👋 Exciting news! UPI payments are now available in India! Sign up now →

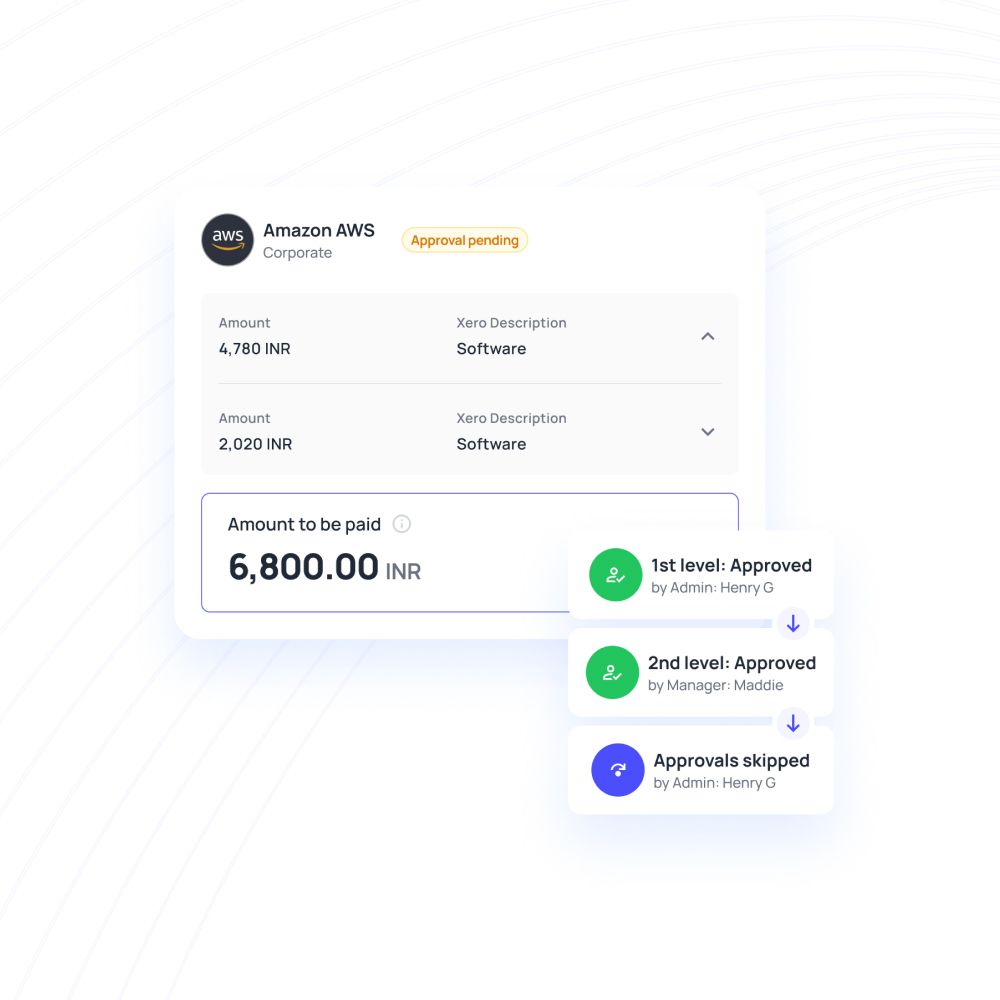

Automated expense approval system for multi-level workflows

Rather than chasing receipts or waiting weeks for approval, you can use expense approval system to create an automated workflow that complies with the company's spending policy while also saving time!

To totally rewrite your company's spending policy, create a precise workflow to handle elements like payments, fund requests, and the staff's expenses. Compliance has just been a lot easier.

Customize expense approval policy

You can set up approval policies ahead of time with bill approval software. These rules can be imposed at the expenditure level, by category, and even by department or project.

To ensure that nothing goes wrong and that all budget oversight is transparent, administrators and managers can be added to the list of multi-level approvers. Merchant-level controls also make approval smoother.

Automate approvals to reduce wait times

Automation is the next step in optimizing your expense approval system. Rather than rejecting every request, the approval software will automatically reject expenses that do not meet the compliance criteria.

Merchant-level controls also let you assign specific merchants for auto-approval; alternately, you can also auto-decline all merchants except for a specific set of approved ones. Only conforming requests are forwarded to approvers, and a level can have numerous individuals assigned to it to reduce wait times. Absences can also be monitored, allowing requests to be skipped or moved along the approval line.

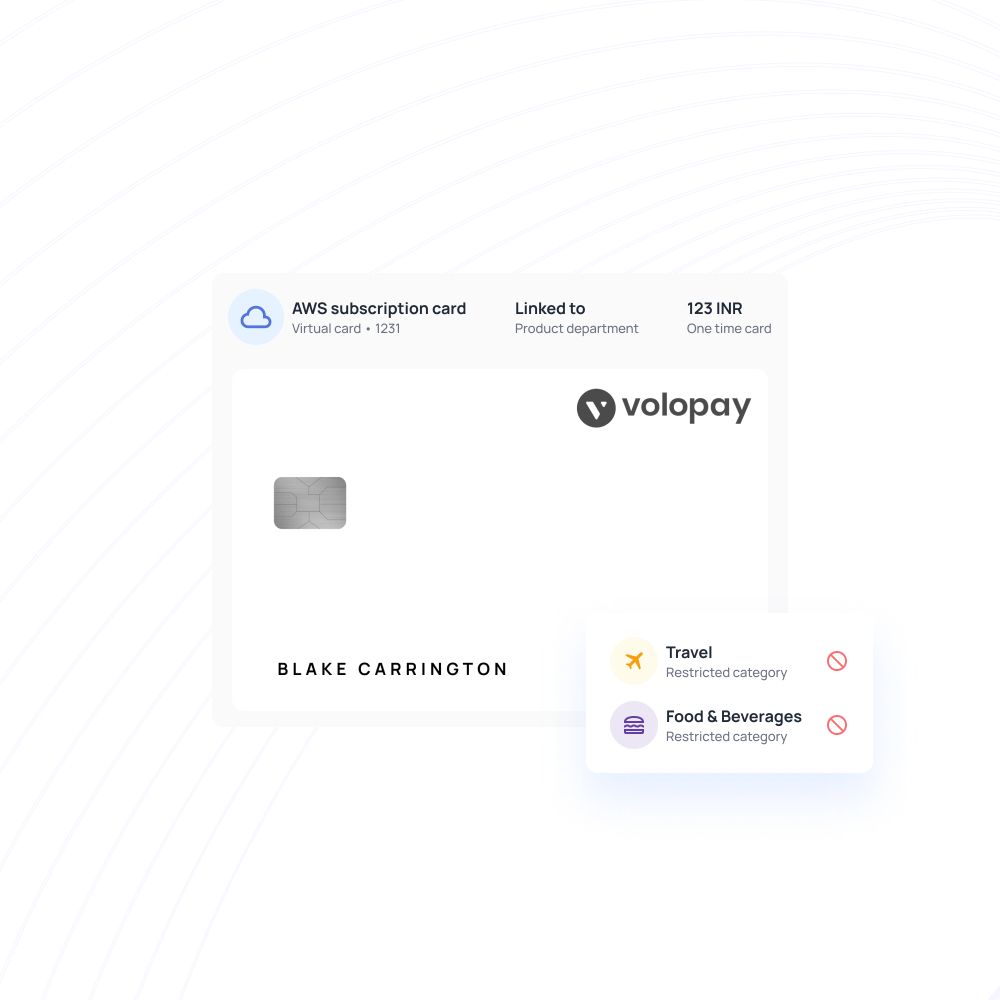

Manage corporate card requests

You may also use the Volopay dashboard to set up approvals for all corporate cards (both physical and virtual). Lower-value expenses, as well as periodic reloads that have been pre-authorized, can be approved automatically.

Multi-level approvals can be used to create cards with more restrictions or that demand bigger budgets. Smart notifications in the expense approval system allow these approvals to happen quickly, reducing delays.

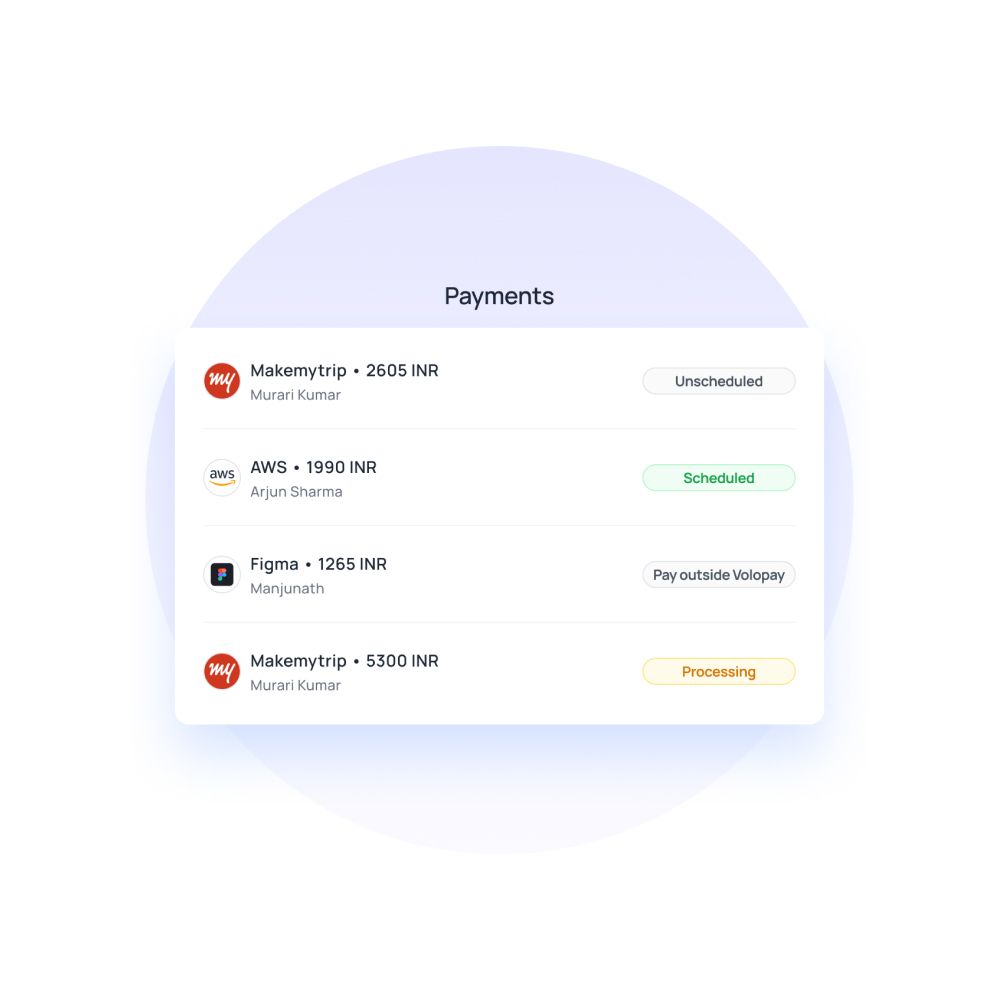

Quick expense reimbursements

Reimbursement is no longer a constraint. You may use the same bill approval software to build up approval workflows to restrict out-of-pocket expenses. Employees can use the system to request reimbursements.

Receipts are taken and data is collected in real time, making the approval process as straightforward as possible. Requests for reimbursement might be denied or approved in a matter of seconds.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our multi-level approvals

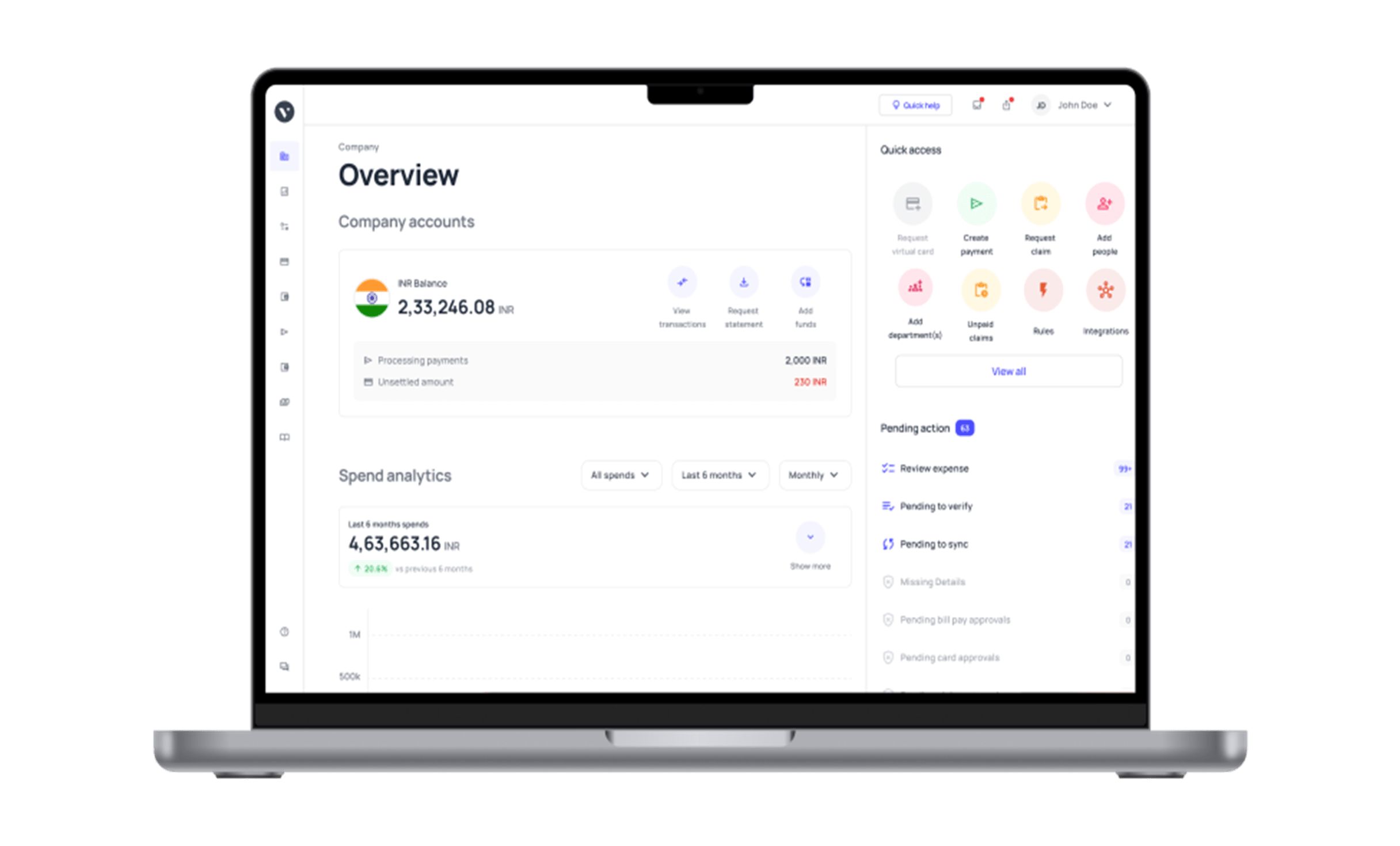

Approvals? Do you have any business cards? What about paying your bills? Reimbursements? Accounting? There is only one platform, so there is no need to make a fuss. Volopay combines everything into a single dashboard.

Instant virtual cards

Volopay allows you to create an unlimited number of virtual cards, making them one of the safest methods to pay online. It can let you keep track of your online spending, send a gift card or allowance to a remote employee, manage your SaaS subscriptions, and even generate burner cards.

Physical employee cards

Financially empower your employees to spend more wisely. Give them physical corporate cards to help them better control their spending and travel money – or even regular offline payments for day-to-day work expenses.

Reimbursements

There will no longer be reams of receipts to sort through or months of waiting for payments to get approved. Allo w your employees to request out-of-pocket expenditure reimbursements in real time, and have them approved in seconds for quick payment. Give them additional power while giving your finance team some breathing room.

Real-time expense reporting

You may create expense reports to track where, when, and why your company's money is spent. Real-time notifications are sent via email and push notifications, and all data is transferred to the ledgers as soon as a card is swiped or a payment is paid.

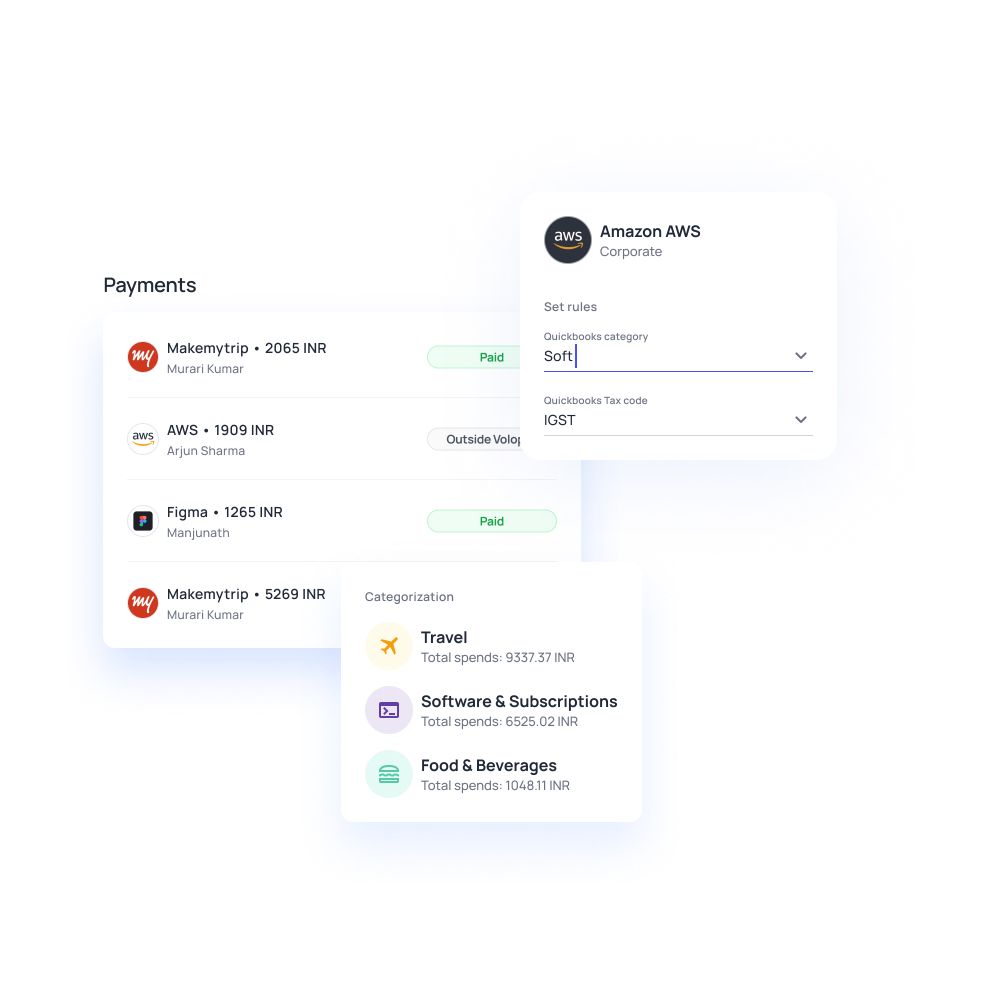

Accounting automation

Accounting automation boosts bookkeeping efficiency. Combine the benefits of your accounting software with the simplicity of our cost management tools. Integrate Volopay with your preferred accounting software, such as Xero, Deskera, Quickbooks, Netsuite, and others.

Bring Volopay to your business

Get started now

FAQs on multi-level approval

Yes, you can create custom approval workflows with Volopay's bill approval software. Departments, admin pools, and budget constraints all influence approval workflows. With up to five tiers of approvers, you may construct a custom payment approval pipeline.

Accounting and ERP software are integrated with Volopay. Deskera, Netsuite, Xero, Quickbooks, Zoho, and Tally are presently available for integration. You can also utilize custom export templates and Universal CSV to export reconciliation data to plug into any other software of your choice.

With Volopay's expense approval system, you can add up to 5 approvers and establish a bespoke approval sequence. If one of the administrators is absent, the request can be forwarded to the next in line to guarantee a seamless workflow, and the entire procedure can be tailored to your company's needs.