Guide to different types of payment methods for businesses

The definition of payment method is easy to confuse with payment processing. On the client end, one might think in terms of how and when money is deducted. Meanwhile, on the vendor end, the focus is on how quickly the money will be credited to the account and when the sale can be considered complete. While it might seem tangential to some, and irrelevant to others, all these questions do make up a part of understanding what types of payment methods exist.

Understanding what the different payment methods are, how they work on both ends, and what benefits they provide can help a vendor choose the best possibilities to aid their business. These, in turn, will inform the ways in which different types of payment channels are created, as well as how their spend management policy is designed.

What is payment method?

Simply put, a payment method is a way in which a client or customer opts to transfer money to the vendor or merchant that they are buying from. On a larger scale, these methods can be broken down into cash versus card (the most common option one might hear at an offline store).

But the intricacies of these two options are extremely varied. For instance, “cash” could refer to actual coins and notes, or even assets (such as bonds, property, or - the one rising in popularity - NFTs and cryptocurrency). Card, on the other hand, generally refers to any kind of transaction that does not involve a physical exchange of money.

Traditional payment methods

Credit cards have always, traditionally, been the understood and accepted form of card payments. They work completely differently from how debit cards work. Debit cards are linked to a bank account, being able to withdraw funds from an ATM. When a debit card is swiped, the money is deducted from the associated bank account. They have always run the risk of real monetary loss. Credit cards, on the other hand, are linked to a credit line granted to a user. The payments on them are deducted from the credit, and a consolidated bill is paid on a monthly basis.

Before the advent of unique payment IDs, bank transfers were the most reliable form of transferring money to a non-merchant entity. Even today, they are preferred for larger amounts. Frequently referred to as “wire transfer”, particularly in regards to international payments. They are a reliable and safe method of transferring a considerable sum of money. Although the transfer comes at a substantial fee (depending on the amount being transferred and to the destination), they are still extremely fool-proof in their payment process.

The oldest and most tangible form of payment. Cash payments have become somewhat obsolete, depending on the economy of the area and the formulation of money transfer applications. Regardless, it is not unheard of for people to still use banknotes and coins to make payments. That being said, cash payments are only useful when in small quantities and at a local level. Making large cash payments is an unsafe and untraceable method of payment - and impossible when the vendor/merchant happens to be in a different place.

Benefits of using different payment methods for business transactions

Preventing fraud is one of the deciding factors on which payment method a business chooses. The online purchasing world is riddled with gateways for data to be lost or stolen. At the same time, the rightly secured payment gateway can protect someone from such fraudulent activity in a way that physical or wire transfers cannot.

The biggest reason for businesses to switch from wire transfers to online payments has been reducing transactional costs. While online payments also require a transaction fee, they don’t necessarily rack up in the same way that bank processing fees do. The higher the invoices on accounts payable, the more the fees.

When a business expands globally, it is important for it to cater to different economies and audiences. This includes plausible payment methods for the target audience. It is not just about finding a payment method that meets international levels of security - it is also important to make it accessible.

For instance, many international vendors use Paypal as a payment method for global customers. However, unless one has an internationally enabled credit card, it becomes impossible to use. Similarly, some websites use Stripe to be able to claim refunds or cashbacks. However, in countries where Stripe isn’t available, customers can’t access the funds sent to them.

The immediacy of online payments comes with the security of data being protected. Whichever payment method and gateway a business opts for, it is always better to make their vendors and clients verify their identities. Some countries’ payment rules require cardholders to enter a unique identification code.

Regardless, a business should be comparing the volume of transactions to the most frequently utilized payment method. Deciding which one to leave behind and which one to introduce should be dependent on the overall cost-benefit ratio.

This cost-benefit analysis should take into account how much the user ends up paying in fees. The last thing any company should face is a product failing in a market simply because of high transaction costs. A well-chosen payment method will have a transactional cost that is negligible for the buyer and a worthy investment for the supplier.

Doing research on the primary accessible payment methods among the customer base makes it easier for a business to reach the intended market. It also creates a sense of trust in the vendor, since the buyer is likely to rely on a payment method they frequently use.

The rule of thumb in preventing online fraud is to verify the entity from which the payment is being made. In recent years, card-issuing companies like Visa have also started creating a secure way for users to save their card information (especially for recurring or frequent payments).

Virtual cards

How are virtual cards used as business payment method?

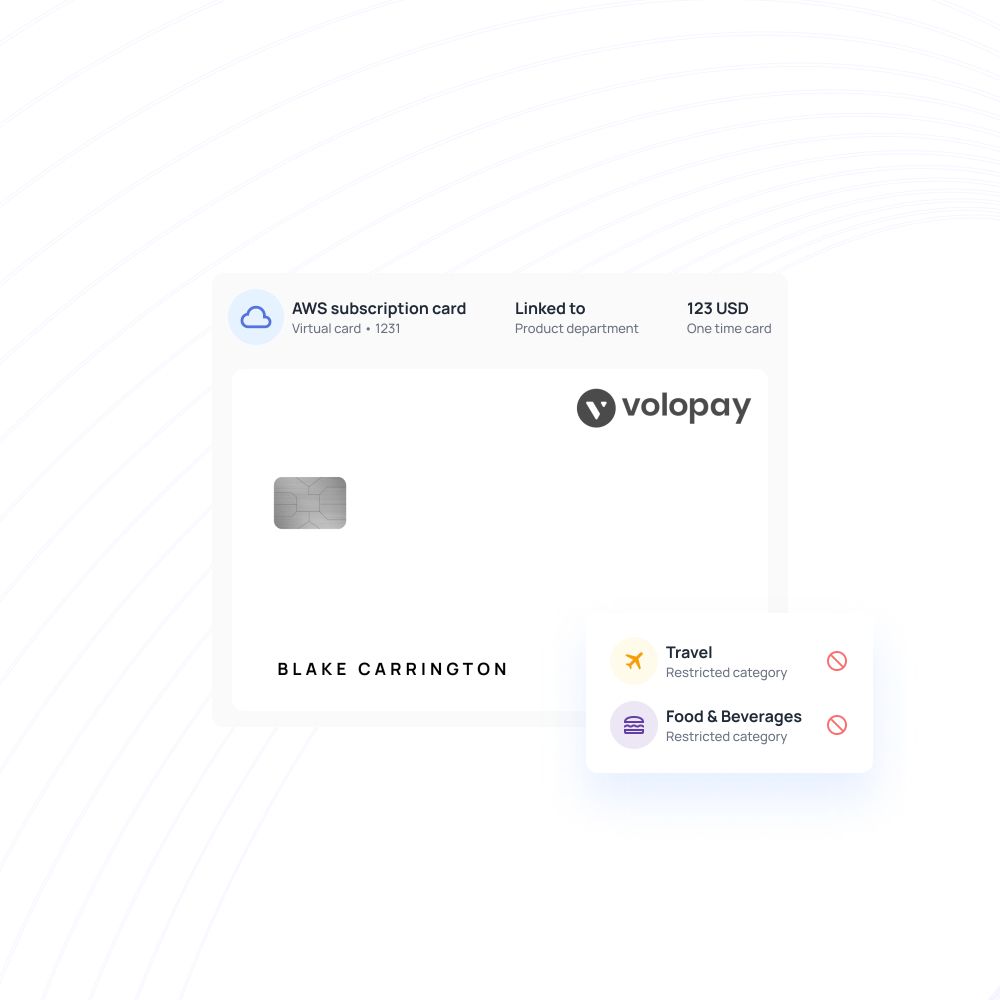

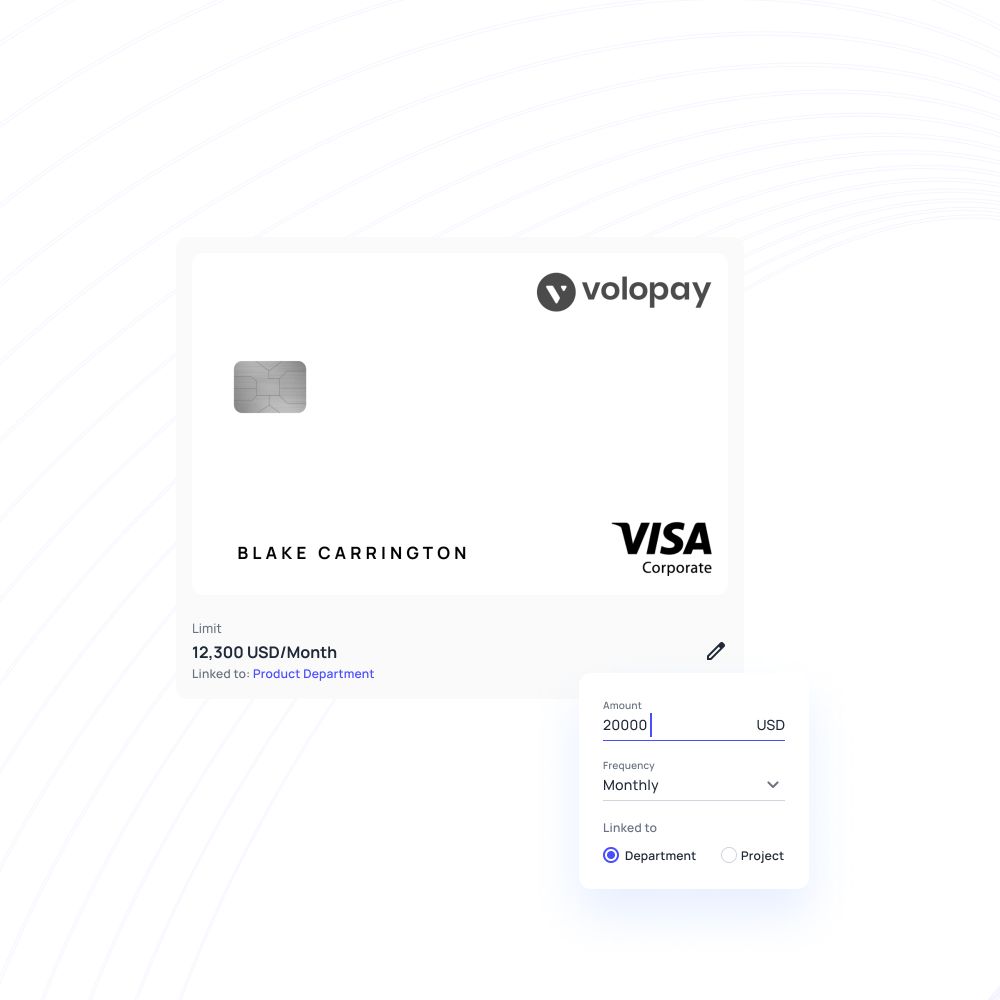

Virtual cards are online versions of physical credit cards or physical debit cards. Virtual credit cards function in the same way and come with a unique number, expiration date, and CVV. Their details can be entered into any portal that supports card payments, and they would function in the exact same way as a physical card.

Policy considerations for virtual cards

Virtual cards are the ideal go-to for all expenses that can be made online (or offline where the capability of paying with a payment app is possible). While every employee can be given a virtual card, in larger groups or tighter budgets, a company might have to create policies on which employees get cards. These should be employees that frequently handle payments, such as tech, marketing, HR, or sales (as well as any work that requires travel).

Set rules to establish designated approvers for reimbursement requests, card creation, increasing spending threshold, and requests for making expenses. With Volopay, you can set a custom 5 level approval chain for individual users and cards. You can also program multiple approvers in a single rule with backup approvers, and real-time approval requests to allow faster approval turnaround time.

Best practices for virtual cards payment method

Virtual cards should come with defined spending policies and parameters. It’s good to link a card to a department, and also assign a spend control. Assigning a virtual card to specific vendors is also a good way to control how much money is spent on which vendor.

What is unique about Volopay’s virtual card?

Volopay offers the chance for preloaded virtual cards, which come with a granted credit line. The company does not have to rely solely on its present bank balance to fund these cards.

Additionally, Volopay accounts can make an unlimited amount of virtual cards available to their departments and employees. These can come with set expiration dates (for single-use), or even be made for specific vendors (for instance, AWS, WordPress, G-Suite).

Recommended use cases with examples

Virtual cards are ideal for any place that accepts card payments online, but especially for specific vendors and/or recurring payments.

Use Case 1: A company’s website is supported by Amazon Web Services. A virtual card can be created specifically for AWS (for easier statement analysis), and recurring payments activated for the payment plan.

Use Case 2: The HR department requires office utility bills to be paid online. A virtual company card can be attached to these bills so that no out-of-pocket expenses are incurred. Additionally, the utility expense can also be analyzed separately since it is linked to that one card.

Physical corporate cards

How are physical cards used as business payment method?

Physical corporate cards are ideal for employees that frequently travel or happen to frequently make offline payments for business purposes (site visits, client meals, intracity travel, deliveries, HR-related purchases). Instead of their personal cards, they utilize the company-provided credit card (in this case, issued by Volopay) with the merchant or vendor.

Policy considerations for physical cards

There should be clear rules on which employees get physical corporate cards. Unlike virtual cards, physical cards have longer expiration dates and are linked to only one user. There should be special parameters to decide what qualifies for a physical card (certain amount of travel in a quarter, certain amount of offline purchases for business). There should also spend limits and expense policies that the cardholder has to adhere to.

Best practices for virtual cards payment method

An employee given a physical card should only use it when a virtual payment is not possible. Spend policies should be respected, and proof of payments should be provided at the quickest and in the most thorough manner.

What is unique about Volopay’s physical card?

Volopay’s physical corporate prepaid cards are already linked to the Volopay accounts. All department and company-wide policies can be attached to the card when it is issued. Additionally, the statement is directly added to the ledger, and real-time spending gets updated on the system for the managers and finance department to see.

Recommended use cases with examples

Physical corporate cards can be used by employees who either travel often or happen to make offline payments frequently for business purposes.

Use Case 1: A sales manager needs to travel to a different city for work. They can use the physical card for their airport-related charges, intra-city travel in the city of visit, meals, and petty cash.

Use Case 2: An account manager needs to take out a client for dinner. They can use the physical card to pay for the meal.

Bill pay

How does bill pay work as business payment method?

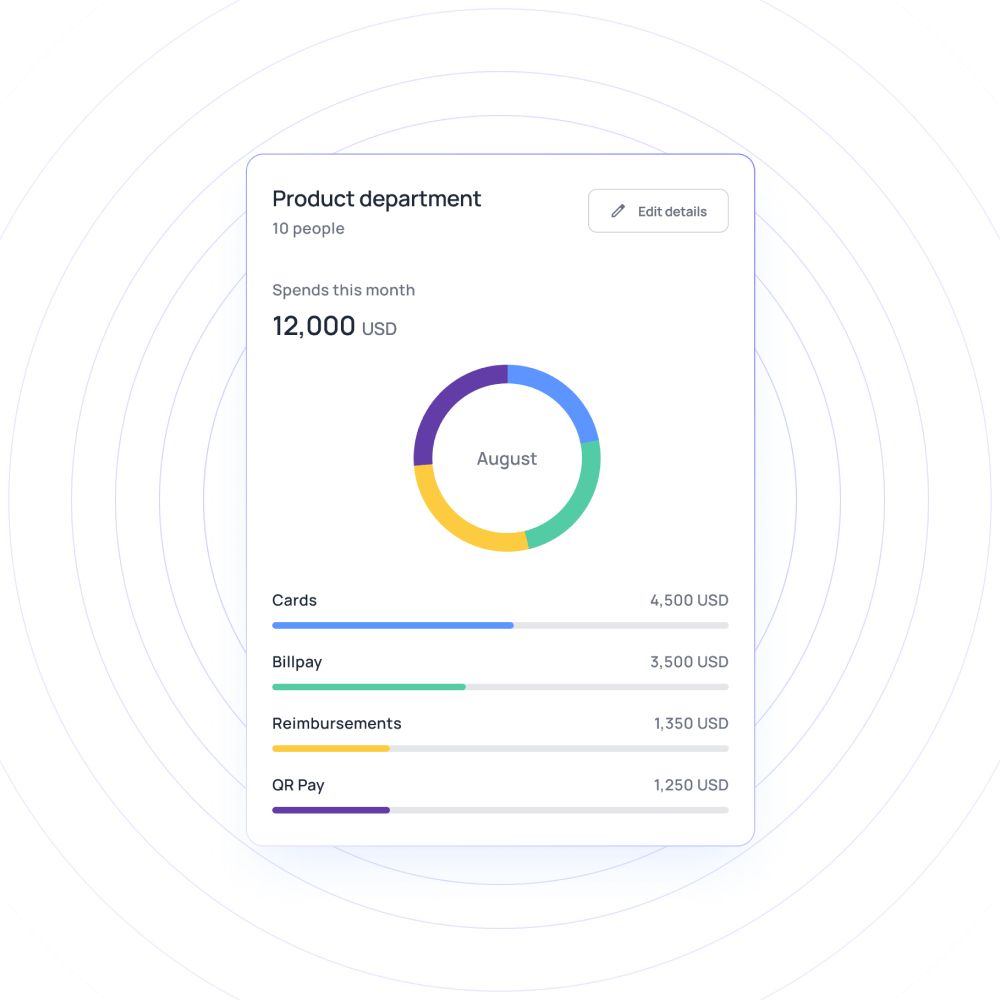

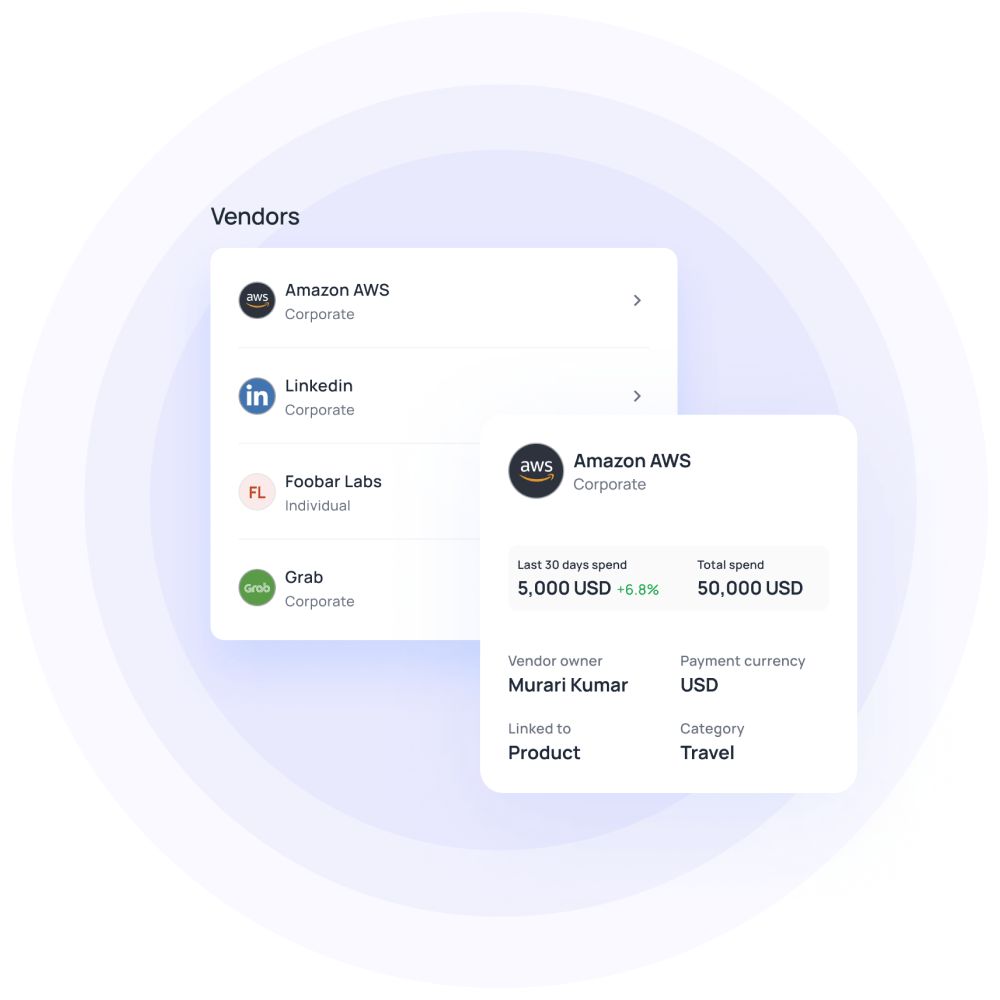

Bill Pay handles all accounts payable processes. This means that invoices can be uploaded and synced to the ledger. Payments for invoices can be done with a bank transfer initiated through the Volopay portal. It can be a local transfer or an international one.

Policy considerations for bill pay

Bill Pay is how the company will handle all accounts payable, accounts receivable, as well as departmental budgets. Company-wide policies need to be designed to highlight what payments need approval from which employee. Multi-level approvers can be delegated in advance for this, as well as department managers. It is best to define which payment method should be used for what amounts/vendors - particularly if an invoice requests a large amount or if a vendor is in a different country.

Bill pay best practices

Payment methods should be chosen depending on the least cost to the company, the speed with which the payment needs to be made, and the most effective returns. For instance, some vendors will have discount options for timely or early payments, which should be taken advantage of. Foreign transactions to some countries might have larger cashbacks.

What is unique about Volopay’s bill pay?

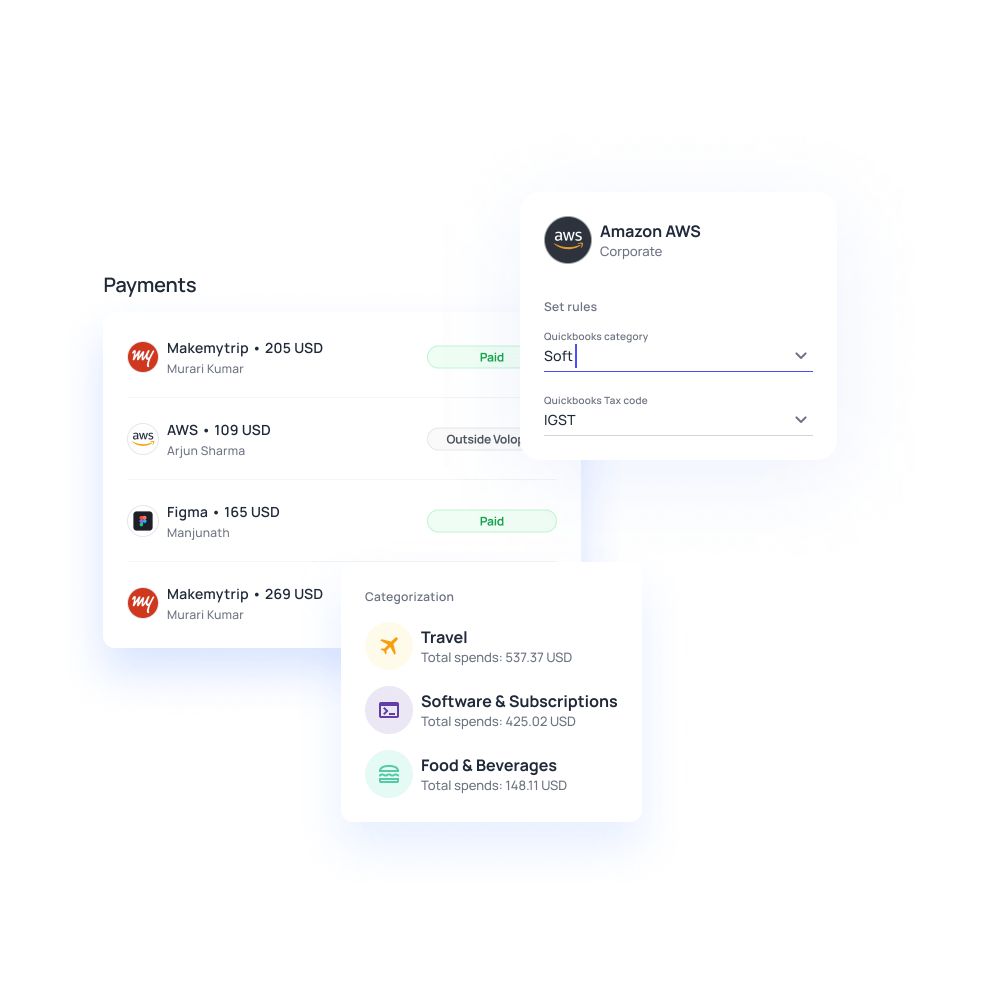

Volopay’s Bill Pay updates the general ledger in real-time, and all reports can be generated at the click of a button. The Volopay interface can also be integrated with the company’s accounting software of choice (Xero, Netsuite, Quickbooks) so that all payments are compliance-ready. Volopay also offers competitive transfer rates, support of over 130 currencies, as well as cashback from 1-3% on international transactions.

Recommended use cases with examples

Using Bill Pay money transfers is ideal for overseas clients, large and complex order contracts, and clients that require wire transfers.

Use Case 1: An overseas vendor requires a quarterly payment to be made on time. Utilizing Bill Pay gives you competitive exchange rates and cashbacks.

Use Case 2: A vendor accepts only bank transfers to be made for the contract to come into effect. Using Bill Pay lets the transaction happen as efficiently as going to the bank to initiate payment, and also lets them reflect on the ledger.

Employee out-of-pocket expenses

What are out-of-pocket expenses?

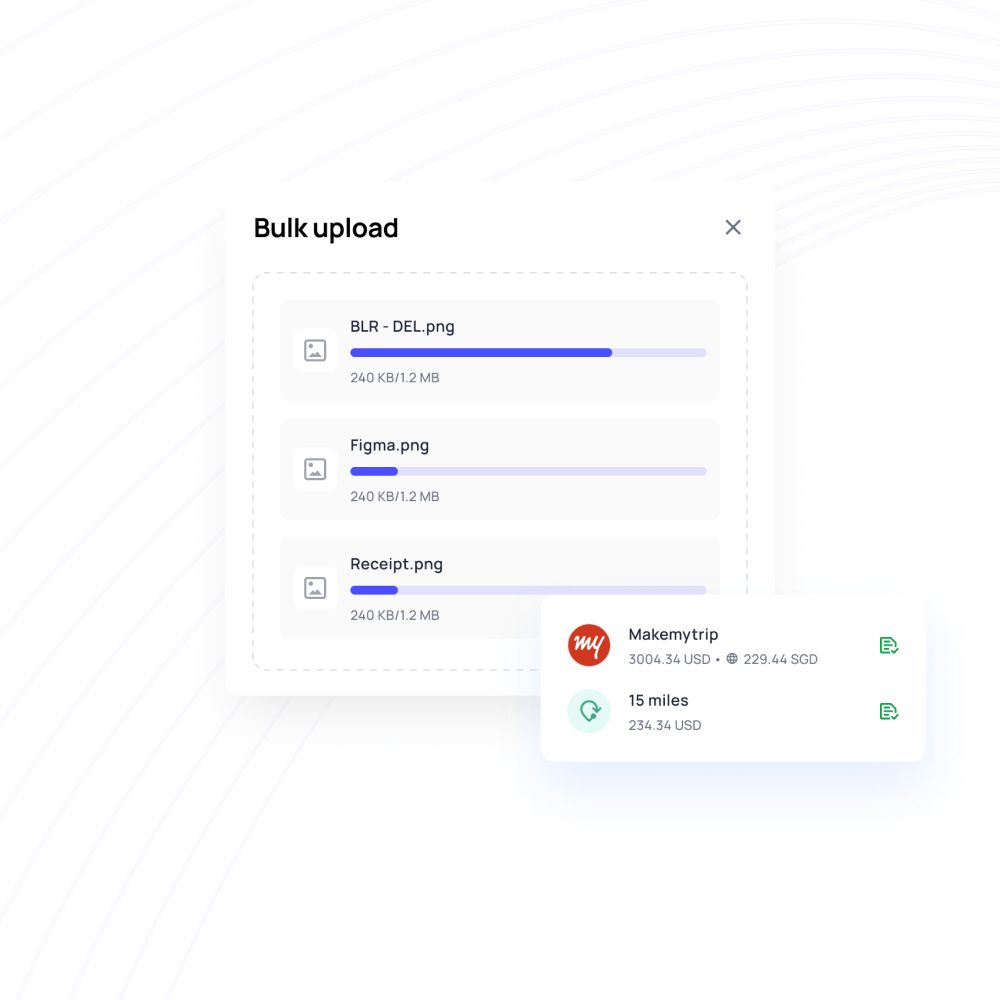

Out-of-pocket expenses are expenses made by an employee from their personal account. This could be on travel, food, stay, or even one-off purchases directly related to the business, the office space, or the employees. There is usually a policy that outlines which of these expenses classify as business expenses, as well as a reimbursement process.

Policy considerations for out-of-pocket expenses

It is important to decide the degree of out-of-pocket expense that a company will allow for its employees before it snowballs into an unmanageable situation. If a company has employees that frequently make business payments offline, then it would be best to furnish them with a physical corporate card. Similarly, if employees frequently make business payments online, providing a virtual card is best. This makes it possible for the company to control spending, and have all business-related transactions reflected in real-time on the general ledger.

Best practices for purchases from personal funds

Personal expenditure should be limited as much as possible, not only to remove the burden from employees but also to make accounting smoother. They should only be a last resort for one-off payments where a virtual cardholder needs to make an unexpected physical card purchase, or when an employee who usually does not make business-related purchases must make one. In such cases, employees should be encouraged to save all receipts and related documentation and to also upload the same on the reimbursement portal.

Additionally, the company should outline a cap amount and a time limit by when a reimbursement can be claimed. For the safety of employees, Volopay offers a multi-level delegation of approvers. This way, all approvals can take place timely and prevent employees from waiting a long time to get reimbursed.

What is unique about Volopay’s reimbursement capabilities?

Employees under a company’s Volopay account can request reimbursements directly through the portal. It allows them to upload receipts, any relevant documents, as well as specify which vendor the payment was made to. Administrators can request additional details before approving the reimbursement, and all information is reflected in the accounting report. It is also possible for a department to define a delegated multi-level approver list so that reimbursements can be scanned and approved quicker.

Recommended use cases with examples

Out-of-pocket expenses make the most sense for niche situations or one-off transactions.

Use Case 1: Unexpected offline purchase. An inventory manager needs to make a vendor payment in person to delivery personnel.

Use Case 2: Company-wide employee benefits. HR is gifting employees with a meal or drink and allowing them to reimburse it after the fact.

Setting modern payment methods with Volopay

What Volopay does is bridge the gap between a company’s chosen payment portal and whatever data they frequently need to extract and manually process. Here, it gives the company an option to directly make payments from the expense management interface, while also offering an array of options on how they will make the payments.

Automate your payment methods

A spend management system is an optimized way to not only automate the entire expense management process but also provide employees and customers with a variety of payment methods. What, then, is the difference between a regular payment portal (like Paypal or Stripe) and business expense management software? The former provides the user with a range, the chance to choose between different payment methods.

This could be, quite literally, a debit or credit card, a bank transfer, cash on delivery of service (if it is a physical object), or whatever else is a viable option in that region’s market. While it does have the capability to support different types of payment methods, it does not, however, allow someone to analyze or work with any of the data.

Automate business expenses

Volopay’s spend management is different. It is a place for a company to offer different payment methods to their employees, and to manage their vendors. Think of it, not as a payment portal, but as a financial tool with payment abilities built into it. These can range from the generation of virtual cards to management of invoices, and even doing international bank transactions for accounts payable.

But why choose an corporate expense management tool over a payment portal? Simply because it’s an all-in-one solution to a business’s financial needs. A Volopay account comes with capabilities that offer the best payment methods to employees and departments alike.

Corporate cards with credit line

Physical corporate cards and an unlimited number of virtual cards can be generated for employees. These cards are linked to departments, so keeping track of your business expenses becomes much easier. If a business has recurring payments to a specific vendor, a special card for that vendor can be created with a unique number and expiration date. None of these cards are linked physically to a bank account, unlike a classic bank-issued debit card.

Bill pay

One of Volopay’s winning features is the Bill Pay portal. Bill Pay gives a business an eagle-eye view of their expenses. It is also the optimum tool for managing accounts payable It can be used to fund generated cards, allocate expenses to specific events or departments, and for external transactions. It supports international transfers at competitive rates, so a business can save considerable bank fees on wire transfers, while also being guaranteed support in over 130 currencies.

Out of pocket expenses

The portal isn’t just for financial managers either. All employees can have an account, with certain privileges. They can be delegated as managers or approvers for transactions, but they can also have a place to request funds or reimbursements. All out-of-pocket expenses then become very easy to keep a list of, since all the information is in one place.

Comparing types of payment channels

- Pre-approval functionality

- Approval routing functionality

- Streamlined document submission

- Auto-categorization

- Direct syncing to ledger

- Deniable spend requests

- Spend limit policies

- Customizable expiration

- Relevant vendor suggestions

- Duplicate spend flagging

- Spend logging before transaction

- Mobile app support

- Fraud safety

- Back office usability

- Employee usability

- Offline purchase capabilities

- Real-time spend visibility

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free