👋 Exciting news! UPI payments are now available in India! Sign up now →

Why AP automation for automotive industry is crucial?

The automotive industry is one with many moving parts to it. It’s very rare that a vehicle is made from start to finish with all materials present at a single location. There are multiple suppliers, manufacturers, dealerships, OEMs, etc. involved in the process. And with each entity comes the liability to fulfill financial obligations and carry out operations smoothly.

AP automation for the automotive industry is crucial as manually processing all invoices can take a lot of time and hinder the efficiency of the operational teams.

Why managing AP is a challenge?

The automotive industry is one that has many individuals as well as many entities involved in carrying out their functions. This makes communicating, coordinating, and executing accounts payable tasks a lengthy process. The more stakeholders there are in the supply chain, the more invoices there are to process.

Most of the time all these invoices are processed manually by individuals. Without the help of accounts payable automation system, this process is a tedious one and can take a lot of time. Manual processes are also prone to many errors due to the large volume of invoices that need to be processed and there are also chances of fraud in the form of duplicate invoices if they go undetected.

Common accounts payable challenges for automotive industries

Prone to human error

Whenever there is manual effort involved in completing a task, you can expect errors to occur. Even a tiny error in data entry when adding the amount to be paid from an invoice to the payment system can cause a huge loss to the company. And the more volume of work there is, the more likely it is that errors will be made.

Manual processes

It is not just the volume of invoices due to which it takes time to process payments but also the time it takes the AP team to verify and get each invoice approved by the respective managers to make the payments. This manual back and forth is also why AP automation for the automotive industry is necessary.

Incoming multiple invoices

Any entity in the automotive industry including a manufacturer, dealership, service center, OEMs, etc. know that they have multiple invoices to deal with on a daily basis. This is often a challenge as the operations teams are dependent on the processing of payments to carry out their tasks.

Multiple vendors involved

Another challenge the AP teams face in the automotive industry is a large number of suppliers or vendors involved. There also might be cases where you are dealing with vendors in different countries. Often, your existing payment system might not support the currency the vendor deals in. In such cases, you’ll have to create another bank account or use a different system.

Scattered financial data

In the absence of an accounts payable automation system, all the financial transactions are usually carried out through paper invoices and are hard to manage and track at all times. Having to use a different system for international payments to vendors and suppliers also causes the scattering of financial data.

How can accounts payable automation offset problems?

Increased internal controls and visibility

AP automation for automotive industry companies helps the management set better controls on the spending of the budgets that have been allotted to each team and individual. It also acts as a centralized system so that all invoice payments can be viewed easily in one system rather than having all of them scattered across different platforms.

Faster processing times

When AP teams are able to process invoices faster, it leads to efficiency in business operations and gives the finance team more time to focus on strategic tasks such as data analysis to gain insights and make better financial decisions. The AP automation systems often have the ability to create reports automatically for financial analysis.

Benefits of early payment discounts

Tech automation systems for accounts payable not only helps to complete AP tasks faster but also build better business relationships. With on-time or even early payments, your vendors and suppliers might give you the benefit of early payment discounts. Not only does this help you save money but also improves loyalty between your business and suppliers.

Streamlined approval flow

If you implement an AP automation system to handle all your accounts payable, you will most likely have the ability to set approval workflows. This will help the AP team streamline all invoice approvals and ensure faster payment processing with minimal back and forth between the respective managers.

Faster approval and payment of supplier invoices

The reason why an accounts payable automation system helps you get faster approvals and process payments is that it can be used remotely from anywhere in the world as long as you have a compatible device and an internet connection. AP teams are no longer bound to physical locations where they have to deal with paper invoices.

How can Volopay help automotive businesses?

Volopay is an all-in-one expense management system for businesses. Our ecosystem of tools includes corporate cards and a centralized platform that can be accessed through a web app or mobile app to track, manage, and control all payments. Our automated accounts payable system helps businesses in the following ways:

Accounting integrations

Volopay is an expense management software that has native integrations with some of the leading accounting software in the industry including Xero, Netsuite, Deskera, Quickbooks, MYOB, and Tally. Even if you don’t use any of these tools, you can still integrate Volopay with your accounting software thanks to our Universal CSV feature.

Custom multi-level approval workflows

Volopay’s platform allows its users to set multi-level approval workflows with up to 5 levels of approvers depending on the payment range. This helps companies set compliance for each degree of payment with higher payment amounts needing more approvers and low payment requests having fewer approvers.

Multicurrency support

If your company deals with any vendors or suppliers in different countries, then making payments to them with Volopay is super simple as our platform supports 60+ currencies and payments in over 100+ countries. Using Volopay you also save a lot on the hefty FX fee that you had to pay on international payments through other platforms.

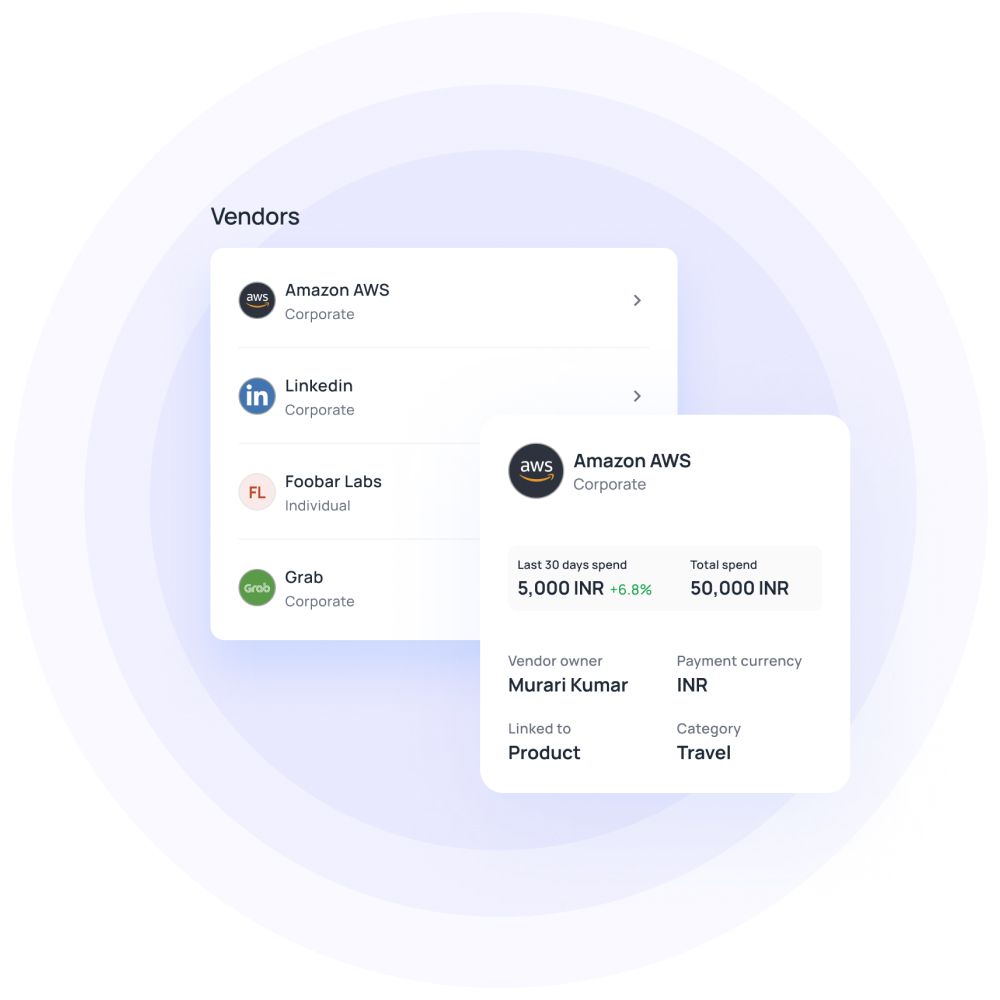

Vendor management

Without a proper tech system, it is tough for companies to manage all invoices and all the important data of each vendor to make payments to them. With a centralized platform like Volopay, you can create vendor accounts and store their payment information safely. By doing this, you won’t have to enter each vendor’s data every time you need to make a payment.