👋 Exciting news! UPI payments are now available in India! Sign up now →

Articles

In India opening, a bank account for startups can be a complex process. We have listed down some easy and best practices in this article.

The fintech sector in India is filling the loopholes and gaps left by traditional banks. Hence this is leading to higher adoption of fintech in India.

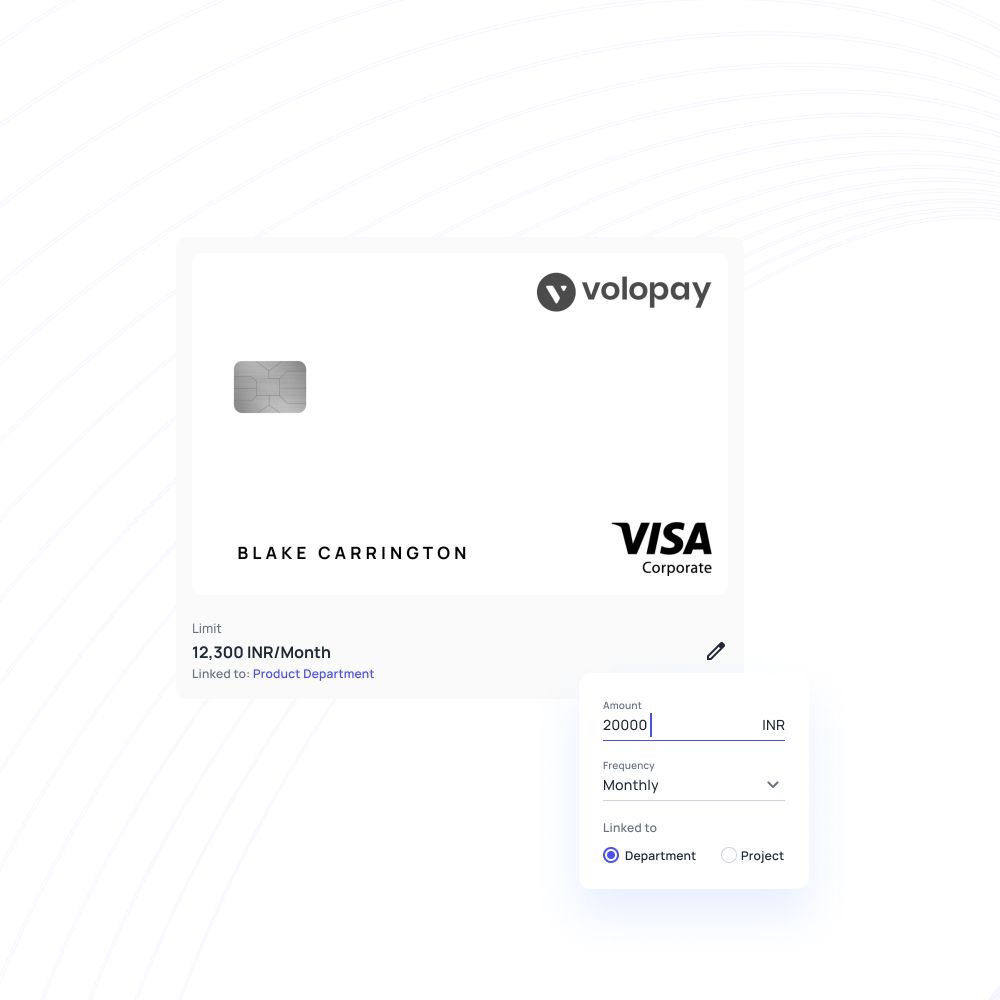

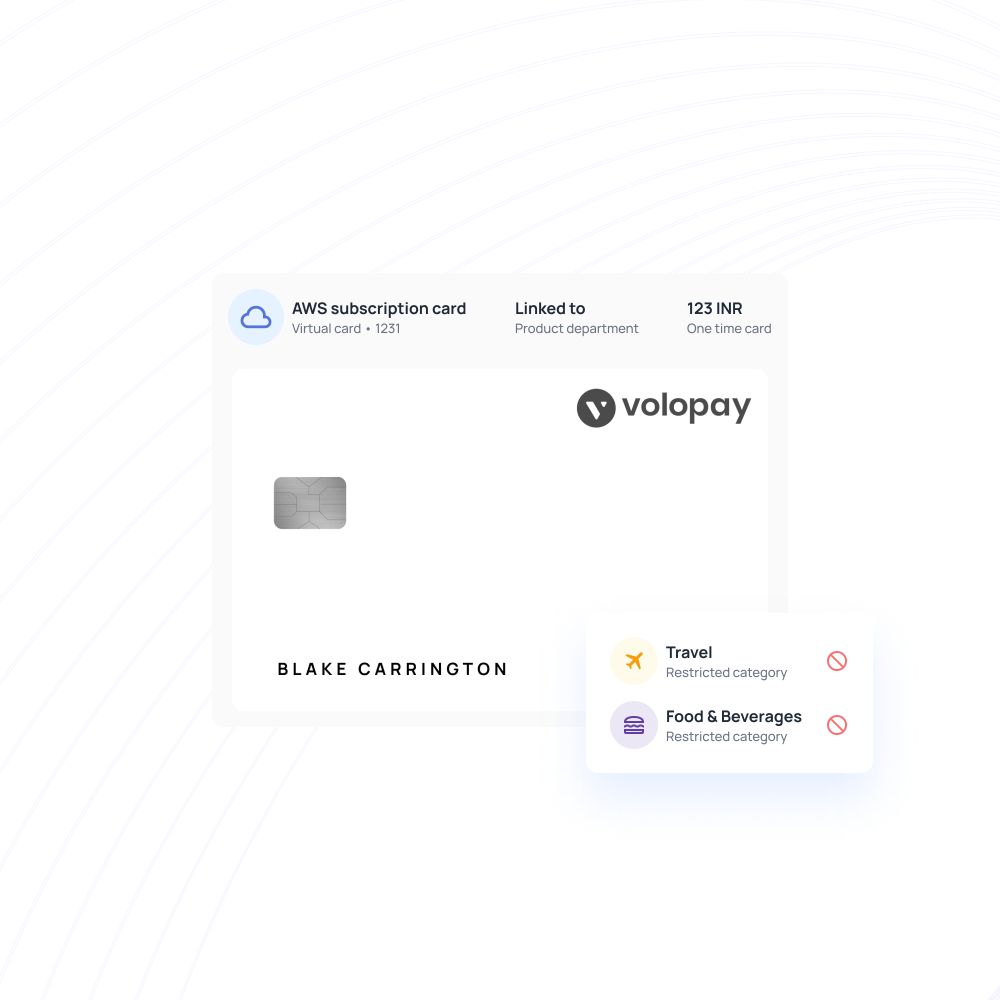

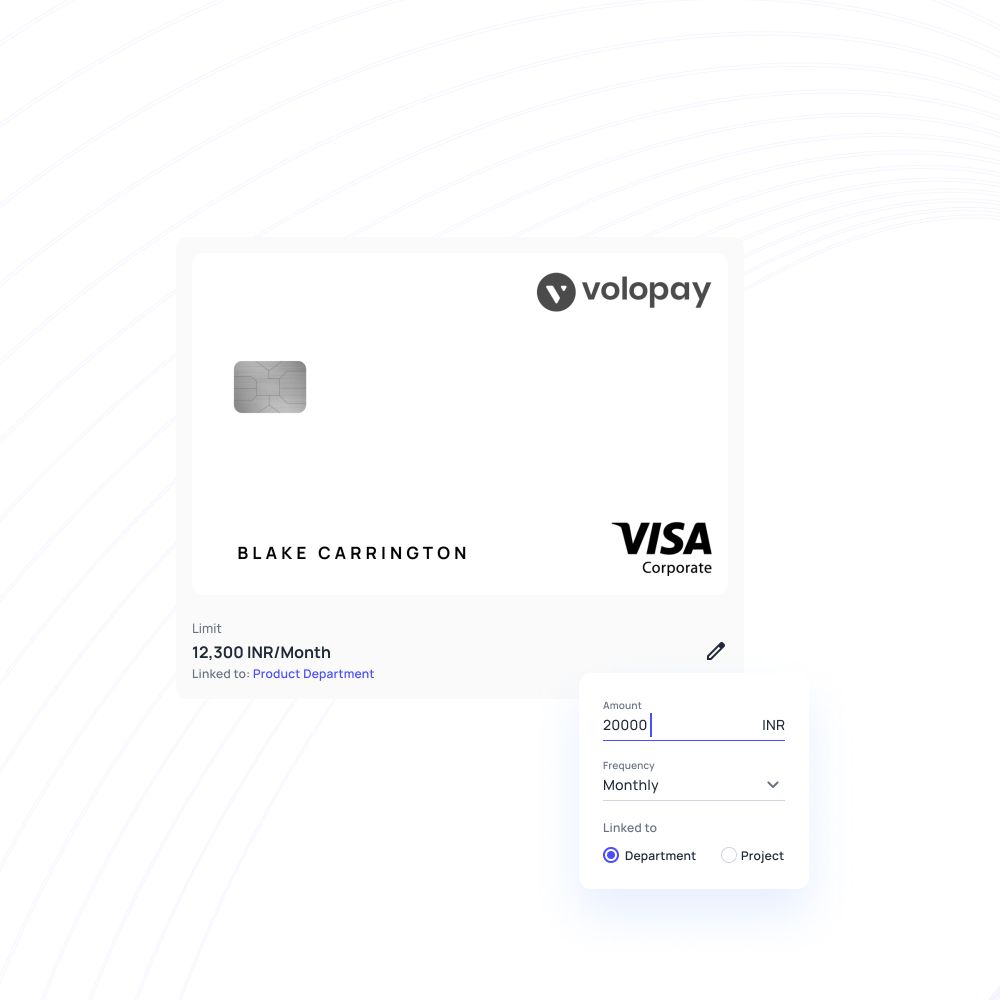

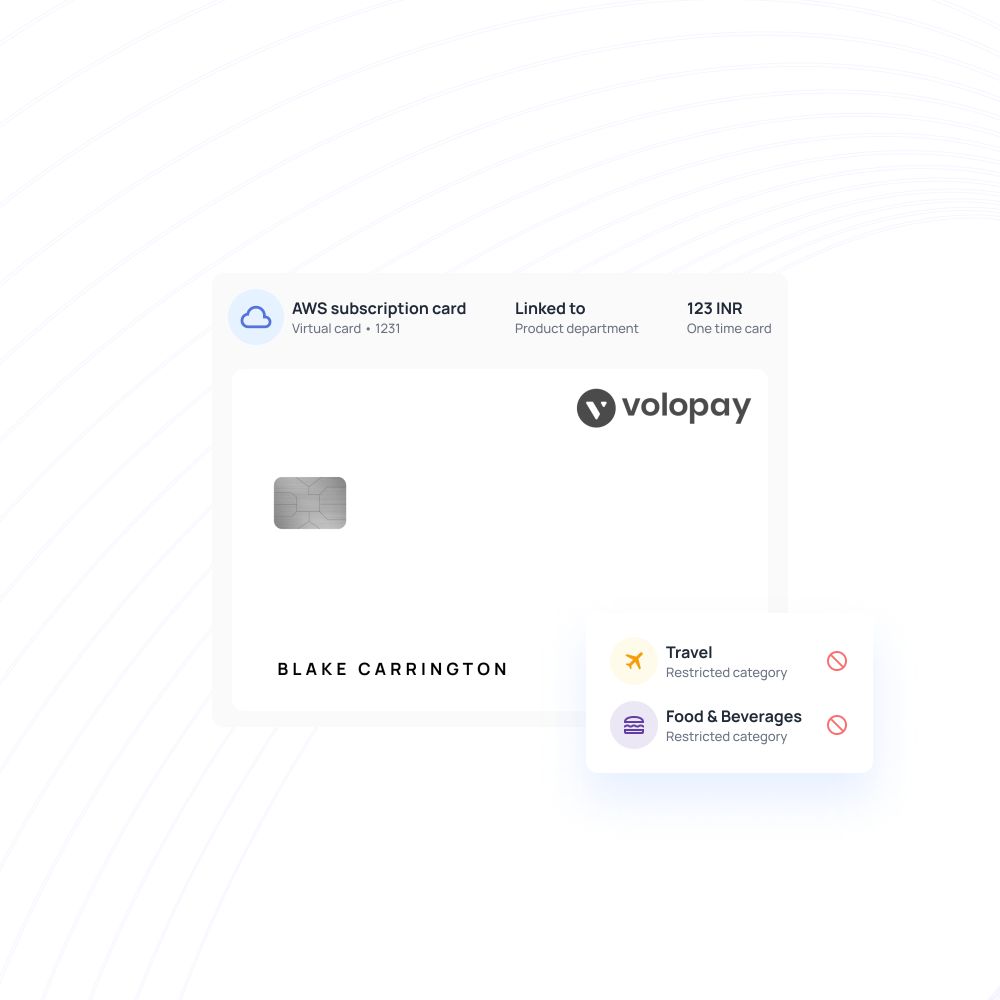

Manage petty cash transactions by disbursing petty cash funds digitally, customizing card limits, and Controlling unauthorized spending.

Get to know the most common business expenses, its tax deductibility and how to keep your business expenses under control.

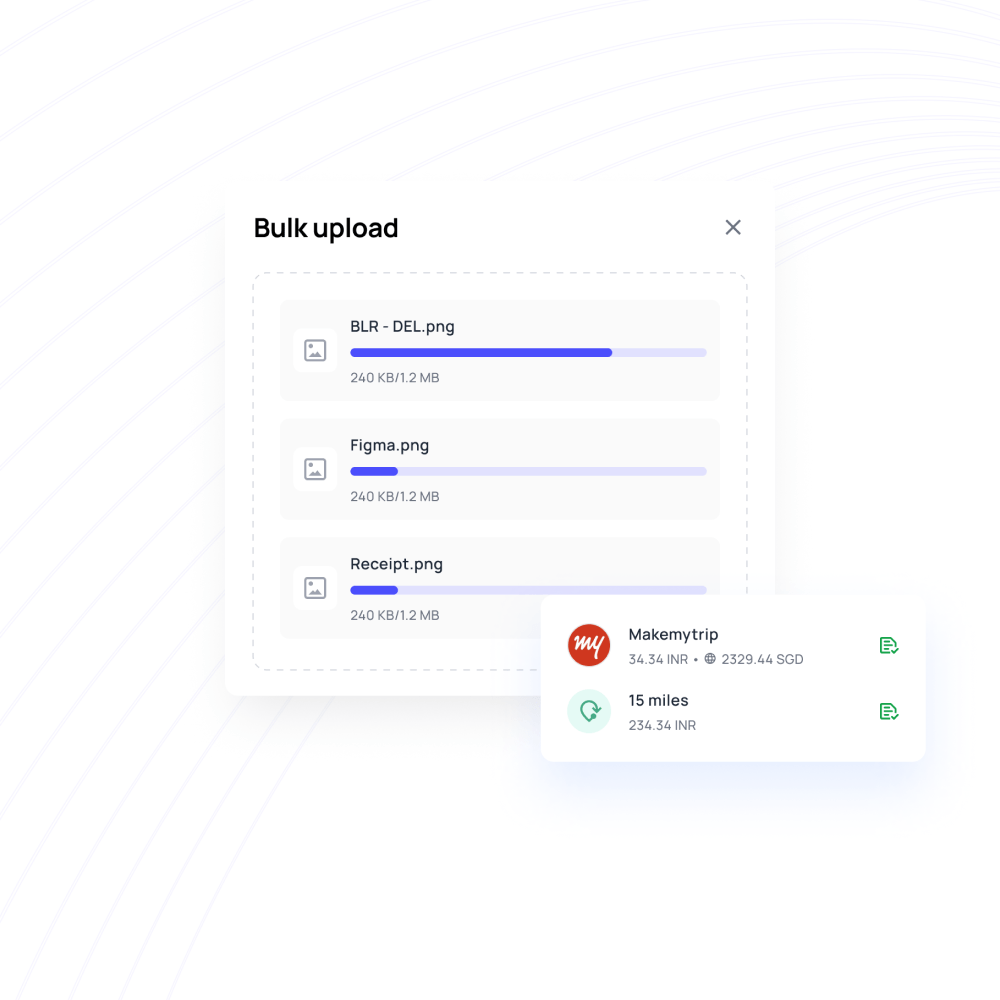

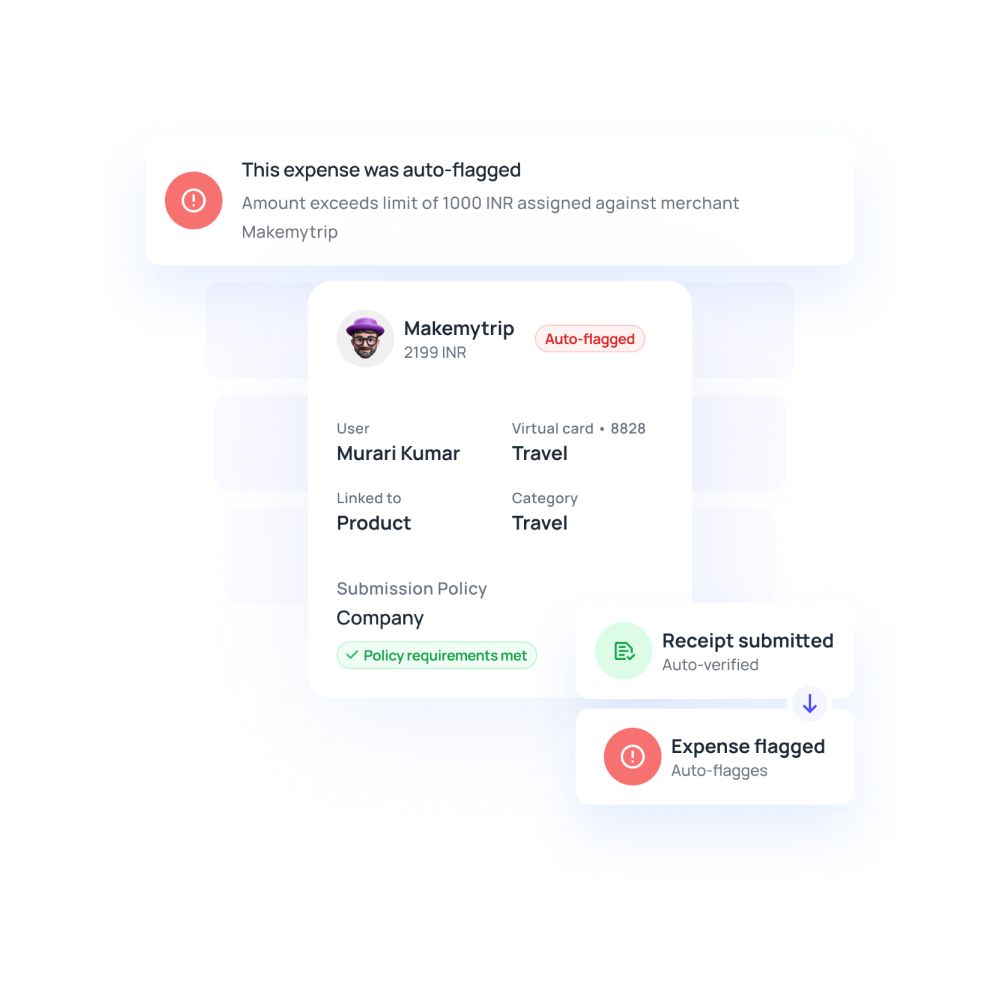

Get to know the expert tips for an effective expense claim management process. Take control of your reimbursement process with our comprehensive guide.

To open a business bank account in India, you need a company pan card, address proof, and certificate of incorporation and much more.

RBI has come up with a new mandate to regulate recurring payments in India. Learn more to see how you can simplify your recurring payments.

Corporate credit cards benefit from zero personal liability, an easier reimbursement process, Improved cash flow. Explore this article.

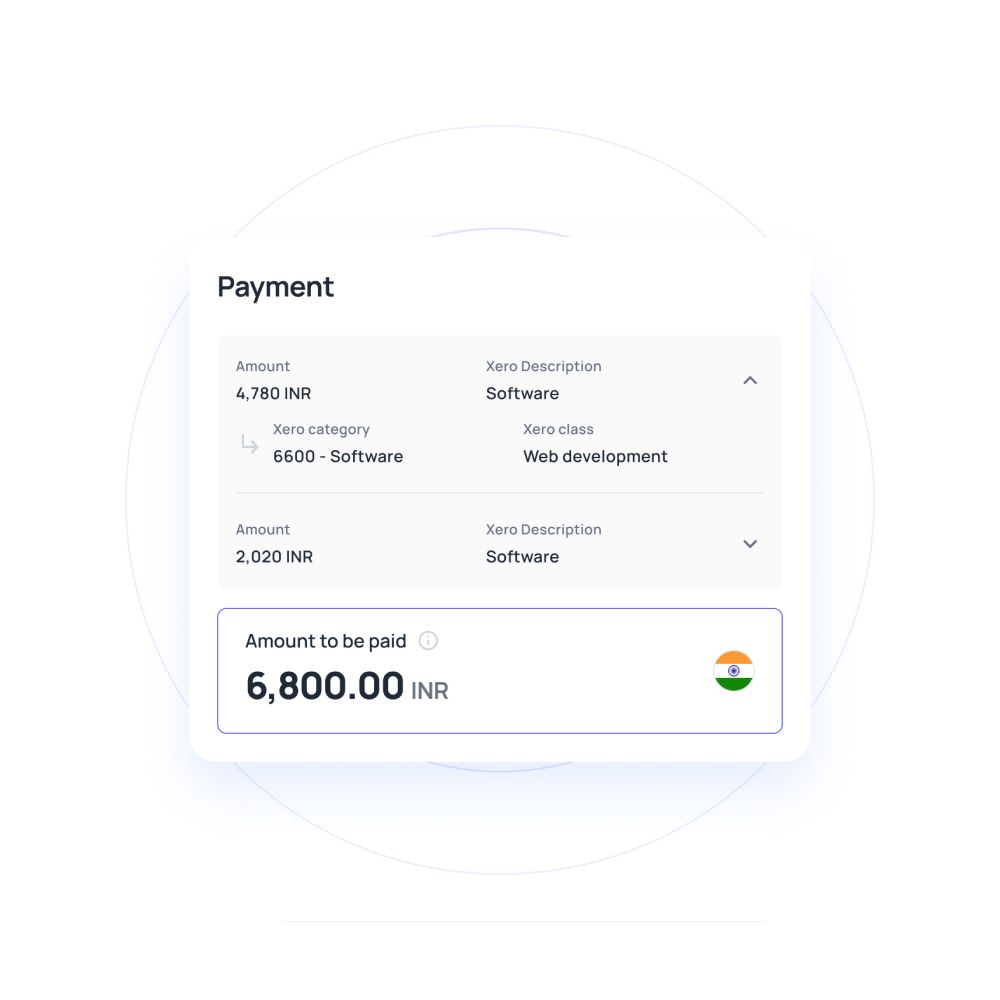

Best AP automation software offers your business great benefits. In this article, we have reviewed and suggested the best AP automation software.

Employee savings plans and schemes are established by governments to help workers secure their financial future while employed.

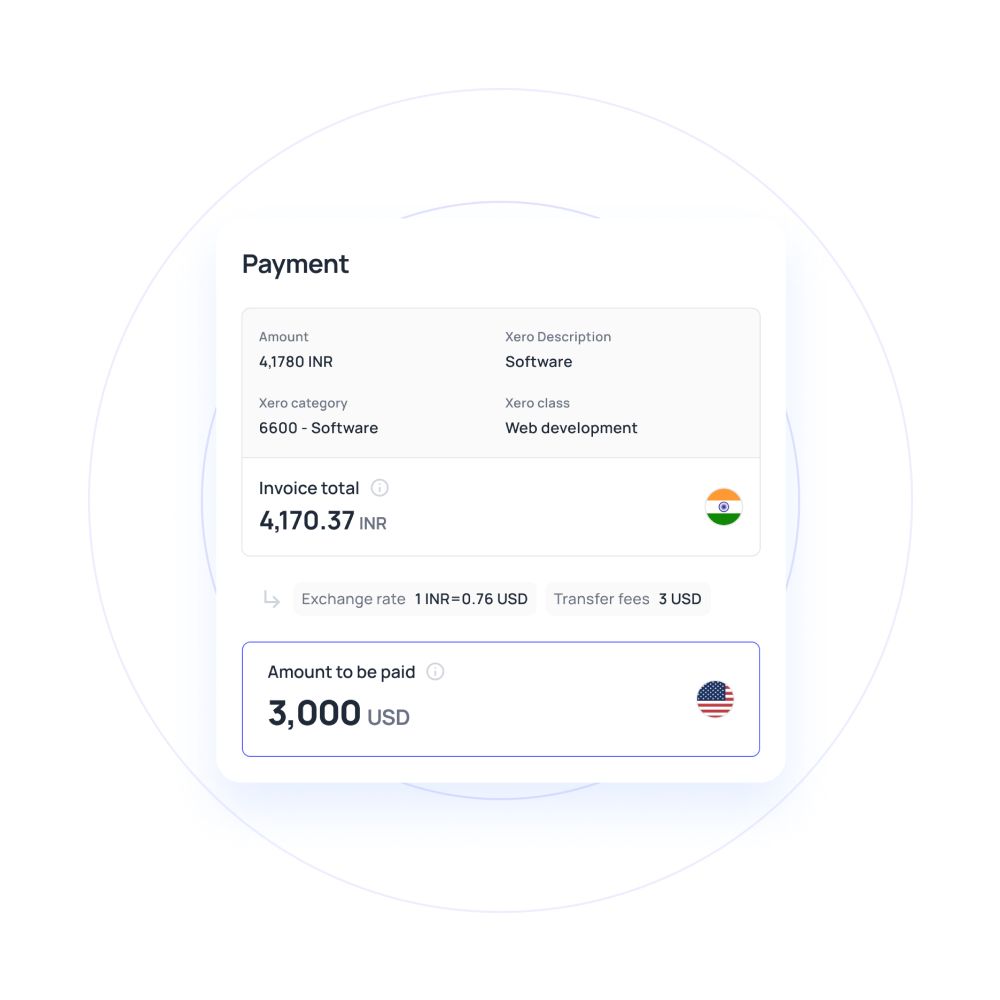

Cross-border payments have seen a paradigm shift in India with the advent of non-banking finance companies. Learn how exactly they work.

Zero-balance current accounts are those accounts in which they do not have limits on transaction volumes, minimum balance etc..

Read to know how Volopay can help you regulate your SaaS subscriptions without the intervention of RBI guidelines.

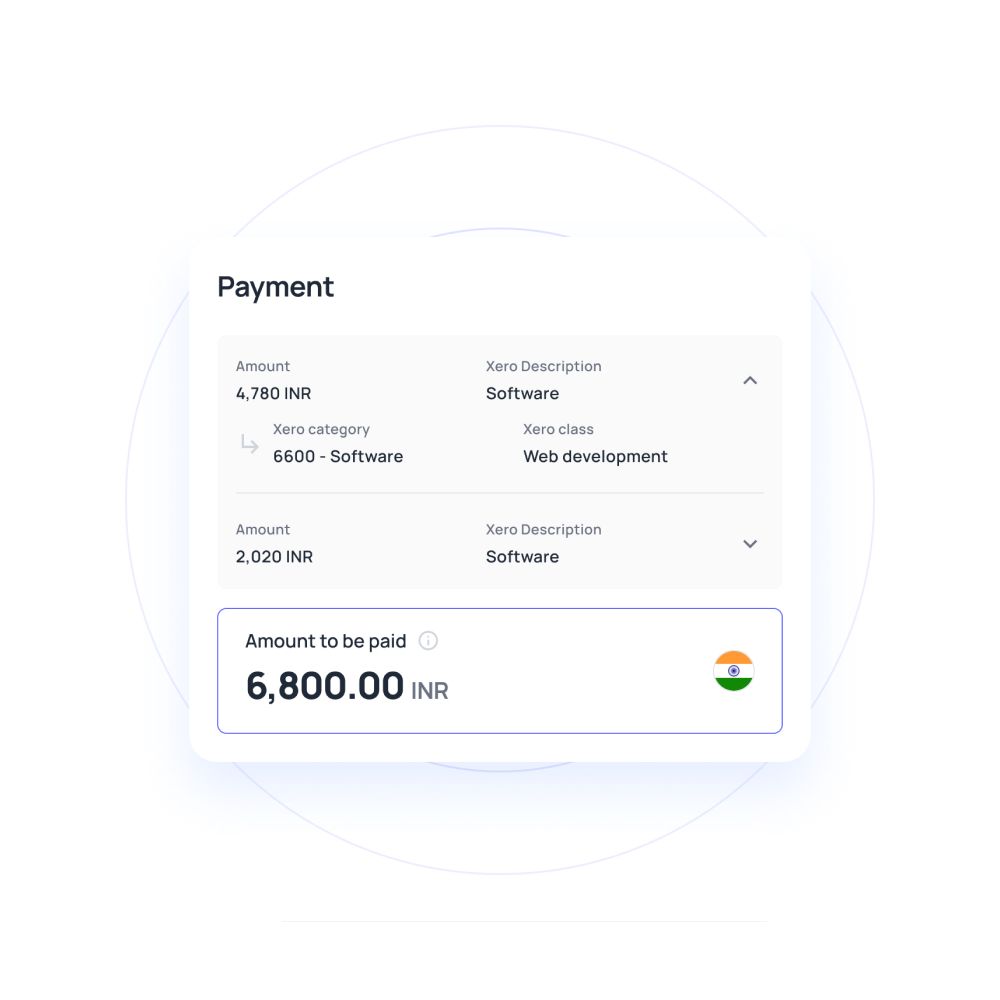

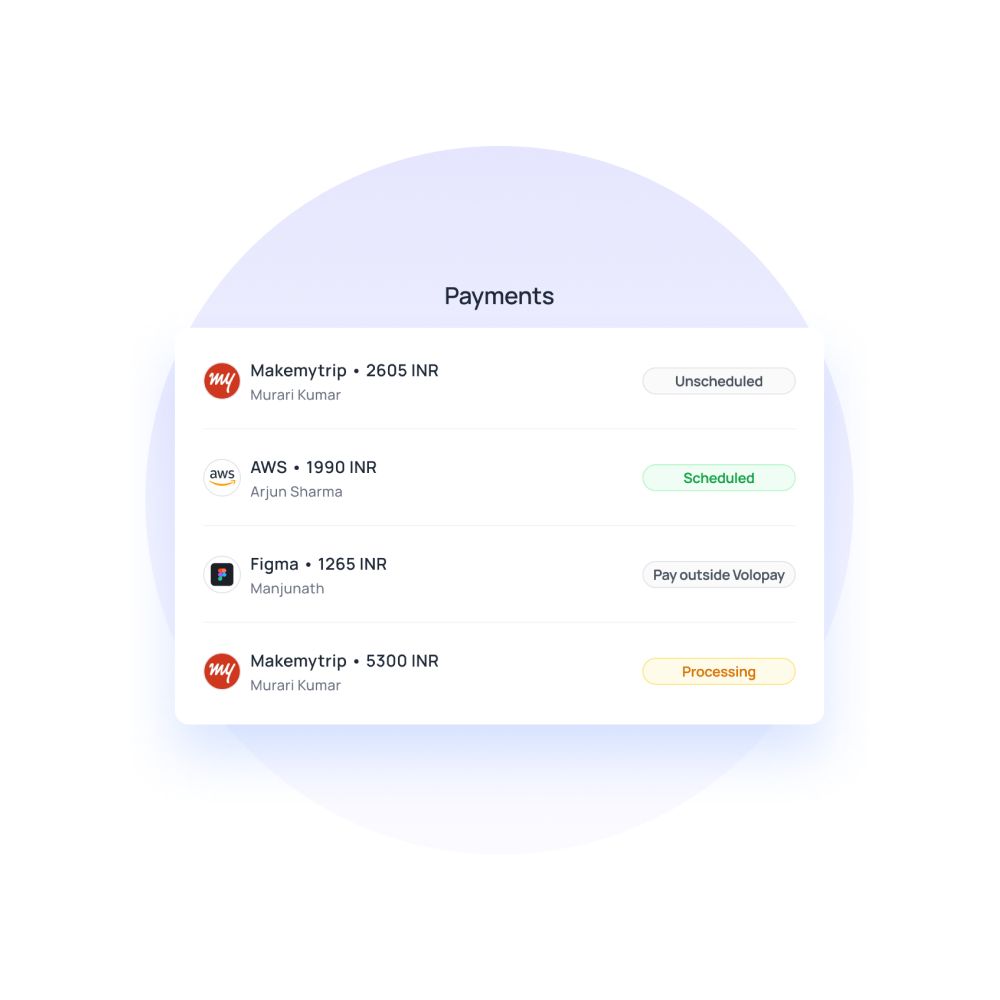

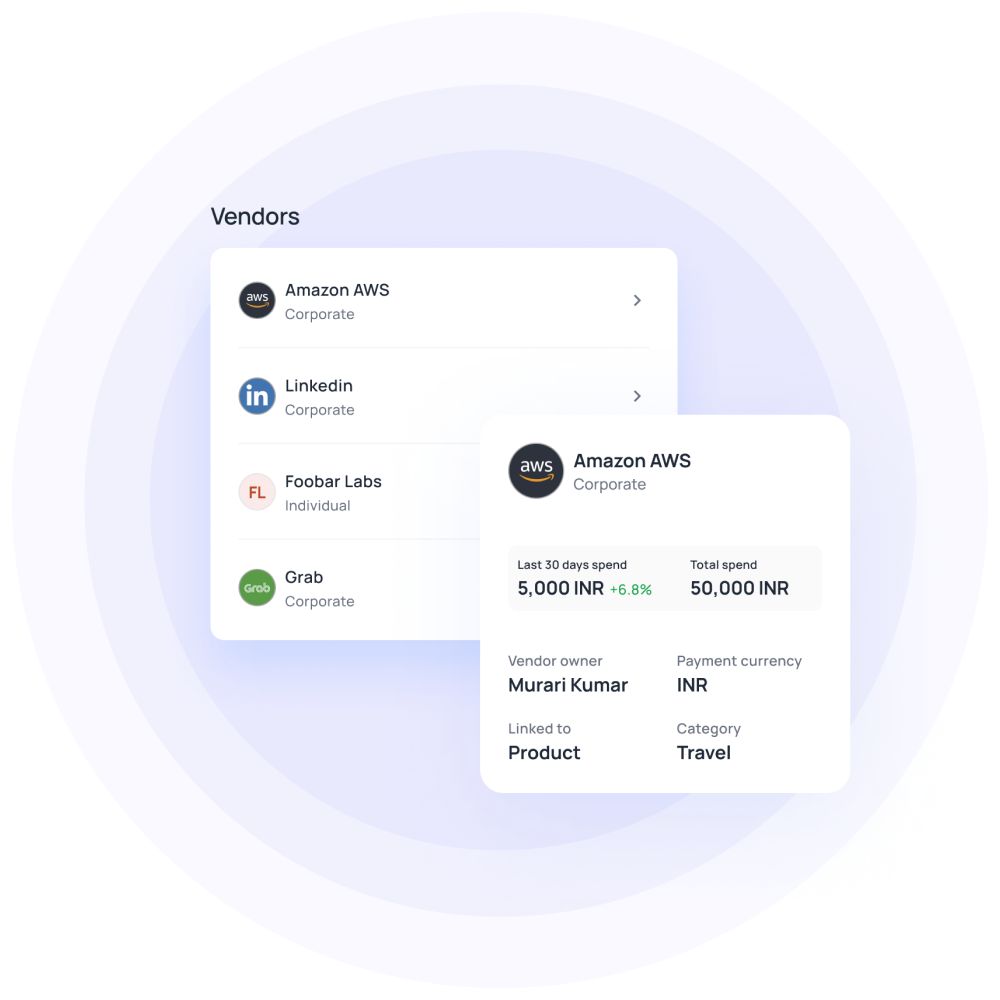

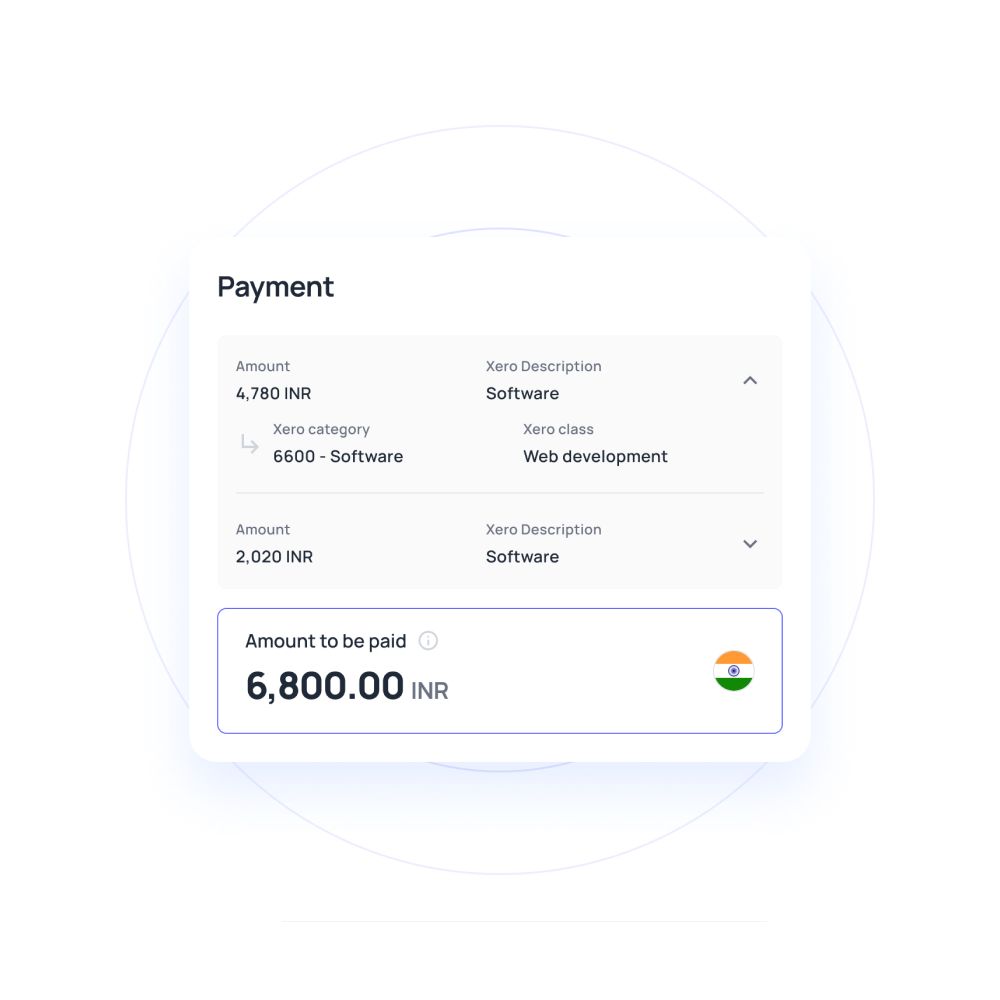

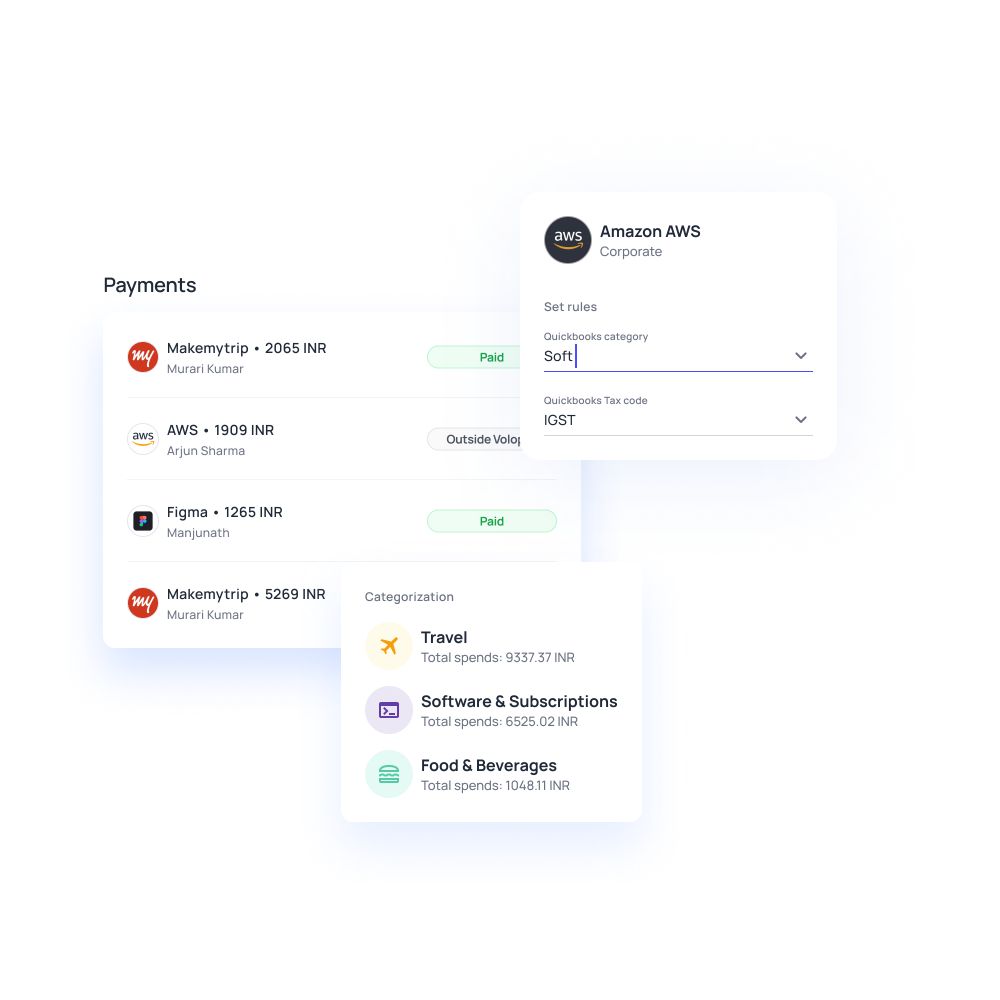

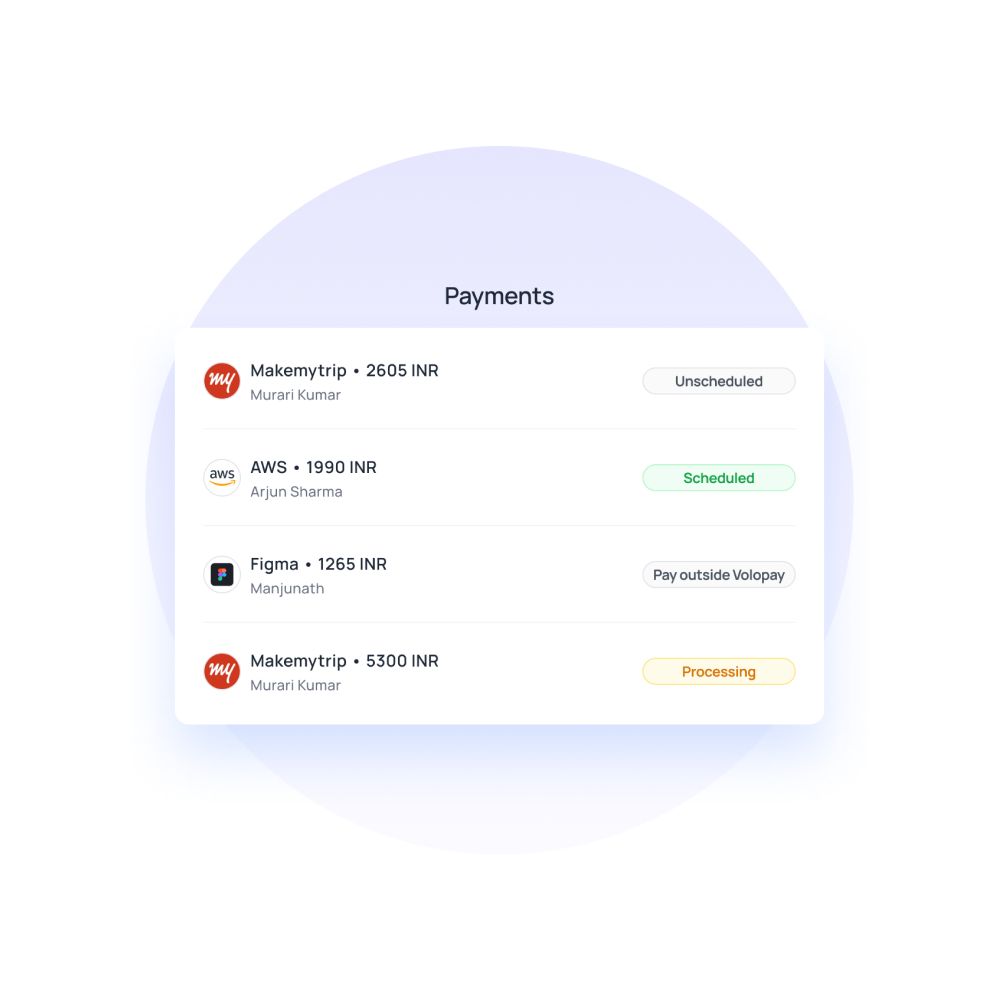

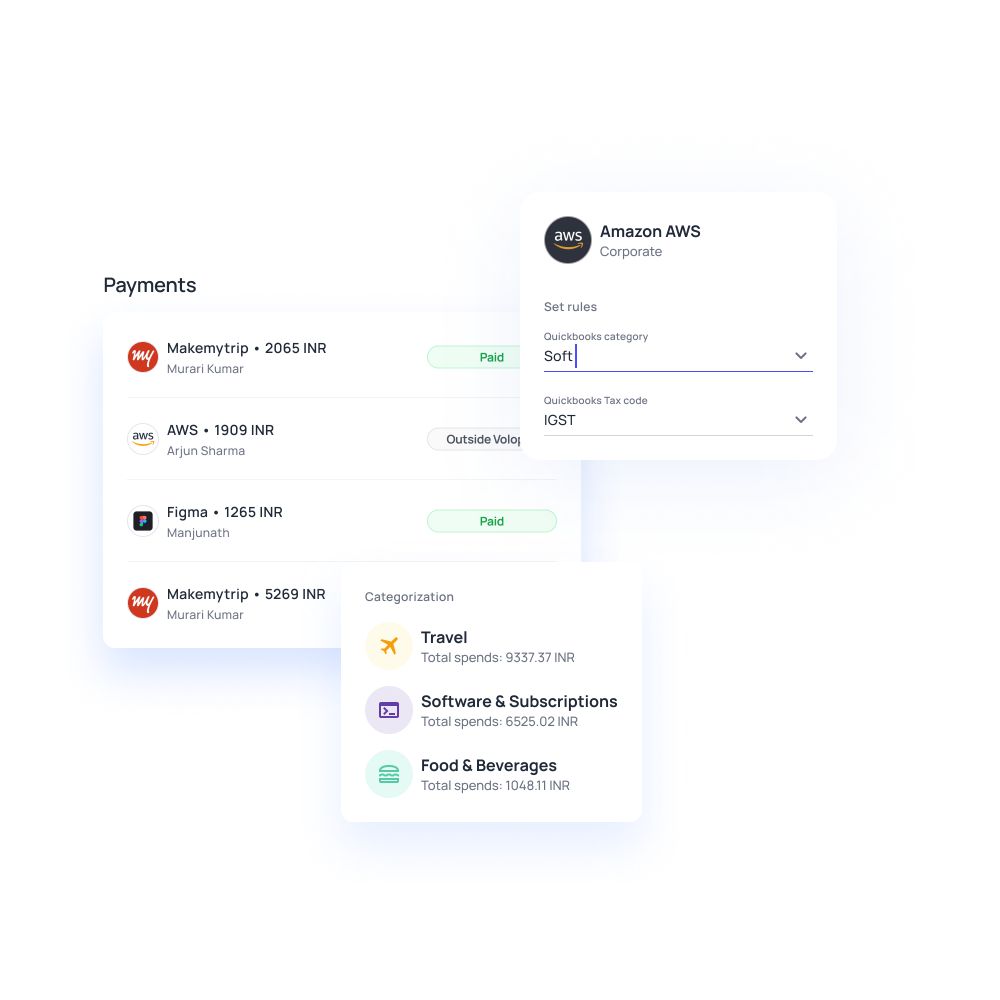

This guide talks in detail about how businesses can achieve vendor payments automation and help maintain good vendor relationships.

Travel and expense automation software automates employee expense reporting, minimizes administrative efforts, and much more.

This guide will walk you through documents, working process, and features to consider when getting corporate credit cards in India.

Read this simplified guide to learn everything about small business tax filing and how to navigate the complexity of tax season in India.

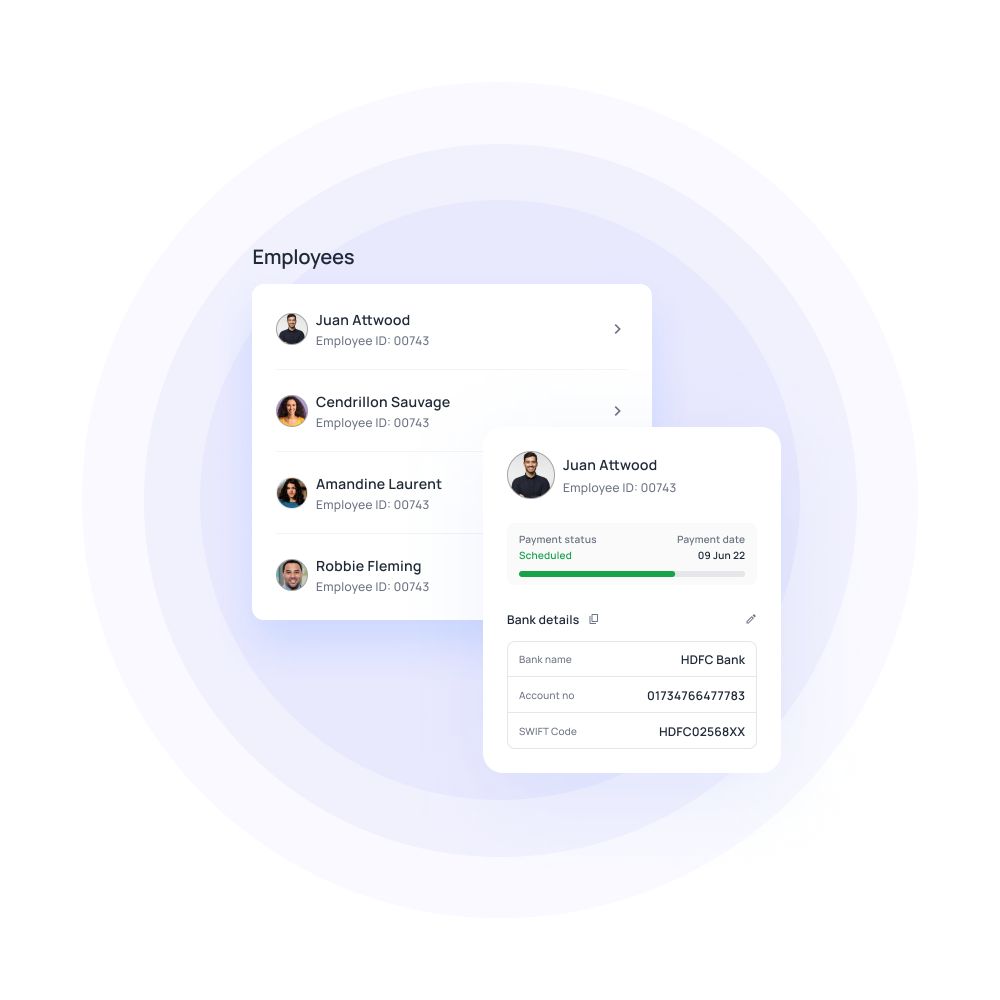

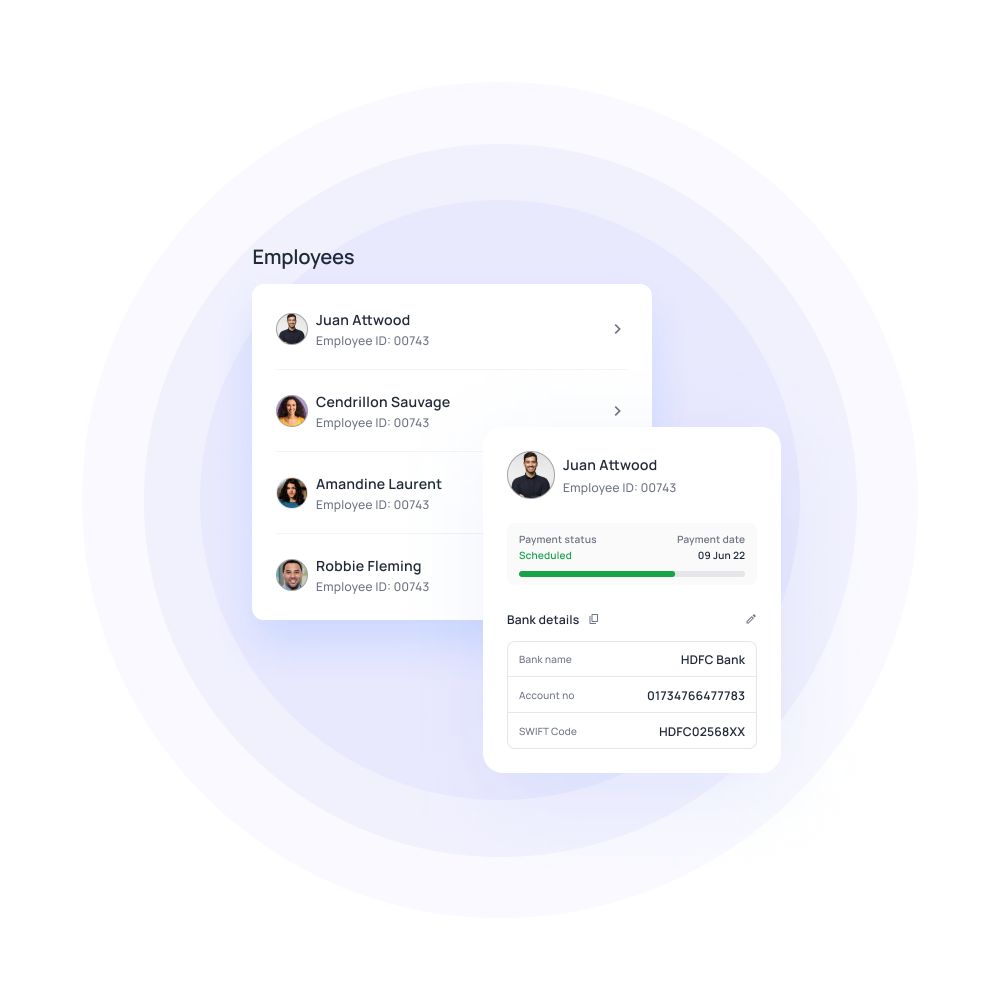

This statutory and payroll compliance guide is everything you need to know to be up to date with the current labor laws in India.

This article is a comparison of Nodal vs escrow vs current account to assist businesses with dealing with mind-boggling business payments.

RBI announced that soon people will be able to link credit cards to UPI platforms. Read this article to know reasons and benefits of this decision.

Buy now pay later benefits businesses in drawing new customers, Increase sales, Diminish cart abandonment, and much more.