How to design efficient expense approval workflow?

It is becoming more prevalent for employees to go on business trips and carry out expenses related to business. As a rule, they submit reimbursement requests, which get approved or rejected by their HR. If approved, the employee receives the money back. This approval workflow process may sound like an easy, two-step process, but it’s more challenging and grueling in reality.

This is why organizations strategize expense approval workflows to throw light on what qualifies for reimbursement and what doesn’t. Approval workflows are basic guidelines that have defined steps that must be followed while proceeding expense approval process.

The accounting team is responsible for expense reporting, where they have to record every expense of the company and proper documentation. So, the expense reporting team looks for proof like bills and receipts for every approved claim. This is the other side of the reimbursement process where the internal teams like accounting, finance, or HR process the claim request.

7 common problems with manual expense reporting and approvals

Policy violation

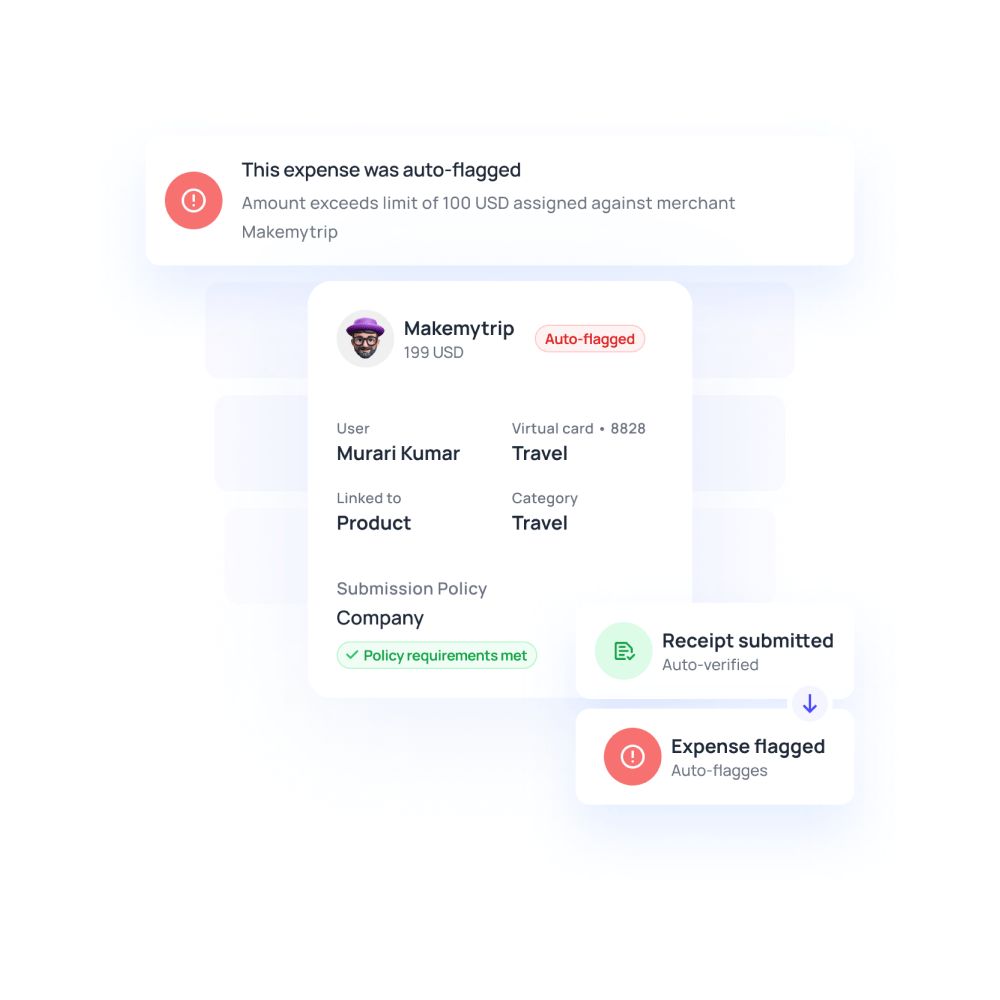

Policy violations happen both advertently and inadvertently. Lack of knowledge about the T&E policies of the company paves the way for this. When the T&E structure and management are loose-knitted, employees will likely exhibit fraudulent behavior. This mishandling is inevitable when it’s all managed manually.

When a limit is set on the expense category, it can be hard to identify and pick that out in manual workflow. This can also lead to a policy violation if it gets approved accidentally.

One such negligent incident can provoke other employees to follow suit and submit fake claims. Think about the damages in the long run when this continues. Strict adherence to T&E policies is mandatory to secure your organization's financial health and structure.

Missing receipts

The only proof that can validate an expense claim anytime is a receipt. Missing receipts can put your accounting team at risk when there is an audit, as they are accountable for storing every valid document related to the reimbursement process.

When you collect bills and receipts manually, you create opportunities for them to get damaged or go missing. It's burdensome work for everyone, including employees, approvers, and the expense management team. Missing receipts are known to cause antsy search spells and make employees produce fake replacement bills. It's the manual storage process that invites unscrupulous practice.

Approvals overloaded

There aren’t any organizations here that have appointed exclusive people to take care of the expense approval system. Typically, these approvals are granted either by the HR professionals, team leaders, or managers of the respective employee. After this stage, the request gets seconded by someone from the accounting or finance department.

In a typical expense approval workflow, the approval stage is usually carried through email or printed/handwritten paper with bills attached. Due to their approvers’ workload, the approval can get easily neglected or, in some cases, overloaded.

When asked about this, some managers felt that the current process of obtaining their consent through email or signature is highly labor some. Missing a few details or wrongly approving requests can land them in trouble too.

Not having clear expense policy

Manual processing of a delicate task like this can turn this into messy and clumsy. One day, you would wonder whether you had an expense policy in the first place. There will be hardly any categorizations, and let’s not even talk about misplaced and mistagged receipts.

Questions may arise from employees' end to find out if their expenses are claimable or not. Or worse, the approver may not be abreast of revised expense policies and pass-through requests out of their own will.

It’s complicated to align your T&E policies with the expense approval workflow if you bring them about manually. And when there is a blunder, it will be hard to put the finger on where exactly it happened.

It takes lot of time to do every task

There are three or four steps involved in the expense approval workflow. If crossing each action takes a week, then the reimbursement process gets delayed for almost a month, and the employee receives it in their salary many months later.

Manually expense approval process is not on auto-pilot mode to move the request smoothly from one step to the next. It takes intense labor at every step, which causes unpredictable delays.

Employees who spend money out of their pocket for business reasons expect quick returns, which cannot possibly happen in this case. Overall, this creates a wrong impression on your accounting team for little or no fault of their own.

Damaged receipts

Let's look at this from the employee’s perspective first. They have to store their receipts neatly throughout the trip and produce them when asked. Most of the bills are printed in low-quality paper and ink, which can get attired and worn down sooner or later.

Getting the money back is close to impossible when it gets damaged before submission. The same goes with storing the receipts post-approval and reimbursement. It can look unprofessional if the accounts team keeps a bunch of receipts where nothing is intelligible.

Unmatched expenses

Matching expense categories and bills incorrectly often happen when too many bills are waiting to be claimed. This chaos leads to the rejection of the entire claim request. Now the employee has to create a new request again and carefully go.

Automate your expense approval process with ease

Factors to consider while designing expense approval workflow with expense management software

So, you have concluded that you will implement an expense approval management software that will automate the whole reimbursement process. Bear the following points in mind before designing your expense workflow.

Set clear guidelines on expense policies

There is no approval workflow without a policy or guidelines. If you don’t have a proper T&E policy, create one. If you already have one which is not up to scratch, it’s about time they get revised and updated. Form a team, gather inputs, go through the past travel and reimbursement data, and categorize the most common expense categories. Now that you have an idea about this, you can set limits and structure them last.

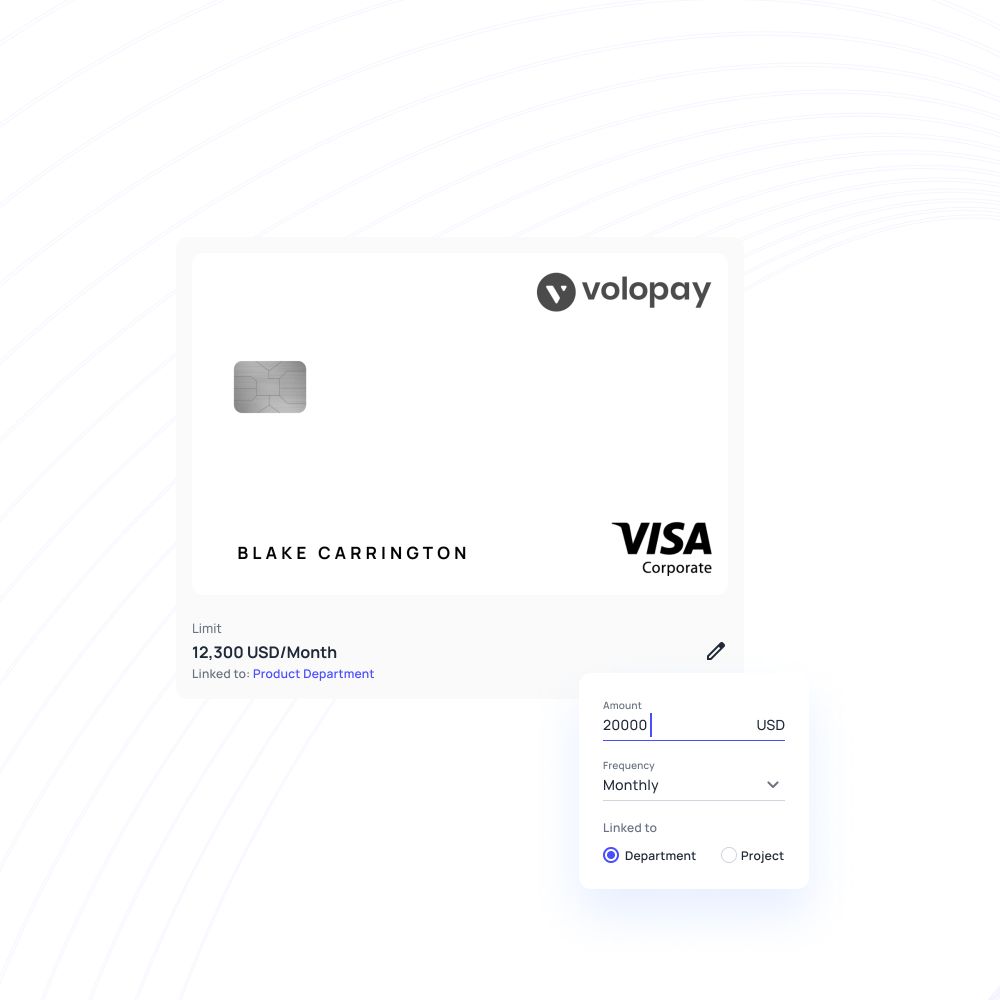

Issuing corporate credit cards

Corporate credit cards are an efficient means to make payments and reduce the overflowing reimbursement queue. You can partner up with a corporate credit card provider and assign an admin to distribute cards, add money & collect it. Virtual cards are new in town where you don’t even have to provide your employee a physical card but only the card details. It also liberates you with its flexibility in operation because you can create multiple cards and distribute to anyone.

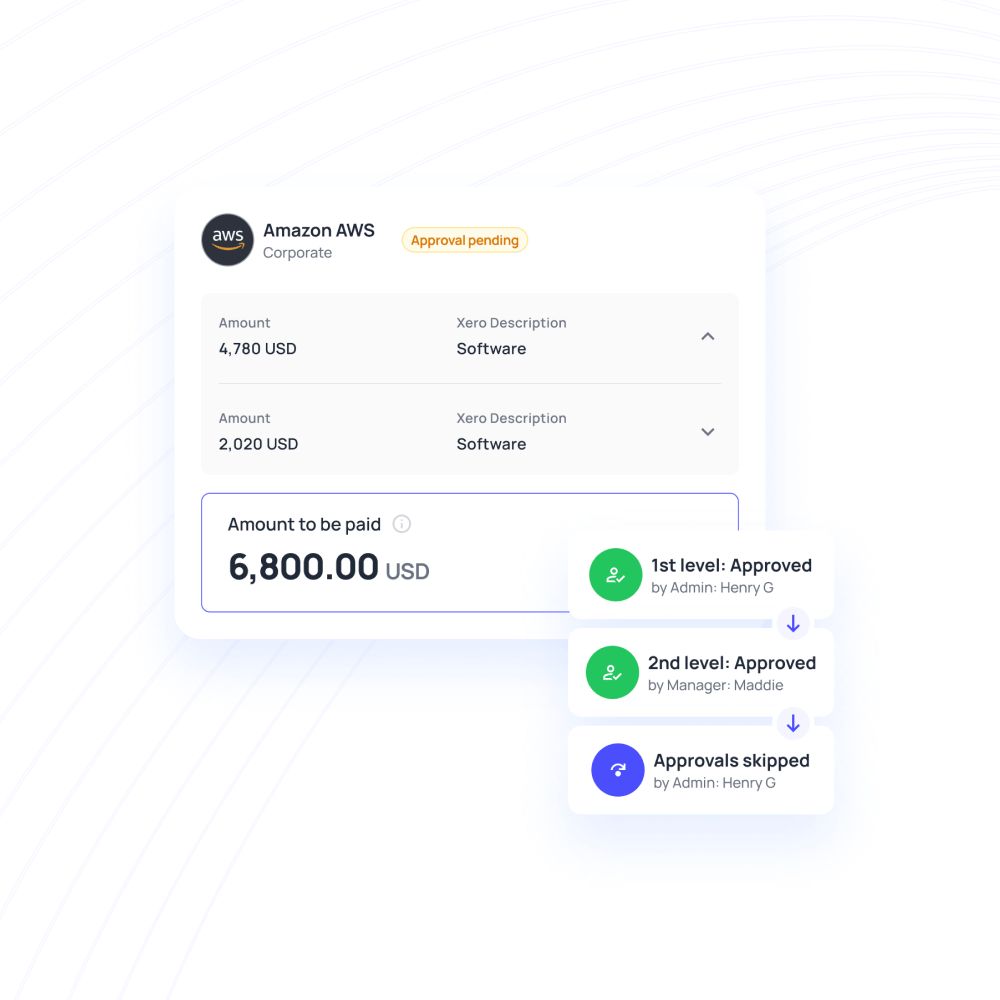

Having multi-level approval

Sticking to multi-level approval can ensure that only the reasonable requests get through and others don’t make it. You can pick a few critical categories that require multi-level approvals and customize the levels based on the classes. With the help of the right software, you can automate the whole expense approval process. You can feed the number of approvals and list of approvers for each category of the T&E into the system once it is developed.

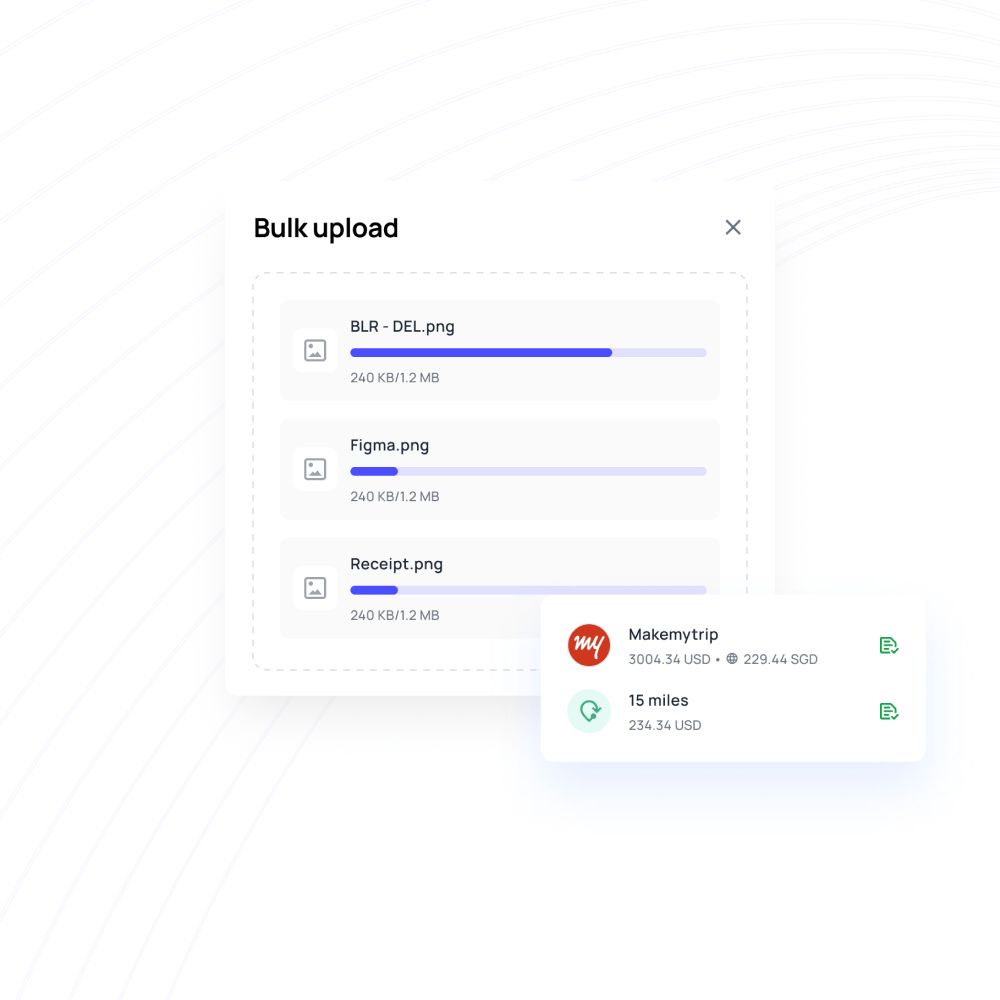

Receipt scanning app for employees

Receipt scanning in expense management software can shorten the reimbursement process and make submissions quickly. Create a quick shortcut to make employees go with instant reimbursement applications. When there is a receipt scanner, they can just open the application, point the camera at the bill, take a picture, upload and throw away the bill. Your employees save time, and so does the accounting team. They can zoom in on the picture and clearly understand why the claim request has been raised.

Benefits of having expense approval workflow for your business

Reduce costs

There is a considerable amount of money wasted everywhere paying back wrong or disingenuous claim requests. You know what, when and how much to pay. Hence, it gets easier to stay away from fraudulent and misleading requests.

Set up multi level approval

In the manual process, multi-level approval may not be workable. But an automated expense approval system lets you assign multiple approvers who can approve one after another. This way, it is ensured that only the appropriate requests go approved and make it to the end.

Faster reimbursement

It hardly takes 2 to 3 days to get the approvals done and push the money back to employees’ accounts. The approval notices are usually sent as push notifications, which the approver can click on and act. They can work on multiple requests at once and process bulk requests too.

Better visibility

No pesky emails asking for more details about travel expenses. The employee knows the status of their requests, the accounting department knows every detail about the claim, and lastly, the finance team is on the same page with all this information. You can go back to the past and verify the data if you want to.

Set limits

Budgets are a colossal constraint when paying back employees' business expenses. Not when there are preset limits for every category that employees can see for themselves. You are transparent yet gently impose a cap on how much can be spent. This is much better than sending emails notifying them to keep the expenses under control.

Employee satisfaction

It’s highly noticeable when an employer does something to subside the laborsome nature of any task. Your employees would feel valued and heard when they get to know that they can now submit instant reimbursements or even have corporate credit cards! When you do a bit for them, they return it by increasing productivity and showing integrity at work.

Make your expense management process easier with Volopay

The presence of an automated and dynamic expense management processing application like Volopay can metamorphose how you send payments and maintain records. Volopay’s expense management software has everything your accounting team may ever need.

You get access to an effective reimbursement site where you can manage every incoming request and check their status. Your employees can log into the mobile application and submit the expense approval request by attaching or scanning receipts. They are also asked to choose a predefined category. It is automatically taken to the approval queue and followed by approvals; the expense reporting team is notified. They decide to offer settlement all inside the application.

Your employees can view the real-time stats of what they initiated at any time. Corporate cards are another fascinating feature of this suite. You can instantaneously create a new virtual card and assign it to an employee. Creating budgets and blocking cards after usage can be done.

If you may have security concerns, you must know that virtual credit cards aren’t related to another or the main account. So, if one of the cards becomes vulnerable, you can take it off the network by blocking or deleting it. Motivate your employees with the correct reimbursement and travel expense management techniques while strengthening the accounting construction of your company with a futuristic solution like Volopay.

Related page: How maker checker brings better control over expense approvals?

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free