Virtual corporate cards for US businesses

The best way to manage your online payments and subscriptions is with Volopay's virtual corporate cards. Designed with your business needs in mind, Volopay has the ability to generate an unlimited number of virtual cards for streamlined business spending.

Empower employees by equipping them with as many virtual prepaid cards as they need. Improve visibility and accountability within your team while maintaining ease of payments.

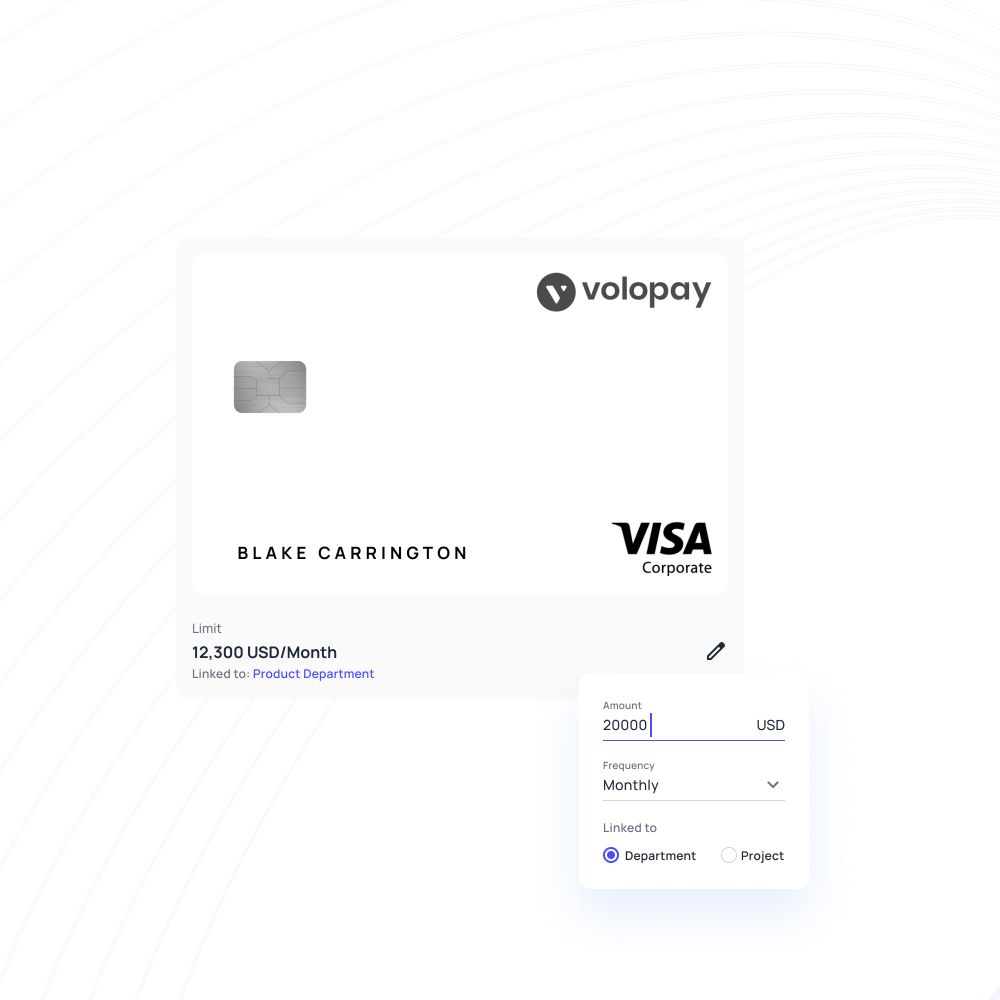

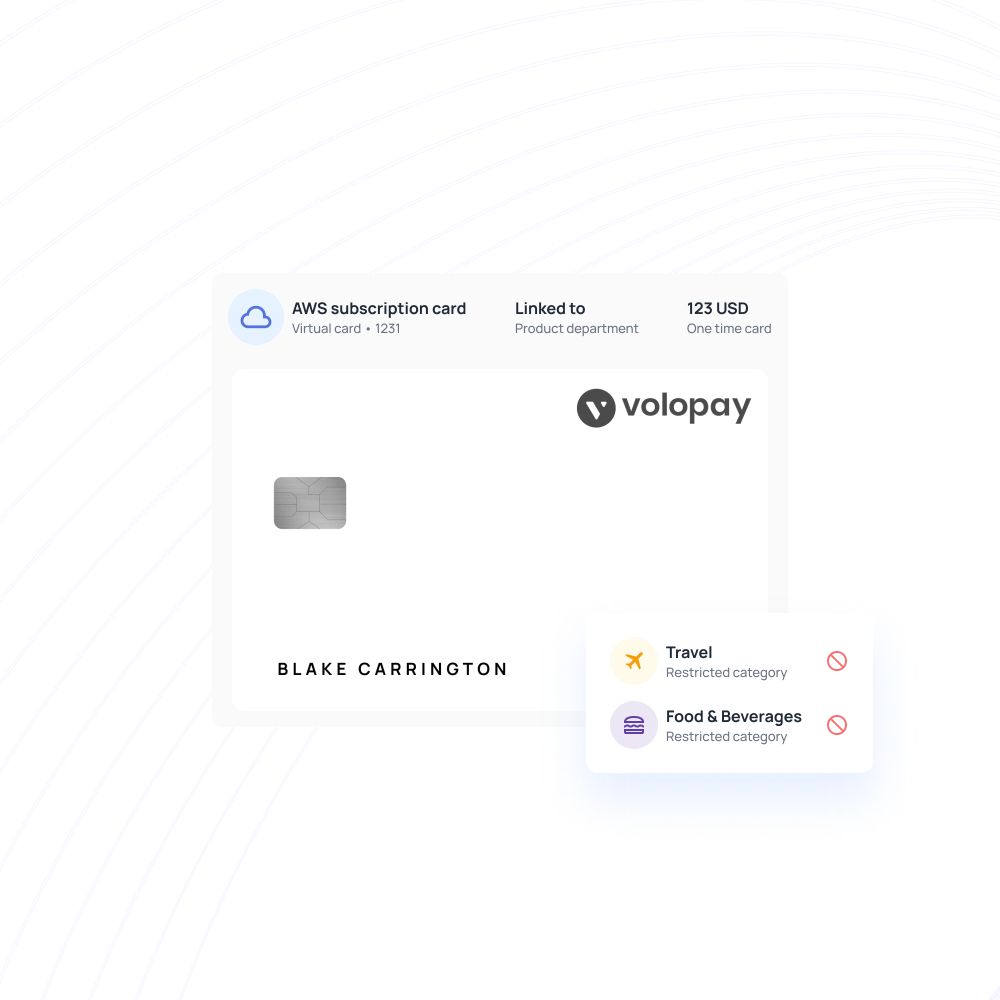

Customizable spend limits

Say goodbye to uncontrolled spending. With Volopay, you can easily set individual spend limits for each virtual prepaid card you generate. You won’t have to worry about spending over your budget or outside the designated policy.

Customizable approval workflows, merchant blocking and greenlighting, and flexible reload options let you control how your funds are spent.

Get quick access to funds

With an easy application process and a short waiting period, you’ll be able to start using your Volopay virtual prepaid cards in no time. It’s a surefire way for your team to get quick access to funds.

Manage your cash flow better and eliminate the need for employee reimbursements with business virtual cards. As long as you have your device, you can make virtual card payments from anywhere!

Easy and fast payments

Payments are faster with Volopay virtual prepaid cards. You can start using your cards as soon as you generate and activate them on your card dashboard.

Online payments become simple when all you need is your virtual prepaid card number. Maintain security and convenience all at once by allowing employees to easily make controlled payments with virtual cards.

Perfect virtual card solution for your business!

Virtual cards that support multi-currency spend

Expand your global reach with Volopay’s virtual corporate cards, now available in multiple currencies. Issue cards in your chosen currency to meet your business needs.

Use home currency cards for flexible multi-currency spending or foreign currency-specific cards for dedicated transactions. Streamline international payments with ease and precision.

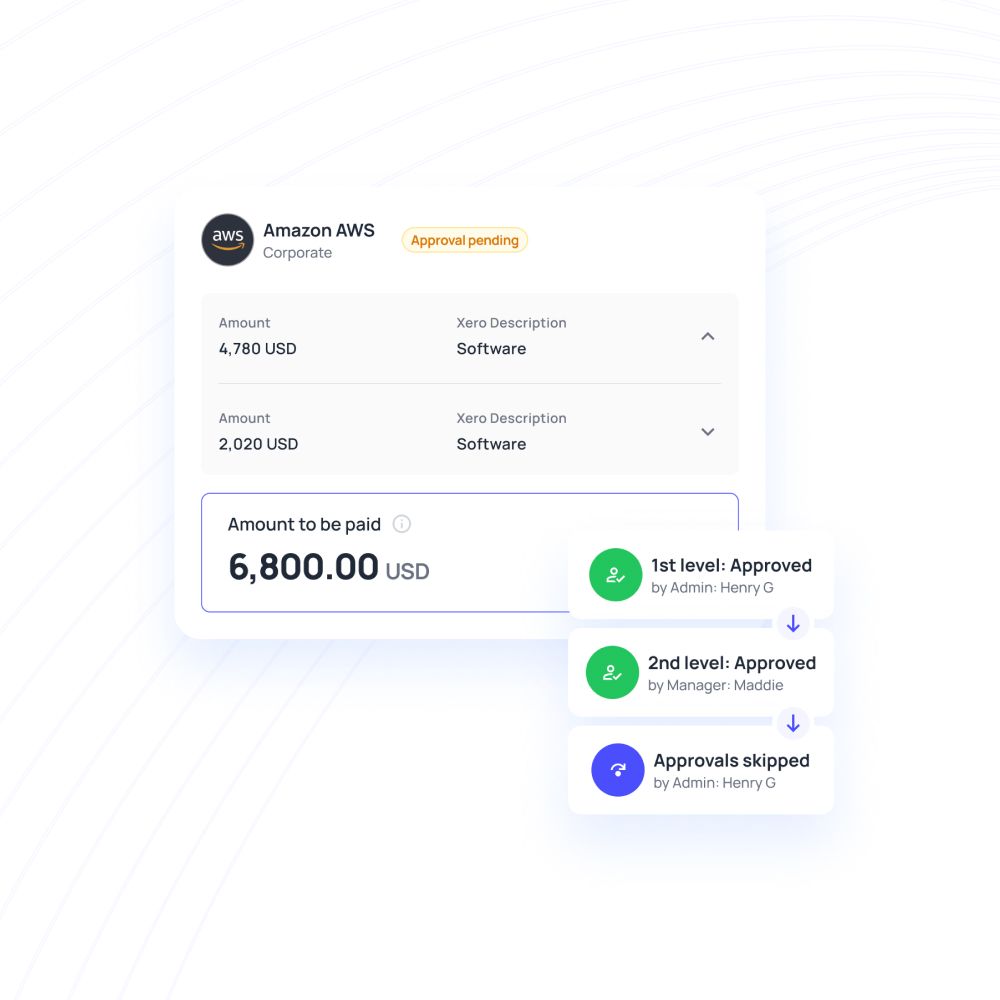

Precise approval workflows

Make the most of Volopay’s automated approval workflows to encourage transparency while avoiding delays. You can set up customizable workflows to get multi-level approvals and make virtual prepaid cards compliant with a specific department or project policy.

Every new card and limit request will be automatically routed through the appropriate approval workflow. Approvers get notified immediately and can approve requests quickly. Approvers and employees can also track requests within the platform for a clear record.

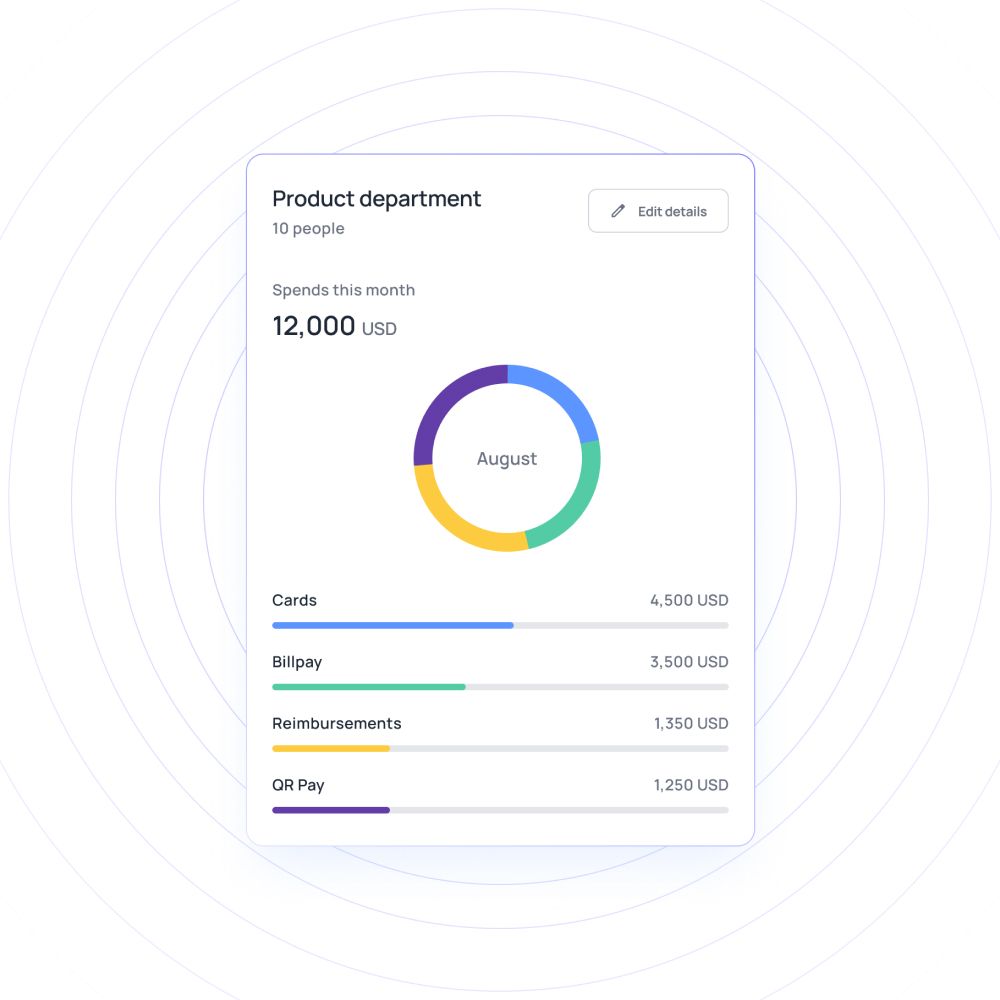

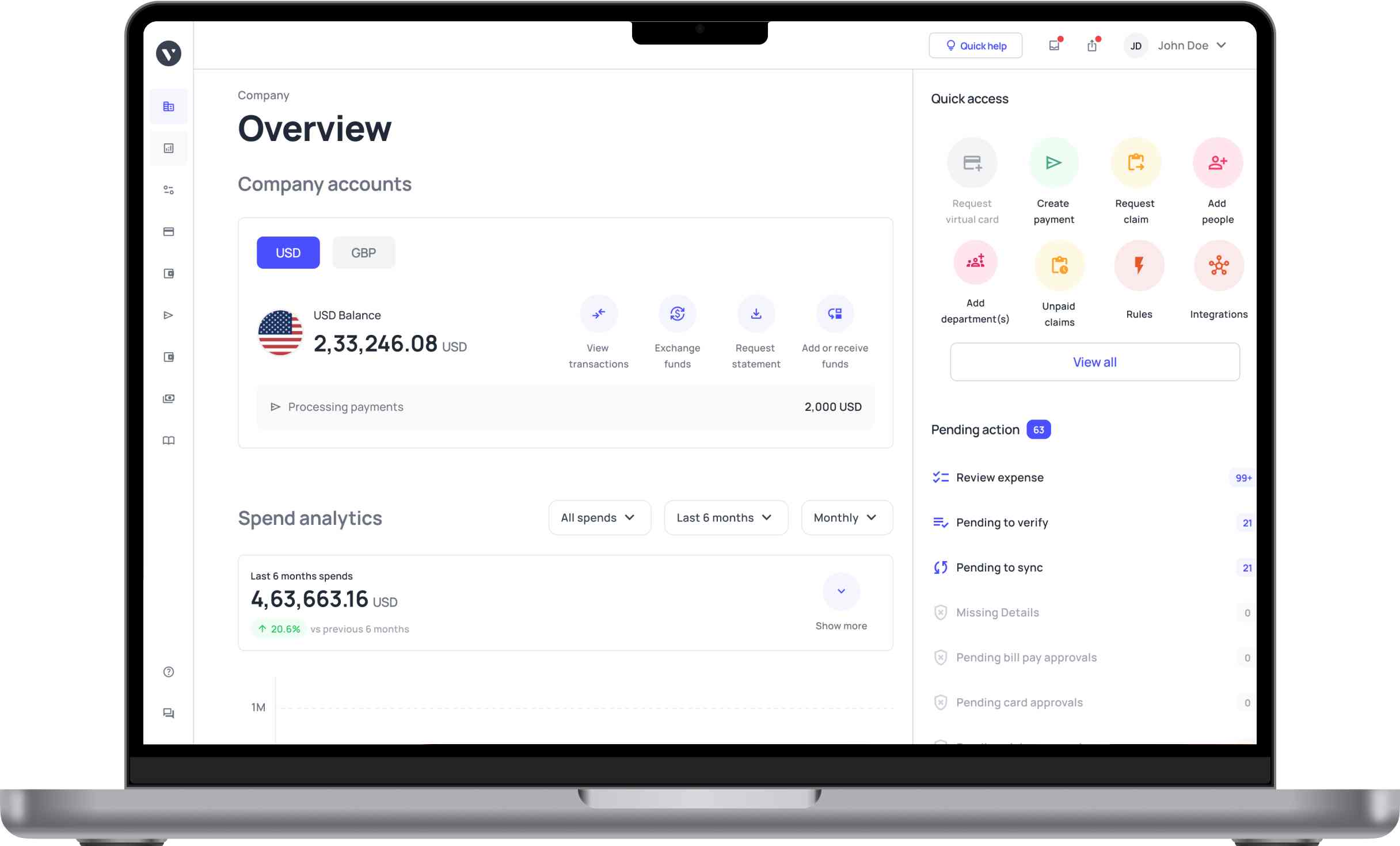

Real-time expense tracking

Get robust expense tracking features through Volopay’s card management system. Every virtual prepaid card you generate on the platform will be automatically linked to your Volopay account. Whenever a card is used to make a payment, the expense gets updated and recorded in real-time.

There are no more surprises and undetected expenses with Volopay. Every penny you spend with virtual card is easily trackable.

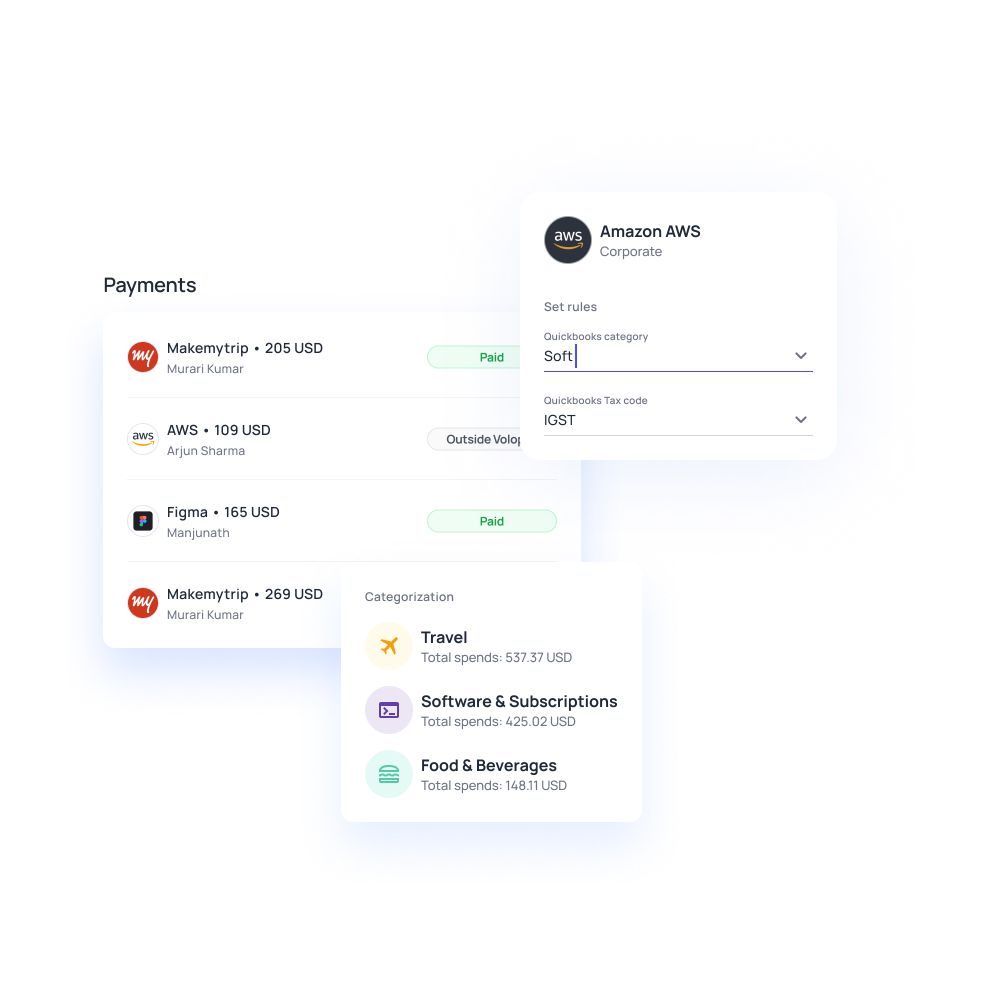

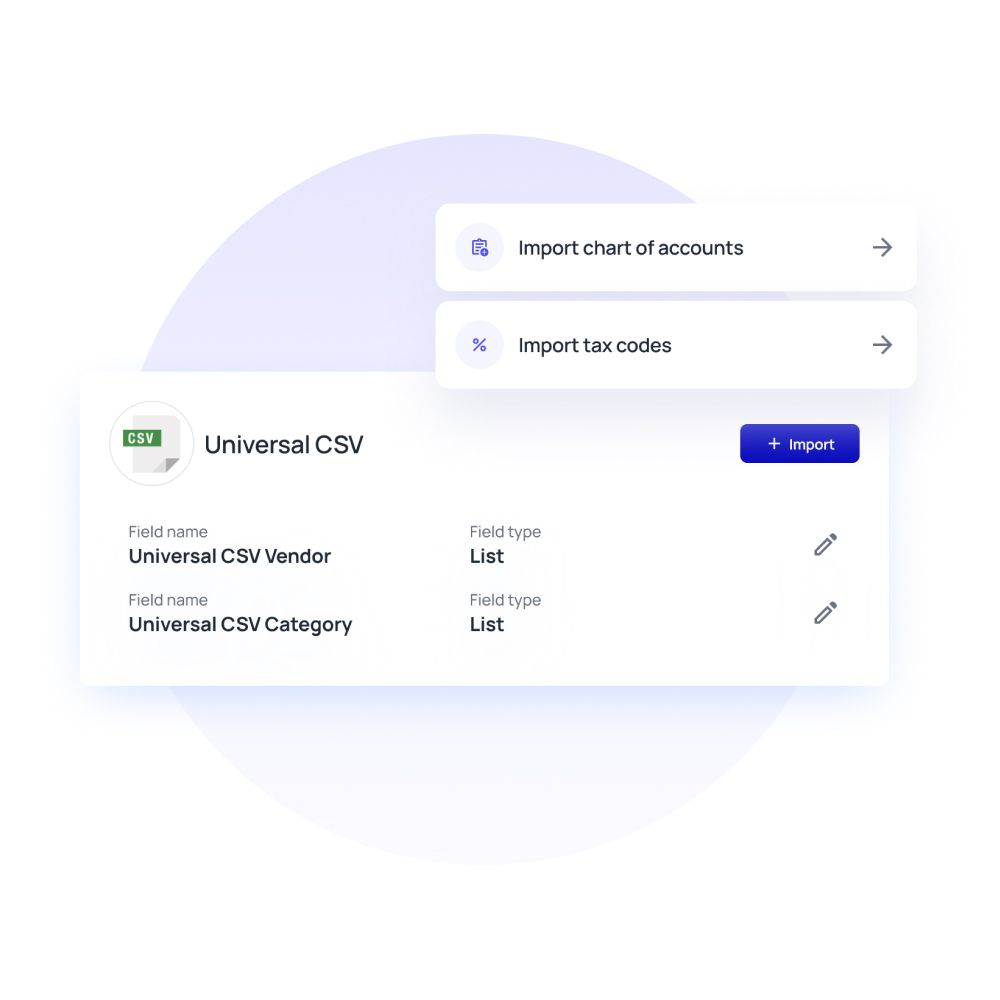

Automated expense categorization

Volopay’s automated expense categorization makes tracking and accounting much simpler. Create customizable expense categories and automatically sort each transaction into its appropriate category.

As soon as you use a Volopay virtual prepaid card, the system will capture the payment details. This enables the platform to categorize your expenses in no time, making for easier accounting. Categories will be reflected in your ledger without the fuss of any additional data entry.

Experience seamless transactions with business virtual cards

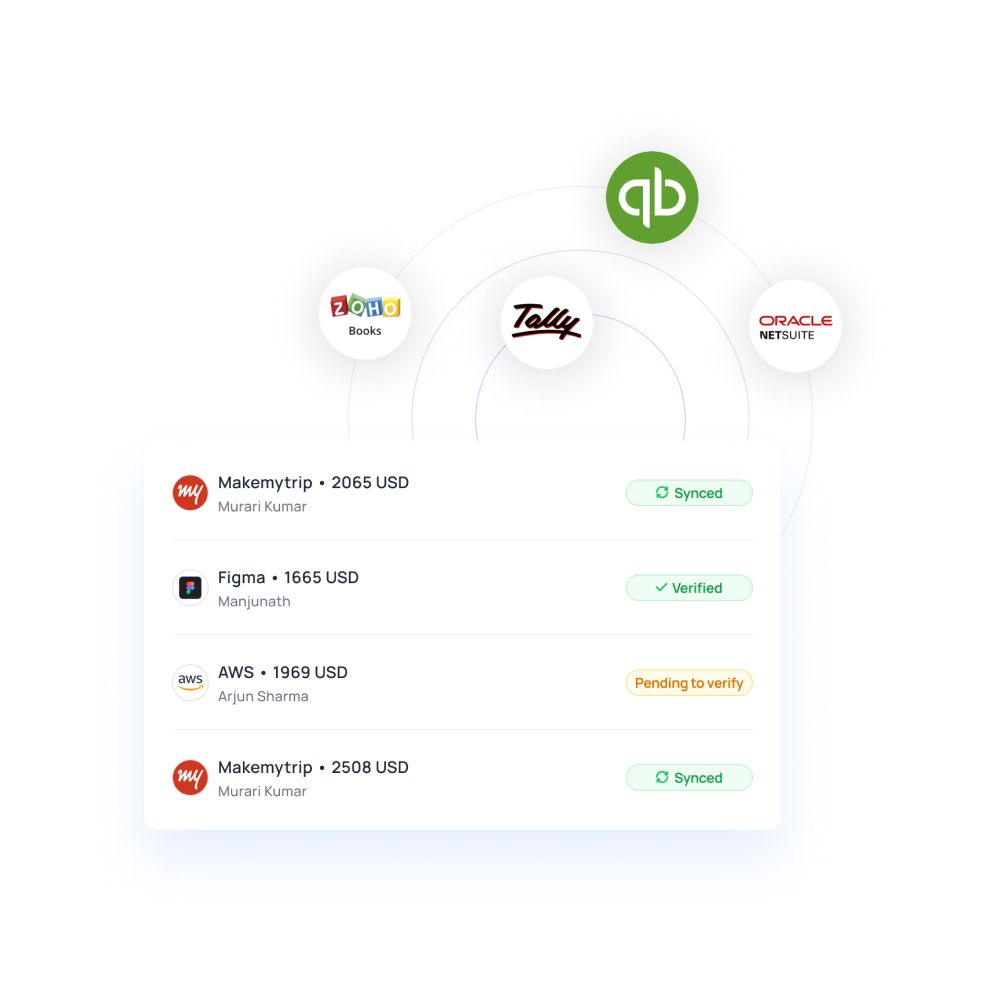

Easy accounting system integration

Don’t waste your time with manual data entry and reconciliations. Volopay offers integrations with a number of popular accounting systems such as Xero, Quickbooks, and many more.

All it takes is a few clicks to set up accounting integration through the Volopay dashboard. Once your accounting system has been integrated, direct sync of your virtual prepaid card expenses will solve all the card accounting hassle.

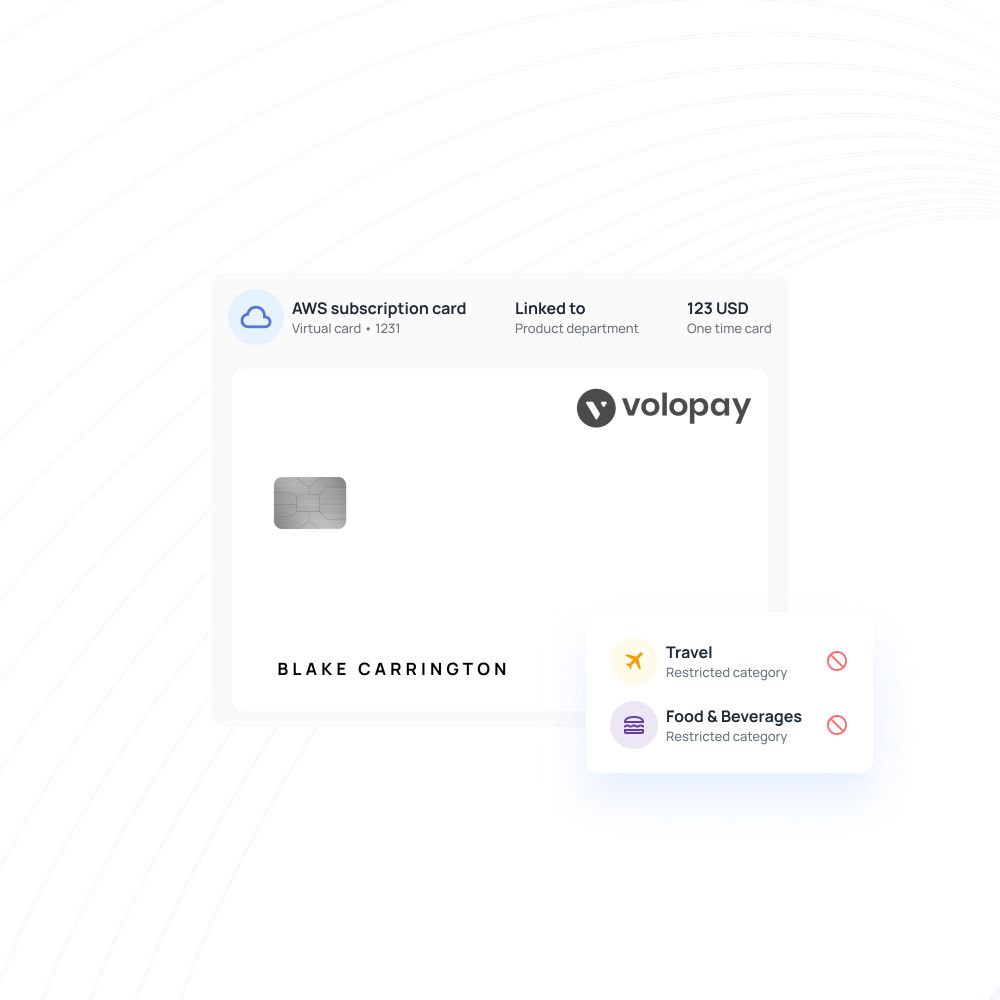

Enhanced security for safe transactions

You can use virtual prepaid cards for one-time payments as well, instead of relying on cash that may get lost, bank transfers that need to be reimbursed, or card sharing that muddles the expense reporting. The use of secure, one-time virtual cards also eliminates unauthorized transactions and blocks the possibility of card theft.

Be assured of the safety of your funds. Volopay has industry-standard certifications and security measures, preventing data breaches and stolen information. Every transaction is made safely through Volopay virtual cards.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

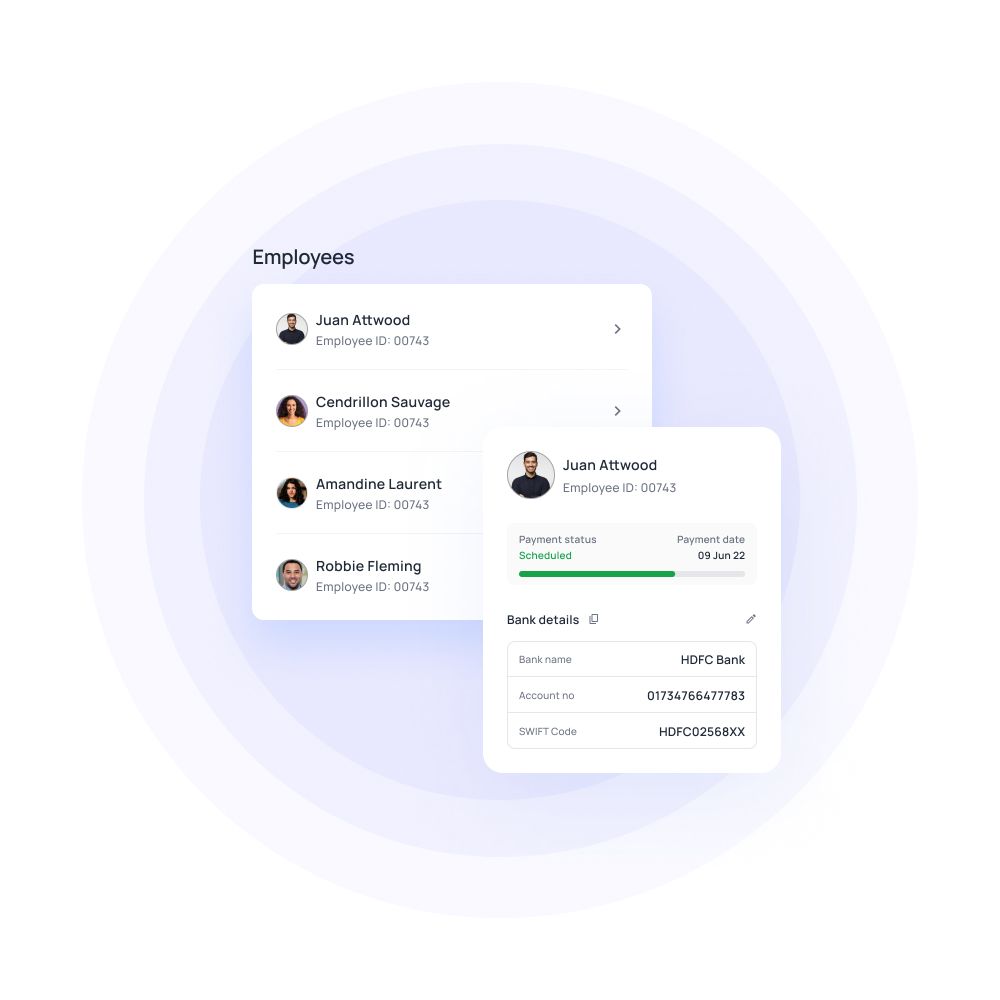

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Volopay: Virtual cards for diverse industries

Volopay’s virtual prepaid card offers startups an agile solution for managing expenses with real-time tracking.

Startups can quickly issue virtual cards to team members, allowing them to efficiently scale their operations while maintaining complete control over their budget.

Small businesses benefit from Volopay’s virtual card, which streamlines expense management and provides transparency.

The ability to easily set customizable spending limits ensures that small businesses can operate efficiently while successfully avoiding unnecessary overspending.

For large enterprises, Volopay’s virtual prepaid cards offer advanced features like multi-level approval workflows, spend analytics, and customizable restrictions.

This helps to streamline and manage complex financial operations seamlessly and securely, leading to improved operational efficiency.

Why choose Volopay virtual cards?

Easy card creation

Volopay’s virtual prepaid card allows for quick and simple card creation through an intuitive, easy-to-use platform, enabling instant access to a digital card without the need for physical issuance.

No hidden charges

Volopay’s virtual card ensures full financial transparency by offering a no-hidden-fee structure, meaning you only pay for exactly what you use, with no surprise charges or extra fees.

Unlimited card issuance

Enjoy the flexibility of issuing an instant virtual card for any team member or department without limitations, ensuring everyone has access to essential business funds whenever needed.

Individual card allocation

Volopay’s virtual prepaid card can be easily assigned to individual employees, allowing you to track and manage personal spending for each team member in real time with complete visibility.

Department allocation

Allocate virtual cards to specific departments, ensuring each team has the necessary funds while maintaining full control over their specific spending limits and expense tracking.

Compliance and security

Volopay’s virtual cards are equipped with advanced compliance and security features, including strong encryption and proactive fraud prevention tools, ensuring all your transactions are safe and secure.

Monitor employee spending

Track employee spending effortlessly with Volopay’s real-time monitoring tools, ensuring complete transparency and effectively preventing overspending on every virtual prepaid card issued to your entire team.

Vendor controls

Set custom spending limits and detailed restrictions on your virtual prepaid card for each individual vendor, maintaining tight control over recurring payments and supplier costs to effectively manage budgets.

Virtual corporate cards designed for growing teams

Marketing teams

Use Volopay’s virtual corporate cards to allocate specific budgets for each marketing campaign. Individual cards let you monitor spending on ads, events, or content without delays.

Your team gains better control while finance maintains full visibility of expenses. This also helps avoid overspending and ensures alignment with campaign ROI targets.

Sales teams

Issue corporate virtual cards to cover travel, accommodation, and client entertainment costs.

Each sales rep receives a dedicated virtual corporate card, helping you streamline reimbursements and stay on top of real-time business development spend across territories. It reduces the need for personal expense claims and increases productivity in the field.

Finance teams

Centralize all spending through a unified dashboard and assign virtual cards as needed.

Gain real-time visibility into every transaction, automate reconciliation, and eliminate scattered expense reports.

Finance teams can make data-driven decisions quickly and confidently.

HR teams

Easily disburse employee perks, welfare allowances, or event gifts with dedicated cards.

Corporate virtual cards simplify spending control, reduce manual claims, and ensure HR-related expenses are always tracked and compliant.

This also boosts employee satisfaction by providing instant, policy-aligned rewards.

IT teams

Track software purchases and recurring SaaS tools efficiently using virtual cards.

Assign a unique card to each subscription, making it easier to monitor renewals, avoid duplicate charges, and stop unauthorized upgrades.

It also improves budgeting and audit readiness for technology-related expenses.

Remote teams

Empower distributed teams across time zones with instant access to funds via virtual corporate cards.

Eliminate delays in reimbursements or fund requests and maintain centralized control over global spending from one platform.

Remote workers can operate independently while adhering to budget limits.

Operations teams

Simplify payments to logistics vendors, warehouse services, or facility providers.

Assign individual virtual corporate cards for each function to ensure transparency, accountability, and avoid overcharging or invoicing delays.

This improves vendor relationships and speeds up operational workflows.

Founders & leadership

Set clear spending limits, customize approval flows, and monitor company-wide expenses in real time.

Volopay’s virtual cards give leadership quick control over budgets without compromising speed or visibility.

Strategic insights from spend data also support better forecasting and financial planning.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Recognized as a leader in financial management

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Subscription management

It’s no surprise that managing subscriptions can be tough, especially when you have a lot of them. With Volopay’s corporate virtual cards, this doesn’t have to be the case for your business.

Generate virtual cards and assign each card a subscription. You can set up recurring payments and expiration dates as needed.

Real-time visibility

Get real-time visibility of all your expenses on Volopay’s card management dashboard. Expenses will be automatically updated and recorded as soon as you use your virtual card for a transaction.

You can view how much you’ve spent on each virtual card and how much of your limit you have left at any time.

Multi level approvals

Set up multi-level approvals for card and limit adjustment requests. Employees will only be able to generate cards or adjust their existing card limits after getting approval.

Each request can be made on the Volopay platform. Approvers will be automatically notified once a request has been made and needs approval.

Accounting automation

Get automated expense categorization with Volopay. Every card expense you make can be automatically categorized, enabling easier accounting for your business.

Integrate your corporate virtual cards with your accounting software to get streamlined financial processes. All it takes is a few clicks to set up the integration. Experience the ease of direct sync!

Bring Volopay to your business

Get started now

FAQs on virtual cards

It only takes a couple of clicks and a few minutes to generate a virtual card through the Volopay platform. All you need to do is enter the cardholder details and assign a card limit.

Volopay offers a card management dashboard for you to view and manage all your card spending. Get in-built spend control features like customizable limits, freeze and block buttons, automatic expense updates, and many more.

Onboard with us to get started with corporate virtual cards. As long as your business is a registered company, you’ll be able to generate and activate your cards through the Volopay platform easily.

No. Corporate virtual cards have no effect on your personal credit.

Yes, Volopay allows you to issue an instant virtual card for any urgent business needs, providing instant access to funds without waiting for a physical card.

Yes, Volopay’s virtual prepaid card supports international purchases, allowing businesses to make transactions globally while benefiting from real-time currency tracking.

Deactivating a Volopay virtual card is simple and can be done instantly through the platform, ensuring immediate termination of any unauthorized or no-longer-needed cards.

Yes, Volopay’s virtual cards are ideal for recurring payments, allowing businesses to automate regular transactions while maintaining control over vendor spending limits.

Volopay provides comprehensive reporting for all virtual card transactions, offering real-time analytics, detailed expense reports, and customizable insights to track spending effectively.

Yes, Volopay provides a fully functional mobile app that allows businesses to manage virtual cards on the go, offering full control over card issuance, monitoring, and spending limits.

Virtual corporate cards offer advanced controls like spending limits, merchant restrictions, and real-time tracking. These features prevent misuse, minimize manual errors, and ensure only approved transactions are processed within policy.

Yes, Volopay’s virtual corporate cards support multi-currency use, enabling teams to spend globally without delays. This makes it easier for international teams and vendors to transact securely across borders.