👋 Exciting news! UPI payments are now available in India! Sign up now →

What is accounts payable - A complete guide for businesses

Whether you’re managing the finances of a multinational corporation or just starting out your own business, knowing what are accounts payable and how to manage them is critical. Given how intricate and complicated accounts payable management can be, having a comprehensive guide at your disposal can make your life much easier.

From understanding the importance of efficient AP management to exploring technological advancements reshaping the field, this guide equips you with the knowledge to optimize cash flow, enhance vendor relationships, and navigate the ever-evolving regulatory landscape.

What are accounts payable?

Accounts payable refers to the financial obligations a business incurs for goods or services received from suppliers, vendors, or creditors, but for which payment has not been made yet.

It represents the short-term liabilities that a company owes to external entities. When businesses purchase goods on credit or receive invoices for services rendered, these amounts are recorded as accounts payable.

Managing this aspect of financial transactions is crucial, as it directly impacts cash flow, relationships with vendors, and overall financial stability. To know what are payables in accounting you must understand that it is all connected to the payments you have to make as a business.

How does the accounts payable process work?

1. Invoice receipt

The accounts payable process begins with the receipt of invoices from suppliers or vendors for the goods delivered or services rendered. These invoices may be received through various channels, such as email, mail, or electronic data interchange (EDI). It is essential to establish a well-organized system to collect and track incoming invoices accurately.

2. Invoice verification

Once the invoices are received, they undergo a thorough verification process. This step involves matching the received invoices with the corresponding purchase orders and delivery receipts.

The goal is to ensure that the goods or services were indeed received as stated in the invoice and that there are no discrepancies or errors. Verification helps prevent fraudulent activities and ensures that the company only pays for valid and authorized expenses.

3. Invoice approval

After successful verification, the invoice needs approval before further processing. The appropriate personnel, such as department heads or managers, review the invoices to validate their accuracy and compliance with company policies.

Approval may involve verifying the legitimacy of expenses, confirming budget allocations, and ensuring adherence to internal controls.

4. Invoice recording

Once an invoice is verified and approved, it is recorded in the company's accounting system. This step involves entering the relevant details from the invoice, such as the vendor's name, invoice number, payment due date, and the amount owed.

Accurate and timely recording is crucial for maintaining an up-to-date accounts payable ledger and enables better financial tracking and reporting.

5. Payment processing

The last step of the accounts payable process involves making the actual payment to vendors or suppliers. Payments are executed following the prearranged payment terms, which might encompass incentives like early payment discounts or extended credit periods.

Businesses have the flexibility to choose from a range of payment methods, including checks, electronic fund transfers (EFTs), or digital payment platforms, to fulfill their outstanding financial obligations.

Related read: What is vendor payment process and how to automate it?

What are the types of accounts payables?

Trade payables

Trade payables are the most common form of accounts payable. These arise from the purchase of goods and services directly related to a company's core operations.

Businesses have specific payment terms with their suppliers, and trade payables represent the outstanding balances for these purchases. These payments are usually made to vendors and suppliers.

Non-trade payables

Non-trade payables encompass financial obligations that are not directly tied to the core business operations.

These can include payments for consulting services, advertising, or any non-core activities. Managing non-trade payables efficiently is crucial to maintaining financial stability.

Accrued liabilities

Accrued liabilities refer to expenses that have been incurred but not yet billed. These are payments that need to be made in the future.

This can include expenses like utilities, which are typically billed after the consumption period. Accrued liabilities are essential to ensure accurate financial reporting.

Taxes payable

Taxes payable represent the amount a business owes to tax authorities, such as income tax, sales tax, or value-added tax (VAT).

Properly managing tax payables is vital to avoid penalties and interest charges. These types of dues also fall under accounts payable.

Employee wages payables

Employee wages payables consist of salaries, bonuses, and other compensation owed to employees.

Timely payment is essential to maintain a motivated workforce and comply with labor regulations. This is a recurring payable that needs to be paid to continue smooth operations.

Rent payables

Rent payables arise from leasing agreements for office space, warehouses, or equipment.

Efficient management of rent payables ensures a smooth operation of the business.

Legal settlement payables

Legal settlement payables occur when a business is involved in litigation or disputes that require financial settlements.

Resolving these payables is crucial to mitigate legal risks and maintain the company's reputation.

Loan payables

Businesses often take loans for various purposes, such as expansion or working capital needs.

Loan payables encompass the outstanding balances on these loans, including principal and interest.

Say goodbye to manual errors and delays

Why is accounts payable important for business operations?

1. Managing vendor relationships

If you are looking to understand what are accounts payable you must know how important they are. AP accounting plays a vital role in managing vendor relationships effectively.

Timely and accurate payments demonstrate reliability and professionalism, fostering trust between a company and its suppliers. Maintaining positive relationships with vendors can lead to better terms, priority in deliveries, and potential future collaborations.

Conversely, delayed or inaccurate payments may strain relationships, resulting in disruptions to the supply chain and higher costs.

Check out our detailed guide on improving vendor relationship to understand how AP automation can strengthen and help establish good relationships with suppliers.

2. Cash flow management

Efficient accounts payable management is crucial for maintaining a healthy cash flow. By optimizing the timing of payments, businesses can ensure they have sufficient funds to cover expenses while taking advantage of any available early payment discounts.

Conversely, poor accounts payable management can lead to cash flow shortages, missed opportunities, and potential financial distress.

With our article, break down the complexities of cash flow statements, empowering you to understand your business's financial position and make informed decisions. The guide provides clear explanations and practical tips for maximizing cash flow, minimizing risks, and achieving financial success.

3. Cost control

Proper accounts payable practices contribute to cost control and expense management. By thoroughly reviewing invoices and expenses, businesses can identify potential cost-saving opportunities, detect errors, and prevent overpayments.

Effective accounts payable processes also reduce the likelihood of duplicate payments or fraudulent activities, safeguarding the company's financial resources.

4. Financial analysis and reporting

Accurate accounts payable data is essential for financial analysis and reporting. The accounts payable ledger provides valuable insights into a company's short-term liabilities and payment patterns.

This data is used to prepare financial statements, analyze vendor spending, and forecast cash flow. It also aids in identifying trends, such as seasonal variations in expenses, which can inform strategic decision-making.

Unlock the power of cash flow analysis with our in-depth guide! Learn how to assess and optimize your business's cash flow for better financial decision-making.

5. Compliance and risk management

Compliance with financial regulations and internal policies is crucial for any business, this is key to the importance of accounts payable.

Accounts payable processes must adhere to various legal requirements, tax regulations, and company-specific policies. Proper management ensures that the company meets its payment obligations within specified timelines, avoiding penalties or legal consequences.

Moreover, diligent accounts payable practices contribute to risk management by preventing fraudulent activities and enhancing financial transparency.

6. Process efficiency

Efficient accounts payable processes streamline the entire payment cycle. Implementing automated systems and optimizing workflows reduces manual errors, speeds up processing times, and frees up staff to focus on more strategic tasks.

A well-organized accounts payable function minimizes delays, enhances productivity, and contributes to the overall efficiency of the finance department. This boosts the importance of accounts payable even further.

7. Supplier negotiations and discounts

A strong accounts payable function enables businesses to negotiate favorable terms with suppliers. By demonstrating prompt payment capabilities and reliability, companies gain leverage during contract negotiations.

Vendors may offer discounts or preferential pricing in return for timely payments, resulting in direct cost savings for the organization.

8. Better business relationships

Effective accounts payable management contributes to building better business relationships across the board. Not only does it enhance relationships with vendors and suppliers, but it also fosters collaboration with internal stakeholders.

When departments collaborate efficiently on purchase orders, receipts, and approvals, it leads to smoother operations and a more cohesive work environment.

What are some of the examples of accounts payables?

1. Purchase of raw materials

One of the most common forms of accounts payable arises from the procurement of raw materials. Businesses often rely on suppliers to provide essential materials for production. Until the supplier's invoice is settled, this outstanding amount represents an accounts payable.

For example, a clothing manufacturing business would need cotton, silk, or some other form of raw material to weave and make clothes as the final product. So when this manufacturing business has purchased raw materials from suppliers, it falls under their accounts payable department to make the payment.

2. Transportation and logistics

Accounts payable can also accumulate from transportation and logistics services. Companies frequently engage logistics providers for the shipment of goods. The fees incurred for these services become accounts payable until they are paid.

For example, if we take the same example of the clothing manufacturing business as in the previous point, for them to procure the raw material, they will need to transport it from the supplier's location to their factory.

To do this, the organization can hire a transportation and logistics service provider to procure and transport the raw material to the manufacturing unit. The payment to be made to this service provider will also fall under accounts payable.

3. Employee expenses

When employees incur expenses related to business activities, such as travel, accommodation, or meals, the company becomes liable for reimbursing these costs. Until the reimbursement is processed, these expenses are considered accounts payable.

For example, if an employee has to travel for a business conference or event on behalf of the company, then the organization must cover expenses like travel, accommodation, and meals.

These expenses are considered under accounts payable whether they have to be reimbursed or if the company directly gives access to budgets through payment tools like corporate cards.

4. Equipment purchase and maintenance

Acquiring, maintaining, or leasing equipment often involves contractual agreements with payment terms. Until the agreed-upon payments are made, the amounts owed to equipment suppliers or lessors constitute accounts payable.

An example of this includes a manufacturing unit buying machinery or renting space or land to set up a factory and produce goods. Usually, payments of this nature are of a large volume and not paid off in a single payment. They are paid in installments and all these payments fall under the accounts payable department’s purview.

5. Licensing cost

Modern businesses rely heavily on software and technology. Licensing fees for software or technology solutions create accounts payable until they are settled. This is particularly relevant in the ever-evolving landscape of business technology.

Different businesses categorized as FinTech, AdTech, MarTech, InsurTech, and so on offer software solutions for purchasing or licensing on a subscription basis. These subscriptions are usually monthly and a company needs to pay for them each month to continue using the software solution.

All these payments fall under the accounts payable department.

Boost efficiency and enhance control

How to record accounts payable?

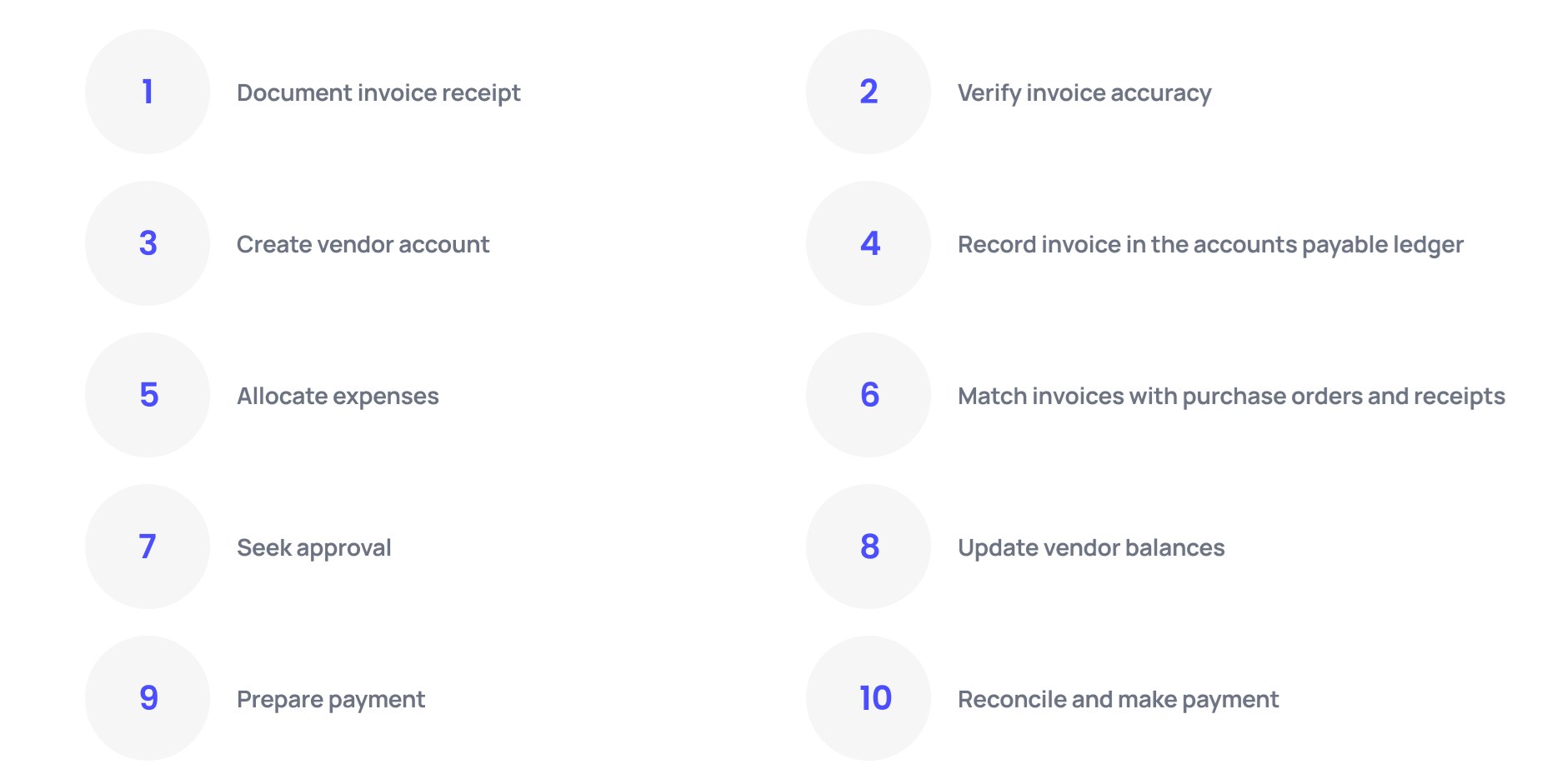

1. Document invoice receipt

The first step in recording accounts payable involves carefully documenting the receipt of invoices from vendors or suppliers. Invoices can be received in various formats, such as physical documents, electronic files, or through automated systems.

A systematic approach to collecting and organizing invoices ensures that no bills are overlooked, and all relevant information is available for further processing.

2. Verify invoice accuracy

Once invoices are received, they undergo a thorough verification process to ensure their accuracy and validity. This step in AP accounting involves comparing the invoice details with the corresponding purchase orders and delivery receipts.

Any discrepancies or errors are promptly addressed by liaising with the vendor or relevant department, ensuring that the recorded information aligns with the actual goods or services received.

3. Create vendor account

To properly manage accounts payable, it is essential to create a vendor account in the accounting system. This account serves as a central repository for all transactions related to a specific vendor.

Key vendor information, such as name, contact details, and payment terms, is recorded to facilitate smoother communication and payment processing in the future. When you are learning what are accounts payable knowing how to manage the technicalities of your accounting system will also play a critical role.

4. Record invoice in the accounts payable ledger

After confirming the accuracy of the invoice, the subsequent stage involves entering it into the accounts payable ledger. This specialized accounting instrument monitors all current liabilities to vendors.

The recorded details encompass the vendor's name, invoice number, invoice date, due date, and the amount payable. Precise recording enhances financial monitoring and reporting, promoting a well-structured and transparent accounts payable procedure.

5. Allocate expenses

In some cases, invoices may pertain to multiple departments or cost centers within the organization. Allocating expenses to the appropriate department ensures accurate cost attribution and budget management.

For example, if an invoice includes office supplies and maintenance costs, the expenses must be allocated to the respective departments based on usage or predetermined cost-sharing ratios.

6. Match invoices with purchase orders and receipts

Matching invoices with corresponding purchase orders and receipts is a critical control mechanism to prevent fraudulent activities and ensure that only authorized expenses are paid.

This step in AP accounting involves cross-referencing the details on the invoice with the relevant purchase order and delivery receipt to validate the legitimacy of the transaction.

7. Seek approval

In many organizations, invoices require approval from the relevant department heads or managers before processing payment.

Approval ensures that the expenses align with budgetary constraints, contractual agreements, and internal policies. The approval process adds an extra layer of oversight, reducing the risk of erroneous or unauthorized payments.

8. Update vendor balances

As invoices are recorded and approved, the vendor balances in the accounts payable ledger are updated accordingly.

The outstanding amounts owed to each vendor are adjusted to reflect the latest transactions. This information is crucial for accurate financial reporting and managing cash flow effectively.

9. Prepare payment

With all necessary checks and approvals completed, the accounts payable team prepares for payment processing. Depending on the agreed-upon payment terms, such as net 30 or net 60 days, payments are scheduled accordingly. Companies may also take advantage of early payment discounts offered by vendors to optimize cash flow and reduce costs.

10. Reconcile and make payment

Before making the actual payment, a final account reconciliation is performed to ensure that all invoices, expenses, and payments align with the accounts payable records. This reconciliation verifies the accuracy of the accounts payable ledger and guards against potential payment errors.

Once the verification is complete, payments are executed through the chosen payment method, such as checks, electronic fund transfers (EFTs), or digital payment platforms, thereby settling the outstanding liabilities with the vendors.

How does accounts payable help in accounting?

1. Accurate financial reporting

Accounts payable ensures precise representation in financial reports by recording all outstanding obligations and expenses owed to suppliers and vendors. These entries form a vital part of the balance sheet, reflecting the company's immediate liabilities.

2. Expense tracking and control

By recording invoices and payables, accounts payable helps track and control expenses effectively. Monitoring these transactions provides insights into the company's spending patterns, identifies potential cost-saving opportunities, and aids in budget planning. It enables management to assess the company's financial health and make data-driven decisions to optimize expenditures.

Also, dive into our comprehensive guide on expense tracking software to discover the best tools and strategies to streamline your financial management.

3. Cash flow management

Effective management of accounts payable is crucial in maintaining a robust cash flow, this is very important to know when learning what are accounts payable.

By managing payment schedules and capitalizing on early payment incentives, businesses can optimize their liquidity.

Suggested read: Ultimate guide on cash flow management

4. Financial analysis

Accounts payable data is valuable for financial analysis. It allows accountants and financial analysts to identify trends, spot potential financial risks, and conduct various financial assessments.

By analyzing accounts payable records, businesses can assess vendor performance, negotiate better terms, and evaluate the efficiency of their procurement processes.

5. Ensuring compliance and audit support

Accounts payable's proper administration is essential for adhering to regulatory requirements and supporting audits.

Compliance with accounting standards and tax regulations ensures accurate and transparent financial records, facilitating the auditing process with organized documentation and supporting evidence.

Automate your accounts payable process

What are 2-way matching and 3-way matching in accounts payable?

Before a business processes the payments for an invoice they need to verify its legitimacy and authorize the payments through approvals.

Two methods to verify invoices are known as 2-way matching and 3-way matching. Both these methods use supporting documentation to verify the authenticity of an invoice.

2 way invoice matching

● Components - In 2-way invoice matching, two documents are compared – the purchase order (PO) and the invoice

● Matching Factors - This process verifies that the quantities and prices on the invoice match those specified in the PO.

● Purpose - The primary goal of 2-way matching is to ensure that the goods or services were received as ordered and that the invoiced amount is accurate.

● Discrepancies - In case of discrepancies, such as price differences or missing items, the accounts payable team typically communicates with the vendor to rectify the issues before approving payment.

3 way invoice matching

● Components - In 3-way invoice matching, three documents are involved – the purchase order (PO), the invoice, and the receiving report or goods receipt.

● Matching factors - This method not only checks quantities and prices but also verifies that the goods or services have been physically received and accepted using the goods received receipts or reports.

● Purpose - The primary purpose of 3-way matching is to ensure the completeness of the transaction. It confirms that what was ordered matches what was received and billed.

● Discrepancies - In the event of discrepancies, the process becomes more complex. Accounts payable personnel may need to reconcile differences between the PO, invoice, and receiving report. Resolution often involves close collaboration with both the vendor and the department that made the purchase.

Accounts payable vs. Accounts receivable - What are the differences?

Accounts payable and accounts receivable are two fundamental concepts in accounting that represent opposite sides of a company’s financial transactions. Understanding the differences between these two is essential for managing a company's cash flow effectively.

1. Definition

● Accounts payable

The answer to what are accounts payable and the definition of the same refers to the outstanding liabilities a company owes to its suppliers or vendors for goods or services received on credit. It represents the company's short-term debts and is recorded as a liability on the balance sheet.

● Accounts receivable

On the other hand, accounts receivable refers to the outstanding amounts owed to a company by its customers or clients for goods sold or services rendered on credit. It represents the company's short-term assets and is recorded as an asset on the balance sheet.

2. Nature

● Accounts payable

It is a liability for the company as it represents the money owed to external parties.

● Accounts receivable

It is an asset for the company as it represents the money that the company expects to receive from its customers.

3. Role

● Accounts payable

It is a vital component of managing the company's cash outflows and maintaining good relationships with suppliers.

● Accounts receivable

It plays a crucial role in managing the company's cash inflows and ensuring timely collection of outstanding receivables.

4. Initiation

● Accounts payable

It is initiated by the receipt of invoices from suppliers for goods or services provided.

● Accounts receivable

It is initiated when the company provides goods or services to customers on credit, resulting in an account receivable.

5. Financial impact

● Accounts payable

It harms the company's cash flow as it represents an outgoing payment.

● Accounts receivable

It has a positive impact on the company's cash flow as it represents an incoming payment.

6. Importance

● Accounts payable

Efficient management of accounts payable is essential for maintaining vendor relationships, managing cash flow, and ensuring timely payments to avoid penalties or disruptions in supplies. This is a key importance of accounts payable.

● Accounts receivable

Proper management of accounts receivable is critical for optimizing cash flow, minimizing bad debts, and maintaining good customer relationships.

7. Risks

● Accounts payable

The main risk associated with accounts payable is the potential for missed or delayed payments, leading to damaged supplier relationships or supply chain disruptions.

● Accounts receivable

The main risk associated with accounts receivable is the possibility of bad debts or non-payment by customers, affecting the company's cash flow and profitability.

Accounts payable vs. Trade payables - What is the difference?

Accounts payable and trade payables are terms often used interchangeably, but they have distinct differences in their meanings and scope within accounting.

Accounts payable

Accounts payable is a broad accounting term that denotes the aggregate sum a company is liable to pay its suppliers or vendors for goods or services obtained on credit.

What are accounts payable essentially encompasses all immediate liabilities that require settlement within a specified timeframe, usually ranging from 30 to 90 days.

Accounts payable stands as a representation of the company's pending invoices yet to be paid and holds significant importance in managing the company's working capital.

Trade payables

Trade payables, on the other hand, is a more specific term within the category of accounts payable. It refers to the subset of accounts payable that is directly related to the purchase of goods or inventory from suppliers.

Trade payables include invoices for raw materials, finished goods, or any inventory items acquired as part of regular business operations.

In summary, while accounts payable encompasses all short-term liabilities owed by a company, Trade payables focus exclusively on the portion of these liabilities associated with the purchase of goods or inventory.

Trade payables offer more specific insight into the company's outstanding obligations related to its core business activities.

Boost financial efficiency with AP automation

What are the main challenges in the AP process?

1. Manual processes and paperwork

Numerous companies continue to depend on manual procedures and paper-based methods for managing their accounts payable tasks, resulting in inefficiencies, delays, and a higher likelihood of errors.

The manual handling of invoices, approvals, and payments can be time-consuming, leading to extended payment cycles and the potential for vendor relationships to be disrupted.

2. Data entry errors and duplication

Manual data entry is susceptible to human errors, such as mistyped numbers or incorrect information input. These errors can lead to duplicated invoices, overpayments, or incorrect financial records.

Detecting and rectifying such mistakes requires additional effort and can impact the company's financial reporting and reconciliation processes.

3. Late payments and cash flow issues

Vendor relationships can be strained by delayed payments, possibly resulting in supply chain disruptions and the forfeiture of early payment discounts.

Additionally, tardy payments can have adverse effects on the company's cash flow, impacting its capacity to handle expenses, capitalize on growth prospects, or avail itself of supplier discounts.

Benefits of automating the AP process

Time and cost savings

Automation of accounts payable process simplifies routine tasks, substantially decreasing the requirement for manual involvement.

Through the elimination of manual data entry, invoice matching, and approval workflows, businesses can achieve notable time, cost, and resource savings.

The streamlined approach also diminishes administrative burden, enabling employees to concentrate on more strategic and value-generating endeavors.

Improved accuracy and reduced errors

Automated systems, including those utilizing OCR invoice processing, are purposefully developed to reduce human errors commonly associated with manual data entry and invoice processing.

Through electronic data capture, precise and consistent information is ensured, decreasing the chances of data entry errors and discrepancies in invoices.

The outcome is heightened accuracy and enhanced data integrity throughout the accounts payable process.

Enhanced invoice processing speed

Manual invoice processing can be time-consuming, leading to longer payment cycles.

With automation, invoices can be received, processed, and approved faster, enabling prompt payment to vendors.

This efficiency not only strengthens vendor relationships but also allows businesses to take advantage of early payment discounts, optimizing cash flow.

Increased visibility and transparency

Automated accounts payable systems provide real-time visibility into the status of invoices and payment schedules.

Businesses can track the progress of invoices through the approval workflow and gain insights into payment timelines.

This transparency enables better decision-making and helps management monitor the overall health of the accounts payable function.

Improved vendor relationships

Timely payments and accurate processing improve vendor relationships significantly.

Automating the accounts payable process ensures prompt and consistent payments, fostering trust and reliability with vendors.

Stronger vendor relationships often lead to favorable terms, discounts, and better collaboration opportunities in the long run.

Enhanced compliance and audit trail

Implementing AP automation improves compliance with internal policies and regulatory requirements.

Automated systems maintain a comprehensive audit trail of all invoice transactions, including approvals and payment history.

This detailed recordkeeping simplifies audits and ensures compliance with regulations.

Better cash flow management

Automation of accounts payable process provides better control over cash flow.

By automating payment schedules and optimizing the timing of payments, businesses can manage cash flow more effectively.

This allows them to maintain liquidity, meet financial obligations on time, and avoid unnecessary late payment penalties.

Accounting systems integration

AP automation system seamlessly integrate with existing accounting software, creating a unified financial ecosystem.

Integration ensures that data flows smoothly between different financial functions, avoiding the need for duplicate data entry and reducing the risk of errors. This streamlined integration improves overall financial reporting and enhances the accuracy of financial insights.

Transform your finance operations

What are the some of the best practices in accounts payable?

1. Segregation of duties

One of the fundamental best practices in accounts payable process is ensuring a clear segregation of duties. This involves assigning different individuals to handle invoice processing, approval, and payment authorization.

By segregating these functions, businesses can reduce the risk of errors, fraud, and unauthorized payments.

2. Vendor master data management

Maintaining a clean and updated vendor master database is crucial for accurate accounts payable processing.

Regularly review and validate vendor information to prevent duplicate entries, fraudulent vendors, and payment errors.

3. Purchase order matching

Implement a robust purchase order matching process to ensure that invoices align with authorized purchase orders and receipt of goods or services. This three-way match verifies the accuracy of invoices, reduces the risk of overpayments, and enhances control over accounts payable.

4. Invoice approval and authorization

Establish a clear and well-defined invoice approval process that involves appropriate stakeholders.

By enforcing strict authorization protocols, companies can prevent fraudulent activities, reduce payment delays, and maintain compliance with internal policies.

5. Regular reconciliation and statement reviews

Conduct periodic reconciliations between accounts payable records and vendor statements to identify discrepancies and resolve outstanding issues promptly.

Regular statement reviews help maintain accurate financial records and foster stronger vendor relationships.

6. Internal audit and compliance

Implement a comprehensive internal audit program to assess accounts payable processes regularly. This ensures compliance with financial regulations and internal controls, identifies potential weaknesses, and provides recommendations for process enhancements.

7. Fraud prevention and detection

Implement robust fraud prevention measures, including employee training on fraud awareness and establishing a confidential reporting system for suspicious activities.

Regularly monitor accounts payable transactions to detect and prevent fraudulent behavior.

8. Electronic payments and payment controls

Encourage the utilization of electronic payment methods, such as Automated Clearing House (ACH) transfers, to enhance payment efficiency and security.

Implement robust payment controls, such as requiring dual authorization for significant transactions, to prevent unauthorized payments.

9. Documentation and recordkeeping

Maintain meticulous documentation and recordkeeping for all accounts payable transactions. This includes invoices, purchase orders, receipts, and payment details.

Organized documentation facilitates audits and ensures compliance with record retention requirements.

10. Continuous process improvement

Regularly review and analyze accounts payable processes to identify areas for improvement.

Seek feedback from stakeholders, monitor key performance indicators, and implement process enhancements to streamline operations and reduce errors.

When you are learning what are accounts payable make sure to pay special attention to this.

11. Data security and confidentiality

Implement robust data security measures to safeguard sensitive financial information. Use secure storage systems, restrict access to authorized personnel, and regularly update passwords and encryption protocols to protect against data breaches.

12. Outsourcing and vendor management

Consider outsourcing accounts payable processes to reputable service providers with expertise in financial operations. Effective vendor management ensures that outsourced processes adhere to high standards of quality and compliance.

Automate your AP process and grow your business with Volopay!

Volopay is a cutting-edge financial platform that empowers businesses to automate their accounts payable process and drive growth. With Volopay's comprehensive suite of features, businesses can streamline their financial operations, improve efficiency, and gain better control over their expenses.

● Volopay's accounts payable automation simplifies the entire payment cycle. From invoice receipt to payment processing, Volopay seamlessly handles each step, reducing manual intervention and eliminating errors. The platform's intuitive interface and integration capabilities with accounting systems ensure smooth data flow, minimizing data entry and enhancing accuracy.

● One of Volopay's standout features is its smart invoice-matching system. The platform automatically matches invoices with corresponding purchase orders and receipts, ensuring accuracy and preventing overpayments. This three-way matching process enhances financial control and eliminates the need for time-consuming manual verification.

● With Volopay's approval workflows, businesses can enforce strict authorization protocols for invoice approval and payment processing. Dual authorization ensures compliance with internal policies and prevents fraudulent activities, safeguarding the company's finances.

● Volopay's expense management capabilities enable businesses to track and manage expenses effortlessly. Employees can easily capture receipts and categorize expenses on the go, simplifying the reimbursement process. Administrators can set spending limits, manage budgets, and gain real-time visibility into expenses, allowing for better financial planning and control.

● Additionally, Volopay provides physical and virtual corporate cards, granting businesses increased flexibility in expense management. These cards can be assigned to employees with adjustable spending limits and real-time expense tracking, minimizing reliance on petty cash and enhancing overall expense management.

● Volopay's seamless integration with accounting systems enhances financial reporting and reconciliation. Businesses can generate detailed reports, track vendor spend, and analyze financial data effortlessly, enabling better decision-making and strategic planning.

Volopay empowers businesses to achieve efficient growth through automating accounts payable and optimizing expense management. With its user-friendly interface, advanced features, and strong security measures, the platform becomes a valuable asset for businesses of various sizes, spanning from startups to enterprises.

Streamline your financial management

FAQs on accounts payable

An AP (Accounts Payable) invoice is a document received from a supplier or vendor that outlines the details of a transaction, such as the products or services provided, their quantities, prices, payment terms, and the due date. It serves as a formal request for payment and is a crucial component in the accounts payable process.

A journal entry in accounts payable is a financial transaction recorded in a company's general ledger to reflect the movement of funds related to accounts payable.

Typically, it involves debiting accounts payable to increase the liability (to reflect an amount owed) and crediting the appropriate account (e.g., cash, expense, or asset) to show the related expense or asset acquisition.

The P2P (Procure-to-Pay) cycle is a business process that encompasses all the steps from the initial procurement of goods or services to the final payment to the supplier.

It includes activities such as purchase requisition, purchase order creation, goods receipt, invoice verification, and payment processing.

Effectively managing the P2P cycle is crucial for cost control and efficient operations.

In the accounting world, accounts payable is considered a credit. When a company receives an invoice from a supplier, it records the amount as a liability on its balance sheet, which is represented as a credit in the accounts payable account.

When the invoice is paid, the accounts payable are debited to decrease the liability, and the corresponding cash or bank account is credited.

GAAP (Generally Accepted Accounting Principles) provides guidelines for how accounts payable should be recorded and reported in financial statements.

Under GAAP, accounts payable should be recognized when goods or services are received, and an obligation to pay exists.

Proper documentation and disclosure of accounts payable, including their aging and potential disputes, are essential to comply with GAAP rules.