A comprehensive guide to OCR invoice processing in accounts payable

In the ever-evolving business environment, companies are always seeking methods to boost efficiency and simplify workflows. A significant advancement in operational improvement, especially in accounts payable, is the adoption of Optical Character Recognition (OCR) for invoice processing.

OCR invoice processing automates data extraction from invoices, reducing the necessity for manual input, decreasing mistakes, and accelerating processing times. This proves especially advantageous for businesses that handle a large number of invoices, as traditional manual processing can cause bottlenecks, delays, and increased expenses.

By adopting OCR, companies can process invoices faster, more accurately, and in line with accounting regulations. Given how transformative the technology can be, having a thorough knowledge of OCR's role in accounts payable, its advantages, how it works, and key implementation strategies is critical.

Whether you're an accountant, a business owner, or a finance manager, understanding OCR invoice processing can help you optimize your accounts payable workflow and improve financial efficiency.

What is OCR invoice processing?

Optical Character Recognition (OCR) refers to a technology designed to scan and recognize printed or handwritten characters from physical or digital documents and convert them into editable, machine-readable data.

In the context of invoice processing, OCR simplifies the traditionally manual task of inputting data by automatically capturing details like vendor names, invoice numbers, dates, and amounts from invoices.

Instead of requiring human intervention to enter these details into an accounting or accounts payable system, invoice OCR tech extracts the relevant data swiftly and accurately.

For businesses dealing with large volumes of invoices, OCR software invoice processing offers a significant advantage by reducing errors, cutting down processing time, and improving workflow efficiency. This automation supports smoother invoice approvals and overall improved management of financial transactions.

How does OCR technology automate invoice processing?

Manual invoice processing can be labor-intensive, time-consuming, and prone to human error. It typically involves entering invoice data into an accounting system, verifying details, and cross-checking information for accuracy.

This process can become overwhelming, especially for businesses handling a large number of invoices. Automation, powered by Optical Character Recognition (OCR) technology, transforms this process by significantly reducing the need for manual intervention.

OCR invoice processing automates the extraction of critical data from invoices, such as vendor information, invoice numbers, dates, and amounts, and converts this information into structured, machine-readable formats.

Once the data is captured, it is seamlessly integrated into the organization’s accounting or enterprise resource planning (ERP) system, eliminating the need for repetitive data entry tasks.

Automation helps improve the accuracy of invoice processing by minimizing human errors such as miskeyed information or overlooked details.

This ensures invoices are processed correctly and in a timely manner, reducing payment delays and errors in financial records. Additionally, automation with invoice OCR tech can handle bulk processing, enabling businesses to quickly scan and process large volumes of invoices.

The end result is a faster, more efficient accounts payable process that reduces workload, lowers operational costs, and improves the overall financial management of an organization. With automation and OCR, businesses can focus on higher-value tasks rather than tedious manual data entry.

What are the main issues with manual invoice processing?

Manual invoice processing presents numerous challenges for businesses, especially as invoice volumes grow.

Despite the emergence of OCR invoice processing, manual methods continue to persist, are inefficient, prone to errors, and expensive. Issues such as delayed approvals and duplicate payments can substantially affect a company's financial well-being.

Limited visibility and control

One of the major challenges in manual invoice processing is the lack of visibility and control. Relying on paper or email for workflows impedes tracking invoice statuses from receipt to approval and payment.

The absence of a centralized system makes it difficult to get a current snapshot of pending invoices, approvals in process, and approaching payment deadlines.

Consequently, this can lead to missed payments, late fees, and strained relationships with suppliers. Additionally, without a clear audit trail, pinpointing the causes of delays or bottlenecks in the process is challenging.

Higher security and compliance risks

When working with manual invoicing systems there is a considerable risk in terms of security and compliance. Physical invoices can be easily stolen, lost, or tampered with, especially in organizations that regularly work with financial information that is sensitive.

Moreover, the manual method increases the probability of fraud, as it may allow easy, unauthorized access to confidential data.

Additionally, it is difficult to adhere to regulatory requirements such as data privacy rules and tax laws without a robust system for storing and managing invoices. Non-compliance can lead to legal consequences or hefty fines for companies.

Time-consuming process

Manual invoice processing is inherently time-consuming. From receiving and sorting invoices to manually entering data into accounting systems, the process requires considerable human effort.

Staff members must often dedicate significant time to tasks like verifying vendor information, cross-checking figures, and tracking down missing approvals.

This slows down the entire workflow, causing delays in payments and increasing the workload for accounts payable teams. As the number of invoices grows, the time required for manual processing can become unmanageable, leading to backlogs and inefficiencies across departments.

Increased risk of manual errors

Human error is a natural part of manual processes, and this includes invoice processing.

Manual data entry heightens the risk of errors, such as wrong invoice numbers, dates, or amounts. These minor mistakes can lead to major issues, including financial inconsistencies, vendor disputes, and delayed payments.

Furthermore, these errors can remain undetected for extended periods, complicating account reconciliation at the end of financial periods. Such manual errors not only cause operational inefficiencies but also threaten the integrity of financial records.

Delayed approvals and payments

Manual invoice processing often leads to delayed approvals and payments.

When invoices are physically routed through different departments for authorization, the approval process can become bogged down, especially if key personnel are unavailable or occupied with other tasks.

This can result in late payments, which may damage relationships with vendors and result in late fees or interest charges. Furthermore, a lack of standardized workflows can cause invoices to sit unnoticed for extended periods, further delaying payment cycles and creating cash flow issues for the business.

Common data inconsistencies

Inconsistencies in data entry are common when invoices are processed manually. Variations in how information is recorded — such as different formats for dates, names, or amounts — can create confusion and complicate the reconciliation of records.

These inconsistencies can also make it challenging to match invoices with corresponding purchase orders or delivery receipts, further delaying payment approvals.

Additionally, inaccurate or inconsistent data can result in financial reporting errors, affecting the accuracy of budgets, forecasts, and cash flow projections.

Significant risk of duplicate payments

An additional problem with manual invoice processing is the potential for duplicate payments. In the absence of a centralized tracking system for invoices and payments, companies might unintentionally pay an invoice more than once.

Such duplicate payments can cause needless financial losses and also demand extra time and resources to rectify.

The process of identifying and amending duplicate payments is intricate, necessitating collaboration with suppliers and modifications to financial records. Occasionally, companies may remain unaware of the duplicate payments, leading to sustained financial detriment.

Challenges with scaling operations

As a business grows, the volume of invoices tends to increase. Unlike automated invoice OCR tech, Manual processing becomes increasingly difficult to manage at scale, leading to delays, backlogs, and inefficiencies.

A manual approach may work for small companies with limited transactions, but it becomes unsustainable for larger organizations with more complex operations.

Scaling a business requires systems that can handle increased workloads without sacrificing accuracy or efficiency. Manual invoice processing lacks the flexibility and scalability needed to support business growth, making it a significant barrier to expansion.

High processing costs

The expenses tied to manual invoice processing can be quite substantial. In addition to the direct labor costs involved in handling and reviewing invoices, businesses must account for other overheads, such as printing, mailing, and physical storage of invoices.

These costs quickly add up, especially in companies that handle a large volume of invoices monthly.

Moreover, the inefficiencies of manual processing, such as errors or payment delays, often lead to additional expenses in the form of late fees or financial discrepancies. Automating this process can help businesses lower these costs by optimizing workflows and reducing manual efforts.

Missing and lost invoices

One of the most common issues with manual invoice processing is the risk of missing or lost invoices. Physical invoices can be misplaced or lost in transit, leading to delays in processing and payment.

When invoices go missing, accounts payable teams must spend additional time tracking them down or requesting duplicates from vendors, further slowing down the workflow.

Lost invoices can also result in missed payments, which may harm vendor relationships and affect the company’s reputation. In the worst-case scenario, missing invoices may never be recovered, leading to incomplete financial records and potential audit issues.

Why is OCR important for accounts payable?

As the volume of invoices grows and the demand for effective financial management rises, OCR software invoice processing provides a seamless method for managing document data.

It automates the extraction of crucial invoice information, thereby accelerating the processing of invoices, increasing accuracy, lowering expenses, and bolstering compliance.

1. Faster invoice processing

One of the most significant advantages of OCR technology in accounts payable is its ability to expedite invoice processing.

Traditional, manual methods involve tedious tasks like sorting, reviewing, and entering invoice data into accounting systems, which can lead to delays, especially when managing a large number of invoices.

OCR automates this process by instantly scanning and extracting key data from invoices, significantly reducing the time required for processing. This not only improves the speed of invoice approval and payment cycles but also ensures that vendors are paid on time, helping to maintain healthy business relationships and avoid late fees.

2. Better data management

Efficient data management is crucial for the seamless functioning of accounts payable departments. Utilizing OCR invoice processing technology, companies can effortlessly capture, store, and categorize invoice data digitally. This results in a centralized database that is readily accessible and searchable.

Rather than navigating through piles of paper invoices or disordered digital files, accounts payable staff can swiftly locate any document or specific invoice information with a simple search.

This improved organization of data also facilitates enhanced tracking of invoices during their entire lifecycle, ensuring complete transparency at every stage of the approval and payment procedures.

3. Improved accuracy in reporting

Manual data entry is inherently prone to errors, which can lead to inaccurate financial reporting. Mistakes in key invoice details such as amounts, vendor information, or due dates can cause significant problems during audits or financial reconciliation.

OCR helps improve the accuracy of accounts payable reporting by minimizing human involvement in the data entry process.

Since the technology extracts and digitizes data with high precision, it reduces the risk of errors and ensures that financial reports are based on reliable, accurate information. This, in turn, improves the overall integrity of a company’s financial data.

4. Cost-effectiveness

Manual invoice processing is both time-consuming and expensive. The laborious task of reviewing and inputting invoices, along with the associated costs of printing, storing, and mailing, can accumulate rapidly. OCR technology greatly diminishes these costs by automating essential steps in the invoice processing cycle.

With a reduction in manual tasks, companies can redirect resources and personnel towards more strategic initiatives, thus reducing the total operational expenses linked to accounts payable.

Additionally, the enhanced precision provided by OCR technology minimizes the likelihood of expensive mistakes like overpayments, overlooked discounts, or late penalties, thereby improving cost efficiency.

5. Enhanced productivity

OCR technology enhances productivity in accounts payable teams by removing the repetitive and labor-intensive tasks involved in manual invoice processing.

This reduction in manual work allows employees to dedicate their time to more valuable activities, such as managing vendor relationships, analyzing financial data, and refining internal procedures.

Moreover, the improved speed and precision in processing invoices alleviate bottlenecks in the payment cycle, enabling the department to function more effectively and adhere to payment deadlines with greater regularity. Such an increase in productivity culminates in a more efficient and robust financial operation.

6. Data extraction beyond invoices

While OCR software invoice processing is most commonly associated with invoices, its capabilities extend beyond this. OCR can also be used to extract data from other financial documents such as purchase orders, receipts, contracts, and even bank statements.

This versatility makes it an invaluable tool for accounts payable departments, allowing them to manage and process a wide range of documents with minimal effort.

By automating the extraction of data from various sources, OCR helps ensure that all relevant financial information is captured accurately and efficiently, supporting better decision-making and financial oversight.

7. Enhanced compliance and audit readiness

Compliance with financial regulations and readiness for audits are critical for any organization. Manually managing invoices and related financial documents can make compliance and audits more difficult, as it’s challenging to ensure all necessary records are available, accurate, and up to date.

OCR technology enhances compliance by automatically capturing and storing invoice data in a digital, organized format, making it easier to retrieve and audit financial records when necessary.

The digital audit trail created by OCR also ensures that any updates or changes to invoices are tracked, helping businesses meet regulatory requirements and be better prepared for audits.

8. Reduction of duplicate payments

Duplicate payments are a common and costly issue in manual invoice processing. Without a centralized system to track and manage invoices, it’s easy for companies to accidentally pay the same invoice twice.

OCR reduces the likelihood of duplicate payments by automatically scanning and logging each invoice in a digital system, where it can be cross-referenced with other records.

This enables accounts payable teams to identify potential duplicates before payments are made, saving the company money and preventing time-consuming corrections down the line.

9. Data entry automation

Perhaps the most impactful benefit of OCR technology is its ability to automate data entry. By scanning invoices and automatically extracting relevant data, OCR eliminates the need for employees to manually enter information into accounting systems.

This not only speeds up the process but also significantly reduces the chances of data entry errors, such as incorrect amounts or miskeyed invoice numbers.

Automation also enables the processing of large volumes of invoices quickly and efficiently, allowing accounts payable departments to scale their operations without increasing headcount or risking manual errors.

Adopt OCR technology for your business with Volopay

Steps involved in OCR invoice processing

Optical Character Recognition (OCR) technology is revolutionizing invoice processing by automating data extraction from scanned invoices, thereby reducing manual labor and enhancing efficiency.

OCR technology follows a series of automated procedures to transform invoice images into structured, machine-readable data, which can be easily integrated into accounts payable systems.

Comprehending the steps involved in OCR invoice processing is crucial for businesses to refine their workflow and guarantee a streamlined, precise, and secure management of invoices.

1. Uploading digital invoice copies

The first step in OCR invoice processing involves uploading digital copies of invoices. These copies can come from various sources, such as scanned physical invoices, PDFs, or images received via email.

The uploaded files serve as the raw data for the OCR system to analyze and extract information.

Invoices can be uploaded in batches or individually, depending on the business’s volume. This step centralizes invoice management, making it easier to access and process multiple invoices efficiently.

2. Improving invoice image clarity

Once the digital invoices are uploaded, the next step is enhancing the clarity of the images to ensure that OCR can accurately extract data. Poor image quality, such as blurry or faded text, can hinder the effectiveness of the OCR system.

Various image enhancement techniques, such as adjusting contrast, brightness, and resolution, are applied to improve clarity.

Removing noise or distortions in the image ensures that the OCR software can accurately detect and recognize text from the invoice, even in challenging conditions.

3. Analyzing and handling invoice images

After improving image clarity, the OCR system begins analyzing the invoice images. This involves breaking down the document’s structure and identifying different sections, such as headers, line items, and footers.

During this step, the OCR software identifies and categorizes elements of the invoice, such as the vendor name, invoice number, date, and payment terms.

The software recognizes the format and layout of the document, allowing it to focus on the most relevant areas for data extraction while ignoring irrelevant information.

4. Converting image text to digital

In this step, the OCR technology starts converting the visual text within the invoice image into digital text. The system scans the entire document and translates the printed or handwritten text into machine-readable characters.

This conversion is a crucial part of the OCR process, enabling the software to turn the static information within the image into editable, searchable, and analyzable data.

OCR algorithms ensure the accuracy of text recognition, enabling seamless extraction of critical details like item descriptions, prices, and total amounts.

5. Isolating text characters from images

OCR invoice processing technology uses advanced pattern recognition to isolate individual characters from the invoice image.

During this phase, the system dissects the image into distinct segments, distinguishing each character, letter, or number from the background.

This character isolation is essential for ensuring that text is accurately captured without interference from graphical elements, such as logos or decorative lines. By breaking the document down into recognizable text segments, the OCR software lays the groundwork for precise data extraction.

6. Extracting text and data from invoices

Once the OCR system has identified and isolated text characters, it begins the process of extracting relevant data from the invoice. This includes vendor details, invoice numbers, payment terms, line items, and total amounts.

The system is trained to identify specific keywords and patterns that correspond to common invoice fields, allowing it to efficiently capture the necessary data.

This extraction process automates the manual effort typically required in accounts payable, reducing the chances of human error and speeding up the workflow.

7. Checking extracted data against invoices

After data extraction, the system verifies the accuracy of the extracted information by comparing it with the original invoice. This step involves cross-checking the details to ensure that all fields have been correctly captured.

The software flags any discrepancies between the extracted data and the invoice, prompting further review if needed.

This quality control process helps to catch errors that could lead to payment issues or inaccurate financial records, ensuring that the information is reliable before moving on to the next step.

8. Handling invoice processing discrepancies

Occasionally, discrepancies or errors may arise during the data extraction process, such as missing information or misinterpreted characters. In such cases, the OCR system notifies the accounts payable team to manually review and resolve the issues.

Handling these discrepancies is essential for maintaining data integrity and avoiding problems during invoice approval or payment.

This step may involve clarifying vendor details, correcting amounts, or re-scanning unclear invoices. By addressing discrepancies early in the process, businesses can ensure smooth and accurate invoice processing.

9. Transferring extracted data to systems

After verifying the extracted data and resolving any inconsistencies, the system uploads the information to the organization's accounts payable or enterprise resource planning (ERP) software.

This integration streamlines the data transfer from the OCR system to the company's financial systems, removing the necessity for manual data entry.

Seamless data transfer to the accounting system guarantees swift and precise invoice processing, facilitating timely payments and enhanced financial management. This process is vital for preserving an efficient workflow and preventing hold-ups in invoice approval and payments.

10. Storing invoice data securely

The final step in the OCR invoice processing workflow is securely storing the extracted invoice data. The digitized data, along with the original invoice images, is stored in a centralized and secure system, often within the organization’s ERP or cloud storage platform.

Secure storage ensures that invoices can be easily retrieved for audits, compliance checks, or future reference.

This step not only helps maintain a clean and organized database but also protects sensitive financial information from unauthorized access or loss. Proper storage practices also contribute to long-term compliance with regulatory requirements and internal auditing processes.

What are the methods used for OCR invoice processing?

OCR invoice processing technology offers various methods for invoice processing, each designed to suit different business needs and operational setups.

These methods—templates, machine learning, on-premise, and cloud-based solutions—bring unique advantages depending on the size, complexity, and infrastructure of the organization.

Below are some of the common methods used for OCR invoice processing.

Templates

Template-based OCR is one of the traditional approaches for invoice processing. In this method, specific templates are designed for different invoice formats, allowing the system to recognize fixed positions of data fields like invoice numbers, dates, and total amounts.

While effective for organizations that receive consistent invoice formats from a limited number of vendors, template-based OCR can struggle with variability. Each new invoice format requires a unique template, which can limit scalability and adaptability when dealing with multiple vendors or changing formats.

Machine learning

Machine learning (ML)-based OCR advances automation by employing algorithms that learn from data patterns and adjust to new invoice formats. In contrast to template-based systems, ML OCR operates without the need for predefined templates.

It identifies and extracts essential data fields from invoices through pattern analysis and continuous improvement.

This approach offers high flexibility, making it suitable for businesses processing diverse invoice formats. Additionally, ML-based OCR minimizes manual input by managing alterations and exceptions more adeptly than template-based systems.

On-premise

On-premise OCR solutions are implemented and managed within a company's infrastructure. This approach affords businesses enhanced control over their data since both the OCR software and the information it extracts are kept on local servers.

On-premise options are especially appropriate for organizations that place a high value on data security and are subject to stringent regulatory demands. Nevertheless, they necessitate a considerable initial investment and continuous upkeep.

Cloud-based

In contrast, cloud-based OCR solutions offer flexibility and scalability, enabling invoice processing over the internet. This approach allows businesses to use the software without installing it or managing infrastructure.

Cloud-based OCR is not only more economical but also easier to scale, making it ideal for businesses that are growing quickly or want to reduce IT overhead.

Additionally, the service provider handles updates and maintenance, ensuring the system remains up-to-date without any additional effort from the business. However, companies with stringent data security and privacy requirements might hesitate to adopt cloud solutions.

What types of AP documents can OCR extract?

OCR (Optical Character Recognition) technology has enhanced accounts payable (AP) systems by automating the extraction of critical data from various financial documents.

By converting physical or scanned documents into machine-readable text, OCR allows businesses to process, organize, and store key information more efficiently.

Below are the common types of AP documents OCR can extract data from.

1. Invoice details

Invoices are the most commonly processed documents in accounts payable, and OCR excels at extracting essential details from them. OCR invoice processing can capture vendor names, invoice numbers, dates, payment terms, and line-item descriptions such as quantities and prices.

This automation reduces manual data entry, ensuring faster and more accurate invoice processing, which helps avoid payment delays or errors that could affect vendor relationships or incur late fees.

2. Purchase orders

OCR can also process purchase orders (POs), which are critical documents in matching with invoices. Purchase orders contain information like the buyer’s details, product descriptions, quantities, agreed prices, and delivery timelines.

By extracting these details from POs, OCR enables AP teams to automatically match purchase orders with incoming invoices, ensuring accuracy and consistency before payments are approved.

3. Receipts

Receipts, especially those related to employee reimbursements or company purchases, are often small, inconsistent in format, and difficult to manage manually.

OCR can extract relevant information such as the vendor’s name, purchase date, total amount, and items bought from these receipts. Automating the extraction process for receipts simplifies expense tracking and helps ensure accurate expense reporting for audits or financial reviews.

4. Bank statements

OCR is also useful for extracting data from bank statements, which play a key role in reconciling company accounts and verifying payment transactions.

Details such as account numbers, transaction dates, payment amounts, and balances can be automatically captured using OCR. This simplifies the reconciliation process by ensuring that all payment information is accurate and up to date, reducing errors and improving financial transparency.

5. Contract terms

AP departments often handle contracts that outline payment terms, deliverables, and legal obligations between the company and vendors. OCR can extract critical contract details such as service terms, payment schedules, agreed rates, and deadlines.

By digitizing contract terms, businesses can easily cross-reference agreements with invoices to ensure payments align with contractual obligations, reducing disputes and improving compliance with contract terms.

6. Delivery notes

Delivery notes, or proof of delivery documents, confirm that goods have been received in good condition and in the correct quantities.

OCR can scan and extract delivery dates, product quantities, and shipment details, enabling AP teams to verify whether the invoice matches what was actually delivered. This ensures that payments are only made for goods that were properly received, reducing the risk of overpayments or disputes with vendors.

7. Tax forms

Tax compliance is a major component of accounts payable, and OCR can help by extracting key data from tax-related documents such as W-9s, VAT invoices, and other government forms.

This ensures that all necessary tax information is accurately captured and stored for reporting purposes. OCR helps simplify the tax filing process, reduce errors in tax records, and ensure that businesses remain compliant with local and federal regulations.

8. Expense reports

Employee expense reports can be time-consuming to process manually, especially when they involve multiple receipts and categories.

OCR can automatically extract details such as employee names, dates, expense categories, and amounts from submitted reports. This not only speeds up the approval and reimbursement process but also ensures that expenses are categorized correctly and aligned with company policies.

9. Credit details

Credit-related documents, such as credit notes issued by vendors, can also be processed using OCR. These documents contain information about discounts, refunds, or adjustments that should be applied to future payments.

By automatically capturing credit amounts and conditions from these documents, OCR ensures that credits are properly applied and accounted for in the company’s financial system, reducing the likelihood of overpayments or missed credits.

10. Payment information

Payment-related documents, such as remittance advice, can be processed with OCR to capture details about completed transactions, including amounts paid, dates of payment, and references to specific invoices.

This ensures that payment records are accurate and can be easily reconciled with corresponding invoices, reducing discrepancies and improving financial reporting accuracy.

11. Compliance records

Accounts payable departments are often required to maintain detailed records for audit purposes and to ensure compliance with financial regulations.

OCR can assist in digitizing and extracting data from compliance-related documents, such as audit reports or regulatory filings, enabling AP teams to store this information in an organized manner. By digitizing these records, businesses can quickly retrieve them during audits, making it easier to demonstrate compliance and avoid penalties.

Seamlessly integrate Volopay’s Magic Scan

What factors can affect the accuracy of OCR results?

OCR (Optical Character Recognition) technology is highly effective at extracting text from documents, but its accuracy can be influenced by several factors.

These factors, such as document quality, image clarity, and OCR software capabilities, determine how well the technology can convert scanned or digital documents into machine-readable data.

Below are the key factors that impact the accuracy of OCR results.

Quality of the scanned image

Even if the source document is in good condition, the quality of the scanned image affects how well OCR can process it. A low-resolution scan may result in blurry or pixelated text, making it difficult for the software to distinguish individual characters.

The ideal scan resolution for OCR is usually 300 dots per inch (DPI) or higher, as this ensures that the text is sharp and clear.

Additionally, any noise or distortions in the scanned image—such as shadows, skewed text, or uneven lighting—can interfere with OCR accuracy. High-quality scanning practices and ensuring good lighting conditions are essential to achieve reliable results.

Font type and size

The type and size of the font used in the document can also significantly impact OCR accuracy. Certain fonts, such as decorative or stylized fonts, are more difficult for OCR software to recognize than standard, well-defined fonts like Arial or Times New Roman.

Unconventional fonts with irregular shapes or spacing can lead to misread characters, particularly if they are used in complex documents like invoices or contracts.

Similarly, very small or very large fonts can challenge OCR systems, with small text being difficult to detect and oversized text potentially being misaligned during the scanning process. Using clear, legible fonts at moderate sizes improves the likelihood of accurate text recognition.

Document complexity

The more complex the layout of a document, the harder it is for OCR to accurately extract text. Documents with multiple columns, tables, embedded images, or non-standard formatting can confuse OCR systems.

For example, an invoice with a mix of text, numbers, and graphical elements may cause the software to misinterpret certain sections or extract data incorrectly.

Handwritten annotations or overlapping content can further complicate the recognition process. Simple, well-structured documents with a clear separation between text and non-text elements generally produce more accurate OCR results.

Language and vocabulary

The language and vocabulary used in the document also play a role in OCR accuracy. Some OCR systems may struggle with languages that have complex grammar, unique characters, or special accents.

Additionally, domain-specific vocabulary, such as technical terms in legal, medical, or financial documents, may not be recognized correctly if the OCR software is not trained for those specialized fields.

Selecting OCR software that supports multiple languages or includes customizable dictionaries for industry-specific terms can help improve the accuracy of text extraction.

OCR software capabilities

The capabilities of the OCR software itself are crucial to achieving high levels of accuracy. Not all OCR tools are created equal—some systems offer more advanced algorithms, support for a wider range of fonts and languages, and better handling of complex document layouts.

Modern OCR software equipped with artificial intelligence (AI) and machine learning (ML) capabilities can adapt to different document types and improve accuracy over time by learning from data patterns.

Choosing the right OCR software based on your specific needs can significantly impact how well the system extracts text and handles challenging documents.

Preprocessing techniques

Preprocessing techniques applied before running OCR can greatly improve the accuracy of text extraction.

Preprocessing includes actions like deskewing (aligning the document to avoid tilted text), noise reduction (removing artifacts or specks), and binarization (converting the image to black and white for better text detection).

Other techniques, such as contrast adjustment and image sharpening, can also enhance the clarity of the text, making it easier for OCR to accurately recognize characters. Effective preprocessing ensures that the document is in optimal condition for text extraction, resulting in higher accuracy.

What are the benefits of using OCR for invoice processing?

Optical Character Recognition (OCR) technology has revolutionized invoice processing, altering the way businesses manage their financial documents. By converting printed or handwritten text to digital data, OCR streamlines the once manual task of data extraction from invoices.

This advancement not only minimizes human error but also accelerates the processing time, aiding companies in enhancing their financial operations. With the ongoing digital transformation, OCR is increasingly becoming a vital asset for ensuring efficiency and precision in managing invoices.

1. Automated data extraction

One significant benefit of using OCR for invoice processing is its capacity to automate the extraction of data. OCR technology can accurately scan and retrieve essential details from invoices, including vendor information, invoice numbers, dates, and totals.

This automation removes the necessity for manual data entry, which is often error-ridden and labor-intensive.

Consequently, businesses can capture crucial data quickly and reliably, allowing their finance teams to concentrate on more strategic activities such as budgeting and financial analysis.

2. Faster processing cycles

OCR accelerates the invoice processing cycle by automating key steps that would otherwise require significant manual input. Traditional invoice processing often involves several time-consuming stages, from manually entering data to obtaining approvals.

With OCR, these processes are streamlined. Invoices are scanned, data is extracted instantly, and they can be reviewed and approved much faster.

This reduction in processing time leads to quicker payment cycles and improves cash flow management, especially for businesses handling high volumes of invoices.

3. Validation and cross-referencing

Invoice OCR systems often integrate with accounting and enterprise resource planning (ERP) software, allowing for automatic validation and cross-referencing of invoice data.

Once the data is extracted, it can be compared against existing purchase orders, contracts, or delivery notes to ensure accuracy.

This automated validation process reduces the likelihood of errors, such as duplicate payments or mismatches between the invoiced amounts and purchase orders. By catching discrepancies early, businesses can prevent overpayments and ensure that only valid invoices are processed.

4. Consistent data quality

Maintaining high data quality is critical for any financial operation, and OCR helps businesses achieve this by ensuring consistent data extraction.

Manually entered data often varies in format, leading to errors and inconsistencies that can cause issues later in financial reporting or audits.

OCR ensures that all data is captured in a standardized format, leading to cleaner, more reliable data. This consistency enhances the accuracy of financial records and supports better decision-making, as businesses can trust the data they are working with.

5. Timely payments

Making payments on time is crucial for sustaining healthy relationships with vendors and suppliers.

Payment delays can incur late fees, penalties, and harm business partnerships. Accelerating the invoice processing cycle with OCR technology ensures swift invoice processing and punctual payments.

Moreover, timely payments enable businesses to take advantage of early payment discounts, enhancing cost-effectiveness. Furthermore, consistent prompt payments foster trust with suppliers, which can result in more favorable negotiation terms and more seamless transactions in the future.

6. Centralized document management

OCR contributes to more organized and efficient document management by converting paper invoices into digital formats. All invoices, whether physical or digital, can be stored in a centralized system, making them easy to access, search, and retrieve when needed.

This centralized document management reduces the risk of losing important invoices and improves the visibility of financial operations.

Additionally, it simplifies remote work scenarios, as teams can access digital records from anywhere, ensuring smooth collaboration across departments.

7. Adaptability to different formats

Invoices come in a variety of formats, from paper documents to PDFs and email attachments. OCR’s adaptability to different formats ensures that businesses can process all types of invoices without needing to standardize them manually.

This flexibility streamlines workflows, enabling companies to handle diverse invoice types without additional steps.

Whether it's scanning a physical invoice or extracting data from a digital file, OCR handles the process efficiently, providing a consistent solution for invoice processing across various formats.

8. Comprehensive audit trails

OCR invoice processing provides comprehensive audit trails by recording each step of the invoice processing workflow. Every action, from when the invoice is scanned to when it is approved and paid, is logged in the system.

This detailed audit trail is invaluable during internal reviews, external audits, and for compliance purposes, as it provides clear documentation of how each invoice was handled.

This level of transparency helps businesses ensure that their financial processes are fully compliant with regulatory standards and reduces the risk of errors or fraud.

What are the drawbacks of automated invoice scanning?

While OCR software invoice processing offers numerous advantages, like any technology, it too has limitations.

There may be a variety of obstacles in the way and understanding how to navigate these obstacles can help businesses make informed decisions when adopting automated invoice scanning solutions.

Complexity of setup and configuration

Implementing an automated invoice scanning system typically demands a considerable initial investment of time and resources.

The setup process includes tailoring the software to identify particular invoice formats, fields, and data points, a task that can be intricate for businesses dealing with multiple types of invoices.

Moreover, the initial training phase to guarantee precise data capture from the invoices of various vendors is a lengthy process. In the absence of proper expertise, businesses might encounter setbacks and inefficiencies during the implementation stage, which could curtail the immediate advantages of the technology.

Challenges with unstructured data

One of the biggest challenges of automated invoice scanning is handling unstructured data. While OCR systems excel at extracting data from well-structured, uniform invoices, they struggle when invoices come in inconsistent formats or layouts.

Some suppliers may use highly customized invoice designs, which automated systems may not recognize correctly, leading to incomplete or incorrect data extraction.

Additionally, if key information is missing or placed in unexpected locations, the system may fail to capture the necessary details, requiring manual intervention and reducing overall efficiency.

Integration limitations

OCR invoice processing systems frequently require integration with other enterprise software, including Enterprise Resource Planning (ERP) systems, accounting platforms, or document management solutions.

These integrations can present challenges, particularly when the existing systems are incompatible with the scanning solution. Inadequate integration can lead to data silos, hindering seamless information sharing between systems and causing issues such as duplicate data entries, miscommunication, or incomplete financial reporting.

Additionally, custom integrations might necessitate extra development, thereby escalating the costs and extending the timeline for implementation.

Reliance on high-quality inputs

Automated invoice scanning systems rely heavily on the quality of the scanned documents they process. Poor-quality inputs, such as low-resolution images, faded text, or documents with smudges and marks, can result in inaccurate data extraction.

OCR technology has difficulty reading damaged or poorly scanned invoices, often leading to incorrect information being captured.

To mitigate this, businesses must invest in high-quality scanning hardware or ensure vendors provide clean, legible digital invoices, adding another layer of complexity to the process.

Limited contextual understanding

OCR systems lack the ability to fully comprehend the context of the data they process. While the technology can extract numbers and text, it may not understand the relationships between those data points.

For example, it might extract invoice amounts but fail to recognize discounts, taxes, or credits that should be applied. This lack of contextual awareness can result in errors that require manual review, undermining the system’s overall efficiency and reliability.

Difficulty in handling multi-currency and multi-language invoices

Handling invoices across multiple currencies and languages presents a significant challenge for automated scanning systems. Many businesses operate internationally, receiving invoices in various formats and languages.

OCR systems may struggle to accurately interpret these differences, especially when faced with unfamiliar languages or currency symbols.

This can lead to incorrect conversions, errors in currency identification, or misinterpretation of text. As a result, businesses may need to manually review or correct these invoices, negating some of the time-saving benefits of automation.

Transform your business with advanced OCR today

Role of machine learning in improving OCR for invoice management

Machine learning (ML) has significantly advanced Optical Character Recognition (OCR) technology, especially in the field of invoice management. Traditional OCR invoice processing systems, while useful, face limitations in handling complex data.

By integrating machine learning, OCR can continuously learn and adapt, improving its ability to extract, classify, and process invoice data more accurately. This combination enhances automation, reduces errors, and improves overall efficiency in financial workflows.

1. End-to-end automation

Machine learning enhances OCR by enabling true end-to-end automation in invoice management. In the past, OCR systems were used mainly for extracting basic information like invoice numbers, dates, and totals.

However, with ML, OCR can now go beyond mere data extraction and automate the entire invoice processing cycle, from capturing invoice data to validating, classifying, and even approving payments.

By learning from previous invoices and continuously improving its data extraction capabilities, the system becomes more autonomous, requiring less human intervention over time.

2. Improved data classification

A major advantage of integrating machine learning into OCR systems is improved data classification.

Invoices often contain a variety of fields, including vendor names, payment terms, and tax details, which may appear in different locations or formats across invoices from different vendors.

Machine learning helps OCR systems accurately classify this data, regardless of where it appears on the document. The more invoices the system processes, the better it becomes at recognizing patterns and categorizing information correctly, significantly reducing errors in data capture.

3. Pattern recognition for identifying inconsistencies

Machine learning algorithms are excellent at detecting patterns and identifying inconsistencies in invoice data. This is especially helpful when processing large volumes of invoices, where small errors can go unnoticed by human reviewers.

ML-enhanced OCR systems can flag potential issues, such as mismatches between invoice amounts and purchase orders, duplicate invoices, or unusual payment terms, based on learned patterns.

By catching these inconsistencies early, businesses can prevent costly mistakes, such as overpayments or fraud, and improve overall data accuracy.

4. Integrations with automation technologies

Machine learning-enhanced OCR systems easily integrate with other automation tools like Enterprise Resource Planning (ERP) and Robotic Process Automation (RPA) platforms. This allows for a more streamlined and cohesive workflow.

OCR, for example, can handle data extraction from invoices, while RPA ensures the transfer and updates of financial data into ERP systems.

These integrations reduce manual labor, increase efficiency, and create a smooth workflow for managing invoices from start to finish.

5. Enhanced character recognition

One of the biggest improvements ML brings to OCR invoice processing is enhanced character recognition, particularly when dealing with complex, distorted, or unclear text. Traditional OCR systems often struggle with low-resolution documents, handwritten notes, or faded invoices.

Machine learning models, however, can "learn" from different styles of text and improve their ability to recognize even poorly scanned or handwritten data over time.

This leads to more accurate data capture and reduces the need for manual corrections, ensuring that invoices are processed with greater precision.

6. Better user experience

Machine learning improves the user experience in OCR-based invoice management by minimizing errors, speeding up processes, and offering more intuitive systems.

As the technology learns and adapts, it helps reduce the frequency of mistakes, meaning users spend less time on manual corrections.

The system also anticipates and fixes potential issues before they escalate, notifying users promptly when exceptions occur. This proactive approach helps streamline workflows and enhance productivity.

7. Automated exception handling

Handling exceptions in invoice management can be labor-intensive, but machine learning automates much of this process by learning from past errors and how they were resolved.

When an invoice is flagged, for example, for discrepancies in tax or payment terms, the invoice OCR system uses previous cases to either suggest or automatically apply solutions.

This minimizes manual intervention, speeds up the approval process, and ensures that only truly complex issues require human review.

How does combining OCR with manual review enhance invoice handling?

Combining Optical Character Recognition (OCR) technology with manual review in invoice handling creates a powerful synergy that boosts efficiency while ensuring accuracy.

While OCR automates data extraction, reducing the time and effort needed for processing invoices, it is not always flawless, especially when dealing with inconsistencies or complex scenarios.

The manual review adds an additional layer of oversight, catching errors and anomalies that OCR might miss. Together, these methods significantly improve invoice processing accuracy, reliability, and overall operational effectiveness.

Identifying duplicate invoices

OCR systems are excellent at capturing data, but they can sometimes overlook duplicates, especially if the invoices are presented in slightly different formats or scanned at different times.

Manual review provides an extra safeguard by cross-referencing invoices and identifying any duplicate entries that may have slipped through the automated process.

Human reviewers can catch these duplicates based on context, experience, and the ability to recognize subtle variations, such as differences in vendor names or invoice numbers. This prevents double payments and helps maintain cleaner financial records.

Handling non-standard formats

While OCR invoice processing excels with structured data and standard invoice formats, it can struggle when faced with unstructured or non-standard invoices.

Some vendors may use unique layouts, fonts, or formats that OCR systems have difficulty interpreting. A manual review allows finance teams to correct errors caused by these unconventional formats, ensuring that no crucial details are missed.

This hybrid approach ensures that even invoices that don’t conform to common templates are processed accurately, reducing the need for rework and avoiding delays in payment.

Human oversight

The combination of OCR and manual review ensures a balance between automation and human oversight. OCR processes large volumes of invoices efficiently, but human involvement ensures critical errors are caught before they escalate.

Human reviewers can verify extracted data for accuracy, flag discrepancies, and make informed decisions based on context and nuances that the automated system might overlook.

This layer of oversight is particularly crucial in high-value or sensitive invoices, where mistakes could lead to financial losses or damaged vendor relationships.

Handling exceptions

OCR systems typically handle routine invoices well, but exceptions—such as missing fields, ambiguous information, or discrepancies—can present challenges. Manual review plays a critical role in resolving these exceptions.

When the system encounters an issue, human reviewers can step in to interpret incomplete or conflicting data, apply judgment, and resolve the issue.

This ensures that outliers or complex cases don’t slow down the invoice processing cycle, maintaining smooth operations even when faced with more complicated scenarios.

Feedback for OCR improvement

Manual review not only corrects errors but also provides valuable feedback for improving OCR systems.

Each time a human reviewer catches an error, corrects data, or handles an exception, that information can be used to retrain the OCR system, helping it improve over time.

This feedback loop allows the system to gradually learn from mistakes and adapt to new or complex data patterns. Over time, the OCR system becomes more accurate, requiring less manual intervention and improving overall efficiency.

Expense categorization

Expense categorization is another area where the combination of OCR invoice processing and manual review excels. While OCR can automatically extract line-item details, it may not always assign them to the correct expense categories.

Human reviewers can ensure that expenses are accurately classified, especially when dealing with ambiguous or complex items.

Proper categorization is essential for accurate financial reporting, budgeting, and tax compliance, making the manual review process an important complement to OCR’s automated capabilities.

What are the best practices for using OCR in accounts payable?

While an invoice OCR system can be relatively straightforward to use there are, however, some best practices to keep in mind.

Ensuring these best practices can make a significant difference in an organization’s experience with an OCR-enabled workflow. Efficient operation of this system not only ensures maximum utilization of resources but also a smooth integration process.

1. Prompt invoice entry

● Immediate scanning

One of the core benefits of OCR in accounts payable is the ability to scan and digitize invoices immediately upon receipt.

Prompt invoice scanning ensures that no documents are misplaced or delayed in the payment process. As soon as an invoice is received—whether it’s in paper format or a digital PDF—using OCR to convert the information into an editable digital format speeds up the workflow.

This prompt entry of invoices allows businesses to maintain accurate records and avoid late payments. Moreover, immediate scanning reduces bottlenecks in the accounts payable process by ensuring that invoices are processed in real time, eliminating manual input delays.

● Automated routing

Once invoices are scanned and digitized, OCR systems can facilitate the automated routing of invoices to the appropriate personnel or departments for approval.

Rather than depending on manual sorting or employee intervention, the system can autonomously direct invoices to pertinent managers or departments according to predefined business rules. Such automation expedites the approval process and diminishes the likelihood of human errors and miscommunications.

Automated routing leads to swifter approvals, reduced processing times, and enhanced overall accounts payable (AP) efficiency by guaranteeing that every invoice receives attention and is not misplaced within the system.

2. Implement PO matching

● Automated matching

Purchase order (PO) matching is a critical function in accounts payable, as it ensures that invoices align with purchase orders and goods received. OCR can streamline this process by automating the comparison between the invoice details and the PO data.

The OCR software extracts the relevant data from the invoice, matches it against the corresponding purchase order, and verifies that the quantities, prices, and terms are consistent.

Automating PO matching helps eliminate manual cross-checking, which is often time-consuming and prone to errors. It speeds up invoice approvals and ensures accuracy in the payment process, ultimately reducing the risk of overpayments or fraud.

● Discrepancy flagging

Despite automation, discrepancies between invoices and purchase orders can still arise. OCR technology allows for the automatic flagging of discrepancies, alerting accounts payable teams to any mismatched data.

Whether it’s a quantity discrepancy, a price variation, or an incorrect product description, OCR systems can notify users to investigate further.

By flagging discrepancies early, companies can address issues promptly, avoid payment delays, and maintain healthy supplier relationships. This proactive approach to discrepancy management also reduces the risk of disputes with vendors and improves the accuracy of financial records.

3. Integrate with existing systems

● Accounting system integration

Invoice OCR systems can be seamlessly integrated with accounting software to facilitate uninterrupted data flow.

By linking the OCR platform to existing accounting systems, companies can bypass manual data entry, as all pertinent information is automatically populated into the correct ledgers or accounts. Such integration reduces redundant efforts and improves the precision of financial data.

The automation of data entry into accounting systems enables accounts payable teams to concentrate on more strategic activities, like vendor management or process improvement, instead of administrative tasks.

● ERP integration

For larger enterprises, incorporating OCR systems with enterprise resource planning (ERP) platforms can enhance the accounts payable and vendor procurement processes.

ERP systems handle various business operations, from procurement to finance, and integrating OCR with ERP ensures smooth data transfer across different departments.

This integration streamlines the entire process from purchase to payment and provides real-time insights into invoice statuses, approval workflows, and financial health. Such connectivity promotes increased transparency and efficiency throughout the organization.

4. Utilize validation features

● Validation rule configuration

OCR software invoice processing provides customizable validation rules that enhance the precision of invoice data prior to its entry into the system.

By establishing rules tailored to specific business needs, such as verifying that invoice totals do not surpass purchase order values, companies can streamline the validation process and avert mistakes from happening.

Configuring validation rules correctly diminishes the likelihood of improper payments and reinforces internal controls, guaranteeing that only legitimate invoices are processed and remitted.

● Automated flagging

OCR technology goes beyond basic validation by automatically identifying any discrepancies or mistakes during data capture.

This includes missing invoice numbers, incorrect supplier information, or inconsistent tax rates. The system notifies the accounts payable department of these potential issues.

The automated alert system upholds stringent data accuracy and prevents problems from being overlooked. It also facilitates quicker adjustments, guaranteeing that invoices are processed and settled promptly.

5. Regular training and updates

● User training

Maximizing the advantages of OCR technology in accounts payable is essential, and this requires consistent training for users.

Regular training sessions ensure that staff are adept at using the OCR system, stay updated with new features, and remain informed about procedural updates. Training should encompass strategies for addressing typical problems, interpreting validation alerts, and utilizing sophisticated OCR functions.

Persistent education of users contributes to more efficient operations, enhanced productivity, and an accounts payable team that is well-informed and capable of promptly addressing any challenges.

● Software updates

OCR invoice processing technology, like any software, requires regular updates to maintain peak performance.

Ensuring that the OCR software is updated with the latest patches and features will help protect against bugs, improve processing accuracy, and enhance system functionality. Regular updates also ensure compliance with evolving regulatory requirements and business practices.

Failing to update OCR software can result in decreased efficiency, data capture errors, or even security vulnerabilities.

6. Monitor and evaluate KPIs

● Processing time

Measuring the duration of invoice processing is a crucial key performance indicator (KPI) for accounts payable departments.

OCR technology significantly shortens processing times, and consistent monitoring of this metric assists organizations in pinpointing bottlenecks and areas needing improvement. Keeping track of processing times ensures invoices are paid promptly, avoiding late fees and fostering robust supplier relationships.

● Error rate

Monitoring the error rate in invoice processing is another vital KPI. Although OCR technology reduces errors relative to manual entry, errors such as data misreading or misclassification can still occur. By tracking the error rate, companies can detect patterns, refine validation rules, or implement additional training as needed.

Reducing the error rate leads to more precise financial reporting, fewer disputes, and enhanced trust in the accounts payable process.

7. Maintain document security

● Access controls

Given the sensitivity of the financial information passing through accounts payable systems, it is crucial to maintain document security.

Implementing robust access controls ensures that only authorized personnel can view, edit, or approve invoices. Role-based permissions should be set up to prevent unauthorized access to confidential financial data.

Strong access controls minimize the risk of fraud and data breaches, ensuring compliance with all kinds of regulatory requirements.

● Data encryption

To further secure sensitive data, invoice OCR systems must use encryption during data transmission and storage.

Encrypting sensitive financial information ensures it remains inaccessible to unauthorized parties, offering a layer of protection even if the system is compromised.

Utilizing advanced encryption protocols is vital for maintaining the confidentiality and integrity of accounts payable data.

8. Encourage vendor communication

● Vendor portal

A dedicated vendor portal allows suppliers to upload invoices directly, check the status of their payments, and communicate with the accounts payable team.

Integrating OCR with a vendor portal enhances communication and reduces the back-and-forth between vendors and AP teams.

● Dispute resolution

Disputes between vendors and accounts payable departments are inevitable. OCR systems help resolve disputes more efficiently by providing instant access to digitized invoice records, allowing for quicker verification and resolution.

9. Utilize analytics for insights

● Spend analysis

OCR invoice processing systems generate vast amounts of data that can be leveraged for insightful analysis. Analyzing spending patterns allows businesses to identify cost-saving opportunities, such as optimizing payment terms or consolidating suppliers.

● Supplier performance metrics

Monitoring supplier performance through OCR data can help businesses evaluate vendor reliability, pricing, and delivery times. By using this data, companies can make informed decisions about future supplier relationships.

Boost efficiency with Volopay’s OCR technology

Factors to consider before choosing an OCR solution for your business

The market offers a variety of OCR solutions, and choosing the appropriate one for your business necessitates meticulous consideration of several factors.

It is crucial to select an OCR system that not only meets your specific requirements but also integrates effortlessly with your current workflows and delivers dependable performance, thereby optimizing the advantages of this technology.

Evaluate text recognition precision

Accurately recognizing and extracting text from scanned documents, PDFs, or images is a fundamental function of OCR invoice processing technology.

The precision of text recognition can vary significantly between OCR solutions, so it’s essential to evaluate how well the software reads different types of text. This includes assessing how accurately it handles various fonts, handwriting, or poor-quality scans.

For businesses dealing with complex documents such as contracts or invoices, which have specific layouts, the OCR system must be proficient in recognizing both structured and unstructured text.

Additionally, it is crucial to test the OCR's accuracy in real-world scenarios to ensure its ability to handle documents in various formats, including receipts with poor print quality and inconsistencies.

Ensure compatibility with existing systems

A crucial consideration is the OCR solution's ability to integrate seamlessly with your current systems, including accounting software, enterprise resource planning (ERP) platforms, and document management systems.

The objective is to prevent the adoption of a solution that leads to data silos or necessitates significant manual effort to move data across systems.

Go for OCR software that provides API integrations, enabling direct connections with your existing business applications. This promotes efficient workflows and minimizes manual data entry. Additionally, verify that the OCR system is capable of adapting to future enhancements in your systems, ensuring scalability over time.

Check capacity for growing document volumes

As your business grows, so will the volume of documents requiring processing. It’s critical to choose an OCR solution that can scale alongside your company, efficiently managing increasing document loads without performance degradation.

Some OCR systems are designed for small to medium-sized businesses, while others are built to handle the document processing needs of large enterprises.

Before making a decision, assess your current document volume and project future growth to ensure that the OCR system can handle both. This includes understanding whether the system processes documents in real time or in batches and whether there are any limitations on the number of documents it can manage concurrently.

Confirm multi-currency capabilities

Confirming multi-currency capabilities is crucial if your business spans multiple regions or engages with international suppliers and customers. Not every OCR invoice processing solution provides multi-currency support, making it essential to confirm which currencies the software can recognize accurately.

Go for OCR systems that support an extensive array of currencies, particularly those pertinent to your business dealings. Additionally, assess the system's proficiency in managing various multi-currency transactions, a frequent requirement for global companies.

The capability to effortlessly transition between currencies while maintaining precision is vital for smooth cross-border operations.

Look for tailored solutions for specific needs

Specialized OCR capabilities are essential for various industries and business functions. For example, an accounts payable department might require OCR software specifically designed for processing invoices and matching purchase orders.

Similarly, a legal firm may need an OCR solution that is optimized for extracting text from contracts and legal documents.

Choosing an OCR system that is customizable or pre-configured to meet your specific business requirements is essential for fully leveraging the technology's advantages. Numerous OCR providers offer industry-specific solutions or customizable features to address the distinct needs of a business.

Ensure robust data protection measures

Given the sensitive nature of many business documents—such as invoices, contracts, and employee records—it’s crucial that your OCR solution provides robust data protection measures. Security should be a top priority when choosing an OCR system, particularly if the software processes financial or personal data.

Ensure that the OCR solution supports encryption for both data in transit and at rest, to prevent unauthorized access to your sensitive information.

Additionally, verify whether the system complies with relevant regulatory standards, such as GDPR or HIPAA, to safeguard your business from potential legal and financial penalties related to data breaches.

Consider total expenses, including maintenance

While the initial cost of an OCR solution is a key consideration, it’s also important to evaluate the total cost of ownership, which includes ongoing maintenance, software updates, and potential integration expenses.

Some solutions may offer low upfront costs but come with hidden fees for support or updates, while others may require expensive hardware investments.

It is crucial to evaluate if the pricing model fits within your budget. Take into account not just the licensing fees, but also the expenses for any required hardware, training, and system integration. Additionally, it's vital to comprehend the vendor's pricing strategy for expansion as your document processing demands increase.

Assess ease of use and training requirements

An advanced OCR system should not only provide sophisticated features but also be user-friendly.

If the software is complex, it could result in more errors, extended processing times, and user dissatisfaction. Evaluate the OCR solution's learning curve and the need for specialized training for your staff.

Opt for an OCR solution that provides straightforward instructions, user-friendly interfaces, and easy accessibility for non-technical users. Also, take into account if the vendor offers reliable customer support and extensive training materials to facilitate a swift learning process for your team.

Review data processing and management features

Beyond text recognition, OCR solutions often offer additional data processing and management features that can greatly enhance document workflows.

Look for solutions that offer features such as automatic document classification, metadata extraction, and indexing to improve the efficiency of document storage and retrieval.

Advanced OCR systems may also include features for validating captured data against pre-configured business rules, ensuring that extracted information is accurate and reliable. These additional capabilities can further streamline your operations and reduce the time spent on manual verification.

Research vendor reliability and customer feedback

Ultimately, researching the OCR vendor's reliability is crucial before making a choice.

Seek a vendor known for high-quality OCR software invoice processing and robust customer support. Examine reviews and testimonials from current users to evaluate the system's effectiveness in actual business settings.

Additionally, it is advisable to ask for a demo or a trial period to personally test the software. This allows you to determine its compatibility with your business operations and its fulfillment of your criteria for accuracy, efficiency, and user-friendliness.

How can Volopay's Magic Scan assist with invoice processing?

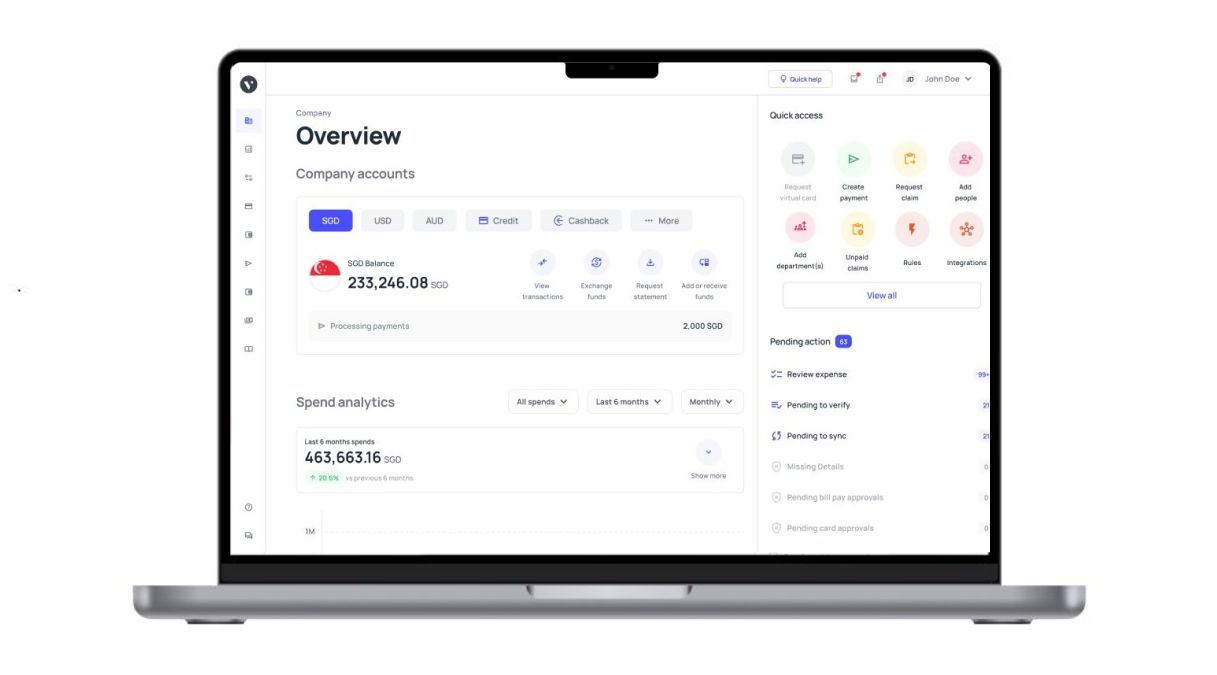

Volopay’s Magic Scan is an advanced feature designed to streamline accounts payable (AP) processes through automation. Magic Scan leverages OCR (Optical Character Recognition) technology to automatically capture, extract, and digitize key invoice data, reducing the need for manual data entry.

Once invoices are scanned, the invoice OCR system intelligently reads and organizes details such as supplier names, amounts, and due dates, which can then be routed for approval without any human intervention.

This AP automation system goes beyond invoice scanning, offering end-to-end automation for managing accounts payable.

This includes automatic purchase order (PO) matching, invoice approval workflows, and integration with existing accounting or ERP systems like QuickBooks, Xero, and Netsuite. By automating repetitive tasks, businesses can reduce human errors, speed up invoice processing times, and maintain compliance with payment schedules.

For businesses, Magic Scan and Volopay’s AP automation tools can result in:

● Time savings: Automating invoice capture and data entry reduces manual workload.

● Cost reduction: Fewer errors and streamlined processes lead to lower operational costs.

● Improved accuracy: Automation minimizes human error in invoice processing and PO matching.

● Better cash flow management: Faster processing ensures timely payments and optimized cash flow.

Volopay’s solution is ideal for businesses looking to enhance operational efficiency, maintain control over their payables, and simplify the complexities of managing multiple vendor payments.

Unlock the power of OCR automation today

FAQs

Data validation in OCR ensures that extracted information is accurate and aligns with business rules. It flags inconsistencies, such as mismatched amounts or missing fields, ensuring that only valid data is processed. This reduces errors, improves compliance, and maintains data integrity throughout the workflow.

Invoice OCR systems can be trained to recognize unstructured and handwritten data, though precision varies. Advanced OCR uses machine learning to interpret irregular layouts and cursive writing. While effective for structured documents, unstructured or handwritten data may result in lower accuracy, requiring human verification.

High OCR accuracy is crucial for financial compliance, as errors in data extraction can lead to incorrect reporting, missed payments, or regulatory violations. Precise OCR ensures accurate financial records, helping businesses comply with auditing standards, tax regulations, and industry-specific laws.

OCR accelerates invoice processing by automatically capturing and organizing invoice data, reducing manual input. This enables faster routing for approval, automates validation, and triggers notifications, ultimately cutting down approval times and ensuring timely payments, avoiding delays or penalties.

OCR improves fraud detection by automating validation rules and flagging suspicious invoices, such as duplicates, inconsistent data, or unapproved suppliers. By automating these checks, OCR helps identify fraudulent activities early, enhancing the security of the accounts payable process.

User feedback is vital in enhancing OCR systems. When users report errors or give feedback on incorrectly read documents, the OCR algorithms can be fine-tuned, leading to improved accuracy. Ongoing feedback allows the system to learn from its errors, guaranteeing improved performance as time progresses.

OCR invoice processing significantly reduces manual invoice entry workloads by automating data capture and entry tasks. Instead of manually inputting invoice details, staff can focus on higher-value activities, like resolving discrepancies or managing vendor relations, leading to increased efficiency and productivity.

OCR systems handle multi-page invoices and complex structures by recognizing and extracting data across different sections or formats. Advanced OCR can identify headers, line items, and totals, even when spread over several pages, ensuring that complete and accurate data is captured.

OCR supports document archiving by digitizing and indexing documents, making them easily searchable through keywords or metadata. It enhances retrieval by allowing users to locate specific documents quickly, improving efficiency in accessing historical records for audits, reporting, or dispute resolution.