👋 Exciting news! UPI payments are now available in India! Sign up now →

Understanding the process of capital budgeting in financial management

Making smart investment decisions can mean the difference between thriving and merely surviving. The capital budgeting process stands as a crucial financial management tool that helps businesses evaluate and prioritize their long-term investments. From expanding manufacturing facilities to upgrading technology infrastructure, these decisions shape a company's future.

For Indian businesses navigating the competitive global market, mastering the process of capital budgeting in financial management has become more critical than ever, especially as organizations seek to balance growth opportunities with financial prudence and risk management.

What is capital budgeting?

Capital budgeting is a systematic process that organizations use to analyze and evaluate potential long-term investments or capital expenditure projects. It helps businesses determine which projects are worth pursuing by assessing their costs, potential returns, and associated risks.

This strategic planning tool examines various factors including initial investment requirements, projected cash flows, market conditions, and the project's alignment with company goals. Whether it's investing in new equipment, expanding into new markets, or acquiring another business, the process of capital budgeting provides a structured framework for making informed decisions that can significantly impact a company's financial health and competitive position in the market.

Importance of capital budgeting process in financial management

Understanding the importance of the capital budgeting process in financial management is crucial for any organization's financial success. The process of capital budgeting serves as a cornerstone in financial management, helping businesses make strategic investment decisions that can impact their growth trajectory for years to come.

Let's explore the key reasons why this systematic approach is indispensable in modern financial management.

Directs funds to high-potential projects

The capital budgeting process enables organizations to identify and prioritize projects that offer the highest returns on investment.

By utilizing various evaluation techniques such as Net Present Value (NPV) and Internal Rate of Return (IRR), businesses can systematically assess which projects deserve funding allocation, ensuring optimal use of limited financial resources while maximizing potential returns.

Evaluates risks before investment decisions

Through comprehensive risk assessment tools integrated into the process of capital budgeting, companies can thoroughly analyze potential threats and uncertainties associated with each investment opportunity.

This proactive approach helps organizations understand project vulnerabilities, develop mitigation strategies, and make informed decisions that balance potential returns with acceptable risk levels.

Aligns investments with strategic goals

The capital budgeting process ensures that investment decisions align perfectly with the organization's long-term objectives and vision.

By evaluating projects through the lens of strategic fit, companies can maintain focus on initiatives that not only promise financial returns but also contribute to achieving broader organizational goals and maintaining competitive advantage.

Estimates future cash inflows accurately

A robust capital budgeting process incorporates sophisticated forecasting techniques to predict future cash flows with greater precision.

This includes analyzing market trends, considering economic factors, and evaluating industry dynamics to create realistic projections that help organizations understand the true financial impact of their investment decisions.

Measures success with performance metrics

The process of capital budgeting establishes clear performance indicators and benchmarks to evaluate project success.

By setting specific metrics and monitoring mechanisms, organizations can track project progress, measure actual returns against projections, and make necessary adjustments to ensure investments meet or exceed expected outcomes.

Maximizes value for shareholders

Through systematic evaluation and selection of profitable projects, the capital budgeting process helps organizations maximize shareholder wealth.

By choosing investments that generate returns exceeding the cost of capital, companies can create long-term value, enhance market position, and deliver sustainable returns to their stakeholders.

Incorporates overall cost of capital

The capital budgeting process factors in the weighted average cost of capital, considering both debt and equity financing costs.

This comprehensive approach ensures that investment decisions account for the true cost of funding, helping organizations maintain optimal capital structure while maximizing project returns.

Facilitates informed financial decision-making

By providing a structured framework for evaluation, the process of capital budgeting enables management to make well-informed investment decisions.

This systematic approach combines quantitative analysis with qualitative factors, ensuring a balanced perspective that considers both financial returns and strategic implications.

Enhances accountability in capital allocation

Through clear documentation and systematic evaluation procedures, the capital budgeting process in financial management creates a transparent framework for resource allocation.

This accountability ensures that investment decisions are justified, traceable, and aligned with organizational policies, while also facilitating post-implementation reviews and performance tracking.

Process of capital budgeting in financial management

The process of capital budgeting follows a structured approach that helps organizations make informed investment decisions.

By breaking down complex financial decisions into manageable steps, this systematic process ensures a thorough evaluation of potential investments while considering various factors such as risk assessment, return potential, and strategic alignment with business objectives.

1. Identify investment opportunities

● Generate project ideas

Encourage cross-functional teams to propose innovative investment opportunities through structured brainstorming sessions and regular business reviews. This proactive approach helps identify potential projects that could enhance operational efficiency, expand market reach, or introduce new products and services into the market.

● Assess market trends

Analyze current market conditions, competitor activities, and industry developments to identify emerging opportunities. This includes studying consumer behavior patterns, technological advancements, regulatory changes, and economic indicators that might influence the success of potential investment projects.

● Involve internal stakeholders

Engage key department heads, operational managers, and front-line employees in the ideation process. Their practical insights and hands-on experience can help identify operational gaps, improvement areas, and potential opportunities that might otherwise be overlooked by top management.

2. Conduct preliminary screening

● Establish feasibility criteria

Develop comprehensive screening parameters that include financial thresholds, technical requirements, resource availability, and alignment with company values. These criteria serve as initial filters to evaluate whether potential projects deserve detailed analysis and further consideration.

● Filter projects based on strategic fit

Evaluate how well each proposed project aligns with the organization's long-term vision, mission, and strategic objectives. Consider factors such as market positioning, competitive advantage, and potential synergies with existing business operations.

● Shortlist promising projects

Review all proposed projects against established criteria to create a focused list of viable opportunities. This process helps eliminate projects that don't meet basic requirements, allowing resources to be concentrated on analyzing the most promising investment options.

3. Estimate cash flow projections

● Calculate initial investment costs

Determine all upfront expenses including equipment purchases, infrastructure development, training costs, and working capital requirements. Consider both direct and indirect costs, ensuring all potential expenditures are accurately accounted for in the initial investment calculation.

● Forecast future cash inflows

Project expected revenues and benefits over the investment's lifetime using historical data, market research, and industry benchmarks. Account for factors like market growth rates, pricing strategies, and potential market share to create realistic revenue projections.

● Consider operational expenses

Estimate ongoing costs including maintenance, labor, utilities, raw materials, and overhead expenses. Factor in potential cost escalations, efficiency improvements, and operational synergies that might impact the project's long-term financial performance and viability.

4. Apply budgeting evaluation techniques

● Calculate Net Present Value (NPV)

Determine the present value of future cash flows using appropriate discount rates. Compare the sum of discounted cash inflows against the initial investment to calculate NPV, providing a clear measure of project value.

● Determine Internal Rate of Return (IRR)

Calculate the discount rate at which the project's NPV equals zero. This helps understand the project's potential return rate and provides a useful benchmark for comparing different investment opportunities against the company's cost of capital.

● Assess Payback Period

Calculate the time required to recover the initial investment through project cash flows. Consider both simple and discounted payback periods to understand how quickly the investment can be recovered and when positive returns begin.

5. Perform risk analysis

● Identify potential project risks

Map out possible threats including market risks, operational challenges, regulatory changes, and technological obsolescence. Consider both internal and external risk factors that could impact project success and financial performance over time.

● Conduct sensitivity analysis

Test how changes in key variables affect project outcomes. Examine the impact of variations in revenue, costs, market conditions, and other critical factors to understand the project's vulnerability to different scenarios.

● Develop scenario analyses

Create multiple project scenarios incorporating different combinations of variables. Include best-case, worst-case, and most likely scenarios to better understand potential outcomes and prepare appropriate response strategies for each situation.

6. Make informed decisions

● Compile findings for review

Organize all analysis results, including financial projections, risk assessments, and sensitivity analyses, into a comprehensive report. Present data through clear visualizations and executive summaries that highlight key findings and critical decision points.

● Prioritize projects based on analysis

Rank investment opportunities using a weighted scoring system that considers financial returns, strategic importance, risk levels, and resource requirements. Create a balanced portfolio of projects that optimizes resource allocation and maximizes overall business value.

● Discuss with stakeholders

Present findings to key decision-makers and gather input from relevant stakeholders. Facilitate detailed discussions about project implications, addressing concerns and incorporating valuable feedback into the final decision-making process.

7. Obtain approvals and funding

● Present projects to management

Develop compelling presentations that clearly communicate project benefits, risks, and resource requirements to senior management. Include detailed analysis results, implementation timelines, and expected outcomes to support informed decision-making.

● Secure necessary funding sources

Identify and evaluate potential funding options including internal cash reserves, debt financing, or equity funding. Consider the cost of capital, financing terms, and impact on the company's financial structure when selecting appropriate funding sources.

● Finalize project approval

Complete all required documentation and obtain necessary signatures from authorized personnel. Ensure compliance with internal governance procedures and establish clear documentation trails for audit and tracking purposes.

8. Implement project plans

● Develop detailed execution plans

Create comprehensive project timelines with specific milestones, deliverables, and resource allocation schedules. Include contingency plans and risk mitigation strategies to address potential challenges during implementation.

● Assign responsibilities and resources

Designate project teams and clearly define roles, responsibilities, and reporting structures. Allocate necessary resources including personnel, equipment, and budget to ensure smooth project execution and delivery.

● Coordinate among departments

Establish effective communication channels and collaboration protocols between different departments involved in project implementation. Ensure alignment of objectives and activities across all participating teams and stakeholders.

9. Monitor project performance

● Track progress against projections

Implement regular monitoring systems to compare actual performance against planned targets and forecasts. Use data-driven insights to identify variances and potential issues early in the implementation process.

● Use Key Performance Indicators (KPIs)

Establish and monitor specific metrics that measure project success and operational efficiency. Track both financial and non-financial KPIs to ensure a comprehensive evaluation of project performance and impact.

● Make adjustments as needed

Implement corrective actions promptly when performance deviates from plans. Maintain flexibility to adapt strategies and approaches based on real-time feedback and changing market conditions.

10. Review outcomes and feedback

● Conduct post-project evaluations

Perform thorough assessments of completed projects to measure success against original objectives. Analyze both quantitative results and qualitative impacts to understand the full scope of project outcomes.

● Compare actual results to forecasts

Evaluate the accuracy of initial projections by comparing them with actual performance data. Identify areas where estimates were accurate or needed improvement to enhance future forecasting capabilities.

● Document lessons learned for future projects

Create detailed documentation of successes, challenges, and learning points from each project. Share insights across the organization to improve future capital budgeting processes and project implementations.

Transform your budgeting process with Volopay

Techniques of capital budgeting in financial management

Capital budgeting techniques provide organizations with robust analytical tools to evaluate potential investments effectively.

These methods range from simple calculations to sophisticated financial models, each offering unique insights into project viability. Understanding these techniques is crucial for making well-informed investment decisions that align with organizational objectives and risk tolerance levels.

Net Present Value (NPV)

NPV calculates the difference between the present value of cash inflows and outflows over a project's lifetime, using a specified discount rate.

This technique considers the time value of money, providing a clear monetary value that indicates project profitability. A positive NPV suggests the project will create value, while a negative NPV indicates potential value destruction.

Internal Rate of Return (IRR)

IRR represents the discount rate at which a project's NPV equals zero, essentially showing the project's break-even rate of return.

This technique helps organizations compare projects of different sizes and durations, as it expresses returns as a percentage rather than an absolute value, making it particularly useful for benchmarking against required rates of return.

Payback period

This straightforward technique calculates the time required to recover the initial investment through project cash flows.

While it doesn't consider the time value of money, it provides a quick assessment of project liquidity and risk. Organizations often use this method as an initial screening tool, particularly in industries with rapid technological changes.

Real options analysis

This sophisticated approach considers the value of flexibility in project decisions, including options to expand, delay, or abandon investments.

By incorporating managerial flexibility and strategic alternatives into the evaluation process, real options analysis helps organizations understand and quantify the value of different strategic choices within a project.

Accounting Rate of Return (ARR)

ARR calculates the percentage return on investment using average annual profits and the initial or average investment.

While this method uses readily available accounting data and is easy to understand, it focuses on accounting profits rather than cash flows and doesn't consider the time value of money.

Modified Internal Rate of Return (MIRR)

MIRR addresses the limitations of traditional IRR by assuming that positive cash flows are reinvested at the company's cost of capital rather than the IRR.

This technique provides a more realistic assessment of project returns and helps avoid the multiple IRR problem that can occur with unconventional cash flow patterns.

Profitability Index (PI)

PI measures the relationship between a project's benefits and costs by dividing the present value of future cash flows by the initial investment.

Also known as the benefit-cost ratio, this technique helps organizations rank projects and make optimal investment decisions when capital is constrained, with values greater than 1 indicating profitable investments.

Discounted payback period

This enhanced version of the traditional payback period incorporates the time value of money by discounting future cash flows to their present value.

By considering both the timing and magnitude of cash flows, this technique provides a more accurate assessment of how long it will take to recover the initial investment.

Sensitivity analysis

This technique examines how changes in key variables affect project outcomes by varying one factor while holding others constant.

By identifying which variables have the greatest impact on project success, sensitivity analysis helps organizations understand project vulnerabilities and develop appropriate risk management strategies.

Scenario analysis

This comprehensive approach evaluates project outcomes under different combinations of variables, typically including best-case, worst-case, and most likely scenarios.

By considering multiple variables simultaneously, scenario analysis provides insights into project resilience under different market conditions and helps in developing contingency plans.

How to estimate cash flows for capital projects?

The accurate estimation of cash flows is a critical component of the capital budgeting process in financial management, serving as the foundation for project evaluation and decision-making. This systematic approach to cash flow forecasting helps organizations develop realistic projections and make informed investment decisions while considering various financial aspects and market dynamics.

1. Understanding cash flow fundamentals

Cash flow estimation requires a clear distinction between cash versus accrual accounting principles and recognition of relevant versus irrelevant flows.

Organizations must focus on incremental cash flows that directly result from the project, excluding sunk costs and non-cash expenses like depreciation, while considering opportunity costs and indirect effects.

2. Estimating initial investment costs

Initial investment estimation involves comprehensive identification of all upfront expenditures, including equipment purchases, installation costs, training expenses, and site preparation.

Organizations must consider both direct and indirect costs, potential cost escalations, and contingency allowances to ensure an accurate projection of the total initial investment required.

3. Forecasting expected revenue streams

Revenue forecasting requires detailed market analysis, considering factors such as projected sales volumes, pricing strategies, and market penetration rates.

Organizations should incorporate competitive dynamics, industry trends, and potential market shifts while maintaining realistic assumptions about growth rates and market share expectations.

4. Estimating ongoing operating expenses

Operating expense projections should include all direct costs like raw materials, labor, and utilities, as well as indirect costs such as maintenance, insurance, and overhead allocations.

Organizations should bear in mind potential cost escalations, efficiency improvements, and scale economies that might impact operational expenses over the project's lifetime.

5. Considering tax implications

Tax considerations involve analyzing the impact of depreciation, tax shields from interest payments, and applicable tax rates on project cash flows.

Organizations must account for potential changes in tax regulations, available incentives or credits, and the timing of tax payments to accurately reflect after-tax cash flows.

6. Calculating working capital requirements

Working capital needs must be estimated by analyzing inventory levels, accounts receivable, and payable requirements specific to the project.

Organizations should be prepared for seasonal fluctuations, industry payment terms, and potential changes in working capital needs as the project scales or matures over time.

7. Assessing timing and frequency of cash flows

Timing assessment involves mapping out when various cash inflows and outflows are expected to occur throughout the project's lifecycle.

Organizations must take into account seasonal patterns, payment terms, construction or implementation schedules, and potential delays that might affect the timing of cash flows.

8. Utilizing tools and software for precise forecasting

Modern forecasting tools and financial modeling software help organizations create detailed cash flow projections with greater accuracy.

These technologies enable scenario modeling, sensitivity analysis, and real-time adjustments to forecasts based on changing market conditions and project parameters, enhancing the overall quality of estimates.

Fundamental factors influencing the capital budgeting process

The capital budgeting process is influenced by various fundamental factors that significantly impact investment decisions and project outcomes. Understanding these key elements helps organizations make more informed decisions, better assess project viability, and ensure optimal resource allocation while maintaining alignment with strategic objectives and risk management requirements.

1. Cost of capital

● Interest rates and borrowing costs

Organizations must carefully evaluate current and projected interest rates when determining borrowing costs for capital projects. These rates directly impact the overall cost of capital, affecting project viability and required returns. Changes in market conditions can significantly influence financing expenses.

● Required return on investments

Companies establish minimum return requirements based on their cost of capital, risk tolerance, and investor expectations. This threshold helps screen potential projects and ensures investments generate sufficient returns to justify the use of capital while maintaining financial sustainability.

2. Cash flow projections

● Accuracy of revenue forecasts

Precise revenue projections require comprehensive market analysis, historical data evaluation, and consideration of future market conditions. Organizations must account for pricing strategies, market share expectations, and potential changes in customer behavior when estimating future income streams.

● Estimation of operating costs

Detailed analysis of direct and indirect costs, including labor, materials, utilities, and maintenance expenses, is crucial for accurate operating cost projections. Organizations should consider potential cost escalations, efficiency improvements, and economies of scale in their estimates.

3. Risk assessment

● Identification of market risks

Organizations must systematically evaluate potential market risks, including changes in customer preferences, competitive actions, and industry disruptions. This analysis helps develop appropriate risk mitigation strategies and ensures projects can withstand various market challenges.

● Economic and political factors

Assessment of macroeconomic conditions and political stability is crucial for project evaluation. Organizations must consider factors like GDP growth, inflation rates, currency fluctuations, and potential policy changes that could impact project success.

4. Investment duration

● Length of the project lifespan

Project duration affects risk assessment, return expectations, and resource allocation decisions. Organizations must consider technological obsolescence, market changes, and maintenance requirements when determining appropriate project timeframes and investment horizons.

● Impact on cash flow timing

The timing of cash flows influences project valuation and risk assessment. Organizations must carefully evaluate when investments are required and when returns will be generated, considering seasonal variations and potential delays.

5. Market conditions

● Demand and supply dynamics

Understanding market demand patterns and supply chain factors is essential for project evaluation. Organizations must analyze current market conditions, growth potential, and possible disruptions that could affect project success and financial returns.

● Competitive landscape and trends

Analysis of competitor actions, market share distribution, and industry trends helps organizations assess project viability. Understanding competitive advantages, potential market responses, and industry evolution ensures better investment decision-making.

6. Regulatory environment

● Compliance with laws and regulations

Organizations must ensure projects meet all applicable legal requirements and industry standards. This includes environmental regulations, safety standards, licensing requirements, and other compliance matters that could affect project implementation and costs.

● Impact of government policies

Changes in government policies, tax regulations, incentives, and trade policies can significantly influence project viability. Organizations must monitor policy developments and assess their potential impact on project costs, returns, and implementation timelines.

7. Strategic goals

● Alignment with long-term objectives

Projects must support and advance the organization's strategic vision and mission. Evaluation criteria should include how well investments align with long-term growth plans, market positioning, and overall business strategy.

● Focus on growth, sustainability, and innovation

Investment decisions must balance traditional financial returns with broader strategic objectives like sustainable practices, technological advancement, and market expansion. This ensures projects contribute to both immediate profits and long-term value creation.

8. Technological changes

● Advances in technology affecting projects

Organizations must evaluate how technological developments might impact project viability and returns. This includes assessing potential disruptions, opportunities for efficiency improvements, and needs for technological integration or upgrades.

● Need for innovation and upgrades

Continuous technological evolution requires organizations to consider future upgrade requirements and innovation needs. This includes evaluating flexibility for future modifications and potential costs of staying technologically competitive.

9. Stakeholder input

● Consideration of management and investor perspectives

Project evaluation must incorporate feedback from senior management and investor expectations. This includes assessing alignment with management vision, risk tolerance levels, and return expectations of key stakeholders.

● Impact of employee feedback

Input from operational staff and department heads provides valuable insights into project feasibility and implementation challenges. This feedback helps identify potential operational issues and ensures practical considerations are addressed.

10. Financial constraints

● Availability of funds for investment

Organizations must evaluate their current and projected financial capacity to support investments. This includes assessing internal cash reserves, borrowing capacity, and potential access to external funding sources.

● Budget limitations and resource allocation

Careful consideration of budget constraints and optimal resource allocation is crucial. Organizations must prioritize projects within available resources while maintaining sufficient reserves for operational needs and unexpected opportunities.

Unlock smarter spending and budgeting with Volopay

Challenges in the capital budgeting process

Difficulty in estimating cash flows accurately

Projecting future cash flows involves numerous variables and assumptions that can significantly impact project viability.

Organizations struggle with forecasting market conditions, customer behavior, and competitive responses accurately.

The challenge intensifies when projects involve new technologies or markets where historical data is limited or irrelevant to future performance expectations.

Uncertainty in assessing project risks

Identifying and quantifying all potential risks poses a significant challenge, particularly for long-term projects.

Organizations must consider market risks, operational uncertainties, regulatory changes, and technological obsolescence.

The interconnected nature of these risks and their potential compound effects makes comprehensive risk assessment particularly complex and challenging.

Struggle to align projects with strategic goals

Organizations often face difficulties ensuring that proposed investments perfectly align with long-term strategic objectives.

The challenge lies in balancing short-term financial metrics with long-term strategic value, especially when projects offer intangible benefits that are difficult to quantify but crucial for maintaining competitive advantage.

Challenges in engaging stakeholders effectively

Securing meaningful involvement from diverse stakeholders throughout the budgeting process can be challenging.

Different departments may have conflicting priorities and perspectives, making it difficult to achieve consensus.

Communication barriers and varying levels of financial literacy among stakeholders can further complicate the engagement process.

Issues with ensuring reliable data

Obtaining accurate, consistent, and relevant data for project evaluation poses significant challenges.

Organizations struggle with data quality issues, inconsistent reporting formats, and integration problems across different systems.

The challenge intensifies when historical data needs to be adjusted for changing market conditions or new business models.

Complexity in applying the time value of money

Determining appropriate discount rates and adjusting for inflation presents significant challenges, especially in volatile economic environments.

Organizations must consider various factors including risk premiums, cost of capital variations, and changing market conditions while ensuring consistency across different project evaluations and time periods.

Impact of economic uncertainties

Global economic conditions, currency fluctuations, and market volatility create significant challenges in project evaluation.

Organizations must account for potential economic downturns, changing interest rates, and inflationary pressures while maintaining realistic projections that support sound investment decisions in an increasingly interconnected global economy.

Difficulty in using complex evaluation techniques

Advanced evaluation methods often require sophisticated financial modeling skills and a deep understanding of various assumptions.

Many organizations face challenges with implementing complex techniques correctly, particularly when dealing with unusual cash flow patterns or projects with significant strategic options and flexibility.

Limited funding for project priorities

Organizations frequently face constraints in available capital, making it challenging to fund all worthwhile projects.

The difficulty lies in optimally allocating limited resources among competing investment opportunities while maintaining strategic balance and ensuring critical projects receive necessary funding without compromising financial stability.

Challenges in monitoring project performance

Tracking actual performance against projections presents ongoing challenges, particularly for long-term projects.

Organizations struggle with developing effective monitoring systems, establishing relevant performance metrics, and implementing timely corrective actions when deviations occur. Maintaining consistent monitoring across different project stages adds another layer of complexity.

Strategies to overcome challenges associated with the capital budgeting process

1. Conduct thorough cash flow analysis

Develop structured approaches to cash flow estimation using historical data, market research, and expert opinions.

Implement sophisticated forecasting models that consider multiple variables and scenarios.

Create detailed documentation of assumptions and methodologies used in projections to ensure consistency and enable periodic reviews of estimation accuracy.

2. Implement comprehensive risk management practices

Establish systematic risk assessment frameworks that identify, quantify, and prioritize potential risks. Develop specific mitigation strategies for each identified risk category.

Create contingency plans and buffer zones in project timelines and budgets while maintaining regular risk monitoring and updating protocols throughout the project lifecycle.

3. Align projects with strategic objectives

Create clear linkages between project selection criteria and organizational strategic goals. Develop weighted scoring systems that balance financial returns with strategic value.

Implement regular strategy review sessions to ensure ongoing alignment and adjust project parameters as needed to maintain strategic fit over time.

4. Foster open stakeholder communication

Establish regular communication channels and feedback mechanisms among all stakeholders. Create structured processes for gathering and incorporating diverse perspectives into decision-making.

Develop clear documentation and reporting protocols that ensure transparency and maintain stakeholder engagement throughout the project lifecycle.

5. Utilize reliable data sources

Implement robust data collection and verification systems to ensure accuracy and consistency. Establish partnerships with reliable market research firms and industry experts.

Create standardized data collection templates and validation processes while maintaining comprehensive documentation of data sources and assumptions.

6. Apply appropriate discount rates

Develop systematic approaches to determining discount rates that reflect project-specific risks and market conditions. Regularly review and update discount rate calculations to reflect changing economic conditions.

Create clear guidelines for applying different rates to various project types and risk categories.

7. Monitor economic trends regularly

Establish systems for tracking relevant economic indicators and market trends affecting project viability. Develop relationships with economic research firms and industry analysts.

Create regular reporting mechanisms that highlight potential economic impacts on ongoing and planned projects while maintaining flexible response strategies.

8. Simplify evaluation techniques used

Develop standardized evaluation templates that balance complexity with usability. Create clear guidelines for selecting appropriate evaluation methods based on project type and size.

Provide regular training sessions to ensure proper understanding and application of evaluation techniques across the organization.

9. Explore diverse funding options

Research and maintain relationships with various funding sources including banks, investors, and strategic partners. Develop creative financing structures that optimize capital allocation.

Create clear criteria for selecting appropriate funding sources based on project characteristics and organizational capabilities while maintaining optimal capital structure.

10. Perform regular post-implementation reviews

Establish systematic processes for conducting post-implementation evaluations of completed projects. Create detailed documentation of lessons learned and best practices.

Implement feedback mechanisms to incorporate insights into future project evaluations while maintaining a database of historical project performance for reference.

KPIs for capital budgeting process

Key Performance Indicators (KPIs) play a vital role in measuring the effectiveness of capital budgeting decisions and monitoring project performance. These metrics help organizations track project success, identify areas for improvement, and ensure investments deliver expected returns while maintaining alignment with strategic objectives.

Net Present Value (NPV)

This fundamental KPI measures the project's absolute value contribution by comparing present values of expected cash inflows with outflows.

Organizations should track both projected and actual NPV throughout the project lifecycle, establishing specific thresholds for acceptable performance and regularly monitoring variations from initial estimates.

Internal Rate of Return (IRR)

IRR serves as a crucial metric for comparing projects of different sizes and durations by calculating the rate that makes NPV zero.

Organizations should monitor actual versus projected IRR, establish minimum acceptable rates based on the cost of capital, and regularly assess whether projects maintain required return levels throughout implementation.

Payback Period

This KPI tracks the time required to recover the initial investment, providing insights into project liquidity and risk profiles.

Organizations should monitor actual recovery periods against projected timelines, establish maximum acceptable payback periods for different project categories, and regularly assess factors affecting recovery speed.

Return on Investment (ROI)

ROI measures the efficiency of investments by comparing net benefits to costs.

Organizations should track both periodic and cumulative ROI, establish minimum acceptable returns for different project types, and regularly compare actual returns against industry benchmarks while considering risk-adjusted performance metrics.

Profitability Index (PI)

PI evaluates relative profitability by comparing the present value of future cash flows to the initial investment.

Organizations should monitor PI throughout project implementation, establish minimum acceptable ratios for different investment categories, and regularly assess how changing conditions affect project profitability rankings.

Cash flow variance

This metric tracks differences between projected and actual cash flows, helping identify potential issues early.

Organizations should establish acceptable variance thresholds, analyze causes of significant deviations, and implement corrective actions while maintaining detailed records of variance patterns and their underlying causes.

Cost of capital

Monitoring the weighted average cost of capital helps ensure project returns exceed financing costs.

Organizations should regularly review and update the cost of capital calculations, assess the impacts of changing market conditions, and adjust project expectations while maintaining optimal capital structure.

Project completion rate

This KPI measures progress against planned implementation timelines and milestones.

Organizations should track completion percentages, identify causes of delays, and assess impacts on project returns while maintaining clear documentation of progress and implementing corrective actions when necessary.

Asset utilization rate

This metric evaluates how effectively invested capital is being used to generate returns.

Organizations should monitor utilization levels against industry standards, identify opportunities for improvement, and regularly assess whether assets are delivering expected productivity while maintaining optimal operational efficiency.

Budget variance

This KPI tracks differences between planned and actual project costs.

Organizations should establish acceptable variance thresholds, analyze causes of cost overruns or savings, and implement appropriate control measures while maintaining detailed documentation of variance patterns and corrective actions taken.

Simplify your capital budgeting process with Volopay!

Role of stakeholder engagement in the capital budgeting process

Stakeholder engagement is a crucial element of successful capital budgeting, ensuring that investment decisions consider multiple perspectives and maintain broad organizational support. Effective stakeholder involvement helps create more robust project evaluations, better risk management, and a stronger commitment to project success across the organization.

Incorporates diverse stakeholder perspectives

Active engagement with various stakeholders brings valuable insights from different organizational viewpoints, including operations, finance, marketing, and technical teams.

This diversity of perspectives helps identify potential challenges, opportunities, and implementation considerations that might be overlooked when relying on a single department's analysis.

Engages stakeholders in recognizing risks

Stakeholders from different areas of the organization can identify unique risks based on their specific expertise and experience.

This collaborative approach to risk identification helps create more comprehensive risk assessments, develops more effective mitigation strategies, and ensures potential challenges are addressed early in the planning process.

Ensures projects meet strategic goals

Involving key stakeholders in the project evaluation process helps ensure that selected investments align with broader organizational objectives.

This alignment process helps validate that projects not only meet financial criteria but also support strategic initiatives and contribute to long-term organizational success.

Builds commitment for project success

Early and consistent stakeholder involvement creates a sense of ownership and commitment to project outcomes.

When stakeholders feel their input is valued and incorporated into decision-making, they are more likely to support implementation efforts and actively contribute to project success.

Optimizes resources based on needs

Stakeholder engagement helps organizations better understand resource requirements and constraints across different departments.

This understanding enables more effective resource allocation, ensures realistic project planning, and helps identify potential synergies or conflicts in resource utilization across multiple projects.

Promotes transparency throughout the process

Regular stakeholder communication and involvement create transparency in the capital budgeting process.

This openness helps build trust, ensures decisions are well-understood across the organization, and creates clear accountability for project outcomes while maintaining strong organizational support for investment decisions.

Role of capital budgeting process in project management

The capital budgeting process serves as a fundamental framework within project management, providing structured approaches for the evaluation, implementation, and monitoring of investment initiatives.

This systematic process helps organizations make informed decisions about resource allocation while ensuring projects deliver expected returns and align with strategic objectives.

1. Allocates resources effectively to projects

Capital budgeting enables systematic resource allocation by evaluating project requirements against available resources.

This process helps organizations prioritize investments based on expected returns, strategic importance, and resource constraints while ensuring optimal distribution of limited resources across multiple projects.

2. Assesses project feasibility before initiation

Through comprehensive feasibility analysis, capital budgeting helps determine whether projects are viable from financial, technical, and operational perspectives.

This evaluation process identifies potential challenges early, validates assumptions, and ensures projects have realistic chances of success before significant resources are committed.

3. Identifies risks during project planning

The capital budgeting process incorporates systematic risk assessment during project planning phases.

This helps project managers identify potential threats, develop mitigation strategies, and create contingency plans while ensuring risk factors are properly considered in project evaluation and implementation decisions.

4. Measures project profitability and success

By establishing clear financial metrics and performance indicators, capital budgeting provides frameworks for measuring project success.

This enables project managers to track progress, assess actual returns against projections, and make necessary adjustments while maintaining focus on achieving desired outcomes.

5. Aligns projects with organizational objectives

Capital budgeting ensures selected projects support broader organizational goals by evaluating strategic fit alongside financial returns.

This alignment process helps project managers maintain focus on strategic objectives while delivering project outcomes that contribute to long-term organizational success.

6. Communicates project benefits to stakeholders

The process provides structured approaches for articulating project benefits and expected returns to various stakeholders.

This helps project managers build support for initiatives, secure necessary resources, and maintain stakeholder engagement throughout project implementation.

7. Supports data-driven project decision-making

Capital budgeting frameworks encourage evidence-based decision-making throughout the project lifecycle.

This helps project managers make informed choices about resource allocation, timeline adjustments, and scope changes while maintaining focus on achieving optimal project outcomes.

8. Forecasts project cash flow needs

Through detailed cash flow analysis, capital budgeting helps project managers anticipate funding requirements and timing.

This enables better planning for resource needs, helps prevent cash flow shortages, and ensures projects maintain adequate funding throughout implementation phases.

9. Monitors project timelines and budgets

The process establishes monitoring frameworks for tracking project progress against planned timelines and budgets.

This helps project managers identify deviations early, implement corrective actions promptly, and maintain project control while ensuring efficient resource utilization.

10. Reviews project outcomes for improvements

Capital budgeting includes post-implementation review processes that help evaluate project success and identify lessons learned.

This enables project managers to improve future project planning, enhance evaluation techniques, and optimize implementation strategies based on actual experience.

Practical applications of capital budgeting process

The process of capital budgeting finds practical application across various business initiatives, helping organizations make informed decisions about significant investments. Understanding these real-world applications demonstrates how capital budgeting principles can be effectively utilized to evaluate and implement different types of projects across various business contexts.

Launching new products

Capital budgeting helps organizations evaluate the viability of new product launches by analyzing development costs, market potential, and expected returns.

The process considers research and development expenses, marketing costs, production requirements, and competitive factors while assessing the product's potential success and alignment with market demands.

Expanding facilities

When considering facility expansion, capital budgeting provides frameworks for evaluating construction costs, equipment needs, and operational implications.

The process helps analyze location benefits, capacity requirements, and potential revenue increases while considering factors like market demand, workforce availability, and regulatory requirements.

Upgrading equipment

Capital budgeting supports decisions about equipment upgrades by comparing the costs of new equipment with potential productivity gains and maintenance savings.

The process evaluates factors like technological advancement, operational efficiency improvements, and competitive advantages while considering the timing and impact of equipment replacement.

Investing in technology

For technology investments, capital budgeting helps assess the value of digital transformation initiatives and IT infrastructure upgrades.

The process evaluates implementation costs, efficiency gains, and potential competitive advantages while considering factors like technological obsolescence, integration requirements, and staff training needs.

Developing infrastructure

Infrastructure development decisions benefit from capital budgeting through a comprehensive analysis of long-term costs and benefits.

The process evaluates construction expenses, maintenance requirements, and operational improvements while considering factors like regulatory compliance, environmental impact, and future expansion possibilities.

Entering new markets

Capital budgeting guides market entry decisions by evaluating setup costs, market potential, and competitive dynamics.

The process analyzes factors like market research costs, marketing expenses, distribution requirements, and regulatory compliance while assessing potential returns and risks in new markets.

Conducting mergers and acquisitions

The process helps evaluate potential mergers and acquisitions by analyzing purchase prices, integration costs, and expected synergies.

Capital budgeting considers factors like market valuation, operational integration, cultural alignment, and potential revenue enhancements while assessing overall transaction viability.

Implementing sustainability initiatives

Capital budgeting supports the evaluation of sustainability projects by analyzing implementation costs against long-term environmental and financial benefits.

The process considers factors like energy savings, regulatory compliance, stakeholder expectations, and potential incentives while assessing the overall impact on organizational sustainability goals.

Funding research and development

Research and development investments are evaluated through capital budgeting by analyzing potential returns against uncertain outcomes.

The process considers factors like development timelines, success probabilities, market potential, and competitive advantages while assessing the strategic value of innovation investments.

Manage your capital budget with Volopay!

How can technology improve the capital budgeting process?

Technology plays a transformative role in modernizing and streamlining the process of capital budgeting. By leveraging advanced tools and digital solutions, organizations can enhance the accuracy, efficiency, and effectiveness of their investment decisions while maintaining better control over project implementation and monitoring.

1. Automated data entry minimizes errors

Advanced automation technologies reduce manual data entry requirements, significantly decreasing the likelihood of human errors in financial calculations.

These systems can automatically import data from various sources, validate information against predefined parameters, and flag potential discrepancies while maintaining consistent data formats across projects.

2. Predictive analytics improves cash flow

Modern predictive analytics tools utilize historical data and market trends to generate more accurate cash flow projections.

These technologies can identify patterns, account for seasonal variations, and incorporate multiple variables to create sophisticated forecasting models that help organizations better anticipate future cash flow requirements.

3. Integrated software enhances reporting efficiency

Integration of various financial and project management software streamlines the reporting process by automatically consolidating data from multiple sources.

These systems generate standardized reports, custom analytics, and real-time updates while ensuring consistency in reporting formats and reducing time spent on manual report preparation.

4. Risk assessment tools quantify uncertainties

Sophisticated risk assessment technologies help organizations better identify, quantify, and analyze potential project risks.

These tools can simulate various risk scenarios, calculate probability-weighted outcomes, and provide detailed risk analysis reports while helping organizations develop more effective risk mitigation strategies.

5. Centralized dashboard to deliver actionable insights

Digital dashboards provide real-time visibility into project performance metrics and key indicators.

These centralized platforms enable quick access to critical information, highlight potential issues, and facilitate prompt decision-making while maintaining clear visualization of project progress and performance trends.

6. Scenario analysis evaluates multiple outcomes

Advanced modeling tools enable organizations to quickly analyze multiple project scenarios and their potential outcomes.

These technologies can process complex variables, generate comparative analyses, and provide detailed insights into different project alternatives while maintaining consistency in evaluation methodologies.

7. Compliance systems ensure regulatory adherence

Automated compliance systems help organizations maintain adherence to regulatory requirements throughout the capital budgeting process.

These tools track regulatory changes, flag potential compliance issues, and maintain detailed audit trails while ensuring all investment decisions meet necessary legal and regulatory standards.

8. Mobile access facilitates timely decisions

Mobile technologies enable stakeholders to access project information and make decisions from any location.

These solutions provide secure remote access to critical data, enable quick approvals, and facilitate real-time communication while maintaining necessary security protocols and data protection.

9. User-friendly interfaces enhance usability

Modern software interfaces make complex financial analysis tools more accessible to various stakeholders.

These user-friendly designs simplify navigation, provide intuitive workflows, and offer customizable views while maintaining robust functionality for advanced users and detailed analysis requirements.

Simplify your capital budgeting process with Volopay

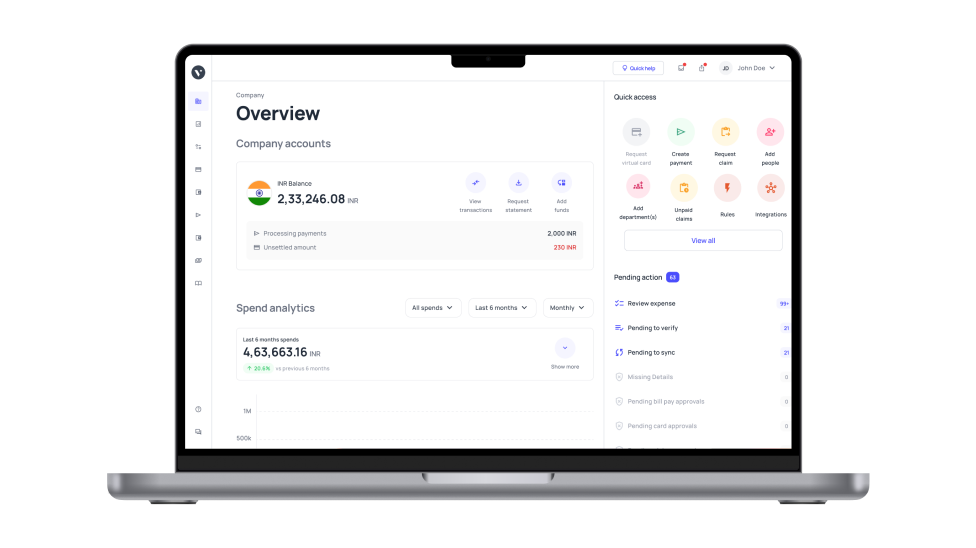

Volopay's business budgeting software streamlines and simplifies the capital budgeting process by automating tasks and offering better visibility into financial data. This solution allows organizations to maintain tighter control over spending, reduce manual effort, and enhance the accuracy of financial tracking and reporting.

Automated expense tracking

Volopay automatically captures and categorizes expenses in real time, eliminating manual data entry requirements. This automation helps organizations maintain accurate records of project-related expenses, track spending patterns, and identify cost-saving opportunities while reducing the risk of human error.

Real-time financial reporting

Volopay also provides instant access to financial data and generates comprehensive reports on demand. Real-time reporting capabilities help organizations monitor project expenses, track budget utilization, and make informed decisions quickly while maintaining clear visibility into financial performance across different projects.

Integration with accounting software

Seamless integration with existing accounting systems ensures smooth data flow between different financial platforms. This integration eliminates the need for manual data transfer, reduces reconciliation efforts, and maintains consistency in financial records while streamlining the overall accounting process.

Customizable spending controls

Volopay's advanced expense management solutions allow organizations to set up customized spending limits and approval rules. Volopay’s controls help prevent unauthorized expenses, ensure compliance with budget allocation, and maintain proper oversight while providing flexibility to adjust rules based on project requirements.

Multi-level approval workflows

Advanced multi approval workflows streamline the process of reviewing and authorizing expenses across different organizational levels. These automated workflows reduce approval delays, maintain clear audit trails, and ensure proper validation of expenses while accommodating complex organizational structures.

Automated reconciliation

Software-driven reconciliation processes automatically match expenses with corresponding transactions and receipts. This automation reduces manual reconciliation efforts, identifies discrepancies quickly, and maintains accurate financial records while saving significant time for finance teams.

User-friendly dashboard

Volopay’s intuitive dashboards provide a clear visualization of expense data and key metrics in an easily digestible format. These interfaces help stakeholders quickly understand spending patterns, track budget utilization, and identify trends while maintaining easy access to detailed information when needed.

Instant alerts for policy violations

Automated monitoring systems immediately flag expenses that violate predetermined policies or exceed budget limits. These alerts help organizations maintain spending control, prevent policy breaches, and take corrective action promptly while ensuring compliance with established guidelines.

OCR technology for receipt management

Volopay’s Magic Scan—AI-powered Optical Character Recognition technology—automatically extracts and processes information from receipts and invoices. This feature eliminates manual data entry, reduces processing time, and improves accuracy in expense recording while maintaining digital records for future reference and audit purposes.

Empower your finances with Volopay!

FAQs

Essential data includes projected cash flows, initial investment costs, operating expenses, market analysis, industry trends, competitor information, risk factors, and expected returns over the project's lifetime.

Organizations should conduct quarterly reviews of ongoing projects and annual comprehensive evaluations of the entire capital budgeting process to ensure effectiveness and identify necessary improvements.

Inflation affects project costs, revenue projections, and discount rates, requiring organizations to adjust cash flow estimates and use real rather than nominal values in calculations.

Financial ratios help evaluate project viability by measuring profitability, efficiency, and risk metrics, providing standardized benchmarks for comparing different investment opportunities against set criteria.

Benchmarking compares project performance metrics against industry standards and historical data to assess competitiveness and identify areas for improvement in investment decision-making processes.

Artificial intelligence, sustainability considerations, real-time data analytics, automated risk assessment tools, and integration of ESG factors are transforming modern capital budgeting practices.