Effective ways to improve indirect spend management

For any business, small or large, official company expense policies are an important part of effectively running and developing the business. A properly and clearly written expense policy rules document terminates any risk related to team members spending the company funds without getting expenses approved, or the expense limits and budgets per activity, and how to get reimbursements if the employees have made out-of-pocket company expenses and how is an accurate expense report created.

Writing down a plainly defined and fair expense management policy can help your employees understand what is best for the company and how should the company fund be put to its most productive use, which in turn reduces any misunderstandings and offenses which contribute in create a constructive and productive workplace culture.

What is indirect spend?

Indirect spending consists of any expense for products and services that are not straightforwardly fused into an item being made. This makes it a different class that incorporates broadcast communications, IT programming, travel, cleaning supplies, janitorial administrations, office supplies, 401K agreements, medical services arrangements, advisors and that's just the beginning. Representing 15% to 30% of an association's complete costs, indirect spending portrays the acquisition of labor and products that don't turn out to be important for an association's eventual outcome or administration.

This could be whatever adds to the association's everyday tasks and could include:

- Utilities, including gas, electric, and water

- Satisfaction focuses, on warehousing, or office space

- Office supplies like PCs, PCs, printers, work areas, and writing material

- Promoting expenses like PR and imaginative offices

Difference between direct and indirect spend

Cost management

Indirect acquisition, should-cost examination - investigation led by a client of the costs caused by the provider in conveying an item or administration, to direct exchanges - is a much-utilized expense of the board practice.

For indirect spend categories, zero-based planning is a best practice. A strategy for drawing up the indirect spend analysis without any preparation as opposed to putting together it concerning the past financial plan.

Inventory management:

Stock administration knows what materials you have, where they're loaded, and the amount you'll require. With the direct acquisition, to guarantee a smooth creation process and to forestall delays, materials should be held in stock.

Interestingly, the indirect spend procurement is administered by request; that is, buys are made when required, so the stores, as well as the related expenses, are lower.

Common methods to calculate your indirect costs

Proportionate allocation

"Whatever floats their boat" is the guideline supporting the proportionate portion. Utilizing this strategy, indirect expenses are shared out among projects, divisions, specialty units, and so on in light of the sort of cost and how the labor and products so bought will be utilized. These rates can be doled out month to month however are for the most part determined, apportioned, and surveyed once every monetary year.

Movement based cost allocation

This way to deal with assigning your total indirect costs takes additional time and exertion, but on the other hand, is significantly more exact than proportionate or fixed expense allotment. To gather the information required for indirect expense computation, supervisors: 1. Identify and record all business exercises inside their specialty for a given bookkeeping period. 2. Categorize these exercises as direct or Indirect spend categories.

Utilizing cost rate calculators

Indirect expense rate estimations depend on what's known as an expense pool. This is worth addressing complete expenses (for this situation, absolute aberrant expenses) that are broken out and distributed because of rates determined in different ways, ordinarily by isolating the expense pool by an expense object (i.e., a variable like use, created income, actual aspects, project class, office, and so on), likewise called an expense objective.

Fixed cost classification

The most essential of indirect cost allocation strategies, fixed expense order works best with (prepare yourself) fixed costs, for example, aberrant work expenses, deterioration, and lease. These expenses are recorded as charges to explicit resources, projects, offices, subcontracts, specialty units, and so forth.

Common challenges in indirect spend management

Subsidizing

Indirect acquisition is regularly viewed as less significant than direct acquisition, which brings about an absence of financing and an absence of mindfulness across the association. As per Spend Matters, CFOs commonly underrate indirect consumption, and that implies associations apportion fewer assets and less venture to indirect acquisition. This hole makes it harder for us to address difficulties around here. For acquisition to follow through on objectives like driving production network effectiveness, fulfilling partner assumptions - and keeping the expense of teddy bears as low as could be expected - it's critical to enhance and smooth out all spending.

Free thinkers spend

Spending free thinkers drive up costs, harms provider connections, and increases the hazard for the association by buying outside of supported channels. For instance, the acquirement group might have arranged a markdown with a lodging network (Business Travel is quite often an aberrant class), yet a dissident could decide to utilize their beloved travel booking site all things considered. Not exclusively does this mean their buy won't exploit any mass limits, however, the provider won't get however many appointments as guaranteed in the agreement. Furthermore, the organization will have zero ability to see the quality (and wellbeing) of the convenience booked.

Inconsistent buying

Indirect spending envelops a huge and various scope of materials and administrations that are acquired through a few channels and different areas across the business. Many buys are one-off, with absolutely no point in being locked in provider within the future. Under these conditions, it's really difficult and complex to expect or foresee spending needs and consequently screen and distinguish open doors for cost-saving.

Provider relationship management

An association's indirect spend best practices are habitually restricted to driving down costs. This implies acquirement experts contribute less time supporting associations with their indirect providers, arranging ideal legally binding terms, or fostering a favored provider program. This sets supply chains in a weak position. The expanded recurrence of problematic occasions means it's a higher priority than any time in recent memory to zero in on SRM, even with indirect providers.

Ways businesses can gain better control over indirect spending

Create key obtaining plan

An association hoping to further develop its indirect spend procurement processes should zero in on fostering a key obtaining plan for both direct and indirect spend management.

To begin, check out the entire picture to distinguish the reserve fund's amazing open doors inside your inventory network. Look at regions where you could foster more significant and cooperative merchant connections. Then, act inside and out investigation on all indirect spending. This will assist with making an arrangement that incorporates hierarchical objectives, statistical surveying, a definite SRM procedure, and indirect provider execution standards.

Tidy up your information

Obtainment experts have a gigantic measure of information readily available yet most battle to figure out everything. Great information the board makes ready for extra chances to relieve production network gambles, assess provider execution, and empower development and joint effort with providers through expanded inventory network straightforwardness.

In any case, you won't have the option to do any of it assuming your information is a wreck. Sarah Scudder, President of Real Sourcing Network, suggests tidying up your information as soon as possible, as this assists you with seeing how to focus on your time and assets. One more motivation to set your information up, as per Susan Walsh, is to ensure it's viable with the costly innovation you're going to put resources into.

Put resources into suitable innovation

It merits putting resources into programming apparatuses, for example, a cloud-based obtainment answer for help more exact and proficient purchasing.

Alongside great information, the computerization of cycles will empower your acquisition group to execute your new procedures. It will likewise give continuous perceivability to control indirect spending inside your association. For instance, robotization can help obtainment groups screen, limit, and lessen the abundance of buying from purchasers across the association. In the meantime, the best eProcurement arrangements are equipped for breaking down and ordering each exchange.

As indicated by a 2019 report from KPMG, only 45% of organizations feel laid out in their utilization of innovation and robotization in acquirement. Procurify's CEO Aman Mann trusts that "You can have dominance, independence, and reason inside your association. You need to burn through cash inside organizations; explicitly indirect spending. This is the truth, you need to. However, assuming you're ready to utilize suitable innovation that gives independence to the end client, they can decide.

Further develop straightforwardness and perceivability

Indirect spending is famous for being divided all through the association, working way outside of obtainment's domain. This frequently reaches out to huge agreements, for example, organization catering, staff travel, or IT administrations. Indirect spend procurement should acquire all out perceivability of their association's spending. This implies uniting all indirect spending into classes and providers. The subsequent rundown of basic, favored providers will assist you to drive with providing chain productivity and empower better provider contract terms, for example, volume limits.

Alter organization outlook

One of the critical difficulties with indirect spending management in acquirement is that a huge extent of indirect spending is completed by non-obtainment experts. On the off chance that acquisition strategies are not imparted, consistency will be below. This can prompt dissident spending and greater expenses for the association. Teach the entire association the significance of following indirect spend procurement best practices. Additionally set key execution measurements to screen and quantify contract consistency.

Related page: Importance of departmental budget for your business

How does comprehensive procure-to-pay software solution improve your indirect spending?

Assuming you maintain any business - from customary to computerized to a mix of each - fundamentally, you comprehend the secure-to-pay process and the robotized frameworks that can assist with outfitting it. From the time an item or administration is requested until the time a receipt is paid, your acquisition and records payable groups ought to have the option to look at the situation with an exchange anytime. At its most strict level, this is the cycle by which a demand is made, a request is submitted and, when the request is received, an installment is made because of a receipt from the provider.

What acquires to pay (or P2P) alludes to is a computerized framework that coordinates obtainment with creditor liabilities to smooth out the interaction, guarantee the exactness, and make efficiencies in cost and time. Our conviction is that the absence of POs can prompt critical misfortunes when spread over a whole association. Also, organizations, where poor people execute a digitized framework to mechanize this business interaction, are as yet dependent upon human mistakes that regularly go with a reliance on paper and manual handling.

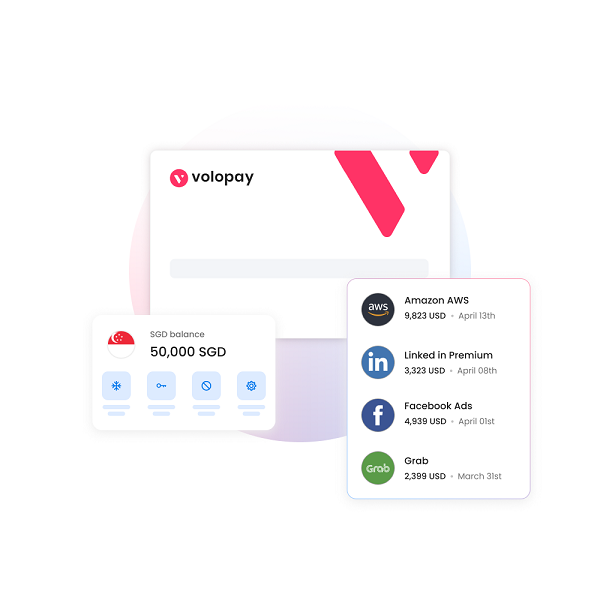

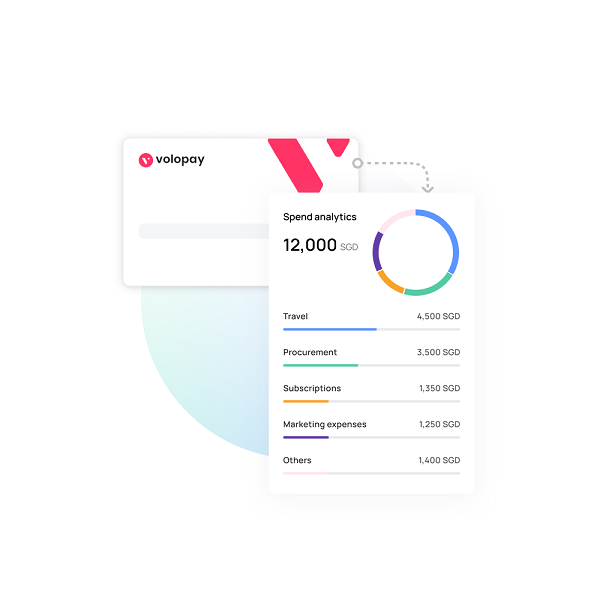

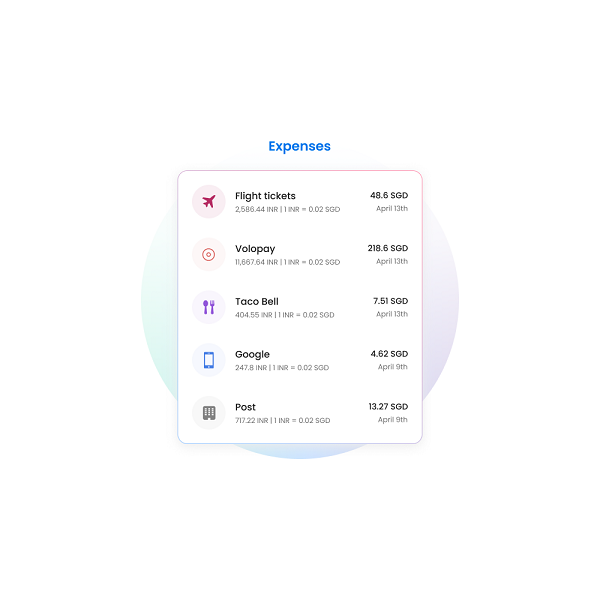

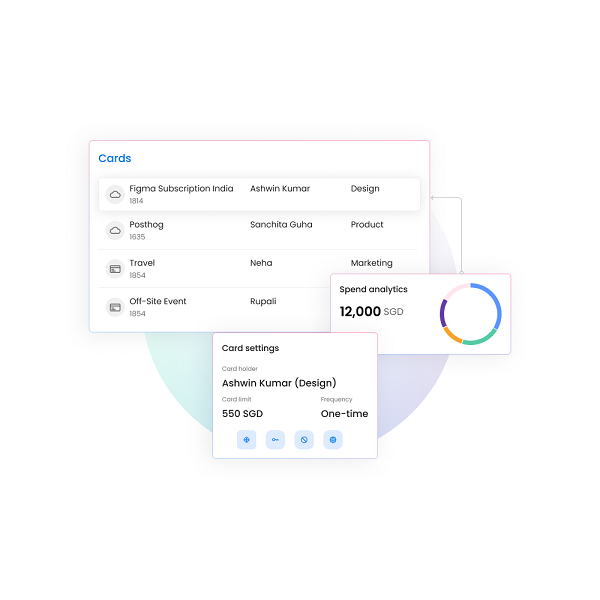

Are you looking for a platform to help you with spend optimization, audit, spend analysis visibility, and many more related processes. Volopay is here to take over all the expense-related processes and can smartly automate all of them according to your convenience. Volopay is an all-in-one spend management platform which was designed to solve all financial problems for businesses and help them grow better and faster.

Volopay can help you control your business spending with various features like expense approval policy where you can set multi-level workflows and procedures for requests and approvals and establish precise approval workflows to handle staff spending, payments, and fund requests. Compliance is simple, quick, and transparent. Not only this, the approval policies can work for your business from company-wide to specific departments, expense levels, or category.

Trusted by finance teams at startups to enterprises.