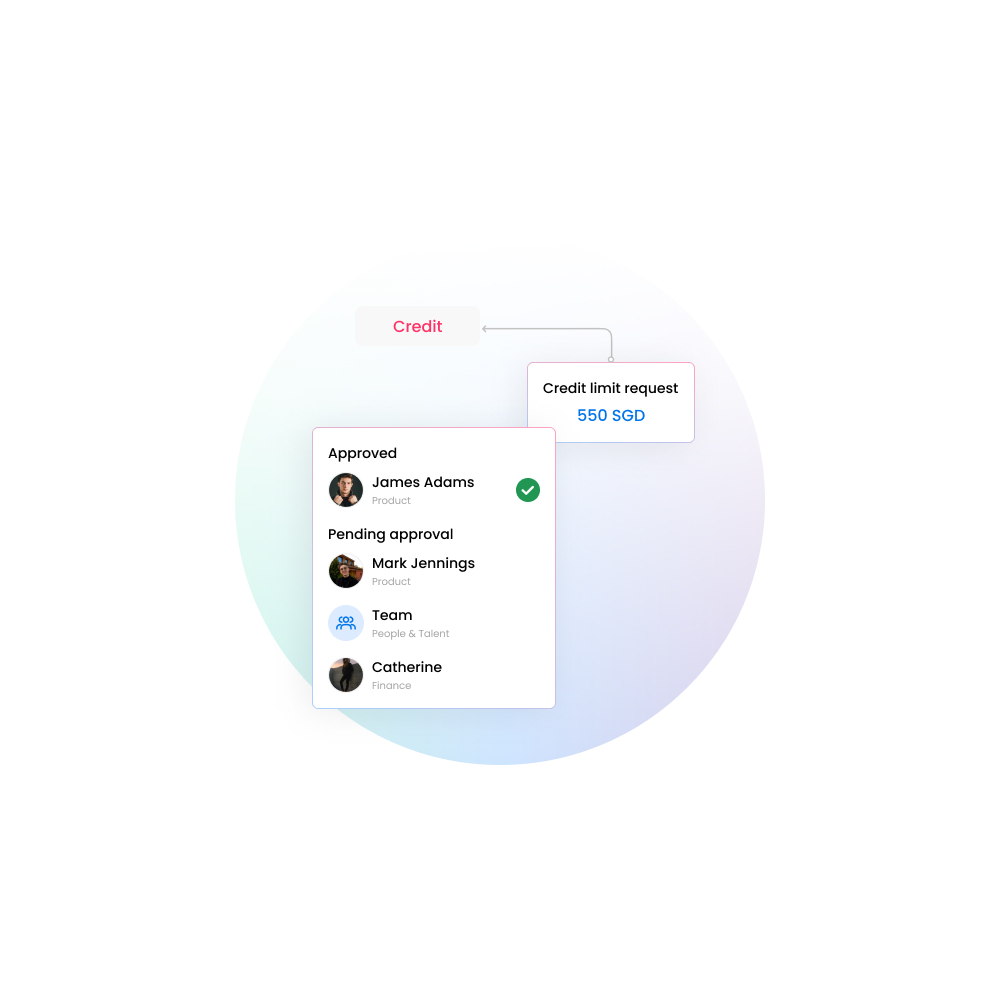

To apply for business credit, please visit your account dashboard, visit the credit section and apply for credit by providing relevant details. You can directly apply through here as well.

Once we get the information, our credit team will process it and inform you of the amount of credit limit. There are multiple factors that will determine the amount of credit limit like current financial situation, cashflows, bank balances, repayment history among many others. Upon sanction of the credit limit, the company needs to sign an e-facility agreement.

A good credit score varies depending on the kind of credit scoring company a particular lender prefers. As a rule of thumb, it is beneficial for a company to score in or near the highest quadrant (70% or higher). Here are some of the major credit scoring bureaus and their respective scales:

- Dun & Bradstreet (D&B): 1-100

- Experian: 1-100

- FICO score: 1-300

No. Personal credit card scores cannot impact your business credit score. Your business credit score is the reflection and representation of your business’s financial health. Your personal loans and liabilities don’t have significance here. This is why you must separate business and personal finances.

To increase your business loan eligibility, you should have rigid financial practices first. Make credit card repayments on time and ensure positive cash-flows. Separate your business and personal finances if you are using the same account for both. Improve your business credit score as banks decide your eligibility based on this.

It can take up to 3 years to build a good, positive business credit score. But with exceptional financial performance, some businesses manage to make it within one year. If new businesses focus on their credit score right from the start, in a year or two, they can reach a strong mark.

Trusted by finance teams at startups to enterprises.

What are you waiting for, get started with Volopay today!

Related pages

Learn how to avoid credit card fraud and what are the steps you should take if you get into credit card fraud.

Building your business credit is crucial for small businesses, find out the techniques to build business credit here.

Greater control, easy approval, and flexibility are some of the benefits of a line of credit for e-commerce financing.