👋 Exciting news! UPI payments are now available in India! Sign up now →

Business expenses - Types, examples, tax deductibility and management

Business expenses are an inevitable aspect of any organization's day-to-day operations. From small startups to established corporations, expenditures play a vital role in sustaining and growing businesses.

Whether it's operational costs, employee salaries, marketing campaigns, or technology investments, every expense contributes to the overall functioning and success of a company. Therefore, it only makes sense to explore the various cost categories and obtain insights so that you can manage your business expenditures effectively.

What are business expenses?

Business expenses refer to the costs incurred by a company in its regular operations to generate revenue and maintain its operations.

The business expenses list encompasses various categories such as employee salaries, rent, utilities, supplies, advertising, marketing, travel, equipment, insurance, and more. They are necessary expenditures that enable the business to function, deliver products or services, and pursue growth opportunities.

Managing and controlling business expenses effectively is crucial for financial stability and profitability.

Types of business expenses

1. Operating expenses

Operating expenses are ongoing costs incurred by a business to maintain its daily operations. They are necessary for the company to function and generate revenue.

Some operating business expenses examples include rent, utilities, employee salaries, office supplies, insurance premiums, marketing expenses, and maintenance costs.

2. Variable expenses

Variable expenses are costs that fluctuate based on the level of business activity or production. They tend to increase or decrease in direct proportion to sales or output.

Common examples of variable expenses are raw materials, direct labor, sales commissions, shipping costs, and production supplies.

3. Cost of Goods Sold (COGS)

COGS refers to the direct expenses incurred in producing or acquiring goods or services that are sold by a business. It includes the cost of raw materials, labor, and overhead costs directly associated with the production process.

For example, if a company sells furniture, the COGS would include the cost of wood, labor to build the furniture, and any additional costs such as hardware or upholstery.

4. Capital expenses

Capital business expenses, also known as capital expenditures or CapEx, are investments made by a business to acquire long-term assets or improve existing assets. These expenses are typically significant and provide future benefits.

Examples of capital expenses include purchasing property or equipment, renovating a building, or investing in software or technology infrastructure.

5. Fixed expenses

Fixed expenses are costs that remain constant over a specific period, regardless of the level of business activity. They are usually recurring and essential for the business's operation, regardless of sales volume.

Fixed expenses include rent, insurance premiums, salaries of employees not directly involved in production, office lease payments, and annual subscriptions.

6. Recurring expenses

Recurring business expenses are costs that regularly repeat at a fixed interval. They typically occur monthly, quarterly, or annually and are necessary for the business's ongoing operations.

Examples of recurring expenses are utility bills, subscription fees, loan repayments, lease payments, and maintenance contracts.

7. Interest expenses

Interest expenses are the costs incurred by a business for borrowing money. They are associated with interest payments on loans, lines of credit, or any other form of debt.

Interest expenses can significantly impact a company's profitability and cash flow.

8. Incidental expenses

Incidental expenses refer to small, miscellaneous costs that are incidental or secondary to the main operations of a business. These expenses are typically unexpected or irregular.

Examples of incidental expenses include small repairs, minor equipment purchases, parking fees, or one-time professional service fees.

Take control of your expenses

Common business expenses list

1. Rental expenses

The expenditure associated with leasing or renting the premises where the business operates, such as office spaces, factories, or any property essential for its functioning.

2. Machinery costs

The business expenses related to acquiring and maintaining machinery and equipment necessary for the production or operation of the business.

3. Compensation

The remuneration or wages paid to both permanent and temporary employees for their services rendered to the company.

4. Travel costs

All the financial outlays incurred during business-related trips, including expenses for flights, accommodations, transportation, and any other travel-related expenditures.

5. Utility expenses

The business expenses or costs associated with essential services required for the daily operations of the workplace, such as electricity, water, internet connectivity, sewage, and other utilities.

6. Interest payments

The fees charged by financial institutions, encompassing the monthly interest amounts paid on loans or credit facilities utilized by the company.

7. Repair expenditures

The funds allocated for the upkeep and restoration of machinery, equipment, or other assets that may deteriorate or require fixing over time.

8. Advertising expenses

The monetary outlay involved in promoting the business's products or services to attract customers and increase brand visibility.

9. Patent costs

The money expended to safeguard the company's intellectual property rights, including the business expenses incurred in obtaining and maintaining patents, trademarks, or trade secrets.

10. Technology & tools

The financial resources utilized to acquire and utilize various technological resources within the company, such as computers, laptops, projectors, management software, accounting software, and other technology-related tools.

11. Legal fees

The charges associated with obtaining legal services, including hiring lawyers or law firms to handle legal matters and provide counsel or representation for the business.

12. Tax payments

The total amount of taxes paid by the company during a specific tax year, encompassing income taxes, commercial property taxes, and other applicable tax obligations.

Tax deductibility of business expenses

Business expenses are generally tax-deductible, meaning that they can be subtracted from a company's taxable income, reducing the overall tax liability. This includes costs incurred for operating, advertising, employee salaries, utilities, rent, and other necessary business expenditures.

However, specific rules and limitations may apply, so consulting with a tax professional is advisable.

Which business expenses are tax deductible in India?

In India, several business expenses are tax deductible, allowing companies to reduce their taxable income and minimize their tax liability. Here are some key tax-deductible business expenses examples:

● Rent and lease expenses

The amount paid for renting or leasing business premises, such as office spaces, factories, or warehouses, is generally tax deductible.

● Employee salaries

Wages, salaries, bonuses, and other compensation paid to employees are fully deductible as business expenses. This includes salaries of permanent, temporary, and contract workers.

● Professional fees

Fees paid to professionals such as lawyers, accountants, consultants, or auditors for services rendered to the business are deductible.

● Business travel expenses

Costs incurred during business travel, including transportation fares, accommodation expenses, meals, and other related expenses, can be deducted.

● Office supplies and equipment

Expenditures on office supplies like stationery, computer software, and hardware, as well as the purchase or lease of office equipment, can be claimed as deductions.

● Advertising and marketing costs

Business expenses incurred for advertising and marketing activities, such as digital marketing campaigns, print media advertisements or sponsorships, are tax deductible.

● Employee benefits

Contributions made towards employee benefits like health insurance, retirement plans (such as Employee Provident Fund), employee education expenses, and other employee welfare schemes are generally deductible.

● Utilities and communication expenses

Costs for utilities like electricity, water, internet, and telephone services used for business purposes are deductible to the extent they are directly related to the business.

● Depreciation expenses

Depreciation is the allocation of the cost of tangible assets over their useful life. Businesses can claim depreciation as a deduction for assets such as machinery, vehicles, or buildings used for business purposes.

● Expense on scientific research

Businesses engaged in scientific research and development activities may be eligible for tax deductions on the expenses incurred for such research projects.

It's important to note that specific rules and limitations apply to each type of expense, and documentation and record-keeping are crucial to substantiate the deductions. Consulting with a tax professional or referring to Indian tax laws and regulations can provide accurate guidance on deductibility and compliance requirements.

Keep your accounting anxieties away

Which business expenses are non-tax deductible in India

In India, certain business expenses are considered non-tax deductible, meaning they cannot be claimed as deductions to reduce taxable income. These expenses include:

● Personal expenses

Expenses that are personal in nature and not directly related to business activities are not deductible. This includes personal travel, personal entertainment, personal insurance premiums, and other personal expenditures.

● Capital expenditure

Capital expenditures, which involve the acquisition or improvement of long-term assets like buildings, land, or machinery, are not immediately deductible. Instead, these costs are typically depreciated or amortized over the useful life of the asset.

● Penalties and fines

Any penalties or fines imposed by regulatory authorities or courts due to non-compliance or legal violations are not tax deductible. This includes penalties for late payment of taxes, non-compliance with regulations, or fines imposed for breaches of contractual obligations.

● Dividends

Dividends paid to shareholders are not deductible as business expenses for the company. While shareholders may be subject to tax on dividends received, the company cannot deduct the dividend payments as an expense for tax purposes.

● Gifts and donations

Non-charitable donations or gifts made by businesses, such as corporate gifts or contributions to non-approved charitable organizations, are generally not tax deductible.

● Salary paid outside India

Salaries paid to employees or contractors outside India for services rendered outside the country are generally not deductible for tax purposes in India. The taxability of such payments may be subject to specific provisions of tax treaties between India and the respective country.

How to keep your business expenses under control?

1. Create a budget

Develop a comprehensive budget that outlines projected revenues and anticipated expenses. This allows you to set spending limits and allocate resources accordingly.

Regularly review and compare actual business expenses with the budget to identify any variances and take corrective action.

2. Establish expense policies

Define clear expense policies and guidelines for employees. Specify a business expenses list for what expenses are allowable and the approved spending limits. This helps to eliminate unnecessary or unauthorized expenses and ensures consistency in expense management.

3. Prioritize the expenses

Prioritize expenses based on their importance and impact on the business. Focus on essential expenses that directly contribute to revenue generation and customer satisfaction.

Non-essential or discretionary expenses should be evaluated carefully before committing to them.

4. Embrace automation technology

Utilize technology and expense management software solutions to automate expense tracking, invoicing, and financial reporting processes. This not only reduces manual errors but also provides real-time visibility into expenses, allowing for better decision-making and cost control.

5. Evaluate subscriptions and contracts

Regularly review and assess ongoing subscriptions, memberships, and service contracts. Identify those that are no longer needed or not providing sufficient value.

Consider renegotiating or terminating agreements to eliminate unnecessary costs.

Revolutionize the way you handle subscription payments. Delve into our comprehensive guide on subscription payment management to know how to keep track of your recurring payments and manage multiple subscriptions without having to worry about any payment hassles.

6. Seek professional advice

Consult with financial advisors or tax professionals to identify potential cost-saving opportunities, tax deductions, and strategies to optimize expenses. Their expertise can provide valuable insights and help streamline financial operations.

7. Monitor cash flow

Maintain a close eye on both the inflow and outflow of cash. Promptly follow up on unpaid invoices and implement efficient accounts receivable processes.

On the expense side, negotiate favorable payment terms with vendors and avoid unnecessary late fees or penalties.

Is your business facing cash flow challenges or seeking to optimize its financial performance? Explore our in-depth article on cash flow analysis to gain valuable insights and strategies that can transform your financial landscape.

8. Optimize energy consumption

Implement energy optimization strategies to reduce utility expenses. This can include using energy-efficient equipment, implementing intelligent energy management systems, and encouraging employee awareness of energy conservation practices.

9. Implement cost controls

Establish a robust expense approval process to ensure that all expenses are justified and within budget. Implementing a system where business expenses require approval from designated personnel can prevent unnecessary or excessive spending.

10. Use expense management tools

Utilize expense management software or apps to streamline expense reporting, tracking, and reimbursement processes.

Using expense management solution can help automate expense submission, receipt management, and reporting, providing greater visibility and control over expenses.

Our informative article on the benefits of expense management software will help you understand how expense management software can simplify your financial workflows, make expense tracking a breeze and eliminate all the challenges with expense management.

Related read: What is an expense claim, its types and how to manage it?

Keep your business expense under control

Why should business expenses be tracked?

Makes audits easier

Properly tracking and documenting business expenses simplifies the audit process. In the event of an audit, having organized and accurate expense records ensures compliance with legal and regulatory requirements, and reduces the likelihood of penalties or fines.

Lesser expense frauds

By diligently tracking expenses, businesses can detect and prevent fraudulent activities.

Regular review of expense reports and receipts can help identify any discrepancies or suspicious transactions, discouraging employees from engaging in fraudulent behavior.

Helps avoid unnecessary spends

Tracking expenses provides visibility into spending patterns and helps identify areas where costs can be reduced or eliminated.

By analyzing historical expense data, businesses can make informed decisions to avoid unnecessary expenditures and allocate resources more efficiently.

Adherence to expense policies

Tracking business expenses ensures adherence to expense policies and guidelines set by the company. It helps verify that expenses are within approved limits and in compliance with established policies, preventing unauthorized or excessive spending.

Performance evaluation

Tracking expenses enables businesses to assess the financial performance of different departments, projects, or initiatives.

By comparing expenses against revenue generated or productivity levels, businesses can identify areas of improvement, allocate resources effectively, and make informed decisions about future investments.

Help identify tax deductibles

Proper expense tracking helps identify deductible expenses for tax purposes. It allows businesses to claim legitimate deductions, such as rent, employee salaries, professional fees, and other eligible expenses, resulting in potential tax savings.

Budgeting and forecasting

Accurate expense tracking provides critical data for budgeting and forecasting purposes. By analyzing historical expense patterns, businesses can develop realistic budgets, make informed financial projections, and set achievable goals.

Financial transparency

Tracking business expenses promotes financial transparency within the organization. It allows stakeholders, including investors, shareholders, and lenders, to assess the financial health of the business, evaluate its performance, and make informed managerial accounting decisions based on accurate financial information.

Cost control and optimization

Effective expense tracking facilitates cost control and optimization. Businesses can identify areas of overspending, implement cost-cutting measures, negotiate better terms with vendors, and optimize resource allocation to improve overall profitability.

How to track business expenses effectively?

1. Set up a system

Establish a system to track and organize expenses. This can be a software application, spreadsheet, or cloud-based accounting platform.

Choose a system that suits your business needs and allows for easy data entry and retrieval.

Check out our article on the best business expense tracker in 2023 to know more about some of the best expense tracking software available and why Volopay is the best pick out of all the options.

2. Collect and organize receipts

Collect and retain all receipts and invoices for business expenses. Organize them systematically, whether physically or digitally, making sure they are easily accessible for reference and documentation.

3. Record expenses promptly and accurately

Record expenses in a timely manner to maintain accurate financial records. Include relevant details such as the date, amount, vendor, and purpose of the expense.

Be diligent about documenting each transaction to ensure accuracy and completeness.

4. Create expense categories

Categorize expenses based on different types, such as office supplies, travel, utilities, advertising, or employee salaries.

Create specific categories that align with your business operations to provide better expense visibility and analysis.

5. Reconcile bank and card statements

Regularly reconcile your bank and credit card statements with your recorded expenses. This helps identify any discrepancies, errors, or missing expenses, ensuring that all transactions are accounted for and accurately reflected in your financial records.

6. Monitor and analyze expenses regularly

Regularly review and analyze your expenses to examine patterns, pinpoint areas where spending exceeds necessary levels, and identify potential opportunities for reducing costs. This process empowers you to make well-informed choices when it comes to budgeting, implementing cost-control measures, and allocating resources effectively.

7. Calculate total expenses

Calculate the total expenses for each expense category and overall for a given period. This provides a clear understanding of the total expenditure incurred by the business, helping in financial planning and reporting.

8. Prepare financial statements

Utilize the business expenses that have been tracked to generate financial statements for your business; this could include income statements, balance sheets, and cash flow statements.

Doing this will help you accurately assess your business's economic well-being and overall performance.

Automate your business expense tacking

Importance of managing business expenses

Financial health

Uncontrolled business expenses can severely impact the financial health of a business. Overspending or mismanagement of expenses can lead to cash flow issues, profit erosion, and even financial distress.

By effectively managing expenses, businesses can maintain stability, meet financial obligations, and ensure long-term sustainability.

Profitability

Expense management is directly linked to profitability. By monitoring and controlling expenses, businesses can optimize costs, reduce wasteful expenditures, and increase profit margins.

A well-managed expense strategy allows for better allocation of resources and the ability to invest in growth opportunities.

Cash flow management

Efficient business expense management plays a vital role in maintaining healthy cash flow. By keeping a close eye on expenses, businesses can ensure that cash inflows are sufficient to cover outflows and maintain positive cash flow. This enables timely payment of bills, payroll, and other financial obligations, as well as facilitates future business investments.

Suggested read: Ultimate guide on cash flow management

Cost control and efficiency

Managing business expenses helps organizations keep costs under control. By identifying areas of unnecessary or excessive spending, businesses can implement cost-cutting measures and improve operational efficiency. This leads to a more streamlined and productive business operation, ultimately enhancing competitiveness and profitability.

Increase stakeholder confidence and investor relations

Well-managed business expenses enhance the reputation and credibility of a company. Demonstrating effective expense management builds trust among stakeholders, including customers, suppliers, and employees. It also attracts potential investors who seek financially responsible and well-controlled businesses as investment opportunities.

Risk mitigation

Uncontrolled expenses pose various risks to a business. These risks include financial instability, compliance issues, fraud, and misallocation of resources.

By implementing robust expense management practices, businesses can mitigate these risks and ensure compliance with legal and regulatory requirements.

Tools and technologies available for expense management

1. Expense tracking and reporting software

Advanced expense tracking and reporting software automates the expense management process. These tools allow businesses to capture, categorize, and track expenses in real-time. They offer features such as receipt capture, expense categorization, policy enforcement, and integration with accounting systems.

Such cash management system provides comprehensive expense reports and analytics, simplifying the task of monitoring and analyzing expenses.

Suggested read: Paperless expense reporting to streamline expense management

2. Mobile expense management apps

Mobile apps enable employees to easily submit business expenses on the go. These apps offer features like receipt scanning, expense categorization, mileage tracking, and integration with cloud-based expense management systems.

Mobile expense management software apps ensure timely and accurate expense reporting, eliminating the need for manual paperwork and reducing administrative burden.

Are you in search of the perfect solution to streamline your expense tracking and control spending in your business? Our latest article features a comprehensive review of the best expense management software in 2023.

3. Virtual cards and digital payment solutions

Virtual cards and digital payment solutions streamline the payment process for business expenses.

Virtual cards, often issued by banks or fintech companies, provide secure and temporary card details for specific transactions.

Digital payment solutions, such as mobile wallets or online payment platforms, enable seamless and instant transactions. These solutions simplify expense tracking, enhance security, and provide transparency in financial transactions.

Suggested read: 5 best virtual debit cards for businesses in 2024

4. Receipt scanning and OCR technology

Receipt scanning and Optical Character Recognition (OCR) technology automate the process of capturing data from receipts.

Users can scan or take pictures of receipts, and OCR technology extracts relevant information such as vendor name, date, and amount. This eliminates the need for manual data entry, reduces errors, and expedites the expense reimbursement process.

Streamline your expense management

What is expense management software?

Expense management software is a computer program or application designed to automate and streamline the process of tracking, managing, and reporting business expenses.

It provides features such as receipt capture, expense categorization, policy enforcement, and integration with accounting systems.

Expense management software helps businesses effectively manage their business expenses, improve efficiency, and ensure compliance.

Benefits of using expense management software

1. Streamlined expense tracking

Expense management software simplifies the process of tracking business expenses. It provides a centralized platform to capture and record expenses, eliminating the need for manual paperwork. Users can easily enter expense details, attach receipts, and categorize expenses, resulting in a more organized and efficient tracking system.

2. Improved accuracy and compliance

Manual expense tracking is prone to errors and inconsistencies. Expense management software automates calculations, reduces data entry errors, and enforces compliance with company expense policies. This ensures that expenses are accurately recorded, and policy violations are flagged, leading to more accurate and compliant expense reporting.

3. Real-time expense visibility

With expense management software, businesses gain real-time visibility into their expenses. Managers can monitor expenses as they occur, view spending trends, and identify areas of overspending.

Real-time visibility enables proactive decision-making, allowing businesses to make timely adjustments and optimize expense management strategies.

4. Enhanced policy enforcement

Expense management software helps enforce expense policies consistently. It can be configured to validate expense submissions against policy rules, such as spending limits or required approvals.

Any policy violations are flagged automatically, reducing the risk of non-compliance and ensuring adherence to company guidelines.

5. Seamless expense reimbursement

Manual expense reimbursement processes can be time-consuming and prone to delays. An expense management solution significantly streamlines the reimbursement process.

It automates the workflow, facilitating quick approval and reimbursement cycles. This saves time for both employees and finance teams, enhancing efficiency and employee satisfaction.

6. Better data analytics

Expense management software provides robust reporting and analytics capabilities. It generates detailed expense reports, allowing businesses to analyze spending patterns, identify cost-saving opportunities, and make data-driven decisions.

Analytics tools within the software enable businesses to gain insights into expense trends, vendor relationships, and budget utilization, leading to more effective financial planning.

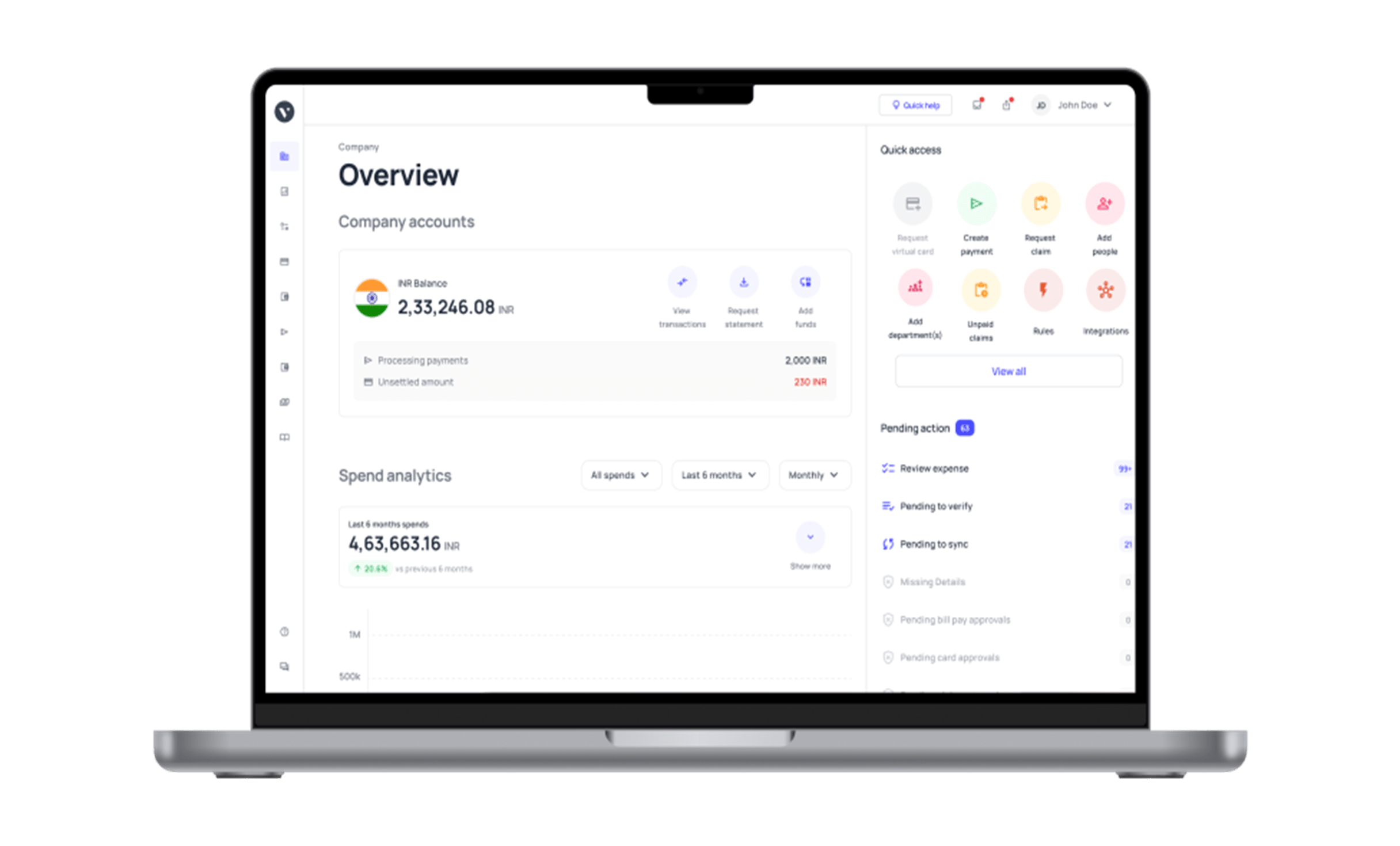

Volopay: All-in-one expense management solution

Volopay’s corporate expense management platform can be the ideal, all-in-one solution to solve pretty much all of a business’s expense management troubles. The platform combines features such as corporate cards, expense tracking, bill payments, and automated accounting in a unified system.

It simplifies and streamlines the entire process by integrating business expenses tracking, corporate cards, bill payments, and automated accounting into a unified platform. This all-in-one expense management solution enables businesses to effortlessly capture and categorize business expenses, manage employee spending through virtual and physical cards, automate bill payments, and seamlessly integrate with accounting systems.

With its extensive range of features, Volopay offers businesses of all sizes a versatile and efficient solution that saves time, enhances accuracy, and provides real-time expense visibility.