👋 Exciting news! UPI payments are now available in India! Sign up now →

Cost accounting - Definition, techniques, and formula

Cost accounting is a crucial aspect of any successful business. It involves tracking, analyzing, and reporting on a company's expenses to make informed decisions about production, pricing, and overall profitability.

By understanding your true costs, you can identify areas for improvement, optimize your operations, and gain a competitive edge. Cost accounting provides valuable insights into your business's financial health, allowing you to make data-driven decisions that drive growth and success.

What is cost accounting?

Cost accounting is a specialized branch of accounting that focuses on tracking, analyzing, and reporting a company's expenses. Unlike financial accounting, which primarily deals with external reporting, cost accounting provides valuable insights for internal management decisions.

● Tracking: Cost accounting meticulously records all costs associated with producing goods or services. This includes direct costs like raw materials and labor, as well as indirect costs like rent, utilities, and administrative expenses.

● Analyzing: The recorded costs are then analyzed to understand their behavior. This involves categorizing costs as fixed (unchanging with production volume) or variable (changing with production volume).

● Reporting: Cost accounting reports provide crucial information for management, such as the cost of producing each unit, identifying cost-effective production methods, and determining the most profitable products or services.

By understanding these cost dynamics, businesses can make informed decisions about pricing, production volumes, resource allocation, and overall profitability.

Importance of cost accounting for businesses

Cost accounting plays a vital role in the success of any business, covering key areas like investment evaluation, resource allocation, risk assessment, and profitability enhancement.

By providing valuable insights into a company's expenses, including factors like amortization of assets, it empowers businesses to make informed decisions that drive profitability and growth.

Evaluates investment opportunities

Cost accounting helps businesses evaluate the potential return on investment (ROI) of different projects. By accurately estimating the costs associated with a new product, expansion, or technology upgrade, businesses can determine if the expected benefits outweigh the financial outlay.

Allocates financial resources efficiently

By identifying and analyzing cost drivers, cost accounting helps businesses allocate their financial resources effectively. This includes managing petty cash accounting, ensuring funds are directed to critical areas, maximizing productivity, and minimizing waste.

Assesses risks

Cost accounting helps businesses identify and assess potential risks. By analyzing cost variances and identifying unexpected expenses, businesses can proactively address potential challenges and mitigate potential losses.

Increases profitability and value

By optimizing production processes, identifying cost-saving opportunities, and setting competitive pricing strategies, cost accounting directly contributes to increased profitability and enhances the overall value of the business.

Aligns with strategic goals

Cost accounting provides the data necessary to align business operations with strategic goals. By tracking costs associated with different departments and projects, businesses can ensure that their activities are contributing to the overall success of the company.

Keeps projects within budget

Cost accounting provides a framework for tracking project expenses and identifying potential cost overruns. This helps businesses stay within budget, avoid financial setbacks, and ensure the successful completion of projects.

Supports growth and competitiveness

By identifying cost-effective production methods and optimizing operations, cost accounting empowers businesses to remain competitive in the market. This allows them to offer competitive pricing, improve product quality, and achieve sustainable growth.

Prioritizes high ROI investments

Cost accounting helps businesses prioritize investments that offer the highest potential return. By analyzing the costs and benefits of different options, businesses can make informed decisions that maximize their financial resources and drive long-term success.

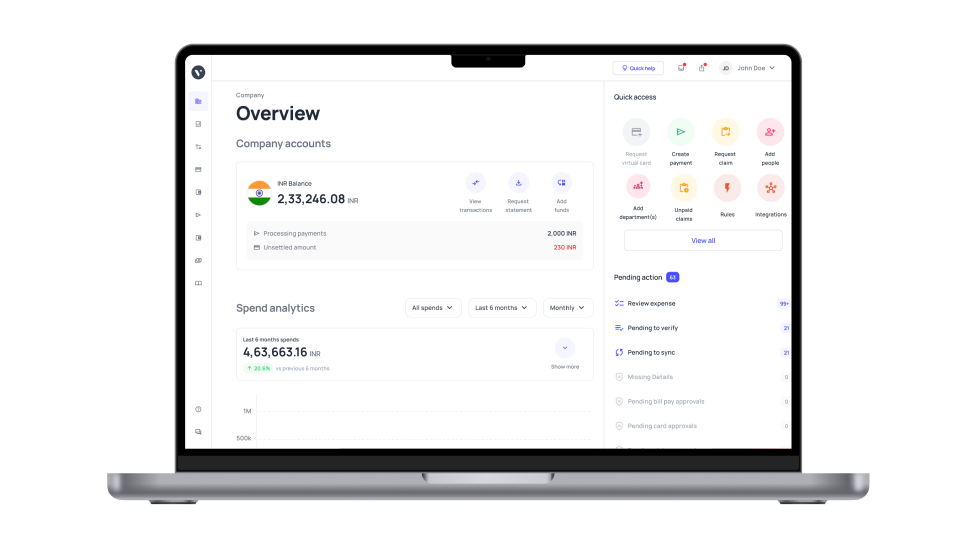

Take control of cost accounting with Volopay

Step-by-step process of cost accounting

Cost accounting involves a systematic process of collecting, analyzing, and reporting financial data. This multi-step process helps businesses understand their expenses, make informed decisions, and improve overall profitability.

1. Identify cost objects

The first step is to identify the specific "cost objects" that need to be analyzed. These could be products, services, departments, customers, or any other entity for which costs need to be determined.

2. Classify cost categories

Costs are then classified into different categories, such as direct materials, direct labor, manufacturing overhead, selling expenses, and administrative expenses. This classification helps in understanding the composition of total costs.

3. Record cost data

Accurate and timely recording of all relevant cost data is crucial. This involves maintaining detailed records of all expenses incurred, including purchases, labor costs, and overhead expenses.

4. Allocate indirect costs

Indirect costs, such as rent and utilities, need to be allocated to specific cost objects. Various methods, such as direct labor hours, machine hours, and activity-based costing, are used to allocate these costs accurately.

5. Analyze cost behavior

Cost behavior analysis helps in understanding how costs change in response to changes in production volume or other factors. This involves identifying fixed costs, variable costs, and mixed costs.

6. Prepare cost reports

Cost reports are prepared to summarize and communicate cost information to management. These reports may include income statements, balance sheets, cost of goods sold statements, and various cost analyses.

7. Estimate future costs

Cost accounting techniques are used to estimate future costs based on historical data, production forecasts, and other relevant factors. This information is crucial for budgeting, pricing decisions, and strategic planning.

8. Compare actual costs

Actual costs are compared to budgeted or standard costs to identify variances. Variance analysis helps pinpoint areas of inefficiency and identify opportunities for cost reduction.

9. Control cost efficiency

Based on the analysis of cost data, businesses can implement measures to improve cost efficiency. This may involve streamlining production processes, negotiating better prices with suppliers, and improving resource utilization.

By following these steps, businesses can effectively implement cost accounting systems to gain valuable insights into their expenses, make informed decisions, and improve their overall financial performance.

Classification of costs in cost accounting

Costs can be classified in various ways to facilitate analysis and decision-making. Understanding these cost classifications is crucial for effective cost management and control.

Fixed costs

Fixed costs remain constant regardless of the level of production or sales. Examples include rent, salaries of permanent employees, and insurance premiums. These costs must be incurred even if no products are produced or sold.

Variable costs

Variable costs change directly in proportion to the level of production or sales. Examples include direct materials, direct labor, and sales commissions. As production increases, variable costs also increase proportionately.

Direct costs

Direct costs are directly traceable to a specific product or service. Examples include direct materials used in manufacturing a product and the wages of workers directly involved in its production.

Indirect costs

Indirect costs cannot be directly traced to a specific product or service. Examples include rent, utilities, and the salaries of supervisors. These costs are allocated to products or services using appropriate allocation methods.

Sunk costs

Sunk costs are past expenses that cannot be recovered. For example, the cost of purchasing equipment that is now obsolete is a sunk cost. Sunk costs should not influence current decision-making.

Marginal costs

Marginal cost is the additional cost incurred to produce one more unit of output. It represents the change in total cost resulting from a one-unit increase in production.

Opportunity costs

Opportunity cost is the value of the next best alternative forgone. When a business chooses one course of action, it forgoes the opportunity to pursue other alternatives. The value of those forgone opportunities represents the opportunity cost.

Operating costs

Operating costs are the expenses incurred in the day-to-day running of a business. These include costs related to production, sales, and administrative activities.

Non-operating expenses

Non-operating expenses are expenses that are not directly related to the primary operations of the business. Examples include interest expenses, losses on investments, and gains on the sale of assets.

Transform your cost accounting with Volopay now!

Techniques of cost accounting

These techniques provide businesses with various tools to track, analyze, and report costs, enabling informed decision-making and improved profitability.

1. Job order costing

Job order costing is used for unique products or services where costs are accumulated separately for each job or order. This method is suitable for businesses like construction companies, custom furniture makers, and advertising agencies.

2. Process costing

Process costing is used for mass production of identical units. Costs are accumulated for each process or department involved in production, and then averaged across all units produced. This method is suitable for industries like oil refineries and beverage manufacturers.

3. Activity-based costing (ABC)

Activity-based costing (ABC) allocates overhead costs based on the activities that drive those costs. This method provides a more accurate picture of product costs by identifying and costing individual activities involved in production.

4. Standard costing

Standard costing establishes predetermined costs for materials, labor, and overhead. Actual costs are then compared to these standards to identify variances and pinpoint areas for improvement.

5. Marginal costing

Marginal costing focuses on the change in total cost resulting from a one-unit increase in production. It helps in decision-making regarding pricing, production levels, and special orders.

6. Absorption costing

Absorption costing allocates all manufacturing costs, including both fixed and variable costs, to products. This method is required for external financial reporting under Generally Accepted Accounting Principles (GAAP).

7. Direct costing

Direct costing only includes variable manufacturing costs in the cost of goods sold. Fixed manufacturing costs are treated as period expenses and are deducted from operating income.

8. Variable costing

Variable costing is similar to direct costing, as it only includes variable manufacturing costs in the cost of goods sold. It is useful for internal management decisions, such as pricing and short-term profit planning. Direct costing and variable costing are often used interchangeably.

9. Contract costing

Contract costing is used for large, complex projects, such as construction contracts or shipbuilding. Costs are tracked separately for each contract, and revenue is recognized as work progresses.

Formulas for cost accounting

Cost accounting involves the use of various formulas to calculate key financial metrics. These formulas are essential for understanding cost behavior, making informed decisions, and improving profitability.

It provides a foundation for understanding and applying cost accounting principles in various business scenarios.

Total Cost (TC)

● Meaning

Total cost represents the sum of all expenses incurred in producing a specific good or service.

● Formula

Total Cost (TC) = Fixed costs + Variable costs

● Example

If fixed costs are INR 50,000 and variable costs per unit are INR 10, and the company produces 10,000 units, then:

Total Variable Costs = INR 10/unit * 10,000 units = INR 1,00,000

Total Cost = INR50,000 (Fixed) + INR 1,00,000 (Variable) = INR 1,50,000

Cost of Goods Sold (COGS)

● Meaning

COGS represents the direct costs associated with producing the goods sold during a specific period.

● Formula

COGS = Beginning inventory + Purchases - Ending inventory

● Example

If beginning inventory is INR 20,000, purchases during the period are INR 100,000, and ending inventory is INR 30,000, then:

COGS = INR 20,000 + INR 1,00,000 - INR 30,000 = INR 90,000

Break-even Point (BEP)

● Meaning

The break-even point is the level of sales at which total revenue equals total costs, resulting in neither profit nor loss.

● Formula

In units: BEP (units) = Fixed costs / (Unit Selling Price - Unit variable cost)

In sales dollars: BEP (sales) = Fixed costs / Contribution Margin Ratio

● Example

If fixed costs are INR 1,00,000, selling price per unit is INR 50, and variable cost per unit is INR 30, then:

BEP (units) = INR 1,00,000 / (INR 50 - INR 30) = 5,000 units

Contribution Margin Ratio (CMR)

● Meaning

CMR represents the percentage of each sales dollar that contributes towards covering fixed costs and generating profit.

● Formula

Contribution Margin Ratio = (Unit Selling Price - Unit Variable Cost) / Unit Selling Price

● Example

If the selling price per unit is INR 50 and the variable cost per unit is INR 30, then:

CMR = (INR 50 - INR 30) / INR 50 = 0.4 or 40%

Operating Profit (EBIT)

● Meaning

EBIT (Earnings Before Interest and Taxes) represents the profit generated from a company's core operations.

● Formula

EBIT = Total revenue - Total costs

● Example

If total revenue is INR 5,00,000 and total costs are INR 4,00,000, then:

EBIT = INR 5,00,000 - INR 4,00,000 = INR 1,00,000

Net Profit (NP)

● Meaning

Net profit represents the final profit after all expenses, including interest and taxes, have been deducted from revenue.

● Formula

Net Profit = EBIT - Interest expense - Taxes

● Example

If EBIT is INR 1,00,000, interest expense is INR 10,000, and taxes are INR 20,000, then:

Net Profit = INR 1,00,000 - INR 10,000 - INR 20,000 = INR 70,000

Cost-Volume-Profit (CVP) Analysis

● Meaning

CVP analysis examines the relationship between sales volume, costs, and profit. It helps businesses understand how changes in these factors will impact profitability.

● Formula

Various formulas are used in CVP analysis, including those for calculating break-even point, target profit sales volume, and margin of safety.

Overhead Rate (OR)

● Meaning

Overhead rate is used to allocate indirect costs (overhead) to products or services.

● Formula

Overhead Rate = Estimated total overhead costs / Estimated activity level

● Example

If estimated total overhead costs are INR 2,00,000 and the estimated activity level (e.g., direct labor hours) is 10,000 hours, then:

Overhead Rate = INR 2,00,000 / 10,000 hours = INR 20 per direct labor hour

Boost efficiency with accounting automation

Key factors affecting the cost accounting process

Several factors interact and influence the cost accounting process in complex ways. Effective cost accounting systems must be flexible and adaptable to these changing internal and external influences.

1. Production volume

Production volume significantly impacts cost behavior. High production volumes can lead to economies of scale, reducing per-unit costs.

Conversely, low production volumes can increase per-unit costs due to underutilization of resources and higher fixed costs per unit.

2. Cost structure

A company's cost structure, comprising the mix of fixed and variable costs, influences its profitability and risk. High fixed costs can increase the break-even point, while high variable costs can impact profitability at different sales volumes.

3. Economic conditions

Economic factors like inflation, interest rates, and exchange rates can significantly impact input costs (materials, labor) and overall business expenses. These fluctuations directly affect the accuracy and relevance of cost accounting data.

4. Business strategy

A company's strategic goals, whether focused on cost leadership, differentiation, or niche market focus, will influence its cost accounting needs. Different strategies require different levels of cost detail and analysis to support decision-making.

5. Technological advancements

Technological advancements can automate data collection, improve production efficiency, and introduce new costing methods.

For example, automation can reduce labor costs, while new technologies like 3D printing can change production processes and associated costs.

6. Market competition

Competitive pressures can force businesses to closely monitor costs to remain competitive. Cost accounting provides the data needed to identify areas for cost reduction, improve pricing strategies, and maintain profitability in a competitive market.

7. Regulatory requirements

Government regulations, such as accounting standards (e.g., GAAP), environmental regulations, and labor laws, can significantly impact the cost accounting process. Compliance with these regulations adds complexity and may increase costs.

Particularly in India, The Companies Act of 2013 is the main law that governs most accounting rules. Certain classes of businesses are required by Section 148 of the Act to keep cost accounting records and have them audited by a certified cost accountant. Accurate cost accounting procedures, increased transparency, and improved corporate governance are the goals of these rules.

Disclaimer: This information is for general knowledge and informational purposes only and does not constitute professional legal or financial advice.

8. Labor costs

Labor costs, including wages, benefits, and training, are a major component of overall costs. Factors like labor availability, wage rates, and employee productivity directly impact production costs and profitability.

9. Material costs

Material costs can fluctuate significantly due to factors like supply and demand, commodity prices, and exchange rates. Accurate cost accounting requires careful tracking of material costs and the identification of opportunities for cost reduction through efficient procurement.

10. Management decisions

Management decisions regarding production methods, pricing strategies, and investment in new equipment or technologies can significantly impact costs.

Cost accounting provides the data needed to evaluate the financial implications of these decisions and make informed choices.

Cost accounting vs financial accounting : What’s the difference?

Cost accounting and financial accounting are both branches of accounting, but they serve distinct purposes and cater to different audiences.

Understanding the key differences between these two disciplines is crucial for businesses to make informed decisions and ensure accurate financial reporting.

1. Purpose

● Cost accounting

Primarily focuses on providing information for internal management decision-making. It helps businesses understand and control costs, improve efficiency, and enhance profitability.

● Financial accounting

Focuses on providing financial information to external stakeholders, such as investors, creditors, and regulatory bodies. Its primary goal is to present a fair and accurate picture of the company's financial performance and position.

2. Users

● Cost accounting

Used by internal users like managers, production supervisors, and cost analysts within the organization.

● Financial accounting

Primarily used by external users like investors, creditors, customers, suppliers, and government agencies.

3. Time frame

● Cost accounting

Can involve both historical and future-oriented data. It uses historical data to analyze past performance and forecast future costs for planning and decision-making.

● Financial accounting

Primarily focuses on historical data. It records and reports past financial transactions to provide a snapshot of the company's financial position at a specific point in time.

4. Reporting

● Cost accounting

Reports are for internal use and may vary depending on the specific needs of management. They may include cost of goods sold statements, variance reports, and budgets.

● Financial accounting

Reports adhere to specific accounting standards (like GAAP) and are typically presented in the form of financial statements, including the income statement, balance sheet, and statement of cash flows.

5. Decision-making

● Cost accounting

Provides crucial information for a wide range of management decisions, such as pricing, production planning, product mix decisions, and capital budgeting.

● Financial accounting

Primarily used for external decision-making, such as investment decisions by investors, credit decisions by lenders, and regulatory compliance.

6. Inventory valuation

● Cost accounting

Can use various methods to value inventory, such as FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted average. The choice of method can significantly impact reported profits and cash flow.

● Financial accounting

Generally adheres to specific inventory valuation methods prescribed by accounting standards, which may differ depending on the industry and the company's accounting policies.

7. Cost classification

● Cost accounting

Employs various cost classifications, such as fixed costs, variable costs, direct costs, indirect costs, and product costs, to analyze cost behavior and make informed decisions.

● Financial accounting

Focuses on classifying costs as expenses based on their nature (e.g., cost of goods sold, selling expenses, administrative expenses) for external reporting purposes.

8. Regulations

● Cost accounting

Generally not subject to the same level of regulatory scrutiny as financial accounting. However, some internal controls and procedures may be necessary for accurate cost analysis.

● Financial accounting

Strictly adheres to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which are sets of rules and guidelines for financial reporting.

9. Scope

● Cost accounting

Scope can vary widely depending on the specific needs and complexity of the business. It may involve detailed analysis of production costs, distribution costs, and even customer profitability.

● Financial accounting

Generally focuses on the overall financial performance and position of the company, providing a broader view of its financial health.

10. Examples

● Cost accounting

Calculating the cost of manufacturing a specific product, analyzing the profitability of different customer segments, determining the most cost-effective production method.

● Financial accounting

Preparing financial statements for external stakeholders, analyzing the company's liquidity and solvency, assessing the company's creditworthiness.

While both cost accounting and financial accounting are essential for businesses, they serve distinct purposes and cater to different audiences. Cost accounting provides crucial information for internal management decisions, while financial accounting focuses on external reporting and stakeholder communication.

Effortlessly manage costs with Volopay’s solutions

Challenges in the cost accounting process

Difficulty in accurate data collection

● Gathering accurate and complete cost data can be challenging.

● Data may be scattered across various departments and systems.

● Manual data entry is prone to errors.

● Timely and accurate data collection requires significant effort and resources.

Complexity in allocating indirect costs

● Allocating indirect costs (overhead) to products or services can be complex and subjective.

● Choosing the appropriate allocation method can significantly impact product costs.

● Inaccurate allocation can distort product profitability and mislead management decisions.

Frequent fluctuations in cost structures

Cost structures are constantly evolving due to factors like inflation, changes in technology, and fluctuations in input costs (materials, labor). These fluctuations can make it difficult to accurately track and predict costs, impacting the reliability of cost accounting information.

Difficulty in forecasting future costs

Predicting future costs with accuracy can be challenging due to numerous uncertainties, such as economic conditions, market demand, and technological advancements. Inaccurate cost forecasts can lead to poor decision-making and negatively impact profitability.

Resistance to new accounting methods

Implementing new cost accounting methods, such as activity-based costing (ABC), can face resistance from employees and management. Resistance can arise from concerns about the cost and complexity of implementation, the disruption to existing processes, and the potential for job changes.

Inconsistent reporting across departments

Inconsistent data collection and reporting practices across different departments can lead to inaccuracies and inconsistencies in cost data. This can hinder effective cost analysis and make it difficult to draw meaningful conclusions from cost information.

Outdated or inefficient costing systems

Many companies still rely on outdated and inefficient manual systems for cost accounting. These systems can be time-consuming, error-prone, and unable to handle the complexities of modern business environments.

Implementing modern, automated systems can significantly improve the efficiency and accuracy of cost accounting.

These challenges highlight the need for businesses to continuously review and improve their cost accounting systems to ensure accuracy, relevance, and effectiveness in supporting management decision-making.

Strategies to overcome the challenges in the cost accounting process

Implement automated data collection tools

● Utilize enterprise resource planning (ERP) systems, data warehousing, and other automated tools to streamline data collection and minimize manual entry.

● Integrate data from various sources, such as production systems, purchasing systems, and payroll systems, to ensure data accuracy and consistency.

Adopt activity-based costing (ABC)

Implement ABC to more accurately allocate indirect costs to products or services based on the activities that drive those costs. This provides a more accurate understanding of product profitability and identifies areas for cost reduction.

Monitor and adapt to market changes

● Continuously monitor market trends, economic conditions, and competitor activities.

● Regularly review and adjust cost accounting methods and procedures to reflect changing business conditions and ensure the accuracy and relevance of cost information.

Use predictive analytics for forecasting

● Utilize data analytics and predictive modeling techniques to forecast future costs more accurately.

● Consider factors such as historical cost trends, economic indicators, and industry benchmarks to improve the accuracy of cost forecasts.

Promote training and change management

● Provide comprehensive training to employees on new cost accounting methods and procedures.

● Address employee concerns and resistance to change through effective communication and training programs.

● Foster a culture of continuous improvement and encourage employee feedback on cost accounting processes.

Standardize reporting procedures across departments

● Establish clear and consistent reporting standards across all departments.

● Ensure that data is collected and reported in a uniform manner to avoid inconsistencies and improve the accuracy and reliability of cost information.

Upgrade to automated accounting systems

● Invest in modern, automated accounting software that can streamline processes, improve data accuracy, and provide valuable insights into cost behavior.

● Explore cloud-based solutions for enhanced accessibility, scalability, and data security.

By implementing these strategies, businesses can overcome the challenges associated with the cost accounting process, improve the accuracy and reliability of cost information, and make more informed decisions that drive profitability and success.

Make cost accounting seamless with Volopay today

Why choose an automated accounting software to simplify cost accounting for your business?

In today's fast-paced business environment, manual cost accounting methods can be time-consuming, error-prone, and inefficient. Automating your accounting processes with specialized software can significantly streamline operations and provide valuable insights into your business's financial health.

By leveraging the power of automated accounting software, businesses can streamline their cost accounting processes, improve accuracy, enhance decision-making, and gain a competitive edge in today's dynamic market.

Improves accuracy and reduces errors

Manual data entry is prone to human error, such as typos, miscalculations, and incorrect data entry. Automated accounting software minimizes these errors through automated data entry and validation checks, ensuring data accuracy and reliability.

Saves time on manual tasks

Automating tasks like data entry, invoice processing, and account reconciliations frees up valuable time for accountants and other staff. This allows them to focus on more strategic tasks, such as financial analysis and decision-making.

Provides real-time financial insights

Automated accounting software provides real-time access to financial data, allowing businesses to monitor their financial performance in real-time. This enables timely identification of potential issues and allows for quick corrective action.

Scalable to accommodate business growth

Many accounting software solutions are cloud-based and scalable, allowing businesses to easily adapt their software to accommodate growth in business volume, employee count, and complexity.

Enhances decision-making with detailed reports

Automated accounting software generates a wide range of reports, including profit and loss statements, balance sheets, cash flow statements, and customized reports. These reports provide valuable insights into cost behavior, profitability, and overall business performance, enabling data-driven decision-making.

Ensures compliance with accounting regulations

Many accounting software solutions are designed to comply with relevant accounting standards and regulatory requirements. This helps businesses ensure the accuracy and reliability of their financial reporting and avoid potential penalties.

Integrates with other business systems

Modern accounting software can integrate with other business systems, such as e-commerce platforms, point-of-sale systems, and payroll systems. This seamless integration streamlines data flow and improves overall business efficiency.

Simplifies audit and record tracking

Automated systems maintain a digital audit trail, simplifying the audit process and making it easier to track and access financial records. This can significantly reduce the time and effort required for audits.

Automates tracking of operational costs

Automated accounting software can help track and analyze various operational costs, including inventory costs, labor costs, and overhead expenses. This provides valuable insights into cost drivers and identifies areas for potential cost savings.

Factors to consider before choosing an automated accounting solution for your business

Carefully consider these factors to choose an automated accounting solution that best meets the unique needs of your business and helps you achieve your financial goals.

1. User access controls and permissions

Ensure the software provides granular user access controls and permissions. This allows you to restrict access to sensitive financial data and ensure that only authorized personnel can perform specific tasks.

2. Integration capabilities

Evaluate the software's ability to integrate with other business systems, such as e-commerce platforms, point-of-sale systems, and payroll software. Seamless integration streamlines data flow and improves overall efficiency.

3. Scalability and flexibility

Choose software that can grow with your business. Ensure the solution is scalable to accommodate increasing transaction volumes, employee count, and business complexity.

4. Multi-currency support

If your business deals with international transactions, ensure the software supports multiple currencies. This simplifies accounting for international sales, purchases, and expenses.

5. Mobile access and cloud support

Consider cloud-based solutions that offer mobile access. This allows you to access and manage your finances anytime, anywhere, from any device with an internet connection.

6. Customization facilities

Evaluate the software's customization options and any bespoke solutions offered by it. Ensure the software can be customized to meet your specific business needs and reporting requirements.

7. Tax calculation and compliance

Choose software that can handle complex tax calculations and ensure compliance with relevant tax laws and regulations. This can help you avoid costly penalties and ensure accurate tax filings.

8. Reporting and analytics capabilities

Evaluate the software's reporting and analytics capabilities. Check if the software can generate a wide range of reports, including financial statements, key performance indicators (KPIs), and customized reports to support informed decision-making.

9. Customer reviews

Research customer reviews and testimonials from other businesses that use the software. This can provide valuable insights into the software's strengths and weaknesses, as well as the vendor's customer support.

10. Audit trail and record-keeping

Ensure the software maintains a detailed audit trail of all transactions to facilitate easier audits, improve data integrity, and help with regulatory compliance.

Automate your accounting and reduce errors

Transform cost accounting with Volopay’s automated accounting solution

Volopay's innovative accounting automation platform empowers businesses to revolutionize their cost accounting processes. By automating key aspects of expense management, Volopay helps businesses gain greater control over their finances, improve accuracy, and enhance overall efficiency.

Save time with automated transactions

Volopay automates many time-consuming manual tasks, such as expense approval workflows, reimbursements, and reconciliations. This frees up valuable time for finance teams to focus on strategic initiatives and improve overall productivity.

Improve accuracy with smart triggers

Volopay leverages smart triggers to automate expense categorization and classification. This minimizes human error and ensures accurate cost allocation, leading to more reliable financial data.

Fast accounting integrations for seamless workflows

Seamlessly integrates with popular accounting software like Xero, QuickBooks, Zoho, and NetSuite. This smooth integration streamlines data flow between Volopay and your accounting system, reducing manual data entry and minimizing the risk of errors.

Auto-sync transactions and receipts

Automatically sync all transactions and receipts with your accounting system, providing real-time visibility into your company's financial performance. This eliminates the need for manual data entry and reconciliation.

Automatic categorization and classification

Volopay automatically categorizes and classifies expenses based on predefined rules and machine learning algorithms. This ensures accurate cost allocation and simplifies the process of analyzing and reporting on business expenses.

Prepare and export expenses easily

Volopay simplifies the process of preparing and exporting expense reports. With a few clicks, you can generate detailed reports for analysis and reimbursement purposes.

Streamline financial workflows across platforms

By integrating with various business systems, Volopay streamlines financial workflows across different platforms. This improves efficiency, reduces bottlenecks, and provides a unified view of your company's financial performance.

By leveraging Volopay's innovative features, businesses can significantly transform their cost accounting processes, improve efficiency, reduce costs, and gain valuable insights into their financial performance.

Unlock smarter cost accounting with Volopay

FAQs

Cost drivers are activities or factors that cause costs to change. Identifying cost drivers helps businesses understand how costs behave and make more informed decisions about resource allocation and cost control.

Variances, the difference between actual and budgeted costs, can significantly impact financial performance. Unfavorable variances can erode profitability, while favorable variances can improve financial results. Analyzing variances helps identify areas for improvement and take corrective action.

Cost accounting helps identify and reduce costs during a production slowdown. By analyzing cost behavior and identifying areas of excess capacity, businesses can implement measures like temporary shutdowns, reduced production schedules, and workforce adjustments to minimize costs.

Seasonality can significantly impact costs. Businesses can adjust for seasonality by:

- Analyzing historical cost data to identify seasonal patterns.

- Developing flexible budgets that adjust for seasonal fluctuations in demand.

- Implementing cost control measures during off-seasons to minimize costs.

Sunk costs should not influence current decision-making. Cost accounting helps businesses focus on future costs and potential returns, rather than dwelling on past expenses that cannot be recovered.

Volopay's automatic categorization accurately allocates expenses to the appropriate cost centers, improving the accuracy of overhead cost allocation. This leads to more reliable cost information and better-informed decisions regarding overhead management.

Volopay helps track project-specific expenses, allowing businesses to accurately monitor project costs, identify cost overruns, and make informed decisions about project profitability.

Volopay's multi-user access with granular permissions allows for controlled access to financial data. This facilitates accurate cost allocation across departments while maintaining data security and preventing unauthorized access.