👋 Exciting news! UPI payments are now available in India! Sign up now →

Make business payments anywhere with a global corporate card

Volopay’s corporate cards in India offer a transformative solution for handling global transactions effortlessly. Our global corporate cards streamline payments with features like worldwide acceptance, easy subscription management, and expense tracking.

Enjoy the freedom of no top-up limits and enhanced security, all integrated smoothly with your existing accounting systems. Elevate your financial operations with Volopay's innovative approach to corporate expense management.

Global acceptance—pay anyone, anywhere

Volopay makes it possible to pay international vendors and manage travel expenses when your employees travel for work. Our global corporate cards come with worldwide acceptance—whether you need to pay for a subscription or make a one-time international purchase, these cards can be used to transact in any currency, anywhere.

They can also be used to cover travel expenses (such as bookings, mobility, accommodation, food, and entertainment) for employees on the move.

Hassle-free management of recurring payments

If your business needs to subscribe to a service from an international provider, managing those payments can be a hassle.

Our global corporate cards make it much simpler. These cards can be easily used for recurring payments, which means you can set up SaaS payments anywhere in the world.

Manage subscriptions easily from the Volopay dashboard, while ensuring that necessary software services are never impacted.

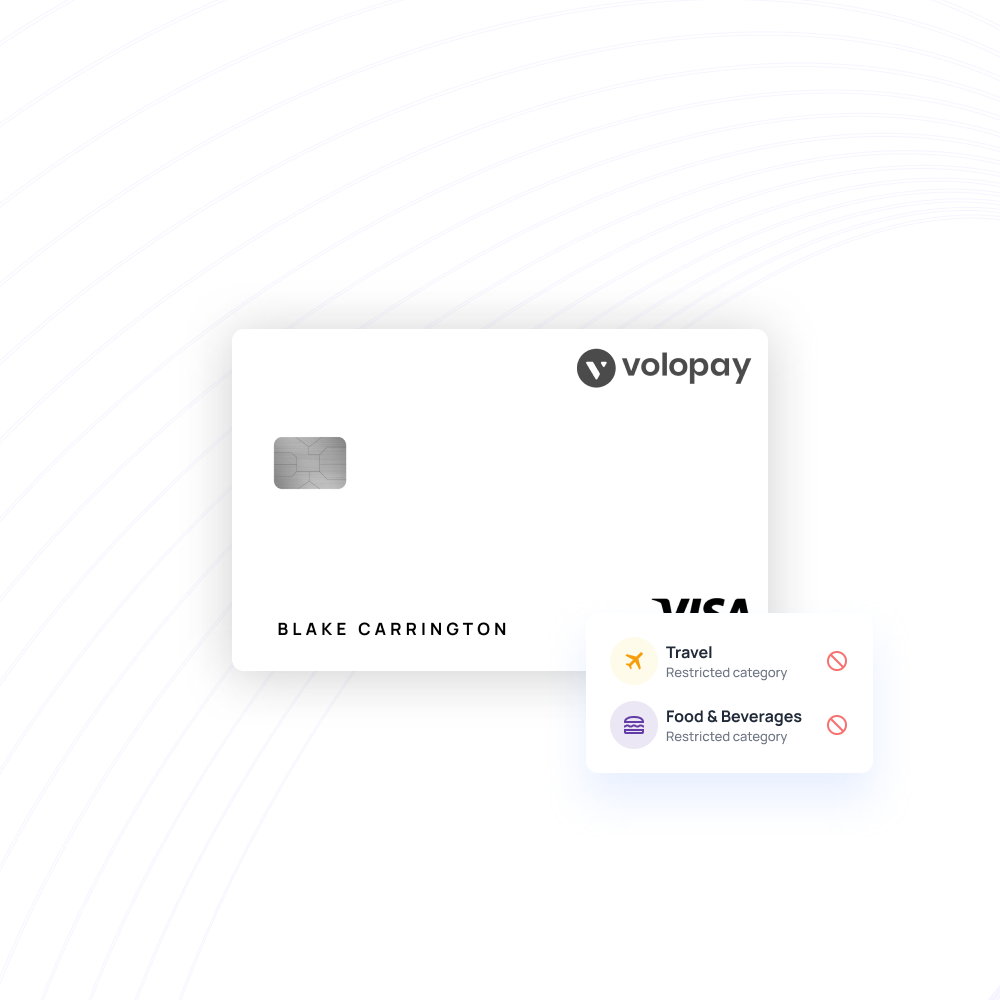

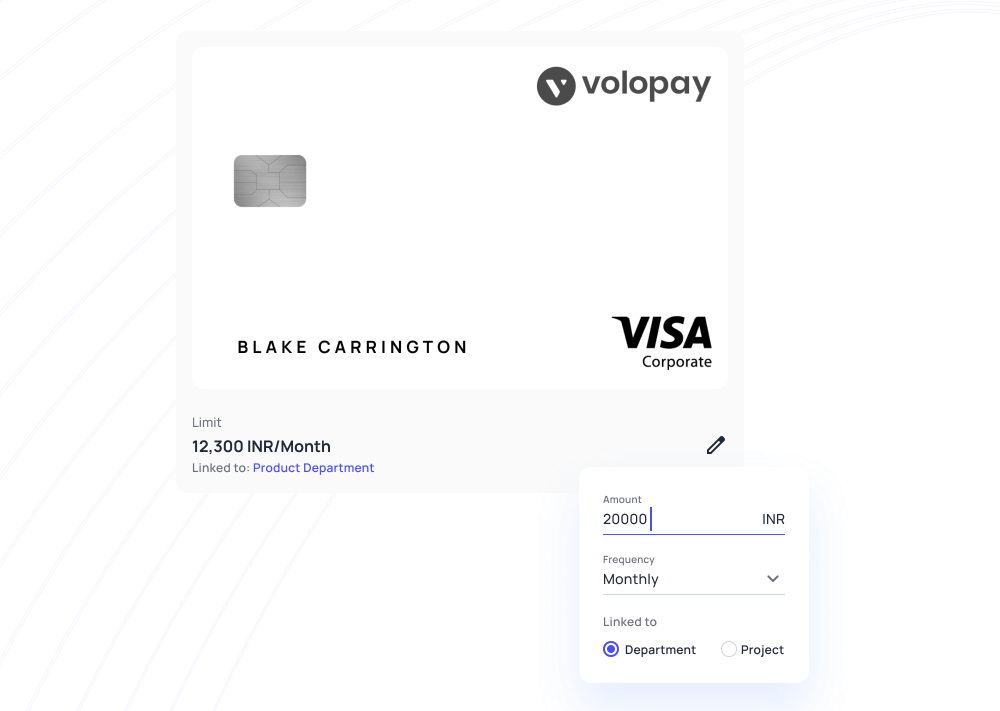

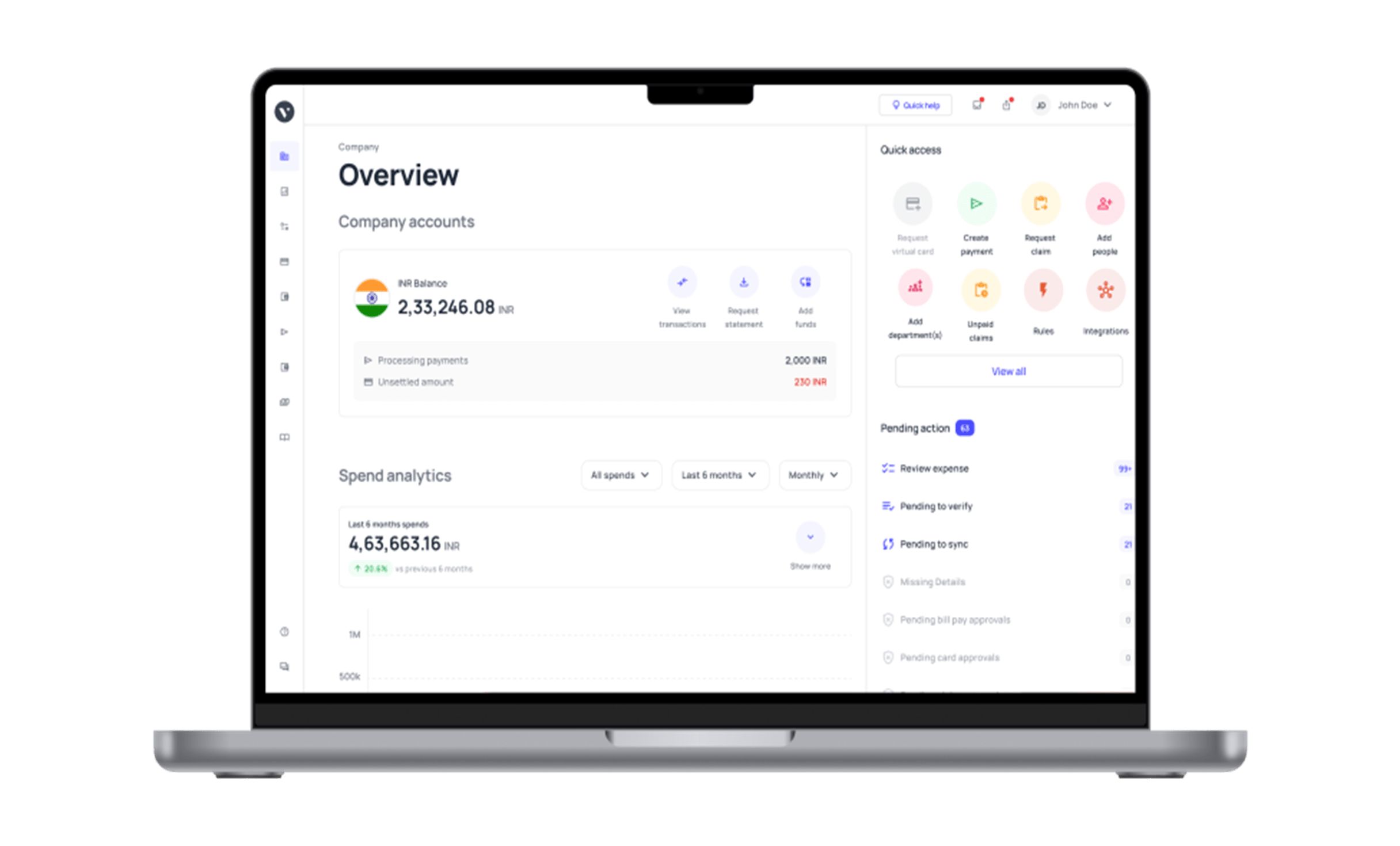

Volopay dashboard for custom spend controls

Volopay’s expense management dashboard allows admins and managers to enact spend controls on all cards linked to specific projects or departments.

Custom spend limits, combined with real-time transaction monitoring, allow you to manage all the expenses your team makes. This creates complete transparency in expense logging and provides a necessary system of balances and checks for responsible spending.

Unlock global spending with our corporate card

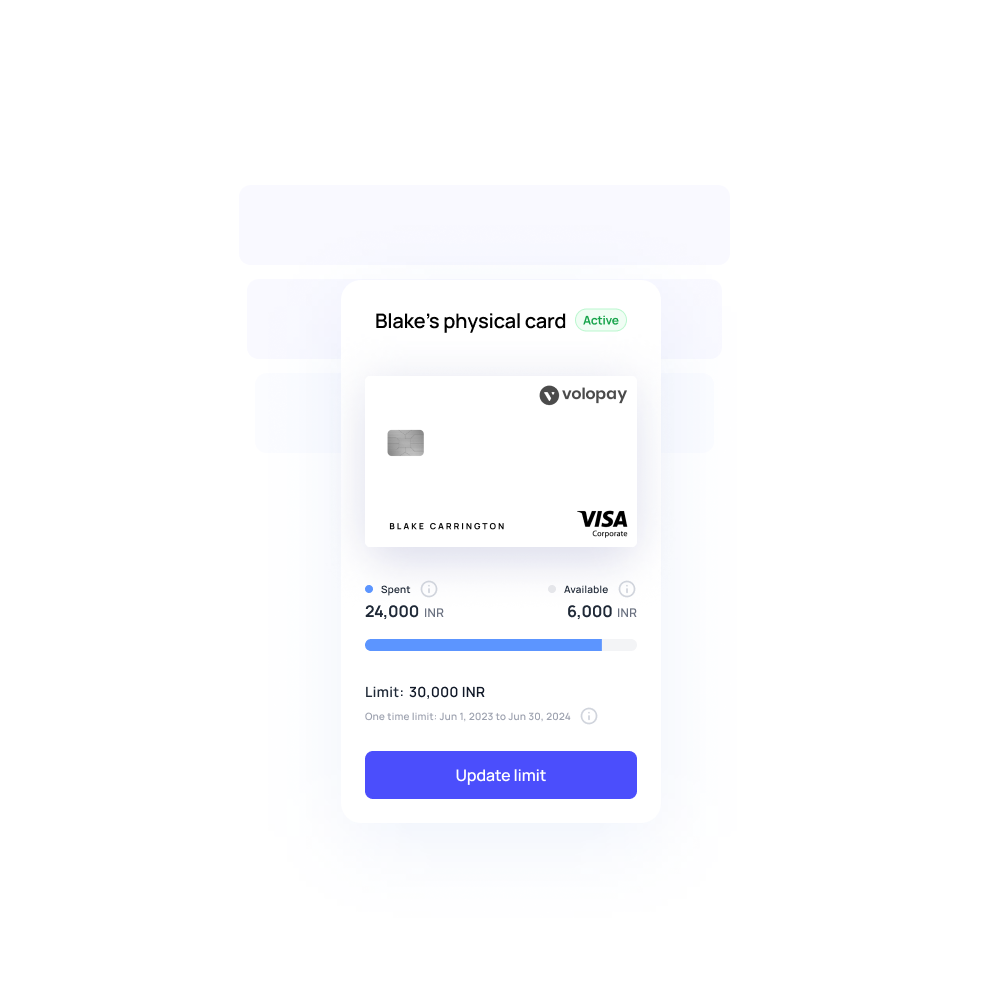

Load anytime, spend whenever you need

Volopay’s global corporate cards are limitless in their spending capabilities. What this means is that admins can top up cards as frequently as required, with any amount that is deemed necessary at the time of use. There are no monthly top-up caps, and cards can be used as frequently as the department or project needs.

As a result, cardholders are free to make multiple payments, which can streamline business processes—particularly important, unexpected payments.

Secure cards for global transactions

Our international cards are designed to keep your security in mind. These features ensure that your funds are protected, as is any data linked to your transactions.

Cards can be frozen or permanently blocked once they are no longer required. This also provides a layer of security in case of loss or theft.

The Volopay dashboard and app lets you manage your card settings, which gives admins complete spend control from any place, at any time.

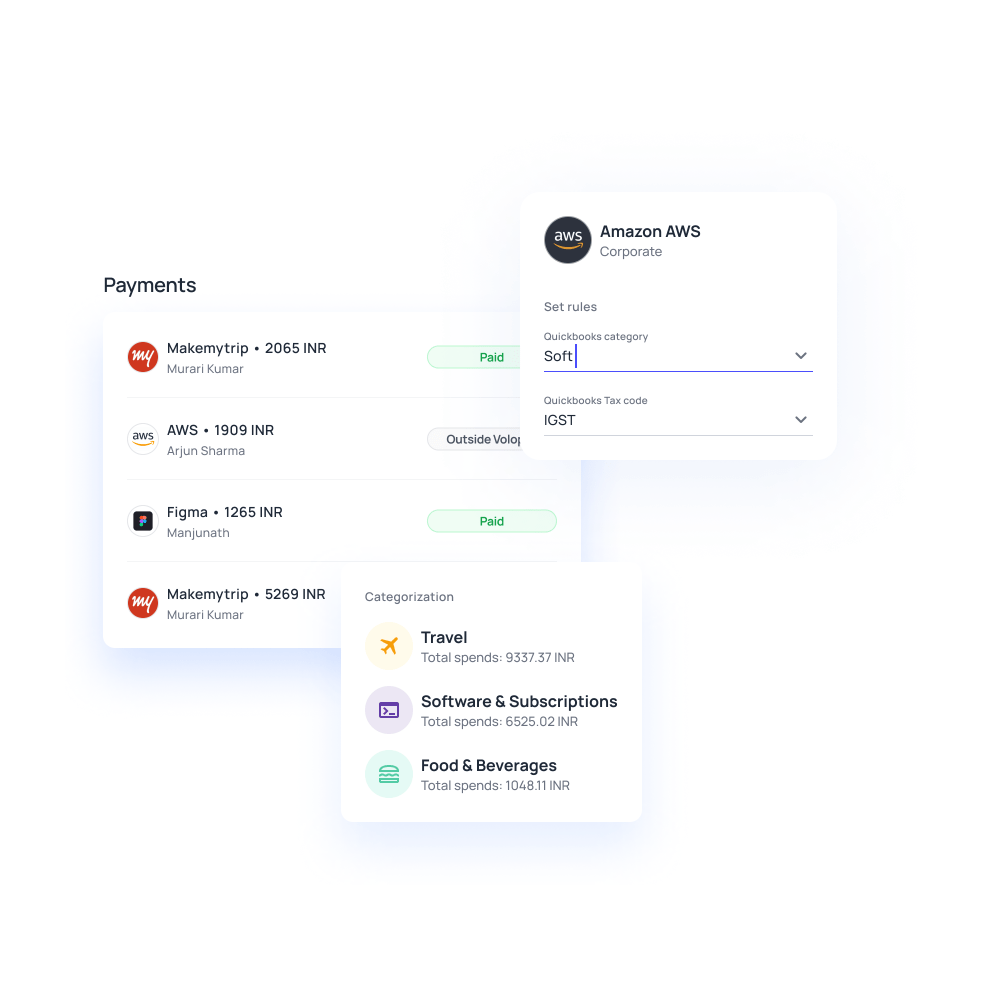

Seamless integration with accounting systems

Your Volopay account can be easily integrated with major accounting software, streamlining your bookkeeping and reconciliation processes. These native integrations include Netsuite, Xero, QuickBooks, MYOB, Tally, Zoho Books, Deskera, and others.

The integration allows a two-way sync for automated expense reporting, which ensures that all transaction records are kept updated and data is mapped based on your preferences.

Additionally, Universal CSV allows you to export and plug your transaction records into any software of your choice.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our corporate cards

Every aspect of expense management must be brought together and accessible for everyone - all admins, employees, and accountants - in one place.

We provide a solution for everything, from physical and virtual corporate cards and business credit to approvals, reimbursements, and accounting.

Physical cards

Your employees no longer have to use their personal cards or make out-of-pocket expenses. With the help of corporate physical cards issued with bank-grade encryption, security and quality, employees can be spend at a variety of merchant portals and on offline transactions. Enjoy simplified expense tracking with spend analytics.

Virtual cards

You have access to an infinite number of virtual cards. Assign to individual employees, departments, or even to keep track of payments made to certain vendors. With virtual corporate cards, make contactless and online payments more efficient than ever.

Business prepaid card

We offer business prepaid cards with built-in spending limit controls that you can assign to employees. With these prepaid cards, you can easily track all expenses in real-time and reconcile your account in a matter of seconds.

Bring Volopay to your business

Get started now

FAQs on corporate cards

There is no minimum criteria to qualify for a Volopay corporate card. Each business is vetted for their financial health and stability based on the documents they provide. We use this to determine whether a business is eligible to get access to Volopay cards.

Our global corporate cards can be used to make both domestic and international payments. Cross-border payments can be made with both physical and virtual corporate cards and employees can also make payments in other countries using cards assigned to them via the mobile app. A truly user-friendly and convenient approach to corporate spend management.

Yes, this is one of the most common ways for companies to financially empower their people. If your team travels regularly both within India and overseas, consider providing them with a global corporate card that is reloaded on a monthly basis. You can provide an employee a card with a limited budget and an expiration date if they have a one-time travel need.

If additional funds are needed at any moment, they can be sought and approved directly from the dashboard.

All of the company's expense and accounting regulations are applied to corporate cards automatically. Department-specific rules can be used in addition to the basic defaults. You can also determine who the approvers are, what the reload cycle is, and what the maximum budget allowance is when a card is generated. The ultimate control over every rupee that leaves your company and over who spends it provided by the only corporate credit card India has to offer.

Yes. Card transactions and expenses are synced in real time as and when they happen. This transaction ledger is accessible from both the website and the mobile app, making it simple to track and review card spends. Admins and approvers can also, if necessary, request extra details for a transaction.

You can order a physical card directly from your Volopay account. You do not need to follow any additional processes.

Our physical cards support ATM withdrawal on the prefunded model.