Why does your business need automated expense reporting?

Expense reports are a major hassle - there is no getting around this. One of the most stressful times of the month (not to mention the fiscal quarter or year), they’ve become a major headache for every single business.

Employees and managers struggling to put together invoices and transactions; finance departments chasing down receipts; CFOs panicking about overshot budgets. Compliance and accounting departments are up to their necks in confusion. You can see why most people would then turn to automated expense reporting.

An expense report is crucial and unavoidable. If your business works with a reimbursement model, this is especially true. Your employees need to have immaculate expense reports in order to be paid back for their out-of-pocket expense claims.

Expense report software can streamline this process to a large extent; even more so if you use corporate credit cards. Letting the software track expenses, invoices, transactions, and vendor reconciliations can remove a major burden from employees.

What is automated expense reporting?

Automated expense reporting helps streamline the expense reporting process by eliminating the need for human intervention.

Expense management software handles everything, generating reports by analyzing previous transaction data. Employees simply input transaction details, and the system compiles the report automatically.

If you utilize the software to make payments, then you don’t even need to enter any data. All transactional information is recorded automatically by the software, and an expense report is generated whenever you need it.

Why automate your expense reports?

Fewer errors

Avoiding human errors is never a foolproof task. No matter how careful or precise you are, mistakes are bound to happen. These mistakes can cost both time and money to rectify. Expense management software takes away the responsibility of accurate reporting from human resources. Instead, everything is generated online so that human intervention is only needed in an emergency.

Saves time

There is a lot of time wasted in manual data entry and analysis. Expense management automation can eliminate this issue so that time and energy can be better utilized for more productive tasks. A simple act of exporting an employee expense report (for accounting) can take hours of line-by-line correction. Softwares like Volopay automatically generate reports and plug them into accounting software.

Fraud reduction

If you are handling money, you are susceptible to fraud. Fraud can occur through data leaks, false reporting, fraudulent expense claims, or multiple invoice processing. Pinpointing these bookkeeping errors is a mammoth task for employees. However, expense management automation reduces your risk of fraud.

With software combing through your transactions, it is possible to immediately recognize double payments, irregularities, and expense report frauds. There is also the added benefit of data protection, ensuring the security of your employees and accounts.

Visibility to spend

Spending becomes better when you know exactly where your money is going. Administrator panel gives you a full view of how budgets are being utilized, and what recurring payments are actually beneficial.

By incorporating spend analysis, expense management automation not only creates transparency in spending patterns but also helps managers identify trends and anomalies in their teams’ expenditures. Expenses can be quickly divided between necessary and unnecessary, and financial control is better achieved.

Built-in policy controls

Employee expense report analysis also brings with it the process of compliance and reconciliation. Accounting and legal teams have to process the data to ensure that everything is up to regulatory standards. However, this can be a long-winded process, eating into the company's time and funds.

Expense report software handles policies differently. The company can outline expense policies, as can departments. These policies are automatically enforced by the platform, preventing employees from making any transactions that go against the policies.

Speed up approvals and reimbursement

Approvals and reimbursements are the biggest time-wasters of account reconciliation. They are hectic to trace, even more, hectic to act on. Expense management automation with Volopay eases this burden. Multi-level approvers can be delegated, in advance, for different budgets and cards.

A well-designed travel and expense report system allows employees to seek immediate approvals for expenses with a one-click process. Additionally, access to unlimited virtual cards eliminates the need for reimbursements. If reimbursements are required, all receipts and information are consolidated in one place, enabling swift approval.

Get the best expense reporting software for your business

Automate expense reports with Volopay

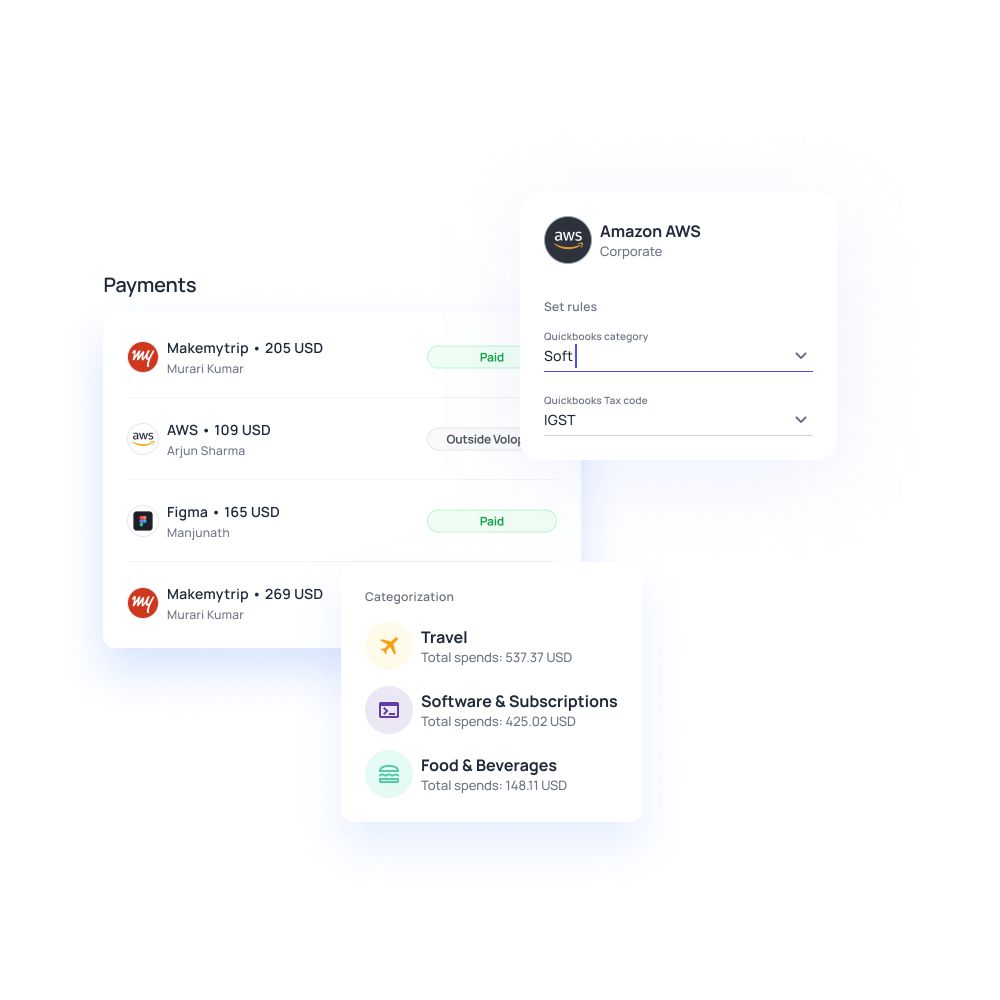

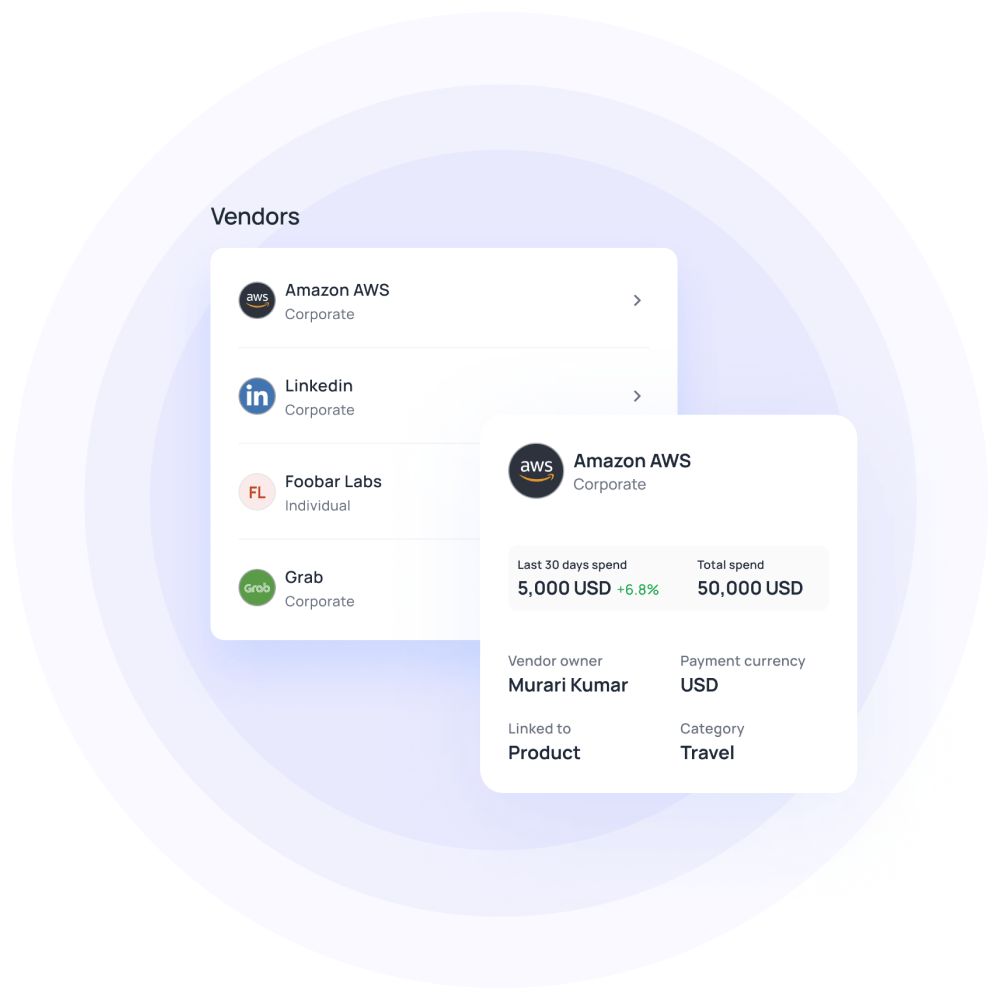

Volopay’s expense management software provides an easy-to-use interface for you to automate your expense reporting. The invoice management system tracks all records for specific vendors, as well as the transactions for each of their payments.

Streamline Bill Pay

Any payments done from the Bill Pay are automatically recorded for expense report generation. These can be local payments or cross-border ones. They’re recorded all the same. Moreover, you can also save money on cross-border payments since Volopay offers competitive exchange rates.

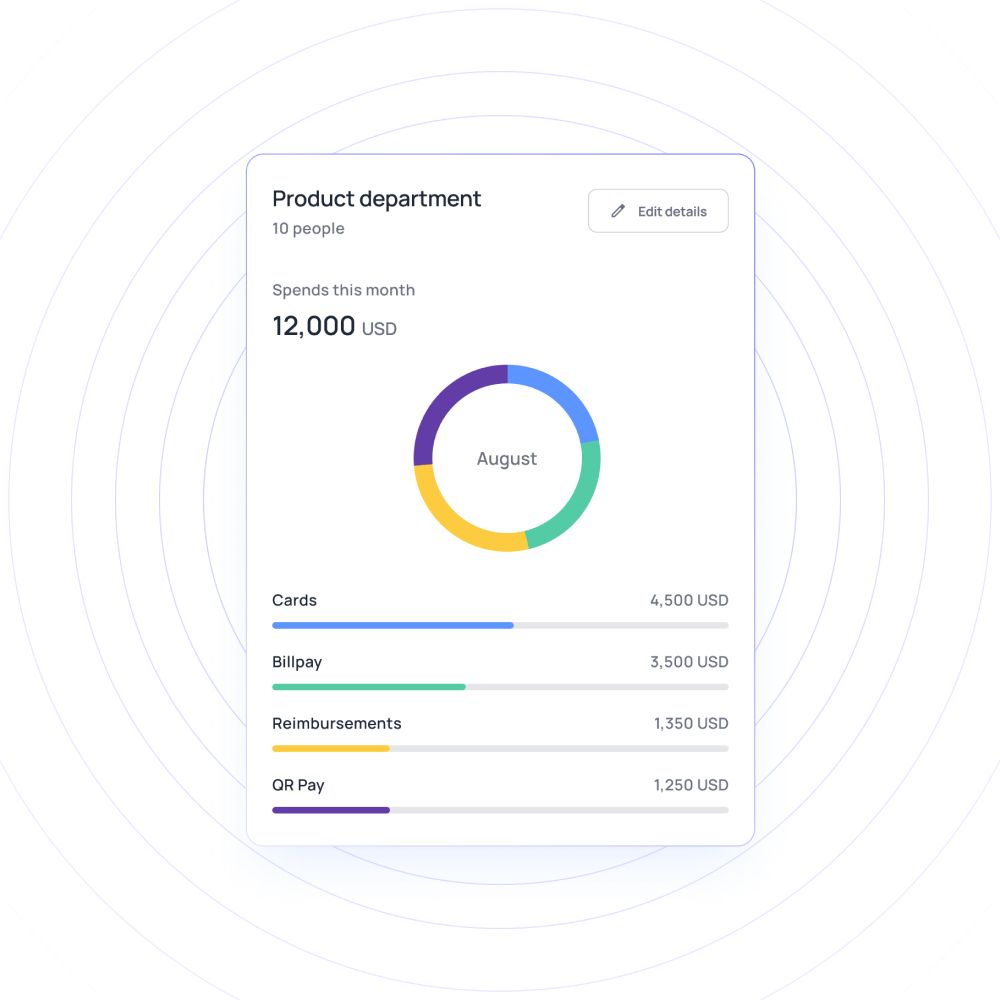

Assign budgets to specific departments

All cards and payments associated with that department are linked to this budget. So, when an employee expense report is generated, it also reflects which budget the expense has come from.

The user interface allows managers to constantly monitor how the budget has been allocated, and how much of it is being utilized with every transaction. These managers can also be delegated approvers for transactions - which makes it easy to trace the authorization of any spending.

FAQs

Expense reports contain a ledger of all transactions done through the Volopay platform, dating back to a frequency of your choice (monthly, weekly, etc.) They also include insights on overspending, duplicate payments, and suggestions for cost-cutting. Automated expense reporting also shows graphs and data on spending patterns.

Expenses that violate policy are automatically declined. They will show up in your ledger as “Not Okay” (if flagged by an approver”, or as Declined (if flagged by the system). Expense claims will also be included in this.

Yes, integrations on Volopay allow you to merge information on reimbursements, as well as Bill Pay and corporate card transactions on the same platform.

Yes, Volopay can integrate with accounting software such as Xero, Netsuite, and Quickbooks to export your expense reports in the required format. Your expense reports are also available to download in PDF or CSV format.

Trusted by finance teams at startups to enterprises.