Importance of departmental budget for your business

A business budget is defined as a calculated prediction of the revenue and expenses of the upcoming business year or specific future time duration. Budgets are used by every entity organization, household, and government and are especially considered as a crucial element for running a business productively. Managing team budgets and setting compliance policy is one of the major tasks of the company managers and along with this a budget also plays a part in an action plan for all the people in the company.

The process of preparing a budget can be extremely challenging for a company, especially when customers fail to pay on time or when the profit margins are tight and sales is bleak. Although, once a managed budget is made the company functioning becomes a little easier in terms of financial operations, and with this enforcing rules for employees to stick to compliance policies also becomes a chaos-free process.

How does company budget function?

Business budget planning can be a complex task for companies, however, at the most basic level, a budget consists of the revenue and expenses of a company for a given time period. Certainly, company budget management and allocation of the budget to different departments determining the needs of various departments, their expenses, and forecasting the sales comprise only one part of the company budget planning.

People involved in the budgeting process have to consider various other factors like upcoming capital expenditure like large purchases of fixed assets such as new factories, machinery, etc. They also have to be careful about the progressing cash requirements, revenue setbacks, economic pitfalls, etc. Despite the type of business, the potential to measure the performance of your company using the prepared budget and cash flow forecast is important to the holistic financial health of the company.

A cash flow statement provides insights into how money is moving within the company—helping to ensure that enough liquidity is available to meet both operational and investment needs. By tracking cash inflows and outflows, it offers a real-time snapshot of a company's financial position, making it easier to plan for future expenditures and allocate resources effectively across different departments.

What is department specific budget?

Departmental budget is defined as a department-level financial plan that specifies the spending pattern and limits for the department for the coming fiscal year. People making department-specific budgets must start with a strong foundation of data. This foundation involves specifying goals in regards to income and expenses, predicted sales, overhead costs, and the anticipated raw material costs. Along with this, the budget makers will also keep some extra funds as an emergency reserve in case things go south.

Looking at the future, a departmental budget strategy can potentially help businesses stand at a financially strong level and make sure that there is enough money reserved always to pay employee salaries, vendors' invoices, and fund future projects.

Importance of having department specific budget

Departmental budgeting gives managers more control over spending at their department levels which facilitates them to analyze the performance of all the teams at the very basic level. Along with this, department budgets are also beneficial when it comes to fulfilling the company objectives.

The other benefits include risk management at the granular level, the ability to distinguish which areas in the business are profitable and which are just not contributing rightly to the revenue. With departmental begets you will know exactly where the money is going, who is using it, for what purpose, and what was the final outcome. This also helps in identifying the blockages in the system much faster in comparison to the one budget for all in the company.

Related page: Indirect spend management: How to control indirect costs?

How do department managers enforce budgets?

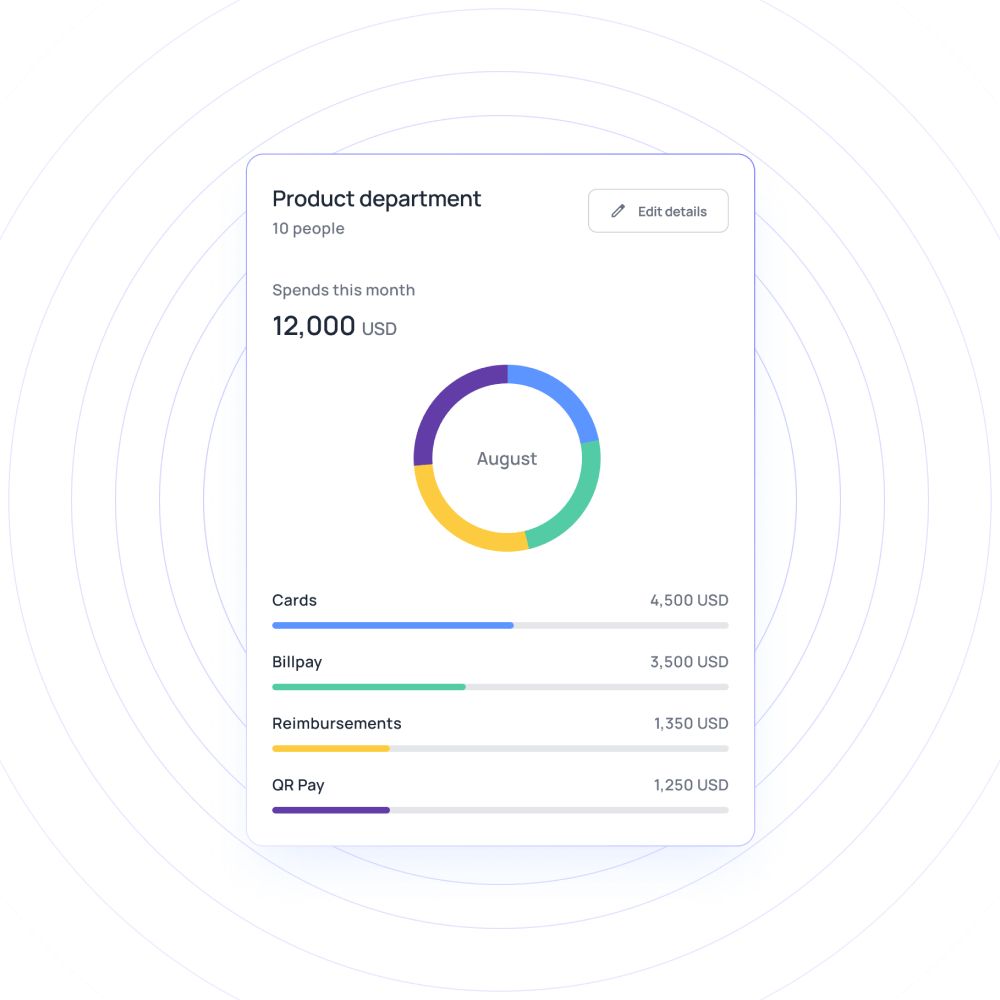

Track & monitor the budgets

With Volopay, you get the excellent feature to track and monitor the budget you set. On your Volopay dashboard, you can see the insights of spent, assigned, and unassigned budgets. This feature allows you to always have enough information to make the right budget decision.

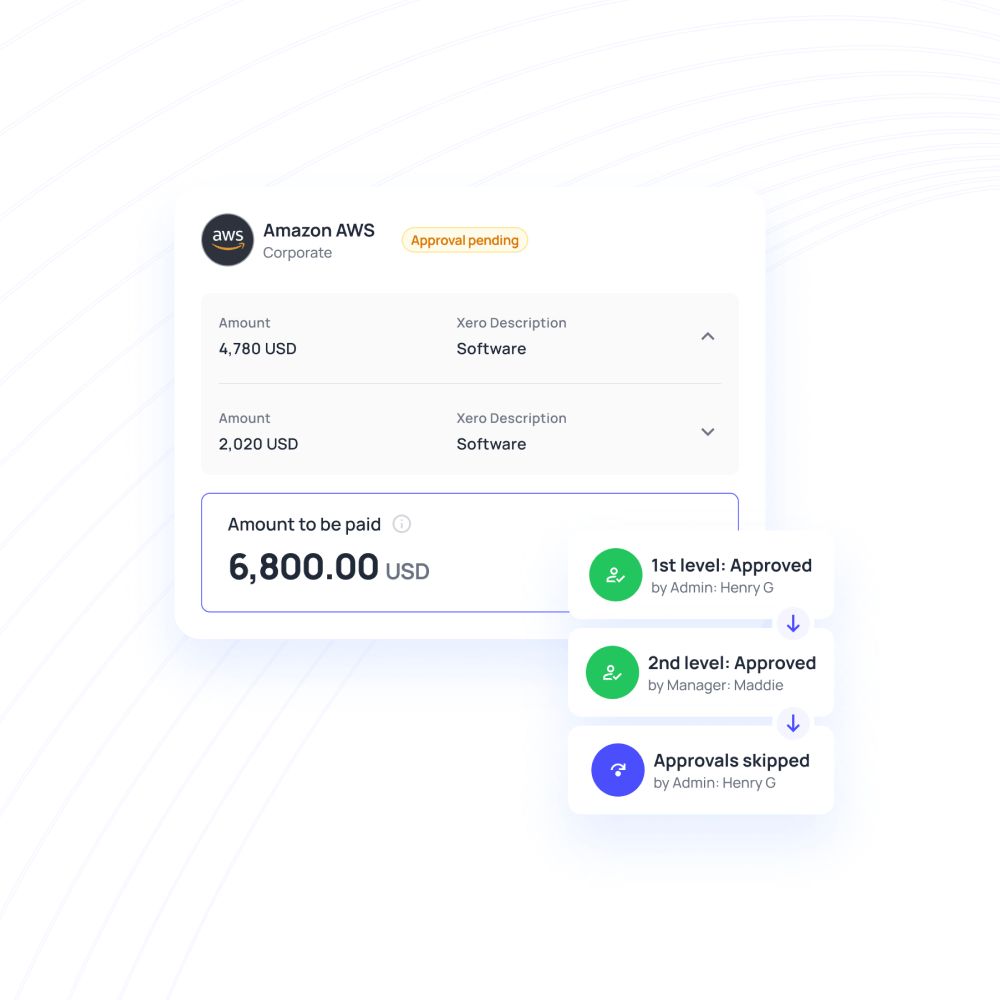

Set multi-level approvals

To ensure maximum compliance, Volopay offers you the feature of setting multi-level approvals. This means whenever any employee would try to use the company funds, the expense request will pass through two or more approvals by managers and the finance department depending on your company’s requirements and policies.

Know your timeline & evaluate spending requirements

Managing team budgets implementing a successful budget needs to begin with the evaluation of the need of the department and the time available to achieve the set targets. Managers have to know what tools are required, the salaries of the team members, the estimated cost of the project & its completion timeline. You have to maintain certain flexibility in the budget to shift according to performance.

Determine the budgets & allocate accordingly

Once you know the needs of the business departments, you can easily allocate funds to each team and also set corporate compliance policies which are automatically enforced through Volopay “Budget”. With Volopay managing team budgets becomes extremely easy as your only task is to set a budget and limit for each department the enforcement and implementation are all done by Volopay.

Effortlessly manage your budget with the expense management software

How can expense management automation help enforce budget?

Get real-time visibility

It is a true fact that budget accounting is potentially superseded by automated expense management. This is because expense management gives better insights for smart business decisions. Having the facility of getting all expense information organized in one place makes it easier to improve performance based on different performance indicators. All information changes get updated in an expense management system immediately, which gives everyone in the company real-time visibility for everything.

Avoid risk & fraud

One major reason to adopt an automation expense management system is to keep your company safe from expense fraud. Automated expense reporting potentially eliminates all the chaotic processes which are prone to error. This means that the employees don’t have to save receipts and manage the budget, the executives don’t have to panic about misinterpreted or wrong information. Along with this, a good expense management system will help you identify if someone is overcharging you or any data is leaked.

Reduce burden for the finance team

An automated expense management system significantly reduces the burden of the finance team, as they don’t have to go through each receipt and check it with the entry or run around to get information for making reports and preparing the budget. All the required information is easily and readily available and all the finance members can focus their energies on many important tasks like financial planning and forecasting.

Great spend control

With real-time visibility, no fraud, and all data centralized, the managers and seniors get immense control over the spending pattern of the company. An expense management system colossally changes the way your company spends and how you can control where the money is going.

Flexibility

Flexibility is an essential quality in a budget to incorporate the changes and adjustments which come over time. Flexible software can support and be a catalyst for a business’s growth. You can easily add new employees to the system, make changes in the previous vendor arrangements, easily get the taxes filled, set multi-level approvals and so much more.

Ensure compliance

Compliance is a major agenda for numerous companies because non-complain can bring in major damage to the company at all levels. Automated expense management systems virtually terminate any risk related to corporate compliance policy. These systems can easily apply complicated tax rules and auditing features.

Related page: Business expense management software for FMCG companies

How do Volopay departmental budgets work?

Volopay is an all-in-one spend management platform designed to help you step up your business game. We offer various business budgeting tools and features which can make managing team budgets and the overall budget a much simpler task.

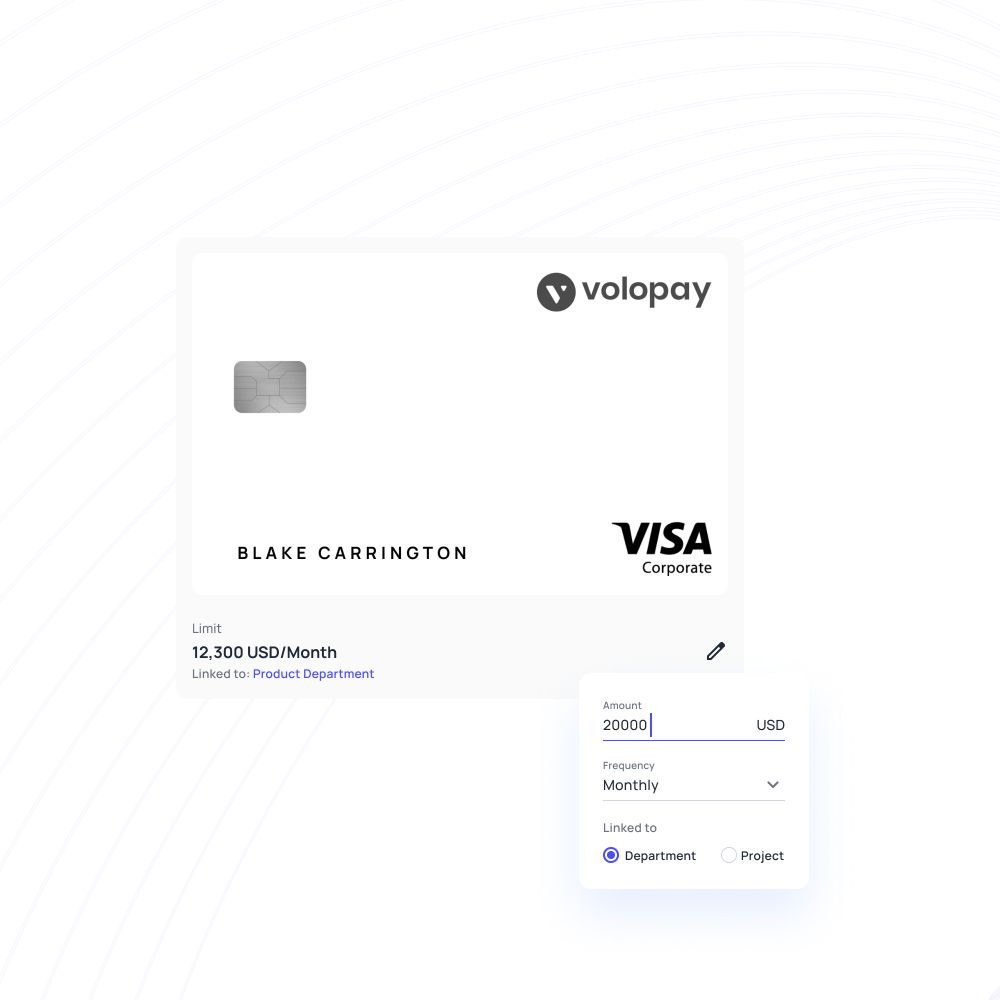

One-time & recurring card payments

A one-time budget can be defined as a set amount for the entire lifetime of the company budget and cannot be reset at the start of every month. This type of budget can only retire if you set an expiration date or manually freeze/block the budget.

A recurring budget is the one that automatically transfers funds to the allocated places on the 1st of every month, updating to the amount you have officially set as the budget limit. Again this budget will not expire until you prefix a date or manually retire the budget.

Allocating budget

Coming to the point where who has access to the budget and its allocation. Our system gives you the option to add multiple owners and members to the budget. When you are setting the budget on Volopay. Add at least one budget owner for each budget, but you can also choose to add multiple members as budget owners for a single budget.

However, don’t panic you can always change, add or delete the roles, members, and other details of the budget. Once you develop better insights into your monthly spending you can easily update your budget settings to match your company's workflow.

Budget owner

A budget owner basically has the authority to allocate the funds of the budget to different teams either in a physical or virtual card. Only budget owners and admins can create virtual cards. Whereas members in the budget have only some functionality options. Members can only access funds once they have been assigned to them by a budget owner.

Furthermore, if there is any suspicious activity identified in your company cards whether virtual or physical, the card owners can simply click freeze, unfreeze and block the cards according to the situation. Plus, you can also archive your business budget if it is not in use but before doing that make sure that the budget is 0.

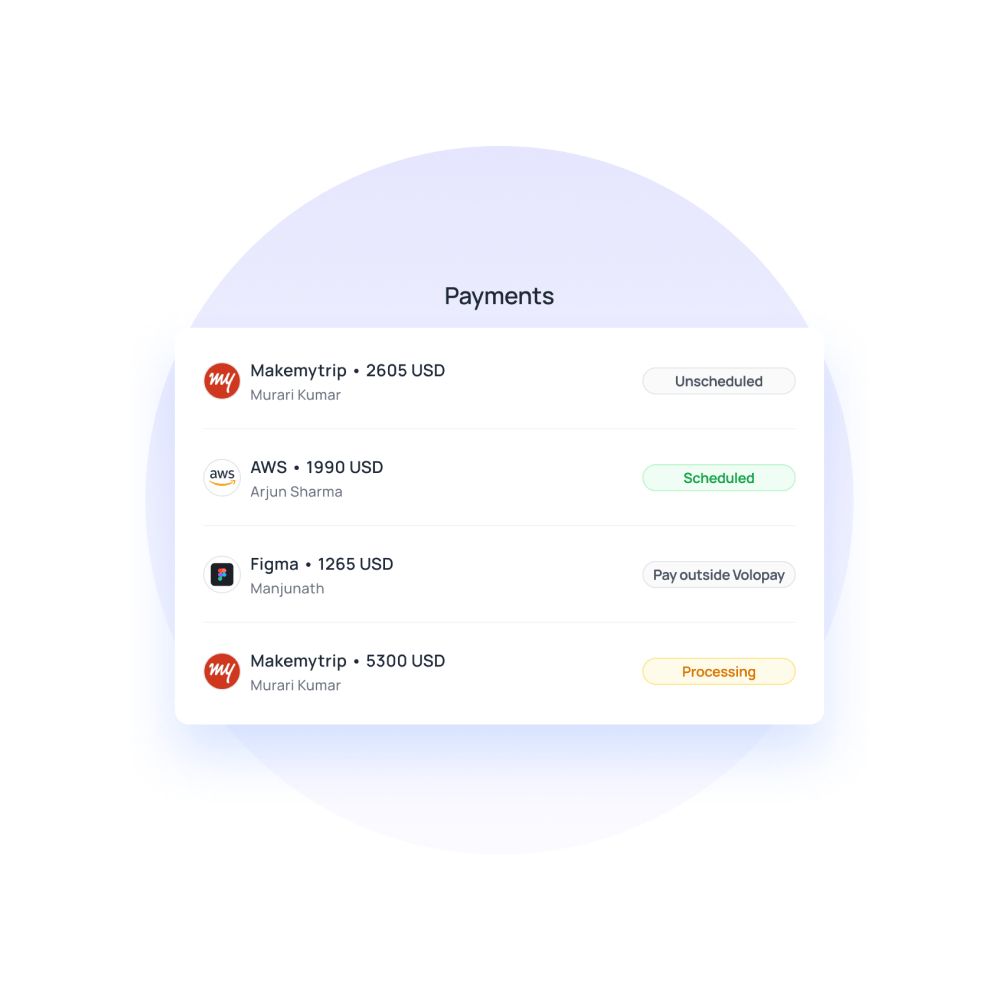

Claim out of pocket expenses

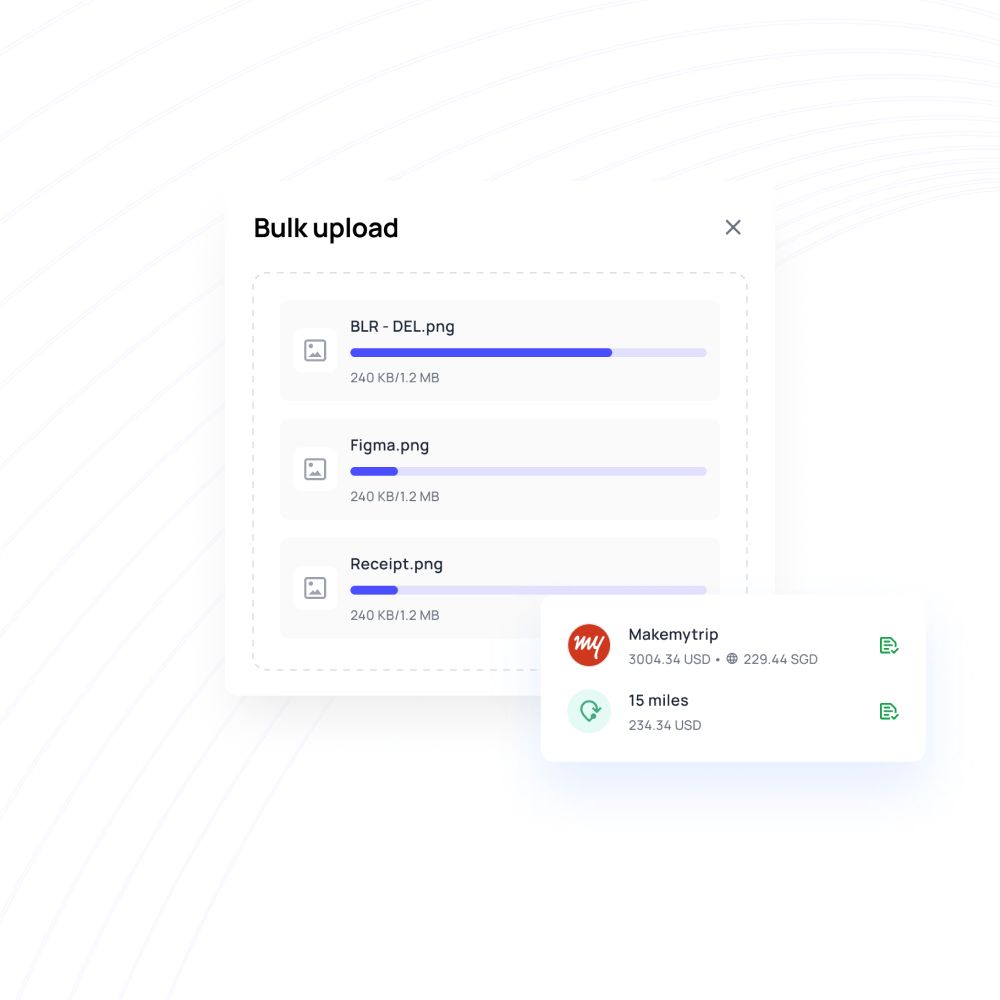

Your employees can claim their expenses without any cumbersome process by simply just submitting the receipts for review. But they should know the employee expense policy before submitting it for review. They just have to click a picture of it and submit it. Then the managers and owners can approve the expense and voila, reimbursement is done. Reimbursements can be done for out-of-pocket expenses, mileage, cash, etc., with real-time transparency and updates.

For instant reimbursements, you just have to fill in the bank account details of your employee and whenever you would make the payment the money would directly be transferred into their bank account. And, you also get the facility to sync your accounting software with reimbursements, which directly reduces the cost of expense processing.

Trusted by finance teams at startups to enterprises.

Managing a departmental budget is easy now with Volopay

Related pages

Explore operating cash flow (OCF) with our guide on its definition, formula, and tips for improvement to optimize your financial management.

Explore strategies to enhance cash flow, manage expenses, optimize revenue, and ensure financial stability for your business.

Learn about the debt-to-equity ratio, its calculation, and its role in assessing a company's financial leverage and stability.