👋 Exciting news! UPI payments are now available in India! Sign up now →

7 best AP automation software in India for 2025

The rise of digital technology has led many modern businesses to opt out of traditional and manual accounts payable management methods.

Rather, businesses are looking for the best AP automation software to aid them in improving the efficiency of their processes.

These modern software suites provide businesses with the necessary tools and technology to automate and streamline tasks such as invoice matching, approvals, document management, and many more.

As accounts payable is a key process for any business, it’s no surprise that AP automation will benefit many aspects of the organization. It not only saves time and maintains better control over expenses, but it also impacts other processes indirectly.

From smoother daily operations to better forecasting, every business should aim to streamline accounts payable with the best AP automation software.

What is accounts payable automation software?

Accounts payable automation software is a tool that businesses can use to streamline their accounts payable processes.

Many businesses struggle to keep up with the complexities of the accounts payable (AP) duties that their teams must perform, especially as they scale and grow rapidly.

If each invoice takes five to twenty minutes to process, for example, the AP team will get overwhelmed really quickly as the number of invoices rises.

With the best AP automation software, however, businesses will not have to worry about slow processes or demanding workloads.

When an invoice is received, there’s no need for manual data entry. Instead, the system can automatically capture its data. Artificial intelligence (AI) technology can also help with invoice matching, lessening the burden of the accounts payable team.

When it is time to get approvals, an accounts payable automation software suite can route invoices through the appropriate and previously set up approval workflows.

Comparison between the 7 best AP automation software in India

Detailed comparison of best accounts payable software in India

There are a lot of AP automation software providers available on the market in the modern day. This is why businesses must thoroughly research the different options to choose which is the best AP automation software for them.

While there are more to choose from, here are 7 of the best options to consider when looking for an AP software suite in India.

1. Volopay

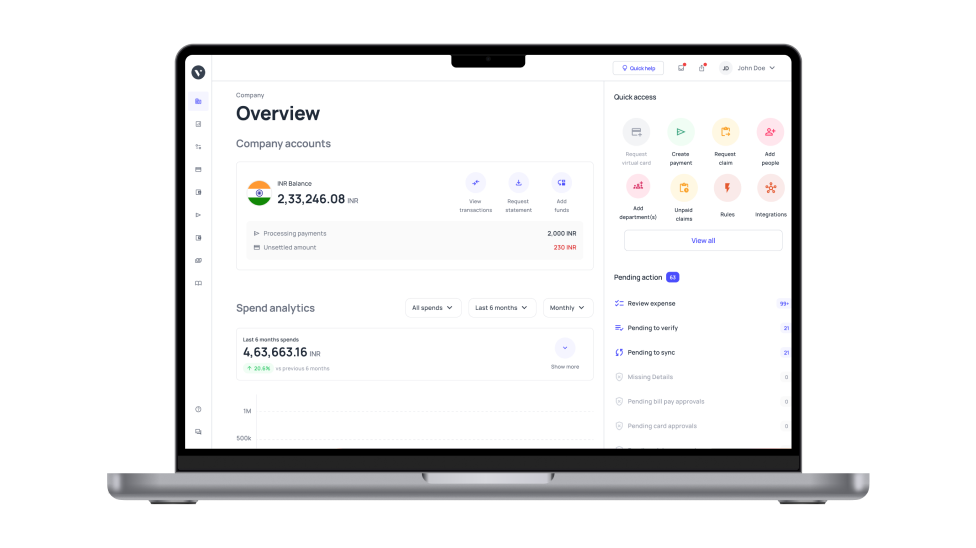

Volopay is an all-in-one accounts payable solution for businesses to manage their finances. Offering products such as business accounts, multi-currency wallets, corporate cards, accounts payable automation, and accounting integrations, businesses will be able to streamline and centralize several processes.

The finance team is guaranteed to have an easier time with Volopay. What makes Volopay the best AP automation software is that every step of the process can be performed through the system, allowing businesses to ensure that the flow from step to step remains smooth.

It is also easy to search through all documents and AP-related information, eliminating the risk of data silos. Modern businesses looking to shorten the time taken to process invoices can make use of Volopay. There’s no need to worry about payment delays.

● Features

Volopay’s automated approval workflows allow businesses to eliminate delays and shorten invoice turnaround time.

Replace the need to chase for signatures from desk to desk with automatic routing and notifications whenever an invoice that requires approval comes in.

Get built-in payment authorization and processing to replace manual payments. Volopay users can utilize domestic transfer, international remittance, and physical or virtual corporate card features.

Easy accounting integrations and direct sync will make bookkeeping simpler to do.

● Limitations

While Volopay has a built-in ledger for transactions made on the platform, it is not an accounting software suite. Businesses will have to enlist help from the customer support team to set up integration with the software they use.

Invoice payments that are not made on the Volopay platform will not be automatically logged and must be manually inputted into the system.

● Target users

Volopay is for modern businesses that are looking to streamline their accounts payable management easily.

It is useful for those who want to perform the accounts payable process from end to end on a single platform. Businesses looking for multiple easy payment methods can utilize Volopay’s bill pay and corporate card features.

2. Zoho

Zoho is a cloud software suite that many businesses in India use to automate a number of processes, such as expense management, accounting, travel, and more.

Its accounting system Zoho Books has plenty of features to help businesses streamline their accounts payable processes.

Given that accounts payable is a key aspect that is deeply connected with accounting, it comes as no surprise that Zoho Books can streamline administrative AP tasks.

With the right setup, the AP team can easily manage vendors and automate transaction records. Customizable reporting options are also available.

Businesses can get started with Zoho Books for free, which allows them to get a more hands-on experience on the platform first before committing to a paid plan if necessary.

● Features

There’s no need to spend countless hours formatting and putting together reports manually. Zoho Books offers automated report generation in several formats. Get reports automatically emailed in PDF, CSV, or XLS.

Zoho Books can be easily integrated with other systems within the Zoho suite. Businesses that use multiple Zoho products can take advantage of this.

Manage invoices and bills from vendors and get automatic notifications. Vendors can use a portal to send invoices directly.

● Limitations

While Zoho Books is a great platform for accounting, it is not built with accounts payable management specifically in mind. It lacks features that other AP automation software providers offer, including a more comprehensive vendor management network.

Because Zoho is a comprehensive software suite on its own, it has fewer integration options than other platforms of its type.

There is a monthly transaction cap of 5,000, which could be a problem for bigger enterprises.

● Target users

Thanks to its free plan, Zoho Books is easy to use for smaller businesses on a budget.

Those without a dedicated AP team will also find Zoho Books helpful to save time and labor costs.

Zoho Books is not recommended for businesses with over 5,000 transactions per year due to its transaction cap.

3. Netsuite

Netsuite is an incredibly comprehensive platform for accounting that includes enterprise resource planning (ERP) capabilities, allowing businesses to manage a number of processes with ease. At present, it is a household name that has proven to be reputable and trustworthy.

There is no shortage of businesses that use Netsuite to manage their processes, including the accounts payable management process. It goes without saying that financial data and management can be taken care of by Netsuite.

Netsuite is also considered one of the best AP automation software providers due to the scope of the platform. The accounts payable team will be able to easily work in tandem with other departments to encourage collaboration.

With features like optical character recognition (OCR) and a vendor portal, Netsuite is a solid choice of AP software.

● Features

Companies can save time using Netsuite’s invoice capture features. OCR technology and artificial intelligence (AI) allow invoice data to be automatically captured just by scanning the invoice.

View and manage invoices on a single platform. Information on paid and unpaid invoices is easily accessible through Netsuite.

Get automated invoice approvals and payments. Netsuite offers built-in approval workflows and payment scheduling features.

● Limitations

Due to Netsuite’s complexities, there is a steep learning curve involved. Businesses will have to spend a lot of time on training to ensure employees are comfortable with using the platform.

In the same vein, Netsuite has a higher price point than most of its competitors because of the sheer size of the platform. It could be a little too expensive for non-enterprise businesses.

Implementing the software could take a long time, up to over a year in full.

● Target users

Netsuite is best suited for larger businesses and enterprises due to its comprehensiveness.

Businesses that have more resources will have an easier time during training and be able to make use of more of Netsuite’s features.

4. Stampli

Marketing itself as an AP automation and invoice management tool, Stampli is undoubtedly designed with these processes in mind.

Its goal is to help businesses streamline their documentation, communication, and workflows, centralizing all of the above by utilizing a single platform to perform most if not all accounts payable tasks.

With Stampli’s AP software, the team will get automatic notifications of invoice requests, rejections, and approvals. Invoices close to their due or already overdue can also be alerted.

Businesses will have an easier time ensuring that all payments are made on time this way.

Stampli boasts features such as effortless 3-way invoice matching, vendor management, and built-in analytics and reporting on top of its invoice processing capabilities. This allows businesses to complete the process from end to end.

● Features

Stampli offers features to automate the entire invoice process, starting from invoice capturing all the way to payments. Approval workflows can also be automated.

Get better insights into the organization’s accounts payable using Stampli’s built-in analytics and reporting features. Businesses can identify spending patterns, invoice turnover times, employee productivity, and more.

Ensure that an audit trail is ready using Stampli’s one-click access feature, allowing all conversations and AP activities to be easily viewed.

● Limitations

Many users agree that Stampli’s tracking and search functions could use improvements, as it could be a bit complicated to use.

The built-in Stampli payment methods can also be difficult to track and slow at times, requiring some manual checking on whether a payment has been received by a vendor.

Keep in mind that some users have reported technical issues while using the platform.

● Target users

Businesses across multiple sectors can take advantage of Stampli.

Considering that its pricing will depend on the business size, Stampli can be used by businesses of all sizes. Ideally, businesses with 50 to 5,000 employees will be able to use it effectively.

5. Tipalti

Tipalti is one of the best AP automation software suites in the market, designed to improve any organization’s efficiency when it comes to accounts payable.

It can help businesses automate as many processes as possible, tackling traditionally manual AP tasks and streamlining them from end to end.

Simplify AP-related communication by using this platform. Businesses will be able to easily onboard vendors, suppliers, and partners using Tipalti’s self-service portal.

There won’t be any more need for long discussions on emails without resolutions.

Everyone can be on the same page and get access to all the necessary information to perform the AP process smoothly.

With its automated invoice capture and matching capabilities, the turnaround time for processing invoices can be cut back by half.

● Features

Get a supplier self-service portal to streamline supplier management with Tipalti. This provides better visibility for all parties involved in the process.

OCR technology allows businesses to automatically capture invoice data. Pair this with Tipalti’s automated two or three-way matching feature.

Integrate Tipalti with other platforms such as an ERP system to simplify payment reconciliation. Reduce the need to perform payment reconciliation manually.

● Limitations

Tipalti can be overwhelming and complicated to set up due to the number of features it has. Setting up integrations, for example, may require some trial and error.

Similarly, businesses may require more time to complete training sessions to equip all employees with the necessary knowledge.

The payment processing feature could use some updates.

● Target users

Tipalti can be used by most companies but is best suited for mid-sized businesses. Companies in sectors such as e-commerce, video gaming, manufacturing, healthcare, financial services, and more can benefit from Tipalti.

It is often used by companies with an employee size of around 50 to 200.

6. Sage Intacct

As a cloud-based accounting and financial management software suite, Sage Intacct allows businesses to easily scale and grow while maintaining their accuracy, efficiency, and data visibility.

While it offers a number of features for many different business processes, such as accounts receivable and cash management, Sage Intacct can also be one of the best AP automation software providers.

Sage Intacct has built-in dashboards that businesses can use to easily view transactions, patterns, and reports.

Pairing that with automation features that speed up the cycle will not only provide better visibility but also cut back hundreds of hours of tedious manual work.

Categorize vendors, gain transaction insights, automate approvals, and manage the accounts payable process from end to end as the business grows with Sage Intacct.

● Features

Sage Intacct allows businesses to automate approval workflows and simplify the implementation of internal controls, with built-in customizable control options available on the platform.

Real-time updates and reports can help improve the AP process’ visibility. Ensure that payments are all made on time and regularly track them with ease.

Expenses can be attributed to specific locations, entities, or departments. This improves expense tracking precision and helps with identifying spending patterns.

● Limitations

Some users have reported that it takes some time to get used to the platform. While Sage Intacct is helpful for businesses looking to scale, it is also not the most user-friendly platform for beginners.

Report writing can be complex with Sage Intacct. Even with automation, it could still take a little longer compared to using other tools of its nature.

Given its complexities, businesses may need to often get in touch with the support team.

● Target users

Sage Intacct is better suited for businesses in the rapid growth stage. This is due to its comprehensiveness but higher price point.

Generally, companies that use Sage Intacct have at least 20 employees.

7. Kissflow

Kissflow’s overall unique selling point is that it’s a low-code platform that allows businesses to build applications and workflows without having to get too technical.

However, with its Procurement Cloud solution, Kissflow can also be one of the best AP automation software suites for businesses of all sizes and industries due to its customization capabilities.

Kissflow’s Procurement Cloud platform helps businesses perform the procure-to-pay process from end to end.

With features like supplier management, invoice automation, spend tracking and analysis, and integrations, accounts payable management is much easier.

Thanks to its low-code capabilities, Kissflow should prove to be easily customizable. Each stage of the accounts payable process can be fully customized according to the company’s needs and policies.

● Features

Kissflow can automatically route invoices to the right approval workflows. Depending on the amount on the invoice, a different team member may have to review it.

Get real-time information updates summarized on Kissflow’s dashboard. This information is presented to the user in a way that is easy to comprehend.

Design AP workflows according to the organization’s policies. These are easily customizable.

● Limitations

Kissflow is not always the most intuitive platform and can be tough to relearn after major updates. Businesses may have to rely on the support team a lot.

The bigger the organization is, the harder it may get to justify the pricing plan.

Kissflow’s integrations can sometimes lack smoothness. Users have reported having to get in touch with the support team to ensure it works as intended, too.

● Target users

Kissflow has customers from many different industries, but the information technology and services sector is one of its biggest user bases.

It can be used by businesses of all sizes, but the majority of its users have over 10 employees.

Boost financial efficiency with AP automation

Evaluation criteria for the 7 best AP automation software in India

When creating a list of the seven best AP automation software solutions in India, we considered several key factors to ensure businesses find the most effective solutions for their accounts payable processes.

These criteria focus on usability, compatibility, customization, cost, and security, among others.

User-friendliness

User-friendliness is essential when selecting the best AP automation software. Solutions with intuitive interfaces and straightforward navigation significantly reduce the learning curve for new users.

Easy-to-use dashboards and features enhance the overall user experience, enabling employees to perform tasks efficiently without requiring extensive training.

A user-friendly system encourages quicker adoption across teams, ensuring that businesses can maximize the benefits of automation and streamline their accounts payable processes effectively.

Customer reviews & testimonials

Customer reviews and testimonials are essential in evaluating AP automation software. They provide insights into real-world experiences, highlighting the strengths and weaknesses of various solutions.

Positive feedback often reflects user satisfaction, ease of use, and effective customer support, while negative reviews can reveal potential issues or limitations.

Analyzing customer feedback helps businesses gauge the reliability and performance of software options, ensuring they choose a solution that meets their needs and enhances their accounts payable processes effectively.

Compatibility with existing systems

The best AP automation software must seamlessly integrate with a company’s existing systems, such as ERP or accounting software.

Ensuring compatibility minimizes disruptions during the transition and allows businesses to leverage their current infrastructure effectively.

Solutions that provide robust integration capabilities with popular platforms enhance data consistency and reduce the need for manual data entry.

This integration streamlines the entire accounts payable process, making it more efficient and less prone to errors, ultimately supporting better financial management.

Customization capabilities

Customization capabilities are essential when evaluating the best AP automation solutions, as every business has unique workflows and requirements.

The ideal software should enable users to tailor features to their specific needs, such as establishing personalized approval workflows or invoice processing rules.

This flexibility allows businesses to adapt the software to align with their existing processes, ultimately enhancing efficiency and effectiveness.

Customized solutions can lead to smoother operations and a better fit for a company’s financial management strategies.

Pricing structure & overall affordability

Pricing structure is a critical factor when selecting the best AP automation solutions. Businesses should evaluate the total cost of ownership, including subscription fees, implementation costs, and any additional charges for upgrades or support.

Solutions with transparent pricing structures and diverse pricing tiers enable organizations of all sizes to find an option that suits their budget while still accessing essential features.

This affordability ensures that companies can implement effective automation without straining their financial resources, promoting long-term sustainability.

Availability of mobile application

The availability of a mobile application is a key consideration in any accounts payable automation software comparison. A mobile app allows users to manage invoices, approve payments, and access essential features while on the go.

This flexibility boosts productivity, enabling employees to perform accounts payable tasks anytime and anywhere. As a result, businesses can ensure timely payment approvals and improve cash flow management.

The ability to operate remotely makes mobile access a vital feature for modern AP automation solutions.

Scaling capacity to grow with your business

As businesses grow, their accounts payable processes become more complex. The best AP automation solutions must scale efficiently, accommodating increasing invoice volumes and additional users without compromising performance.

Scalable software ensures that organizations can manage growing workloads seamlessly, whether by automating more tasks or handling higher transaction volumes.

This flexibility supports long-term business growth, allowing companies to adjust to evolving needs while maintaining operational efficiency and avoiding costly disruptions or system overhauls.

Quality & responsiveness of customer support

The best AP automation software should provide high-quality and responsive customer support to help businesses resolve issues efficiently.

Whether through live chat, phone, or email, reliable support ensures that users can quickly overcome challenges, minimizing downtime.

This level of assistance is essential for maximizing the software's potential and keeping accounts payable processes running smoothly.

Strong customer support also boosts user confidence, ensuring that businesses get the most out of their automation investment.

Data security features offered

When comparing the best AP automation solutions, robust data security features are essential to safeguard sensitive financial information.

Top solutions offer strong encryption, multi-factor authentication, and routine security audits to protect against breaches.

Compliance with regulations like GDPR ensures that data is managed securely and transparently.

By implementing these advanced security measures, businesses can maintain data integrity, prevent unauthorized access, and build trust with vendors and stakeholders.

Unique features offered

When selecting the best AP automation software, unique features are pivotal in enhancing efficiency and accuracy. Some solutions offer advanced analytics, enabling businesses to gain deeper insights into spending patterns.

Others include machine learning for smarter invoice recognition or tools for optimizing vendor relationships.

These distinctive features help companies streamline their accounts payable processes and improve overall operational performance, providing a competitive edge in managing financial workflows more effectively.

Limitations of manual accounts payable process

Manual accounts payable (AP) processes create significant inefficiencies and potential risks for businesses.

Without automation, managing invoices and payments becomes labor-intensive and error-prone, leading to delays, higher costs, and operational bottlenecks. This section explores the major limitations of manual AP processes.

Prone to human errors

Manual data entry in accounts payable processes increases the likelihood of human errors, such as incorrect invoice amounts, wrong vendor information, or lost documentation.

These mistakes can lead to duplicate payments, delays, and strained vendor relationships. Frequent errors can also impact financial reporting and compliance, potentially resulting in penalties.

The best AP automation solutions help eliminate these issues by reducing manual intervention, improving accuracy, and streamlining the entire invoice processing and payment workflow.

Expensive administrative labor costs

Manual accounts payable processes require a dedicated team to handle invoices, payments, approvals, and other tasks, driving up labor costs.

Time-consuming activities like invoice matching, data entry, and verification consume valuable employee time that could be better spent on strategic initiatives. As a business grows, the need for more resources further increases costs.

An accounts payable automation software comparison shows that automating these tasks reduces administrative expenses, boosts efficiency, and frees up staff for higher-value work.

Prone to late and overdue payments

Manual accounts payable processes often result in missed payment deadlines, leading to late fees and penalties. Without automated reminders and notifications, it becomes difficult to track due dates and scheduled payments.

Over time, consistent late payments can strain relationships with suppliers, disrupting procurement and supply chains.

Implementing the best AP automation software ensures timely payments by automating reminders and scheduling, preventing delays, and fostering stronger supplier relationships while avoiding unnecessary penalties.

Long processing time

Manual invoice processing is time-consuming, involving multiple stages like invoice receipt, approval routing, data entry, and final payment.

Each step requires human intervention, leading to bottlenecks and delays that slow down the entire process. These inefficiencies can negatively impact cash flow management and hinder financial planning.

By using the best AP automation solutions, businesses can streamline these steps, accelerate invoice processing, and improve overall financial efficiency without manual bottlenecks or delays.

Difficulty in reconciling payments with accounting

Reconciling invoices with accounting records is often tedious and error-prone in manual systems. Mismatches between payments made and invoices received require time-consuming investigations, slowing down financial processes.

Implementing efficient systems for managing invoices in accounting can help reduce errors and accelerate reconciliation.

Manual data entry discrepancies can lead to inconsistencies between accounts payable records and the actual financial accounts.

By adopting AP automation solutions, businesses can automate invoice matching and reconciliation, ensuring accuracy, minimizing errors, and speeding up the process of aligning payments with financial records.

Centralized vendor invoice receiving platform

Manual accounts payable processes often lack a centralized platform for receiving and managing vendor invoices.

Without a unified system, businesses struggle to track the status of each invoice, resulting in confusion, delays, and the risk of losing important documents. This decentralized approach hampers visibility and control over invoice processing.

Implementing automation provides a centralized platform, enabling businesses to efficiently track, manage, and process vendor invoices, reducing delays and improving overall workflow transparency.

Excessive paperwork & documentation

Manual accounts payable processes generate excessive paperwork, including physical invoices, receipts, and approvals, increasing the risk of losing or misfiling important documents.

Managing these paper-based systems requires significant storage space, which becomes costly and inefficient as the volume grows.

Automated solutions eliminate the need for physical paperwork by digitizing invoices and approvals, streamlining document management, reducing storage requirements, and minimizing the risk of errors and lost information.

Limited scaling capacity

Manual accounts payable processes struggle to scale as businesses grow. As invoice volumes increase, managing payments manually requires more time and resources, leading to inefficiencies.

Without automation, the AP department faces challenges in handling larger volumes, which can result in delayed payments and strained vendor relationships.

Automated systems offer scalability, enabling businesses to efficiently process higher invoice volumes, maintain timely payments, and strengthen vendor relationships without added manual effort.

Limited reporting & visibility

Manual accounts payable systems provide limited reporting and visibility, hindering real-time insights into crucial financial metrics such as invoice processing time, payment status, and cash flow.

Without automation, tracking these key performance indicators becomes challenging, preventing businesses from making proactive decisions and executing strategic financial planning.

Automation solutions ensure enhanced visibility, enabling businesses to monitor AP metrics in real time and make data-driven decisions for optimized financial performance.

Prone to duplicate payments

Manual accounts payable processes are particularly prone to duplicate payments, posing a significant financial risk. Without automated checks in place, invoices may be processed multiple times, resulting in unnecessary financial losses.

This issue often arises from mistakes, such as employees re-submitting invoices or failing to track the status of already processed payments.

By adopting the best AP automation software, businesses can implement safeguards that prevent duplicate payments, ensuring accurate financial management and protecting the bottom line.

Risk of fraud and theft

Manual accounts payable processes significantly heighten the risk of fraud and theft, primarily due to inadequate approval workflows and audit trails.

Employees may take advantage of system vulnerabilities by approving fraudulent invoices or inflating payment amounts.

The lack of automated controls and monitoring increases the likelihood of undetected fraudulent activities, leading to substantial financial losses for the business.

AP automation software helps establish secure approval processes and robust monitoring, effectively reducing the risk of fraud.

Optimize your finances with accounts payable process automation

How does an AP automation software benefit your business?

The accounts payable, or AP, process is a key part of any business, as it is nearly impossible to operate smoothly without some sort of way to manage a company’s accounts payable records.

Businesses are itching to get more efficient at AP management and processes due to this.

One of the best solutions is by utilizing AP automation software. Find out what benefits an organization will get from it.

Although it may differ from company to company, the gist of it is that using the best AP automation software for any organization will streamline and simplify its processes, whilst improving control and accuracy.

Significantly reduces costs

Given that the accounts payable process traditionally involves a lot of manual administrative tasks that are labor intensive, using the best AP automation software will help reduce hiring and training costs.

While most software suites will incur a fee, they are still significantly cheaper, especially in the long run. This is especially true for businesses that are growing rapidly.

With more invoices and AP data to manage, costs will only increase. Scaling with AP software is much cheaper.

Saves time

Manual accounts payable processes are time-consuming. From invoice processing to record keeping, it can be difficult for businesses to manage everything efficiently and promptly as more invoices keep pouring in.

With an AP automation software suite, the accounts payable team will be able to save time, especially on administrative tasks such as data entry. The team will be able to redirect their time and efforts toward other tasks that require more attention.

Easier auditing

The best AP automation software providers enable businesses to do multiple accounts payable procedures on the same platform. Centralizing the team’s work and pooling all data in one place will make it easier to create an audit trail.

When audit seasons arrive, employees won’t have to stress about searching for all the right information to put together an audit trail. Everything is already recorded and easily searchable to ensure smooth audits.

Transparency of data

Transparency is important for all business processes. However, improving the transparency of accounts payable data can be a hassle.

Executives and upper management will have to closely monitor the process and ensure that all accounts payable records are updated as soon as possible.

Using AP automation software will help businesses automatically update records in real time as soon as an invoice is received. Data centralization also contributes to better transparency.

Improves accuracy

There are situations where it is a good idea to minimize human interventions in a particular task. Data entry and recording are some good examples, as doing these processes manually often leads to human errors.

With the help of the best AP automation software, businesses can eliminate these steps. This improves the overall accuracy of the accounts payable process. There are fewer risks of mistakes such as typos, miscalculations, and accidental repetition.

Streamlines your accounts payable process

Given the number of steps involved in the accounts payable process, it’s no surprise that many businesses are looking for ways to streamline it. One of the best solutions remains AP automation software.

Rather than going through paper invoices or chasing approvers from desk to desk, the best AP automation software enables companies to do everything on a single platform.

Not only are AP tasks faster to do, but there is also less noise when everything is organized.

Gives control over your expenses

One major concern that businesses have regarding their AP process is overspending. This is often caused by a lack of visibility and control over expenses. The best AP automation software can ensure that this doesn’t happen.

By offering features that increase the visibility of how, when, and why a company’s funds are used, businesses have nothing to worry about. Built-in requests and approval workflows also help in exercising tighter control over expenses.

Fraud protection

Having all accounts payable data on a single platform helps promote better transparency. As a result, it’s easier to detect fraud attempts or invoices that simply look odd.

With the help of features that automatically flag suspicious activities, the AP team may not even need to comb through every single invoice.

The system can automatically flag suspicious invoices and notify users. Invoices also have to pass the built-in approval workflows before they are processed for payment.

What are the types of AP automation software?

There are several types of accounts payable automation software, each offering distinct functionalities to suit different business needs.

Understanding these categories helps businesses select the right solution based on factors like deployment method, scalability, and the specific features required for their financial workflows.

1. On-premise AP automation software

On-premise AP automation software is installed directly on a company’s servers and managed internally by the organization’s IT department.

This solution provides businesses with complete control over their data and allows for extensive customizations tailored to their specific needs.

However, it requires a significant initial investment in hardware and incurs ongoing maintenance costs.

On-premise software is best suited for companies that prioritize data security and prefer to manage their infrastructure without relying on external cloud services.

2. Cloud-based AP automation software

Cloud-based AP automation software is hosted on external servers and accessed via the Internet, offering flexibility and scalability for businesses.

It allows users to manage accounts payable from any location with an internet connection, reducing IT overhead and providing real-time updates.

Cloud solutions are ideal for businesses seeking a cost-effective and scalable option that simplifies AP management.

3. Procure-to-pay automation software

Procure-to-pay automation software streamlines the entire procurement process, from generating purchase orders to processing payments.

By automating procurement, invoice approvals, and payment workflows, it enhances visibility and control over business spending.

This solution is ideal for companies with complex procurement needs, as it simplifies processes and reduces manual intervention.

Businesses looking to optimize procurement and payments can benefit from the best AP automation software solutions available.

4. SaaS AP automation software

SaaS (Software as a Service) AP automation software is subscription-based and hosted by a third-party provider, offering easy access to advanced features, regular updates, and customer support.

This model eliminates the need for significant upfront investment, making it a cost-effective choice for businesses.

AP automation solutions in this category are ideal for companies prioritizing ease of use, quick implementation, and scalability as they expand.

5. Invoice processing software

Invoice processing software automates the receipt, validation, and approval of invoices, often utilizing OCR (Optical Character Recognition) invoice processing technology to digitize paper invoices.

This streamlines the entire workflow, reducing manual data entry and minimizing errors. Businesses handling large volumes of invoices benefit from faster processing and increased efficiency.

When compating accounts payable automation software, this solution stands out for companies looking to optimize their invoice management processes.

6. PaaS AP automation software

Platform as a Service (PaaS) AP automation software provides a customizable platform that allows businesses to tailor their accounts payable processes.

With the flexibility to integrate custom workflows and manage infrastructure, it offers greater control and adaptability.

PaaS solutions are ideal for companies seeking to build bespoke AP processes on a strong foundation, making it one of the best AP automation software options for businesses with unique requirements.

Features to look for in an AP automation software

While it’s true that the best AP automation software for any business will depend on its specific requirements, there are some must-have features that every business should consider.

These are a good benchmark, as they indicate that the software provider has a complete suite of features. Most if not all businesses will also need a good number of these must-have features listed.

1. Invoice automation

So much of the accounts payable management process is closely tied to invoice management. From receiving an invoice all the way through its payment, every step is crucial in ensuring that all short-term debts are managed accordingly.

This is why invoice automation is a key feature for any business looking to get the best AP automation software. Automating tasks such as data capture, invoice validation, and document management will save so much time.

2. Approval workflows

A major cause of delays in the accounts payable process is approvals. Traditionally, employees are required to go from desk to desk to chase after the rightful approvers’ signatures.

Modern accounts payable no longer have to look like that. Businesses should look into the best AP automation software for approval workflows.

With the right features, each invoice and payment request can be automatically routed through its appropriate workflow. It also makes multi-level approvals easier.

3. Document matching

It’s wise for businesses to ensure that all incoming invoices match their corresponding purchase order and delivery receipt documents.

However, this process is notoriously tedious and time-consuming, especially when performed manually.

This is why it’s important to look for AP software that offers automated document matching.

The system should be able to scan and read an invoice, fetch its corresponding purchase order and delivery receipt, and perform the match process. Any inconsistencies will be automatically flagged.

4. Bill payments

The best AP automation software will offer built-in payment methods to simplify the accounts payable process from end to end.

While it is possible for businesses to make payments elsewhere, it’s much easier to pay directly from the platform. This eliminates the need for manual records.

Try to look for platforms that offer electronic transfers to easily pay bills. Once an invoice has been processed, it can be automatically sent for payment authorization and creation.

5. Cash disbursement reports

Accurately recording and reporting cash disbursements are equally as important as settling these disbursements on time.

Luckily, plenty of AP automation software providers offer this feature, which is key for any business.

Cash disbursement reports are also useful for future forecasts and decision-making.

With the best AP automation software, businesses will be able to automate disbursement reporting so that executives and higher management can get the best data and spend more time on decision-making.

6. GL posting

Any sort of manual data entry is a hassle, particularly for big businesses or businesses that are rapidly expanding and dealing with hundreds of invoices and transactions each month. For this reason, automatic general ledger (GL) posting is invaluable.

Try to look for a software provider that will automatically post transactions to the general ledger. This way, it’s easy to maintain that no transaction gets missed. Accurate records will be easier than ever.

7. Control over invoicing lifecycle

The best accounts payable automation software keeps control over your company’s invoicing lifecycle. As it simplifies the invoice approval process, automates the billing process of your business, and maintains efficient cash disbursement reports.

It is clear that the best accounts payable software has a strong influence over the invoicing lifecycle of your business. Apart from these, the best accounts payable software also plays a major part in GL posting.

8. Accounting integration

Most modern businesses will already have a digital accounting system to make bookkeeping easy. To ensure there is a smooth and accurate data flow, consider picking an AP software suite with integration capabilities.

The best AP automation software is one that offers integrations with the accounting software already in use by the business. Businesses that don’t have accounting software yet should look into it while employing an AP automation solution with integrations.

9. Vendor information management

Efficient vendor information management is a crucial feature to look for in AP automation software. It allows businesses to centralize and organize vendor details such as contact information, tax data, and payment terms.

This feature reduces the risk of manual errors and ensures that vendor records are up-to-date, helping streamline communications and payment processes.

Comprehensive vendor management leads to smoother operations and stronger supplier relationships.

10. Role-based access control

Role-based access control (RBAC) is essential for maintaining security and compliance in AP automation software. It ensures that only authorized personnel have access to sensitive financial data and approval rights, based on their roles within the organization.

By limiting access to specific features or information, businesses can minimize the risk of fraud and unauthorized actions, thereby safeguarding their AP processes and enhancing overall control.

11. Mobile access

Mobile access provides the flexibility to manage AP tasks remotely, enabling users to approve invoices, check payment statuses, and monitor KPIs on the go.

This ensures seamless continuity of accounts payable processes, even when employees are away from their desks.

It's especially beneficial for teams needing real-time updates and quick decision-making, enhancing both efficiency and responsiveness in managing AP operations.

12. Supplier self-service portal

A supplier self-service portal allows vendors to submit invoices, track vendor payment process statuses, and access important documents independently, enhancing transparency and reducing communication delays.

This feature streamlines the AP process by minimizing administrative tasks and improving efficiency. Suppliers can manage their transactions directly, which accelerates payments and fosters stronger business relationships.

Ultimately, this portal improves workflow, allowing companies to focus on more strategic tasks while maintaining smoother operations with their vendors.

13. Payment scheduling & alerts

AP automation software with payment scheduling and alerts help businesses avoid late payments and missed opportunities for early payment discounts.

This feature allows users to schedule payments in advance and receive notifications about upcoming due dates, ensuring timely payments to suppliers.

It enhances cash flow management by helping businesses stay on top of payment obligations and improve vendor relationships through timely transactions.

Experience the future of financial efficiency with our AP software

Which is the best accounts payable automation software for business?

Each of the best accounts payable software has its own features and merits. This software can positively add to the ROI and efficiency of your business.

Some solutions come under the best accounts payable automation software because they facilitate invoice payments, while others provide safety and security to your necessary documents.

You can choose the best accounts payable software for small businesses from the software mentioned above. The best accounts payable software can help eliminate paperwork and errors.

They provide real-time intelligence in the form of automation to companies. Accounts payable automation solutions add to the efficiency of your small retail businesses.

Accounts payable automation for small businesses can accelerate the efficiency and ROI of your retail business. Accounts payable automation best practices come with accounts payable invoice automation.

Small retail businesses can handle multiple invoices with the help of accounts payable automation solutions. It is capable of producing efficient cash disbursement reports.

Accounts payable automation for small businesses eliminates human errors and tedious paperwork.

How to implement AP automation software in your organization?

There are several steps that businesses must take to be able to implement AP automation software smoothly. Before even choosing a software provider, make sure that all concerned personnel and stakeholders are aware of how accounts payable automation should be implemented in an organization.

Having a well-thought-out plan that includes creating new policies and hosting training sessions is crucial for any business looking to implement the best AP automation software.

Understand what the current AP process looks like and identify pain points to formulate a detailed plan. From then on, it will be easier to research which software providers are best suited for the business.

Review the existing AP process

It’s imperative for any business looking to implement the best AP automation software to first review what the existing accounts payable process looks like. This will help identify what the pain points are.

Knowing how the AP team manages short-term debts and invoices is also key to understanding what needs to be done. It gives everyone a clearer picture of what exactly the AP process consists of. Researching AP software is easier with this knowledge.

Identify your exact requirements

While the AP process has key steps that most, if not all, businesses will share, every business will also have its own variation of how things are done. This is why it’s so important to review what the current process looks like within the organization.

When going through the list of bottlenecks to tackle, note the exact requirements for any particular pain point. This list will vary from business to business.

Create a wireframe & pitch deck to propose the plan

Convincing every concerned personnel within the organization to make changes to the existing accounts payable process may not always be an easy task. Upper management and executives will want to know the benefits of AP automation software.

Create a wireframe and put together a pitch deck to explain how the best AP automation software can help streamline the process. Elaborating on the implementation plan is also a good idea.

Involve all stakeholders

Implementing accounts payable automation requires a couple of different teams to work together. It’s also important to let stakeholders know what the plan is.

When outlining and proposing this plan, it’s a good idea to involve as many stakeholders as possible. Ideally, all stakeholders should be involved.

Different stages of the best AP automation software implementation plan may also include different personnel. It’s good to have feedback on the proposed plan from everyone involved.

Research AP automation software

Begin by researching the best AP automation software solutions available in the market. Consider features such as integration capabilities, user-friendliness, scalability, and pricing.

Look for software that aligns with your organization's needs and can streamline your accounts payable process.

Comparing various solutions will help you shortlist the most suitable options for your business. Use an accounts payable automation software comparison to assess the advantages of each platform.

Look for centralized information management

When selecting the best AP automation software, prioritize solutions that offer centralized information management.

A centralized platform streamlines the organization of invoices, vendor data, and payment records, making it easier to track, store, and retrieve information.

This feature helps eliminate data duplication and reduces the risk of errors, enhancing the overall efficiency of your accounts payable processes and ensuring smoother financial operations for your business.

Look for automated tax form collection

An essential feature of AP automation software is automated tax form collection. This functionality ensures your business remains compliant with tax regulations by simplifying the process of gathering and storing necessary documents.

Automated tax form collection reduces administrative workload, minimizes errors related to tax compliance, and streamlines the overall accounts payable process, ensuring smoother financial operations for your organization.

Study customer reviews & testimonials

Before making a decision, thoroughly examine customer reviews and testimonials for the best AP automation software.

Reviews provide valuable insights into real-life user experiences, highlighting the strengths and weaknesses of each solution.

Positive feedback regarding features, customer support, and ease of use can guide you in selecting the right software for your business.

Look for unbiased opinions that align with your company's goals to ensure you choose a solution that meets your specific needs effectively.

Book demos with shortlisted software services

Once you have narrowed down potential software solutions, book demos with each provider to explore the best AP automation solutions.

Demos offer an opportunity to see how the software functions in a live environment and allow you to assess its suitability for your accounts payable processes.

Use this time to ask questions and gain insights into features and functionalities that matter most to your organization, ensuring that the selected system aligns with your specific requirements.

Choose your AP automation software

After evaluating demos, customer reviews, and comparing features, it's time to make your final decision on the AP automation software.

Choose the solution that best meets your business's needs, prioritizing ease of use, scalability, and cost-effectiveness.

Ensure the selected software provides the necessary tools to enhance efficiency and support your long-term growth goals.

Making the right choice will streamline your accounts payable process and contribute to overall operational success in your organization.

Set up and customize according to needs

The best AP automation software for a particular organization is one that can be customized to suit the business needs. When speaking to a provider about implementing a software suite that it offers, make sure to ask about its customization features.

Once the onboarding process is completed, take the time to go through all the different features. Set them up according to the company’s needs and customize them to help streamline existing processes.

Define your approval policy & workflow

Before implementing the software, it's essential to clearly define your approval policy and workflow. Ensure that the AP automation software can accommodate your company's unique invoice approval process.

Establish a system that minimizes bottlenecks and outlines roles and responsibilities.

With clear policies in place, you can optimize the automation process, reduce errors, and enhance overall efficiency, ensuring that invoices are processed smoothly and timely.

This foundation will support seamless operations in your accounts payable department.

Data migration & transfer

The next step in implementing your AP automation software is migrating existing data into the new system, which includes vendor information, outstanding invoices, and payment records.

Careful planning and execution of this data transfer are crucial to prevent disruptions and ensure that the new software integrates seamlessly with your previous accounts payable records.

A thorough data migration process minimizes the risk of errors and ensures that your team can rely on accurate and up-to-date information from day one.

Conduct employee training programs

Training your employees is a crucial step in ensuring the success of your AP automation software implementation.

Conduct comprehensive training programs to familiarize your accounts payable team with the system's features and functionalities.

Employees should gain a solid understanding of how to effectively use the software to manage invoices, approve payments, and generate reports.

Well-trained staff will maximize the benefits of automation, leading to increased efficiency and productivity while minimizing errors during the transition to the new system.

Conduct system testing

Before fully deploying the software, conduct thorough system testing to ensure everything is functioning as expected.

Test workflow processes, invoice uploads, payment approvals, and reporting capabilities to identify any potential issues or bugs that could affect performance.

This step is crucial for ensuring a smooth transition to the new AP automation software.

By addressing any concerns beforehand, you can optimize the system's functionality and ensure it meets your organization’s needs, leading to a successful implementation and operation.

Deploy the AP automation software

Once testing is complete, you can fully deploy the AP automation software within your organization. Start with a phased launch, beginning with small groups or departments before expanding it company-wide.

This gradual approach ensures a smooth transition, allowing employees to adapt to the new system without feeling overwhelmed.

It also provides an opportunity to gather feedback and make necessary adjustments, enhancing the overall user experience and maximizing the benefits of the software across the organization.

Monitor analytics & performance

After deployment, continuously monitor the software's performance and the efficiency of your accounts payable processes.

Utilize built-in analytics tools to track key performance indicators (KPIs) such as invoice processing times, payment accuracy, and cost per invoice.

Analyzing this data will offer valuable insights into the software's effectiveness, helping you identify areas for improvement.

Regularly reviewing performance metrics ensures that your AP automation software delivers optimal results and aligns with your organization's financial goals.

Continuous improvement

The implementation of AP automation software is an ongoing process that extends beyond deployment. Continuously seek opportunities for improvement by regularly reviewing performance data and addressing any issues that arise.

Make necessary adjustments to optimize the system and enhance efficiency. Encourage feedback from employees to identify areas that can be fine-tuned, fostering a culture of continuous improvement.

By actively refining the software and processes, your organization can maximize the benefits of automation and maintain a competitive advantage.

Challenges faced in using an AP automation software

Implementing accounts payable (AP) automation software can bring numerous benefits, but it also presents several challenges that organizations must address to ensure successful adoption.

Understanding these challenges can help businesses mitigate risks and optimize their AP processes.

1. Employee dissatisfaction & resistance

One of the most significant challenges in adopting AP automation software is employee dissatisfaction and resistance.

Employees may feel wary of the changes that automation brings, fearing job loss or alterations to their workflow.

This resistance can lead to decreased morale and lower productivity if not managed properly.

To overcome this challenge, organizations should provide clear communication about the benefits of automation and involve employees in the implementation process to foster a sense of ownership and acceptance.

2. Integration challenges

Integrating AP automation software with existing systems can be complex and challenging. Organizations often rely on various software tools for different functions, and ensuring seamless integration can require significant effort and expertise.

If the automation software cannot effectively communicate with other systems like ERP or accounting software, it may lead to data inconsistencies and hinder operational efficiency.

Businesses should evaluate potential software for compatibility and support during the integration phase to minimize these challenges.

3. Complexity in implementation

Implementing AP automation software can be a complicated process that requires careful planning and execution.

Organizations need to define workflows, configure settings, and ensure proper training for users. The complexity can lead to delays in implementation, resulting in frustration among employees and management.

To alleviate this, companies should establish a well-defined project plan with clear timelines, allocate resources for training, and consider involving external experts to guide the implementation process.

4. High initial expenses

The initial costs of implementing AP automation software can be a significant hurdle for many organizations.

Expenses may include software licensing fees, hardware upgrades, and consulting services. Smaller businesses, in particular, may struggle to justify these costs against the perceived benefits.

To address this, companies should conduct a thorough cost-benefit analysis to understand the long-term savings and efficiencies gained from automation, thereby justifying the initial investment.

5. Inconsistent customer support

Inconsistent customer support poses a significant challenge when implementing AP automation software.

Many users report experiencing delays in receiving assistance from vendors, leading to frustration and potential downtime during critical phases. This disruption can hinder operations and impact overall efficiency.

To mitigate this risk, organizations should prioritize selecting the best AP automation solutions known for responsive customer service and develop a clear support plan to ensure timely assistance for any issues that may arise.

6. System downtimes & maintenance issues

System downtimes and maintenance issues are significant challenges associated with AP automation software.

Like any software solution, these tools can experience unplanned outages or require regular maintenance, disrupting accounts payable processes and delaying vendor payments. Such interruptions can damage relationships and hinder cash flow management.

To minimize the impact of system downtimes, businesses should develop contingency plans that include regular maintenance schedules, backup processes, and effective communication strategies to ensure operations remain smooth during outages.

7. Exception handling

Despite automation, exceptions are inevitable in the accounts payable process.

Exception handling can become a bottleneck if the automation software does not effectively manage discrepancies, such as invoice mismatches or missing documentation.

A high rate of exceptions can lead to increased manual intervention, negating the efficiency gains from automation.

Organizations must evaluate software that offers robust exception management capabilities to streamline this aspect of the AP process.

8. Departmental restructuring

Departmental restructuring is a common challenge when adopting AP automation. This transition often leads to uncertainty among employees as teams adapt to new roles, workflows, and responsibilities.

Such changes can cause disruption and anxiety within the organization. To mitigate these challenges, businesses should invest in adequate training and support, ensuring that employees understand their new roles and the advantages of automated processes.

Clear communication about the benefits can foster a smoother transition and encourage acceptance among staff.

9. Vendor resistance & integration

Vendor resistance is a significant challenge when implementing new AP automation software. Vendors often prefer traditional payment processes and may be reluctant to adopt changes.

Integrating vendor systems with the automation software can be particularly challenging if vendors lack the technical capability to adapt.

To address this, organizations should engage vendors early in the process, offering necessary training and support.

This proactive approach can facilitate smooth integration, ensuring cooperation and minimizing disruptions in the accounts payable process.

Use automation to eradicate AP inefficiencies

KPIs to monitor AP automation process

Key performance indicators (KPIs) are vital for evaluating the effectiveness of the accounts payable (AP) automation process. Monitoring these metrics helps organizations identify areas for improvement and enhance overall financial efficiency.

Cost-per-invoice

● Description

Cost-per-invoice is a critical KPI that measures the total expenses involved in processing a single invoice, encompassing labor, technology, and operational costs.

Analyzing this metric helps businesses identify inefficiencies and determine which are the best AP automation solutions for streamlining their accounts payable processes.

● Formula

Cost-per-Invoice = Total AP Costs / Total Number of Invoices Processed

● Example

For instance, if a company incurs $20,000 in annual accounts payable operations and processes 1,000 invoices during that period, the cost-per-invoice calculation would be $20.

Days payable outstanding

● Description

Days Payable Outstanding (DPO) measures the average number of days a company takes to pay its suppliers.

This KPI is crucial for evaluating cash flow management and payment efficiency, providing insights into how effectively a company manages its obligations.

Using the best AP automation solutions can help improve this metric by streamlining payment processes.

● Formula

DPO = (Accounts Payable / Cost of Goods Sold) x Number of Days

● Example

For instance, if a company has $30,000 in accounts payable and its cost of goods sold is $300,000 over a year of 365 days, the DPO would be 36.5 days.

This is calculated using the formula: ($30,000 / $300,000) x 365, highlighting the company’s payment practices and efficiency.

Invoice processing time

● Description

Invoice processing time is a vital KPI that measures the total duration required to complete the entire lifecycle of an invoice, from its initial receipt to the final payment.

This metric provides valuable insights into the efficiency of the accounts payable department, helping identify bottlenecks and areas for improvement.

● Formula

Invoice Processing Time = Total Processing Time for Invoices / Total Number of Invoices Processed

● Example

For example, if the total time spent on processing 100 invoices amounts to 400 hours, the invoice processing time per invoice would be 4 hours.

This is calculated by dividing the total processing time (400 hours) by the number of invoices processed (100), revealing the efficiency of the AP process.

Payment error rate

● Description

The payment error rate quantifies the percentage of payments made incorrectly, including duplicate payments or incorrect amounts.

Monitoring this KPI is essential for identifying weaknesses in the payment process, enabling organizations to enhance accuracy and streamline operations.

A lower payment error rate indicates a more efficient accounts payable system, often achievable with the best AP automation solutions.

● Formula

Payment Error Rate = (Number of Payment Errors / Total Number of Payments) x 100

● Example

For example, if a company processes 500 payments in a month and identifies 10 errors, the payment error rate would be calculated as 2%.

This is determined using the formula: (10 / 500) x 100, reflecting the company's payment accuracy and operational efficiency.

Exception invoice rate

● Description

The exception invoice rate calculates the percentage of invoices that require extra handling or approval due to discrepancies, errors, or missing information.

Monitoring this KPI is essential for identifying inefficiencies in the invoice process and improving overall accounts payable operations.

A high exception rate can highlight areas needing improvement, often addressed by implementing the best AP automation solutions.

● Formula

Exception Invoice Rate = (Number of Exception Invoices / Total Number of Invoices) x 100

● Example

For instance, if a company processes 1,000 invoices in a month and 50 of those are flagged as exceptions, the exception invoice rate would be 5%.

This is calculated using the formula: (50 / 1,000) x 100, indicating the frequency of issues in the invoice processing workflow.

Discount capture rate

● Description

The discount capture rate assesses the percentage of available discounts that a company successfully takes advantage of when making payments.

A high discount capture rate indicates effective cash flow management and strategic payment practices, showcasing how the best AP automation solutions can help maximize savings through timely payments.

● Formula

Discount Capture Rate = (Value of Discounts Captured / Total Available Discounts) x 100

● Example

For example, if a company is eligible for $5,000 in discounts but successfully captures $4,000, the discount capture rate would be 80%.

This is calculated as follows: ($4,000 / $5,000) x 100, demonstrating the company's effectiveness in leveraging available discounts for cost savings.

Invoice approval cycle time

● Description

Invoice approval cycle time measures the average duration required to approve an invoice from its submission to final approval.

A shorter cycle time reflects a more efficient approval process, which can enhance the overall effectiveness of accounts payable operations and ensure timely payments to vendors.

● Formula

Invoice Approval Cycle Time = Total Approval Time for Invoices / Total Number of Invoices Approved

● Example

For instance, if a company takes a total of 300 hours to approve 200 invoices, the invoice approval cycle time would be 1.5 hours per invoice, calculated as 300 hours divided by 200 invoices.

This metric helps identify areas for improvement in the approval workflow.

Invoice accuracy rate

● Description

The invoice accuracy rate measures the proportion of invoices processed without any errors.

A high accuracy rate signifies an efficient accounts payable process and minimizes the need for corrections and rework.

This KPI is crucial for maintaining good relationships with vendors and ensuring timely payments.

● Formula

Invoice Accuracy Rate = (Total Accurate Invoices / Total Invoices Processed) x 100

● Example

For example, if a company processes 1,000 invoices in a month and 950 of them are error-free, the invoice accuracy rate would be 95%, calculated as (950 / 1,000) x 100. A high accuracy rate reflects effective invoice management.

Best practices to follow when using an AP automation software

Even with the best AP automation software, businesses can still struggle with accounts payable management if they don’t know how to use it effectively.

A business that knows what the best practices are when it comes to AP and automation software will generally be able to manage its accounts payable better than a business that doesn’t.

It’s important for businesses to cover all aspects of the accounts payable process when considering what the best practices are.

These practices range from prioritizing employee training to monitoring key metrics to get the best results possible. Here are some suggestions when using AP software.

1. Prioritize training

Getting familiar with an AP automation software suite will require employees to spend a little bit of time with it. Make sure to put aside time, especially in the beginning, to host training sessions to get employees used to the software.

It should be a priority to give all the accounts payable employees in an organization the training necessary to use the AP software. Prioritizing training over quick implementation will produce the best AP automation software results.

2. Shift to paperless accounting

Similar to the AP management process, the broader accounting operations will also benefit from automation. To automate as many tasks as possible, it is recommended that businesses shift to paperless accounting.

There are plenty of modern accounting software suites to choose from. Take a look at what features some of these providers offer and consider using one. This will help in keeping your books up to date without the hassle.

3. Use software customized to the user’s needs

The best AP automation software for a business may differ from another business. However, it is easier for any company to use a platform that offers customization options. This allows the organization to adjust each feature as the team sees fit.

Make sure to take into account the current state of the business. Instead of having to change workflows in their entirety, the AP team can customize the software to suit existing processes.

4. Set a clear policy

There will be necessary adjustments in the company accounts payable policies to include clear guidelines and expectations on AP automation. These changes must be made to ensure that the AP automation software can perform with a proper procedure in place.

Having a clear policy can be the difference between a streamlined and a messy accounts payable process. Brainstorm with all concerned stakeholders on what are the best policies to smoothly use the tool.

5. Monitor key metrics

It’s important to set goals when implementing a new tool, such as AP software, within the organization. This will help to determine whether or not the team has the best AP automation software for its intended purpose.

Metrics such as invoice turnover time, for example, should be measured accordingly. There are several different metrics that a company should use to measure performance.

These key metrics, or performance indicators, should be monitored and reviewed regularly.

6. Align AP automation with your business goals

AP automation tools are meant to help businesses streamline their processes and achieve their goals faster.

When implementing automation, it’s important to keep business goals in mind and use them as a guideline for how to move forward with the automation tools.

This will not only ensure that these goals will be achieved faster but also avoid confusion amongst staff members.

The usage of the best AP automation software for a business should be in line with existing priorities.

7. Streamline workflow

A typical and traditional invoice approval workflow will require plenty of time and effort, which is why many businesses look for AP automation software suites to minimize the hassle.

The goal of making an accounts payable automation software comparison list is to find which platform can help streamline workflows the best.

Use tools that allow the accounts payable team to automate approvals. Rather than chasing after signatures, approvers can be automatically notified when a request comes in.

8. Ensure cross-departmental collaboration

Successful AP automation requires fostering collaboration between finance, procurement, and other departments. Involving all relevant stakeholders streamlines workflows, enhances communication, and aligns goals.

This collaborative approach not only leads to a more efficient automation process but also improves problem-solving.

It ultimately contributes to the overall success of the accounts payable department and ensures the implementation of the best AP automation solutions.

9. Calculate total cost of ownership

Understanding the total cost of ownership (TCO) for AP automation software is essential for effective budgeting.

TCO encompasses not only the initial purchase price but also ongoing expenses such as maintenance, training, and support.

By calculating the TCO, organizations can make informed decisions and conduct an accurate accounts payable automation software comparison.

This ensures, they choose the best AP automation solutions that align with their long-term financial plans and operational requirements.

10. Involve employees from the get-go

Engaging employees early in the AP automation process is crucial for fostering acceptance and enthusiasm.

By involving them in discussions about software selection, implementation, and training, organizations can address concerns, gather valuable insights, and promote a sense of ownership.

This proactive approach helps minimize resistance to change, leading to a smoother transition to the new system and ensuring that the best AP automation solutions are effectively integrated into daily operations.

11. Conduct periodic system audits

Regular audits of the AP automation system are essential for maintaining efficiency and compliance. Periodic reviews help identify discrepancies, assess process effectiveness, and ensure that the software functions as intended.

This proactive approach enhances accountability and allows organizations to adapt to changing business needs and regulatory requirements.

By incorporating periodic audits, businesses can maximize the benefits of their AP automation software, leading to improved performance and risk management, ultimately ensuring the selection of the best AP automation solutions.

12. Compare performance with industry benchmarks

To gauge the effectiveness of AP automation software, businesses should regularly compare their performance against industry benchmarks.

Analyzing key performance indicators (KPIs) like invoice processing time and error rates allows organizations to identify improvement areas and ensure competitiveness.

This practice not only aids in setting realistic goals and expectations for the AP department but also ensures the selected software aligns with the best AP automation solutions available, driving overall efficiency and effectiveness.

13. Establish a supplier portal

Creating a supplier portal significantly streamlines communication and enhances the efficiency of the accounts payable process.

This dedicated platform enables suppliers to submit invoices electronically, track payment statuses, and access relevant documentation.

By providing transparency throughout the payment process, organizations can foster stronger relationships with vendors, reduce the risk of errors, and accelerate the overall payment cycle, contributing to a more effective accounts payable system.

Implementing such a portal is essential for optimizing AP automation efforts.

14. Collect e-invoices